|

시장보고서

상품코드

1698296

에피제네틱스 진단 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Epigenetics Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

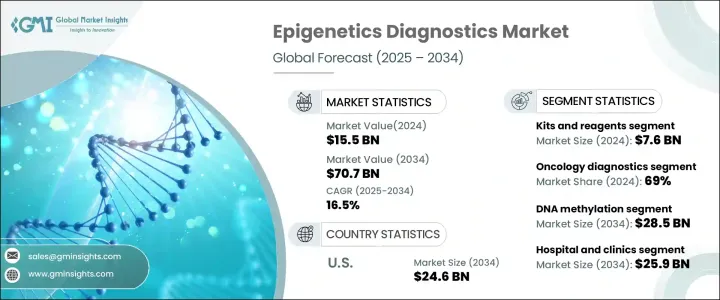

세계의 에피제네틱스 진단 시장은 2024년에 155억 달러로 평가되었고 2025년부터 2034년에 걸쳐 16.5%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

이러한 급속한 확대는 후성유전적 수식이 질병의 개발과 진행의 주요 요인이라는 인식이 높아지고 있는 것이 큰 요인이 되고 있습니다.

최근, 정밀의료의 보급과 분자진단의 기술 진보가 합쳐져, 시장의 확대가 현저하게 가속하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 155억 달러 |

| 예측 금액 | 707억 달러 |

| CAGR | 16.5% |

과학적 발견을 실제 임상 응용으로 연결하는 데 있어 연구기관과 의료 제공자와의 협력관계의 확대도 매우 중요한 역할을 하고 있습니다. 부 증가는 이 분야에서의 혁신을 촉진하고 있습니다.

시장은 키트, 시약, 장비, 소프트웨어, 서비스 등의 주요 제품 카테고리로 구분됩니다. 마리는 사용자 친화적인 설계, 분석 민감도 향상, 자동화 기능, 차세대 시퀀싱(NGS) 및 폴리머 라제 연쇄반응(PCR)과 같은 최첨단 플랫폼과의 호환성에 기인합니다.

후성 유전학 진단의 응용은 종양학과 비 종양학으로 분류되며 종양학은 2024년에 69%의 점유율을 차지했습니다. A 메틸화 패턴, 히스톤 변형, 크로마틴 리모델링의 변화는 암 발병의 매우 중요한 지표로 떠오르고 있으며, 보다 정확하고 맞춤 치료 접근을 가능하게 하고 있습니다.

미국의 에피제네틱스 진단 시장은 2034년까지 연평균 복합 성장률(CAGR) 16.5%를 나타낼 것으로 전망되며 예측 기간이 끝날 때 246억 달러에 이를 것으로 예상됩니다. 만성 질환의 유병률 증가, 생명 공학 기업의 투자 증가 및 유리한 규제 상황은 미국을 세계의 후성 진단 랜드스케이프에서 지배적인 선수로 삼고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 암과 만성질환의 유병률 증가

- 에피유전체 연구와 기술의 진보

- 비침습적 진단에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 에피제네틱스 진단 기술의 높은 비용

- 한정적인 검사 방법의 표준화

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 전망

- 향후 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 키트 및 시약

- 기구

- 소프트웨어 및 서비스

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 종양 진단

- 비종양 진단

제7장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- DNA 메틸화

- 히스톤 메틸화

- 마이크로RNA 변형

- 염색질 구조

- 기타 기술

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원 및 클리닉

- 제약 및 생명공학 기업

- 진단 실험실

- 기타 최종 용도

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Abcam

- Agilent Technologies

- Diagenode

- Dovetail Genomics

- Element Biosciences

- Illumina

- Merck

- New England Biolabs

- PacBio

- Promega

- QIAGEN

- Roche Diagnostics

- Thermo Fisher Scientific

- Zymo Research

The Global Epigenetics Diagnostics Market was valued at USD 15.5 billion in 2024 and is poised to register a CAGR of 16.5% from 2025 to 2034. This rapid expansion is largely fueled by the increasing recognition of epigenetic modifications as key contributors to disease development and progression. As research deepens into the role of DNA methylation, histone modifications, and non-coding RNAs in various health conditions, the demand for advanced diagnostic tools is rising exponentially.

In recent years, the widespread adoption of precision medicine, coupled with technological advancements in molecular diagnostics, has significantly accelerated market expansion. The integration of artificial intelligence and machine learning in epigenetic analysis has further enhanced the accuracy and efficiency of diagnostic solutions. Additionally, major pharmaceutical and biotechnology companies are investing heavily in R&D to develop novel epigenetic biomarkers, further propelling the industry forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $70.7 Billion |

| CAGR | 16.5% |

Growing collaborations between research institutions and healthcare providers are also playing a pivotal role in translating scientific discoveries into real-world clinical applications. The increased availability of funding and government initiatives aimed at improving early disease detection and personalized medicine is driving innovation in the field. With the rise in chronic diseases, including cancer and neurodegenerative disorders, the relevance of epigenetic diagnostics continues to grow, positioning the market for sustained expansion over the next decade.

The market is segmented into key product categories, including kits and reagents, instruments, software, and services. In 2024, the global market for these products reached USD 13.4 billion, with the kits and reagents segment dominating at USD 7.6 billion. These diagnostic tools have become indispensable in clinical applications, academic research, and pharmaceutical development. Their growing popularity stems from their user-friendly designs, enhanced assay sensitivity, automation capabilities, and compatibility with cutting-edge platforms like next-generation sequencing (NGS) and polymerase chain reaction (PCR). As the industry moves toward more high-throughput and cost-effective solutions, the demand for reliable and efficient kits continues to escalate.

The application landscape of epigenetics diagnostics is categorized into oncology and non-oncology segments, with oncology commanding a substantial 69% share in 2024. The dominance of this segment is largely attributed to the growing need for early cancer detection and the rising importance of epigenetic biomarkers in diagnosing and treating various malignancies. Changes in DNA methylation patterns, histone modifications, and chromatin remodeling have emerged as crucial indicators of cancer development, enabling more precise and personalized treatment approaches. With the increasing global burden of cancer and continued advancements in biomarker research, the oncology segment remains a major driver of market growth.

The U.S. Epigenetics Diagnostics Market is projected to grow at a CAGR of 16.5% through 2034, reaching USD 24.6 billion by the end of the forecast period. The country remains a frontrunner in this industry, thanks to its robust healthcare infrastructure, extensive research and development initiatives, and early adoption of precision medicine. Government agencies, including the National Institutes of Health (NIH), continue to fund breakthrough research in epigenetics, further accelerating innovation and commercialization. The rising prevalence of chronic diseases, increasing investments from biotech firms, and favorable regulatory policies are further cementing the U.S. as a dominant player in the global epigenetics diagnostics landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cancer and chronic diseases

- 3.2.1.2 Advancements in epigenomics research and technology

- 3.2.1.3 Growing demand for non-invasive diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of epigenetic diagnostics technologies

- 3.2.2.2 Limited standardization of testing methods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits and reagents

- 5.3 Instruments

- 5.4 Software and services

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology diagnostics

- 6.3 Non-oncology diagnostics

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 DNA methylation

- 7.3 Histone methylation

- 7.4 MicroRNA modification

- 7.5 Chromatin structures

- 7.6 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital and clinics

- 8.3 Pharmaceutical and biotechnology companies

- 8.4 Diagnostic laboratories

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Diagenode

- 10.4 Dovetail Genomics

- 10.5 Element Biosciences

- 10.6 Illumina

- 10.7 Merck

- 10.8 New England Biolabs

- 10.9 PacBio

- 10.10 Promega

- 10.11 QIAGEN

- 10.12 Roche Diagnostics

- 10.13 Thermo Fisher Scientific

- 10.14 Zymo Research