|

시장보고서

상품코드

1699247

스마트 교통 시장 - 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Smart Transportation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

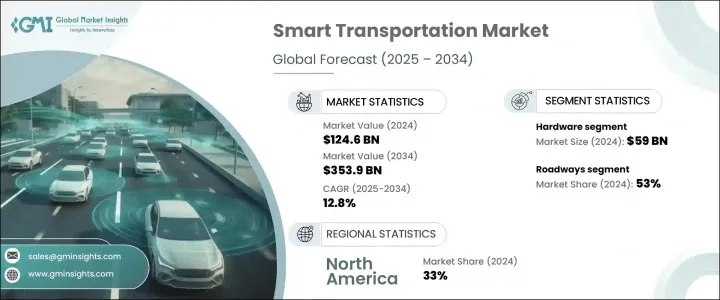

세계의 스마트 교통 시장은 2024년 시장 규모는 1,246억 달러로, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 12.8%로 성장할 것으로 예측됩니다.

세계 각 도시가 지연을 줄이고 배출 가스를 줄이고 전반적인 운송 효율을 높이기 위한 고급 이동성 솔루션을 찾고 있기 때문에 급속한 도시화와 교통 체증 증가가 시장 확대의 주요 요인이 되고 있습니다. 자율주행차(CAV)의 채용 확대가 시장 성장에 크게 영향을 주고 있으며, AI, IoT, 5G 등의 기술이 실시간 교통관리와 V2X(Vehicle-to-Everything) 통신에 중요한 역할을 하고 있습니다.

이러한 진보는 교통 안전 최적화, 교통 흐름 합리화, 스마트 시티 인프라와의 통합을 통한 교통망 강화에 도움이 되고 있습니다. 정부나 교통당국은 지능형 교통 시스템(ITS)에 거액의 투자를 하고 있으며, 스마트 신호, 자동 요금징수, 차량추적 등의 이니셔티브를 지원하고 있습니다. 자동운전차와 전기자동차가 주류가 됨에 따라, AI를 탑재한 모빌리티 솔루션 수요는 계속 증가해 스마트 교통산업의 확대를 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,246억 달러 |

| 예측 금액 | 3,539억 달러 |

| CAGR | 12.8% |

시장은 컴포넌트를 기반으로 하드웨어, 소프트웨어, 서비스로 구분됩니다. 주요 하드웨어 요소에는 GPS, IoT 센서, RFID 칩, 감시카메라, 자동 요금 징수 시스템, V2X 통신 장비 등이 있습니다. 이 기술은 실시간 교통 모니터링, 커넥티드 차량 시스템, 지능형 교통 솔루션에 필수적입니다.

운송 모드별로 보면, 시장은 도로, 철도, 항공, 해운으로 나뉘어져 있습니다. 자율주행차의 보급이 첨단 교통관제 및 예측 시스템의 필요성을 높이고 있습니다.

솔루션 관점에서 시장은 교통관리, 스마트 티켓팅, 주차장관리, 여객정보시스템, 화물관리로 구분됩니다. 지연과 환경에 미치는 영향을 최소화하면서 도로 성능을 최적화하기 위해 AI 주도의 교통 제어, 적응형 신호, 정체 가격 전략이 도입되어 있습니다.

지역별로는 북미가 2024년 시장을 선도해 세계 점유율의 약 33%를 차지해 420억 달러의 수익을 올렸습니다. ITS, 커넥티드 모빌리티, AI를 활용한 교통 솔루션을 촉진하는 연방 정부의 자금 제공 프로그램이나 정책이, 대도시권 전역에서 스마트 교통 인프라의 채용을 가속시키고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 기술 공급자

- 시스템 통합자

- 교통 인프라 제공업체

- 자동차 및 차량 제조업체

- 데이터 및 서비스 제공업체

- 이익률 분석

- 기술 및 혁신 상황

- 특허 분석

- 이용 사례

- 주요 뉴스 및 이니셔티브

- 규제 상황

- 영향요인

- 성장 촉진요인

- 세계 각 도시의 급속한 도시화와 정체

- 효율적이고 지속 가능한 운송에 대한 수요 증가

- IoT, AI, 빅데이터 분석에 있어서의 기술의 진보

- 정부의 이니셔티브와 투자 증가

- 커넥티드카나 자율주행차에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 초기 투자 비용

- 데이터 프라이버시와 보안에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 하드웨어

- 센서

- 카메라

- RFID 칩

- GPS 장치

- 기타

- 소프트웨어

- 교통 관리 시스템

- 차량 관리 소프트웨어

- 기타

- 서비스

- 컨설팅

- 도입과 통합

- 지원 및 유지 보수

제6장 시장 추계 및 예측 : 수송 모드별, 2021-2034년

- 주요 동향

- 도로

- 철도

- 공로

- 해로

제7장 시장 추계 및 예측 : 솔루션별, 2021-2034년

- 주요 동향

- 교통관리

- 스마트 티켓팅

- 주차장 관리

- 승객 정보 시스템

- 화물 관리

제8장 시장 추계 및 예측 : 기술별, 2021-2034년

- 주요 동향

- IoT

- AI와 머신러닝

- 빅데이터 분석

- 클라우드 컴퓨팅

- 블록체인

제9장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 정부기관

- 민간기업

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Alstom

- Bentley

- Cisco

- Conduent

- Cubic

- Hitachi

- Huawei Technologies

- IBM

- Indra Sistema

- Kapsch TrafficCom

- Lyft

- NEC

- Qualcomm

- Robert Bosch

- SAP

- Siemens Mobility

- Thales

- TomTom

- Trimble

- Uber Technologies

The Global Smart Transportation Market was valued at USD 124.6 billion in 2024 and is expected to grow at a CAGR of 12.8% from 2025 to 2034. Rapid urbanization and rising traffic congestion are key factors driving market expansion as cities worldwide seek advanced mobility solutions to reduce delays, lower emissions, and enhance overall transportation efficiency. The growing adoption of connected and autonomous vehicles (CAVs) is significantly influencing market growth, with technologies like AI, IoT, and 5G playing a crucial role in real-time traffic management and vehicle-to-everything (V2X) communication.

These advancements help optimize road safety, streamline traffic flow, and enhance transport networks by integrating with smart city infrastructure. Governments and transport authorities are heavily investing in intelligent transportation systems (ITS), supporting initiatives such as smart signals, automated tolling, and vehicle tracking. As self-driving and electric vehicles become more mainstream, demand for AI-powered mobility solutions continues to rise, reinforcing the expansion of the smart transportation industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.6 Billion |

| Forecast Value | $353.9 Billion |

| CAGR | 12.8% |

The market is segmented based on components into hardware, software, and services. The hardware segment led in 2024, generating USD 59 billion in revenue, and is projected to grow at a CAGR of approximately 13.2% during the forecast period. Key hardware elements include GPS, IoT sensors, RFID chips, surveillance cameras, automated fare collection systems, and V2X communication devices. These technologies are critical for real-time traffic monitoring, connected vehicle systems, and intelligent transport solutions. Investment in embedded systems for urban mobility, including electronic toll collection and AI-driven traffic management, is further strengthening the demand for hardware solutions.

By transportation mode, the market is divided into roadways, railways, airways, and maritime. Roadways accounted for 53% of the market share in 2024 and are anticipated to grow at a CAGR of over 13% through 2034. Expanding urban road networks and the increasing adoption of electric and autonomous vehicles are boosting the need for advanced traffic control and forecasting systems. Ride-hailing services and shared mobility platforms are also accelerating the development of smart roadway solutions, contributing to the sector's growth.

In terms of solutions, the market is segmented into traffic management, smart ticketing, parking management, passenger information systems, and freight management. The traffic management segment dominates due to the rising number of vehicles on roads, increasing urban congestion, and the need for effective mobility solutions. AI-driven traffic control, adaptive signaling, and congestion pricing strategies are being implemented to optimize road performance while minimizing delays and environmental impact. Real-time traffic tracking, automatic incident detection, and predictive analytics are further enhancing road safety and efficiency.

Regionally, North America led the market in 2024, accounting for around 33% of the global share and generating USD 42 billion in revenue. The United States remains at the forefront, with strong government initiatives, technological advancements, and urban development fueling market expansion. Federal funding programs and policies promoting ITS, connected mobility, and AI-powered transportation solutions are accelerating the adoption of smart transport infrastructure across major metropolitan areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 System integrators

- 3.2.3 Transportation infrastructure providers

- 3.2.4 Automotive & vehicle manufacturers

- 3.2.5 Data & service providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapid urbanization and congestion in cities across the world

- 3.9.1.2 Growing demand for efficient and sustainable transportation

- 3.9.1.3 Technological advancements in IoT, AI, and big data analytics

- 3.9.1.4 Rising government initiatives and investments

- 3.9.1.5 Growing demand for connected and autonomous vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment costs

- 3.9.2.2 Data privacy and security concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Cameras

- 5.2.3 RFID chips

- 5.2.4 GPS device

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Traffic management systems

- 5.3.2 Fleet management software

- 5.3.3 Others

- 5.4 Services

- 5.4.1 Consulting

- 5.4.2 Deployment & integration

- 5.4.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Transportation Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Roadways

- 6.3 Railways

- 6.4 Airways

- 6.5 Maritime

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Traffic management

- 7.3 Smart ticketing

- 7.4 Parking management

- 7.5 Passenger information systems

- 7.6 Freight management

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 IoT

- 8.3 AI & machine learning

- 8.4 Big data analytics

- 8.5 Cloud computing

- 8.6 Blockchain

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Government agencies

- 9.3 Commercial businesses

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alstom

- 11.2 Bentley

- 11.3 Cisco

- 11.4 Conduent

- 11.5 Cubic

- 11.6 Hitachi

- 11.7 Huawei Technologies

- 11.8 IBM

- 11.9 Indra Sistema

- 11.10 Kapsch TrafficCom

- 11.11 Lyft

- 11.12 NEC

- 11.13 Qualcomm

- 11.14 Robert Bosch

- 11.15 SAP

- 11.16 Siemens Mobility

- 11.17 Thales

- 11.18 TomTom

- 11.19 Trimble

- 11.20 Uber Technologies