|

시장보고서

상품코드

1699294

심혈관 기기 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Cardiovascular Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

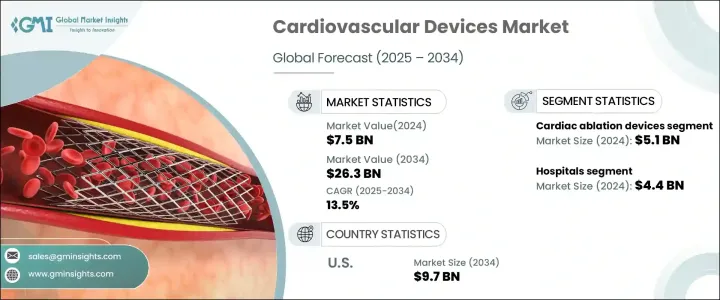

세계의 심혈관 기기 시장은 2024년에 75억 달러로 평가되었습니다. 심혈관 질환(CVDs)의 증례 증가, 기술 진보, 헬스케어 지출 증가를 배경으로 2025년부터 2034년에 걸쳐 13.5%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예측되고 있습니다.

인구의 고령화와 생활 습관병이 주된 원인이 되어 심장 관련 질병의 부담이 증가하고 있는 것이 선진적인 심혈관 솔루션 수요를 크게 밀어 올리고 있습니다. 앉아서 생활하는 습관, 잘못된 식습관, 높은 스트레스 수준이 전 세계적으로 CVD의 원인이 되고 있는 가운데 혁신적인 진단 및 치료 기기의 필요성이 그 어느 때보다 절실해지고 있습니다.

의료 기술의 최첨단 진보는 심혈관 치료에 혁명을 일으키고 있습니다. AI를 활용한 진단, 로봇 지원 수술, 저침습 수술의 도입은 회복 시간을 단축하면서 환자의 예후를 향상시키고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 75억 달러 |

| 예측 금액 | 263억 달러 |

| CAGR | 13.5% |

이 시장은 기기 유형별로 심장 절제기기, 좌심방 부속기 폐쇄기기, 내시경적 혈관 채취기기로 분류됩니다. 불규칙한 심박 리듬으로 진단되는 환자 증가에 따라 낮은 침습 절제 기술의 채용이 증가하고 있습니다.

최종 용도별로는 심혈관 기기 시장은 병원, 외래수술센터(ASC), 심장 센터, 기타 의료시설로 구분됩니다. 고급 화상 처리 기술, 심장 전문 유닛, 집학적 팀을 갖춘 병원은 중요한 심혈관 증례의 주요 치료 거점인 계속하고 있습니다.

미국의 심혈관 기기 시장은 2023년에는 25억 달러였으며, 2034년에는 97억 달러로 성장할 것으로 예상됩니다. 전문가의 강력한 네트워크 등의 장점을 누리고 있습니다.치료 기법의 끊임없는 혁신과 지지적인 규제 정책이 시장 침투를 가속화하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 심혈관 질환을 앓고 있는 환자 증가

- 고령 인구의 확대

- 정부의 이니셔티브 증가

- 심혈관 기기의 기술적 진보

- 낮은 침습 절차에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 심장 수술과 관련된 높은 위험

- 엄격한 규제 시나리오

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 전망

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 디바이스 유형별(2021-2034년)

- 주요 동향

- 심장 절제 장치

- 고주파 절제기

- 전기 절제기

- 냉동 절제 장치

- 초음파 장치

- 기타 심장 절제 장치

- 좌심방 부속기 폐쇄 장치

- 심내막 LAA 폐쇄 장치

- 심외막 LAA 폐쇄 장치

- 내시경적 혈관 채취 장치

- EVH 시스템

- 내시경

- 부속품

제6장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 심장센터

- 기타 최종 용도

제7장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제8장 기업 프로파일

- Abbott Laboratories

- AngioDynamics

- AtriCure

- Biosense Webster

- Boston Scientific Corporation

- Biotronik

- CardioFocus

- Getinge

- Japan Lifeline

- Karl Storz

- Lepu Medical Technology

- Lifetech Scientific

- Livanova

- Microport Scientific Corporation

- Medical Instruments

- Medtronic

- Occlutech

- Saphena Medical

- Stereotaxis

- Terumo Corporation

The Global Cardiovascular Devices Market was valued at USD 7.5 billion in 2024 and is projected to register a CAGR of 13.5% from 2025 to 2034, driven by rising cases of cardiovascular diseases (CVDs), technological advancements, and increasing healthcare expenditures. The escalating burden of heart-related ailments, largely fueled by an aging population and lifestyle-related disorders, is significantly propelling demand for advanced cardiovascular solutions. As sedentary habits, poor dietary choices, and high-stress levels continue to contribute to CVDs worldwide, the need for innovative diagnostic and treatment devices is becoming more pressing than ever. Additionally, greater awareness regarding preventive healthcare and early detection strategies is further boosting market adoption.

Cutting-edge advancements in medical technology are revolutionizing cardiovascular care. The introduction of AI-powered diagnostics, robotic-assisted surgeries, and minimally invasive procedures is enhancing patient outcomes while reducing recovery time. The industry is witnessing a surge in regulatory approvals, expanding access to state-of-the-art cardiovascular devices. Governments and private healthcare entities are heavily investing in research and development to introduce next-generation solutions that cater to evolving patient needs. Rising healthcare expenditures, particularly in developed economies, are facilitating the widespread availability of advanced cardiac devices, further propelling market growth. Moreover, the increasing number of outpatient cardiovascular interventions and home-based monitoring systems is making treatments more accessible and convenient for patients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $26.3 Billion |

| CAGR | 13.5% |

The market is categorized by device type into cardiac ablation devices, left atrial appendage closure devices, and endoscopic vessel harvesting devices. Among these, cardiac ablation devices led the market with a valuation of USD 5.1 billion in 2024 and are projected to witness a CAGR of 13.7% over the forecast period. The rising prevalence of atrial fibrillation is a key driver behind the demand for these devices. With more individuals diagnosed with irregular heart rhythms, the adoption of minimally invasive ablation techniques is on the rise. Additionally, growing awareness about effective treatment options, coupled with continuous advancements in ablation technology, is fostering market expansion.

By end use, the cardiovascular devices market is segmented into hospitals, ambulatory surgical centers, cardiac centers, and other healthcare facilities. Hospitals dominated the sector, generating USD 4.4 billion in 2024 and accounting for 58.3% of the total revenue. A higher patient influx for complex cardiac interventions, including bypass surgeries, catheterizations, and device implantations, is solidifying hospitals' leadership in this space. Equipped with advanced imaging technologies, specialized cardiac units, and multidisciplinary teams, hospitals remain the primary treatment hubs for critical cardiovascular cases. Additionally, their ability to handle emergency and inpatient procedures makes them a preferred choice among both patients and healthcare providers.

The U.S. cardiovascular devices market stood at USD 2.5 billion in 2023 and is projected to grow to USD 9.7 billion by 2034. The country benefits from a well-established healthcare infrastructure, rapid adoption of cutting-edge cardiovascular technologies, and a strong network of skilled professionals, including cardiac surgeons, interventional cardiologists, and electrophysiologists. Continuous innovation in treatment methodologies and supportive regulatory policies are accelerating market penetration. Favorable reimbursement frameworks are further encouraging the adoption of advanced cardiovascular devices, positioning the U.S. as a leading market for cardiac care solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Expanding geriatric population

- 3.2.1.3 Rising government initiatives

- 3.2.1.4 Technological advancements in cardiovascular devices

- 3.2.1.5 Rising demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with cardiac procedures

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac ablation devices

- 5.2.1 Radiofrequency ablators

- 5.2.2 Electric ablators

- 5.2.3 Cryoablation devices

- 5.2.4 Ultrasound devices

- 5.2.5 Other cardiac ablation devices

- 5.3 Left atrial appendage closure devices

- 5.3.1 Endocardial LAA closure devices

- 5.3.2 Epicardial LAA closure devices

- 5.4 Endoscopic vessel harvesting devices

- 5.4.1 EVH systems

- 5.4.2 Endoscopes

- 5.4.3 Accessories

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Cardiac centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 AngioDynamics

- 8.3 AtriCure

- 8.4 Biosense Webster

- 8.5 Boston Scientific Corporation

- 8.6 Biotronik

- 8.7 CardioFocus

- 8.8 Getinge

- 8.9 Japan Lifeline

- 8.10 Karl Storz

- 8.11 Lepu Medical Technology

- 8.12 Lifetech Scientific

- 8.13 Livanova

- 8.14 Microport Scientific Corporation

- 8.15 Medical Instruments

- 8.16 Medtronic

- 8.17 Occlutech

- 8.18 Saphena Medical

- 8.19 Stereotaxis

- 8.20 Terumo Corporation