|

시장보고서

상품코드

1708210

싱글 서브 포장 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Single-Serve Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

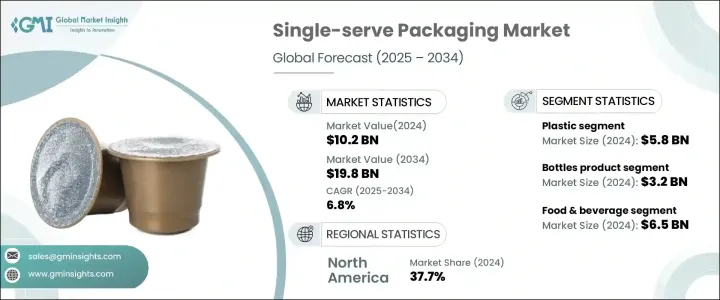

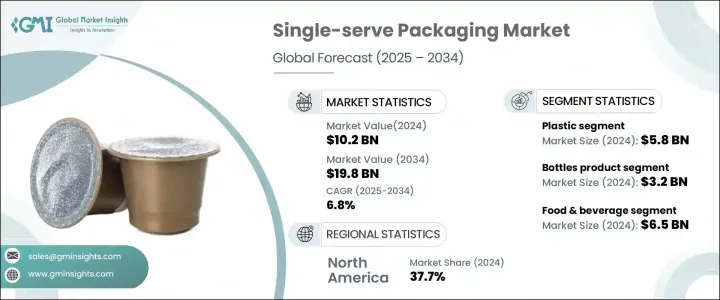

세계의 싱글 서브 포장 시장은 2024년에 102억 달러로 평가되며, 2025-2034년에 CAGR 6.8%로 성장할 것으로 예측됩니다.

이러한 놀라운 성장의 주요 요인은 부분 조절 및 건강 지향적인 소비자 선호도 증가와 편리한 식품 및 음료 옵션의 보급에 기인한 것으로 분석됩니다. 개인들이 건강관리에 대한 관심이 높아짐에 따라 부분 조절에 대한 관심이 높아지면서 편의성과 음식물 쓰레기를 줄일 수 있는 1인분 포장에 대한 수요가 증가하고 있습니다. 바쁜 도시 생활, 연장된 근무 시간, 시간적 제약으로 인해 휴대가 간편하고 RTE(ready-to-eat) 또는 RTD(ready-to-drink) 제품에 대한 요구가 증가하고 있습니다. 1회 제공량 포장 형태는 편리성, 휴대성, 효율적인 용량 관리를 제공하므로 많은 사랑을 받고 있습니다.

또한 제품의 안전성을 향상시키고 유통기한을 연장하며 미적 매력을 향상시키는 포장 솔루션의 기술 발전도 이 시장에 혜택을 가져다주고 있습니다. 또한 환경 인식이 높아지면서 친환경적이고 지속가능한 포장재 개발이 촉진되어 시장 성장을 가속하고 있으며, E-Commerce 플랫폼이 계속 번창함에 따라 운송 중 제품의 신선도를 보장하는 가볍고 내구성이 뛰어난 포장 솔루션에 대한 수요가 꾸준히 증가하고 있습니다. 1회용 포장 형태는 편리함과 지속가능성을 추구하는 소비자의 변화하는 기호에 부응하는 데 효과적임이 입증되었습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작 금액 | 102억 달러 |

| 예상 금액 | 198억 달러 |

| CAGR | 6.8% |

시장은 재료별로 분류되며, 플라스틱, 종이, 금속, 유리 등이 주요 카테고리로 분류됩니다. 플라스틱은 경량성, 내구성, 유연성, 쉬운 운송 및 안전한 보관을 가능하게 하는 특성으로 인해 2024년 58억 달러로 평가되며 지배적인 부문으로 부상할 것으로 예측됩니다. 플라스틱 포장은 습기, 공기, 빛과 같은 외부 요소로부터 제품을 효과적으로 보호하여 유통기한을 연장합니다. 또한 지속가능성에 대한 관심이 높아지고 친환경 솔루션에 대한 선호도가 높아짐에 따라 제조업체들은 규제 기준과 환경적 기대에 부합하는 재활용 가능한 대체 플라스틱 및 바이오 플라스틱을 도입할 수밖에 없게 되었습니다. 이러한 기술 혁신은 소비자의 취향에 부응할 뿐만 아니라 플라스틱 폐기물과 환경에 미치는 영향에 대한 우려 증가에도 대응하고 있습니다.

싱글 서빙 포장은 식품, 음료, 의약품, 퍼스널케어 등 다양한 분야에서 폭넓게 사용되고 있으며, 2024년 65억 달러 규모의 식품 및 음료 부문은 RTE 및 RTD 제품의 인기로 인해 큰 폭의 성장세를 보였습니다. 스낵 팩, 기능성 음료, 밀키트에 대한 소비자 선호도가 높아짐에 따라 포션 조절이 가능하고 휴대가 용이한 포장 솔루션에 대한 수요가 증가하고 있습니다. 온라인 식료품 쇼핑과 음식 배달 서비스의 급증으로 인해 운송 중에도 제품의 신선도를 유지할 수 있는 가볍고 내구성이 뛰어나며 안전한 포장의 필요성이 더욱 커지고 있습니다. 제조업체들은 소비자의 선호도 변화와 지속가능성 목표에 맞추어 제품 안전성을 높이는 포장 혁신에 더욱 집중하고 있습니다.

북미의 싱글 서빙 포장 시장은 2024년 세계 시장 점유율의 37.7%를 차지했습니다. 이 지역에서는 건강 지향적 성향과 부분 조절 소비가 증가하고 있으며, 이동 중에도 먹을 수 있는 라이프스타일이 확산됨에 따라 혁신적인 포장 솔루션에 대한 수요가 증가하고 있습니다. 또한 친환경 포장에 대한 규제적 지원과 지속가능한 대체품에 대한 홍보는 재활용이 가능하고 혁신적인 1회용 포장 포맷의 채택을 촉진하고 있습니다. 지속가능성에 대한 관심이 높아지면서 바이오 및 생분해성 포장 솔루션의 통합은 시장의 성장 궤도를 더욱 가속화할 것으로 예측됩니다.

목차

제1장 조사 방법과 조사 범위

제2장 개요

제3장 업계 인사이트

- 에코시스템 분석

- 업계에 대한 영향요인

- 촉진요인

- 여행, 관광, 접객(Hoapitality) 분야에서 수요의 증가

- 포션 컨트롤과 건강지향의 증가

- 소비자 라이프스타일의 진화와 도시화

- RTE(ready-to-eat) 및 RTD(ready-to-drink) 부문의 확대

- E-Commerce와 소비자 직판 채널의 성장

- 업계의 잠재적 리스크 & 과제

- 원재료 가격의 변동

- 공급망 혼란

- 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 향후 시장 동향

- 갭 분석

- Porter의 산업 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추산·예측 : 재료별, 2021-2034년

- 주요 동향

- 플라스틱

- 종이

- 금속

- 유리

제6장 시장 추산·예측 : 제품 유형별, 2021-2034년

- 주요 동향

- 파우치 & 사쉐

- 컵 & 튜브

- 보틀

- 블리스터 팩

- 트레이

- 기타

제7장 시장 추산·예측 : 용도별, 2021-2034년

- 주요 동향

- 식품 및 음료

- 의약품

- 퍼스널케어 & 화장품

- 기타

제8장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 아랍에미리트

제9장 기업 개요

- Amcor plc

- Amber Packaging

- American FlexPack

- CarePac

- Constantia Flexibles

- CP Italy S.r.l.

- Duropack Limited

- Glenroy, Inc.

- Huhtamaki

- IMA Group

- Mondi

- Polysack Flexible Packaging Ltd.

- ProAmpac

- Rain Nutrience

- RATTPACK

- RCP Ranstadt GmbH

- TIPA LTD

- Transcontinental Inc.

- Winpak LTD.

The Global Single-Serve Packaging Market was valued at USD 10.2 billion in 2024 and is projected to grow at a CAGR of 6.8% during 2025-2034. This impressive growth is primarily fueled by rising consumer preferences for portion-controlled, health-conscious consumption and the proliferation of convenient food and beverage options. As individuals become more focused on managing their health, portion control has gained prominence, driving demand for single-serve packaging that offers convenience and reduced food wastage. Busy urban lifestyles, longer working hours, and time constraints have intensified the need for easy-to-carry and ready-to-eat (RTE) or ready-to-drink (RTD) products. Single-serve packaging formats have gained traction as they provide convenience, portability, and efficient portion management.

The market is also benefiting from technological advancements in packaging solutions that improve product safety, extend shelf life, and enhance aesthetic appeal. Additionally, increased environmental consciousness has prompted the development of eco-friendly and sustainable packaging materials, boosting market growth. As e-commerce platforms continue to thrive, the demand for lightweight and durable packaging solutions that ensure product freshness during transportation is steadily rising. Single-serve packaging formats have proven to be effective in catering to the evolving preferences of consumers who seek both convenience and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 6.8% |

The market is segmented by material type, with plastic, paper, metal, and glass being the primary categories. Plastic emerged as the dominant segment, valued at USD 5.8 billion in 2024, due to its lightweight, durable, and flexible characteristics that facilitate easy transportation and secure storage. Plastic packaging effectively shields products from external elements such as moisture, air, and light, thereby extending shelf life. Moreover, the growing emphasis on sustainability and the increasing preference for environmentally friendly solutions have compelled manufacturers to introduce recyclable and bio-based plastic alternatives that align with regulatory standards and environmental expectations. These innovations not only cater to consumer preferences but also address the rising concerns surrounding plastic waste and its impact on the environment.

Single-serve packaging is extensively utilized across multiple applications, including food and beverage, pharmaceuticals, and personal care. The food and beverage segment, generating USD 6.5 billion in 2024, witnessed substantial growth driven by the popularity of RTE and RTD products. Consumers' preference for snack packs, functional beverages, and meal kits has fueled demand for portion-controlled and easily portable packaging solutions. The surge in online grocery shopping and food delivery services further reinforces the need for lightweight, durable, and secure packaging that maintains product freshness during transit. Manufacturers are increasingly focusing on packaging innovations that enhance product safety while aligning with changing consumer preferences and sustainability goals.

North America single-serve packaging market accounted for 37.7% of the global share in 2024. The region's growing inclination toward health-conscious and portion-controlled consumption, along with the adoption of on-the-go lifestyles, has driven demand for innovative packaging solutions. Additionally, regulatory support for eco-friendly packaging and the push for sustainable alternatives have encouraged the adoption of recyclable and innovative single-serve packaging formats. As sustainability takes center stage, the integration of bio-based and biodegradable packaging solutions is expected to further accelerate the market's growth trajectory.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in the travel, tourism, and hospitality sectors

- 3.2.1.2 Rising demand for portion control and health-conscious consumption

- 3.2.1.3 Evolving consumer lifestyles and urbanization

- 3.2.1.4 Expansion of the ready-to-eat (RTE) and ready-to-drink (RTD) segments

- 3.2.1.5 Growth of e-commerce and direct-to-consumer channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuation in raw materials price

- 3.2.2.2 Supply chain disruption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper

- 5.4 Metal

- 5.5 Glass

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches & sachets

- 6.3 Cups & tubs

- 6.4 Bottles

- 6.5 Blister packs

- 6.6 Trays

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Amber Packaging

- 9.3 American FlexPack

- 9.4 CarePac

- 9.5 Constantia Flexibles

- 9.6 CP Italy S.r.l.

- 9.7 Duropack Limited

- 9.8 Glenroy, Inc.

- 9.9 Huhtamaki

- 9.10 IMA Group

- 9.11 Mondi

- 9.12 Polysack Flexible Packaging Ltd.

- 9.13 ProAmpac

- 9.14 Rain Nutrience

- 9.15 RATTPACK

- 9.16 RCP Ranstadt GmbH

- 9.17 TIPA LTD

- 9.18 Transcontinental Inc.

- 9.19 Winpak LTD.