|

시장보고서

상품코드

1716592

비디오 인터콤 기기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Video Intercom Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

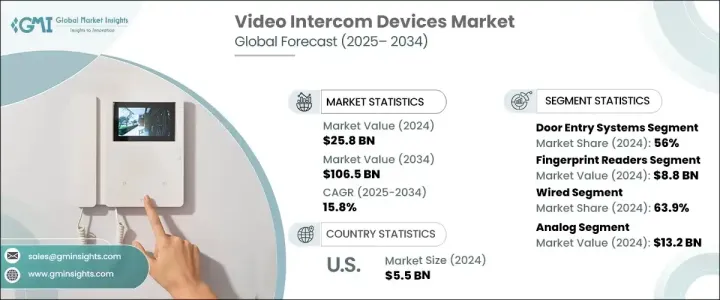

세계의 비디오 인터콤 기기 시장은 2024년에는 258억 달러에 달했고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 15.8%를 나타낼 것으로 예측됩니다.

시장의 급성장은 고도의 홈 보안 시스템에 대한 수요 증가와 무선 통신 기술의 기술 혁신 증가가 원동력이 되고 있습니다. 가처분 소득 증가와 홈 보안 연구 개발에 대한 투자 증가는 이러한 시스템의 세계 보급을 더욱 촉진하고 있습니다. 렌드리한 시스템이 실현되어 비디오 인터콤 기기의 매력이 높아지고 있습니다. 장비로 원격 조작을 제공하는 시스템의 채택으로 전환하고 있습니다. 도시로의 이주가 가속화되어 공동 작업자가 원격 감시 시스템을 추구함에 따라 지능형 보안 솔루션에 대한 수요가 계속 증가하고 있습니다.

시장은 장치 유형별로 휴대용 장치, 도어 엔트리 시스템, 비디오 아기 모니터로 구분됩니다. IoT와 AI 기반의 입퇴실 관리 시스템의 통합으로 사용자의 본인 확인, 원격 관리, 지속적인 감시가 가능해지고, 보안이 강화되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 258억 달러 |

| 예측 금액 | 1,065억 달러 |

| CAGR | 15.8% |

액세스 제어 분야에서는 시장이 지문 리더, 패스워드 액세스, 근접 카드, 무선 액세스로 나뉘어져 있습니다. 의뢰성, 사용 편의성, 무단 액세스를 방지하는 능력에서 바이오메트릭 기반 제어 시스템을 선택하도록 되어 있습니다.

시장은 시스템 유형별로 유선과 무선으로 이분됩니다. 유선 부문은 2024년 시장 점유율의 63.9%를 차지했습니다. 정부 시설, 군사 기지, 중요한 인프라 사이트는 최대한의 보안이 요구되고 유선 시스템은 무선 대체품에 비해 데이터 침해 및 시스템 중단으로부터 보호가 뛰어납니다.

기술 부문은 아날로그 및 IP 기반 시스템으로 나뉩니다. 아날로그 부문은 낮은 대역폭 환경에서 신뢰성으로 인해 2024년에 132억 달러를 차지했습니다.

최종 용도별로 시장은 자동차, 상업, 정부, 주택 등으로 구분됩니다. - 방문자 기록, 비디오 인터콤 시스템을 통한 보안 향상 요구가 높아지고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 홈 보안 시스템 수요 증가

- 무선 통신 기술의 진보

- 스마트 홈의 보급

- 도시화와 집합 주택 증가

- IoT와 자동화와의 통합

- 업계의 잠재적 위험 및 과제

- 높은 초기 도입 비용과 유지 보수 비용

- 프라이버시와 데이터 보안에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 디바이스 유형별(2021-2034년)

- 주요 동향

- 도어 엔트리 시스템

- 핸드헬드 기기

- 비디오 베이비 모니터

제6장 시장 추계·예측 : 액세스 제어별(2021-2034년)

- 주요 동향

- 지문 인식기

- 비밀번호 액세스

- 근접 카드

- 무선 액세스

제7장 시장 추계·예측 : 시스템별(2021-2034년)

- 주요 동향

- 유선

- 무선

제8장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 아날로그

- IP

제9장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 자동차

- 상업

- 정부

- 주거

- 기타

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- ABB Ltd

- Aiphone

- Axis Communications AB

- ButterflyMX Inc.

- Comelit Group

- Commend International GmbH

- Dahua Technologies Co. Ltd

- Doorbird

- Fermax

- Godrej & Boyce Mfg. Co. Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd

- Honeywell

- KOCOM Co., Ltd.

- Legrand

- Mivanta

- MOX Group Limited

- Panasonic Holdings Corporation

- Ring

- Siedle &Sohne OHG

- Xiamen Leelen Technology Co., Ltd

- Zicom

- ZKTeco

The Global Video Intercom Devices Market was valued at USD 25.8 billion in 2024 and is anticipated to grow at a CAGR of 15.8% from 2025 to 2034. The rapid growth of the market is driven by the increasing demand for advanced home security systems and rising innovations in wireless communication technology. Consumers are more concerned about safety, leading to a higher demand for smart home security solutions. Rising disposable income and growing investments in research and development for home security have further fueled the adoption of these systems globally. The integration of AI with smart home technologies has enabled more efficient, secure, and user-friendly systems, enhancing the appeal of video intercom devices. With the increasing popularity of cloud-based and wireless security systems, consumers are shifting away from conventional solutions to adopt systems that offer real-time notifications and remote control through mobile devices. As urban migration accelerates and dual-income families seek remote surveillance systems, demand for intelligent security solutions continues to rise.

The market is segmented by device type into handheld devices, door entry systems, and video baby monitors. The door entry systems segment captured 56% of the global video intercom devices market in 2024, driven by the increasing need for advanced security features in residential and commercial buildings. Integration of IoT and AI-based access control systems has enhanced security by enabling user identity verification, remote management, and continuous surveillance. The growing focus on smart security solutions to address rising security threats is boosting the adoption of door entry systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $106.5 Billion |

| CAGR | 15.8% |

By access control, the market is divided into fingerprint readers, password access, proximity cards, and wireless access. The fingerprint readers segment was valued at USD 8.8 billion in 2024, reflecting the increasing preference for biometric security systems. As security concerns grow in residential, commercial, and industrial settings, property owners are opting for biometric-based control systems due to their reliability, ease of use, and ability to prevent unauthorized access. Fingerprint readers offer contactless, fast, and secure authentication, reducing the risk of credential theft or misuse. The integration of AI with fingerprint recognition, cloud-based access, and mobile authentication further enhances the security and convenience of these systems.

The market is bifurcated by system type into wired and wireless. The wired segment held 63.9% of the market share in 2024, as high-security environments favor wired solutions due to their reliability and resilience against cyber threats. Government facilities, military bases, and critical infrastructure sites require maximum security, and wired systems offer better protection against data breaches and system disruptions compared to wireless alternatives.

The technology segment is divided into analog and IP-based systems. The analog segment accounted for USD 13.2 billion in 2024 due to its reliability in low-bandwidth environments. Unlike IP-based systems that rely on internet connectivity, analog systems operate independently, making them ideal for older buildings and rural areas where broadband penetration is limited.

By end use, the market is segmented into automotive, commercial, government, residential, and others. The commercial segment led the market with USD 9.3 billion in 2024, driven by the rising demand for automated access control in smart offices and co-working spaces. Increased adoption of IoT-based office environments has fueled the need for contactless entry, visitor logging, and improved security through video intercom systems. In 2024, the US market accounted for USD 5.5 billion, with growing demand for sophisticated home security solutions that integrate IoT, AI, and cloud-based monitoring systems to improve residential security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for home security systems

- 3.6.1.2 Advancements in wireless communication technology

- 3.6.1.3 Rising adoption in smart homes

- 3.6.1.4 Growing urbanization and residential complexes

- 3.6.1.5 Integration with IoT and automation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial installation and maintenance costs

- 3.6.2.2 Privacy and data security concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Device Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Door entry systems

- 5.3 Handheld devices

- 5.4 Video baby monitors

Chapter 6 Market Estimates & Forecast, By Access control, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fingerprint readers

- 6.3 Password access

- 6.4 Proximity cards

- 6.5 Wireless access

Chapter 7 Market Estimates & Forecast, By System, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Analog

- 8.3 IP-based

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Commercial

- 9.4 Government

- 9.5 Residential

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB Ltd

- 11.2 Aiphone

- 11.3 Axis Communications AB

- 11.4 ButterflyMX Inc.

- 11.5 Comelit Group

- 11.6 Commend International GmbH

- 11.7 Dahua Technologies Co. Ltd

- 11.8 Doorbird

- 11.9 Fermax

- 11.10 Godrej & Boyce Mfg. Co. Ltd.

- 11.11 Hangzhou Hikvision Digital Technology Co. Ltd

- 11.12 Honeywell

- 11.13 KOCOM Co., Ltd.

- 11.14 Legrand

- 11.15 Mivanta

- 11.16 MOX Group Limited

- 11.17 Panasonic Holdings Corporation

- 11.18 Ring

- 11.19 Siedle & Sohne OHG

- 11.20 Xiamen Leelen Technology Co., Ltd

- 11.21 Zicom

- 11.22 ZKTeco