|

시장보고서

상품코드

1716605

탬핑 래머기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Tamping Rammer Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

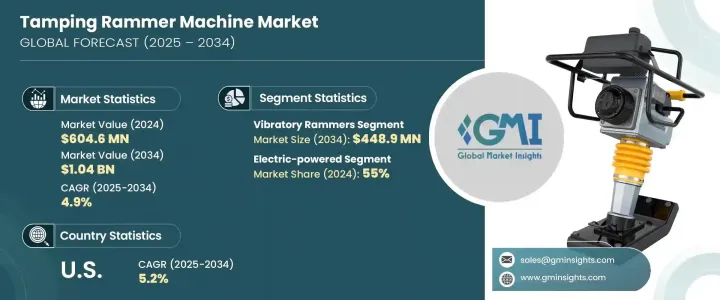

세계의 탬핑 래머기 시장 규모는 2024년에 6억 460만 달러가 되었고, 2025년부터 2034년에 걸쳐 CAGR 4.9%를 나타낼 것으로 예측됩니다.

건설 활동과 인프라 개발 증가는 탬핑 래머기 수요에 크게 기여하고 있습니다. 도시화와 인구 증가에 따라 주택, 복합 상업시설, 도로 등 다양한 유형의 인프라를 건설할 필요성이 계속 확대되고 있습니다. 탬핑 래머기는 자갈, 토양, 아스팔트를 굳히고 이러한 구조물의 안정성과 내구성을 확보하는 데 중요한 역할을 담당하고 있습니다. 신흥국을 중심으로 한 건설 업계의 성장은 이러한 기계 수요 증가의 주요 원동력이 되었습니다. 계약자들이 프로젝트를 효율적으로 강화하기 위해 노력하는 동안, 탬핑 래머기는 구조물의 무결성에 필수적인 적절한 토밀도를 보장하기 위한 이상적인 솔루션을 제공합니다.

탬핑 래머기는 계약자가 인건비와 프로젝트 일정을 최소화하는 데 도움이 되는 효율성에 의해 뒷받침됩니다. 펀치 롤러와 같은 대체 기술도 흙을 굳히는 데 사용되고 있지만, 탬핑 래머기는 시장에서 그 중요성을 유지하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 6억 460만 달러 |

| 예측 금액 | 10억 4,000만 달러 |

| CAGR | 4.9% |

제품 유형에서 시장은 타격식 래머기, 진동식 래머기, 보행식 래머기, 원격 조작식 래머기로 나뉩니다. 이 기계는 응집성 토양이나 혼합 토양에서 높은 효과를 발휘해, 최소한의 노력으로 신속한 조임을 실시하기 위해, 중대형 작업에 최적입니다. 진동 래머기는 또한, 수작업에 의한 조임 방법에 비해 시간과 에너지를 절약할 수 있기 때문에 공공시설의 설치 등의 소규모 프로젝트에 인기가 있습니다.

시장은 동력원별로 구분되어 전동식 래머기가 2024년의 점유율 55%로 시장을 선도했습니다. 배터리 구동식 래머기는 가솔린식과 같은 배기 가스가 없고 휴대성이 뛰어나 실내외에서의 사용에 범용성이 있습니다.

건설 부문은 최대의 최종 용도 부문이며, 2024년 시장 점유율의 30.86% 이상을 차지했으며, 2034년까지 5.3%의 성장률이 예상되고 있습니다. 미국 시장은 상당한 인프라 투자에 힘입어 예측 기간 동안 5.2%의 연평균 성장률(CAGR)을 나타낼 것으로 예상됩니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 가격 분석

- 기술과 혁신의 전망

- 주요 뉴스 및 이니셔티브

- 규제 상황

- 제조업체

- 유통업체

- 영향요인

- 성장 촉진요인

- 건설 활동 증가

- 인프라 개발

- 휴대용 기기에 대한 수요 증가

- 기술의 진보

- 업계의 잠재적 위험 및 과제

- 대체 기술과의 경쟁

- 환경에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- 기술 개요

- 무역 분석(HS 코드-84306100)

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 진동 래머기

- 퍼커션 래머기

- 워크 비하인드 래머기

- 원격 제어 래머기

제6장 시장 추계·예측 : 동력원별(2021-2034년)

- 주요 동향

- 가솔린 구동

- 전동 구동

- 배터리 구동

제7장 시장 추계·예측 : 카테고리별(2021-2034년)

- 주요 동향

- 자동식

- 수동식

- 반자동

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 건설

- 인프라

- 광업

- 조경 및 가드닝

- 농업

- 기타

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Ammann Group

- Atlas Copco

- Belle Group

- Bomag GmbH

- Caterpillar Inc.

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- JCB

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Multiquip Inc.

- Toro Company

- Wacker Neuson

- Weber MT

The Global Tamping Rammer Machine Market was valued at USD 604.6 million in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The rise in construction activities and infrastructure development is significantly contributing to the demand for tamping rammers. With urbanization and population growth, the need for constructing various types of infrastructure, including residential buildings, commercial complexes, and roads, continues to expand. Tamping rammers are critical in compacting gravel, soil, and asphalt, ensuring the stability and durability of these structures. The growth of the construction industry, particularly in emerging economies, is a key driver behind the increasing demand for these machines. As contractors strive for efficient compaction in their projects, tamping rammers provide an ideal solution for ensuring proper soil density, which is essential for structural integrity.

Tamping rammers are favored due to their efficiency, helping contractors minimize labor costs and project timelines. Their ability to quickly and effectively compact materials in tight or difficult-to-reach spaces is a major advantage. While alternative technologies such as vibratory plate compactors, walk-behind rollers, and trench rollers are also used for soil compaction, tamping rammers maintain their significance in the market. Despite the presence of such alternatives, tamping rammers offer exceptional value, particularly for tasks in confined spaces where larger machines cannot operate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $604.6 Million |

| Forecast Value | $1.04 Billion |

| CAGR | 4.9% |

In terms of product type, the market is divided into percussion rammers, vibratory rammers, walk-behind rammers, and remote-controlled rammers. Vibratory rammers are expected to dominate, with a market value of USD 249.6 million in 2024, growing to USD 448.9 million by 2034. These machines are highly effective in cohesive and mixed soils, providing rapid compaction with minimal effort, which is ideal for medium-to-heavy tasks. Vibratory rammers also save time and energy compared to manual compaction methods, making them popular for small projects such as utility installations.

The market is segmented by power source, with electric-powered rammers leading the market with a 55% share in 2024. These machines are particularly suitable for indoor applications due to their zero emissions and low noise. Battery-powered rammers offer portability without the emissions of gasoline-powered models, making them versatile for both indoor and outdoor use. Gasoline-powered rammers remain useful in outdoor environments where electricity access is limited.

The construction sector is the largest end-use segment, accounting for over 30.86% of the market share in 2024, and it is expected to grow at a rate of 5.3% by 2034. These machines are essential for various tasks in roadwork, pavement laying, and trench backfilling, particularly in narrow or confined spaces. The market in the U.S. is projected to grow at a CAGR of 5.2% during the forecast period, driven by significant infrastructure investments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing construction activities

- 3.9.1.2 Infrastructure development

- 3.9.1.3 Growing demand for portable equipment

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Competition from alternative technologies

- 3.9.2.2 Environmental concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Technological overview

- 3.12 Trade analysis (HS Code – 84306100)

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vibratory rammers

- 5.3 Percussion rammers

- 5.4 Walk-behind rammers

- 5.5 Remote-controlled rammers

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Gasoline-powered

- 6.3 Electric-powered

- 6.4 Battery-powered

Chapter 7 Market Estimates & Forecast, By Category, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Manual

- 7.4 Semi-automatic

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Infrastructure

- 8.4 Mining

- 8.5 Landscaping and gardening

- 8.6 Agriculture

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ammann Group

- 11.2 Atlas Copco

- 11.3 Belle Group

- 11.4 Bomag GmbH

- 11.5 Caterpillar Inc.

- 11.6 Chicago Pneumatic

- 11.7 Doosan Corporation

- 11.8 Husqvarna Group

- 11.9 JCB

- 11.10 MBW Inc.

- 11.11 Mikasa Sangyo Co., Ltd.

- 11.12 Multiquip Inc.

- 11.13 Toro Company

- 11.14 Wacker Neuson

- 11.15 Weber MT