|

시장보고서

상품코드

1716659

첨단 항공 모빌리티(AAM) 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Advanced Air Mobility Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

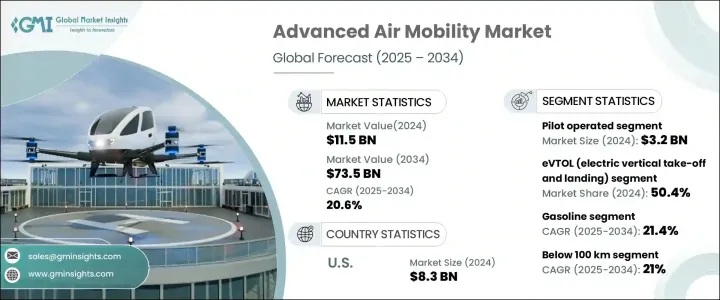

세계의 첨단 항공 모빌리티(AAM) 시장은 2024년에 115억 달러를 창출했고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 20.6%를 나타낼 것으로 예측됩니다.

세계가 이산화탄소 배출량을 줄이고 기후 변화 대책에 대한 노력을 강화하는 가운데, 운송 부문은 보다 깨끗한 솔루션으로의 변혁기를 맞이하고 있습니다. 소리를 최소화하는 지속 가능한 항공 운송 옵션을 제공하는 게임 체인저로서 상승하고 있습니다.

세계 정부와 규제 당국은 유리한 정책과 투자를 통해 이러한 진보를 지원하고 있으며, AAM 기술의 신속한 인증과 상업화를 가능하게 하고 있습니다. 하지만 시장의 성장을 가속하고 있습니다. 도시화가 진행되고 보다 빠르고 효율적인 이동 솔루션에 대한 수요가 높아지는 가운데, AAM은 원활한 포인트 투 포인트의 운송을 제공함으로써 지역 및 도시의 이동성에 혁명을 일으킬 것으로 기대되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 115억 달러 |

| 예측 금액 | 735억 달러 |

| CAGR | 20.6% |

2024년에 32억 달러로 평가된 조종사의 고급 항공 이동성 분야는 안전하고 신뢰할 수 있는 도시 항공 운송을 실현하기 위해 인간의 전문 지식과 기술 혁신을 융합시켜 따라서 강력한 성장을 목격하고 있습니다. 숙련된 파일럿의 기술을 활용하여 안전성을 한층 더 높인 첨단 항공 모빌리티는 복잡하거나 인구 밀도가 높은 환경에서도 원활한 운행을 보장합니다. 또한 기존의 항공 인프라와의 통합이나 유리한 규제 프레임워크의 도입으로 인증 프로세스가 빨라지고 이러한 기술의 신속한 전개와 폭넓은 수용에의 길이 열리고 있습니다.

첨단 항공 모빌리티(AAM) 시장은 전기 수직 이착륙(eVTOL)기, 단거리 이착륙(STOL)기, 기존의 고정익기 등 차량 유형별로 분류됩니다. 하지만 여객 운송 요건을 충족할 수 있기 때문에 인기를 끌고 있습니다. eVTOL 기술의 개발은 첨단 항공 모빌리티(AAM)의 미래를 형성하는 데 있어 매우 중요한 역할을 할 것으로 예측됩니다.

2024년에 83억 달러로 평가된 미국의 첨단 항공 모빌리티(AAM) 시장은 강력한 기술 혁신 생태계와 유명한 항공우주 기업의 존재에 힘입어 세계적 리더로 자리매김하고 있습니다. 미국은 AAM 솔루션의 진보와 채용을 추진하고 있습니다. 이 나라의 적극적인 규제 환경은 관민의 이해 관계자간의 지속적인 협력과 함께 첨단 항공 모빌리티(AAM) 기술의 상업화를 가속화하고 미국을 세계의 AAM 랜드스케이프에서 프론트 러너로 자리 매김하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 도시화와 교통 정체

- 소비자의 기호의 변화

- 투자와 정부 지원

- 전략적 파트너십과 제휴

- 이용 사례와 용도의 확대

- 업계의 잠재적 위험 및 과제

- 규제와 안전성의 과제

- 일반 대중의 수용과 인식

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 운전 모드별(2021-2034년)

- 주요 동향

- 파일럿 운전

- 자율/원격 운전

제6장 시장 추계·예측 : 차량 유형별(2021-2034년)

- 주요 동향

- eVTOL(전기 수직 이착륙) 항공기

- STOL(단거리 이착륙) 항공기

- 기존 고정익 항공기

제7장 시장 추계·예측 : 추진 유형별(2021-2034년)

- 주요 동향

- 가솔린 엔진

- 터빈 엔진(터보)

- 왕복동(피스톤) 엔진

- 전기 추진

- 하이브리드 추진

제8장 시장 추계·예측 : 거리별(2021-2034년)

- 주요 동향

- 100km 미만

- 100km-250km

- 250km-500km

- 500km 이상

제9장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 화물 운송

- 여객 운송

- 매핑 및 측량

- 특수 임무

- 감시 및 모니터링

- 기타

제10장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 상업

- 정부 및 군사

제11장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제12장 기업 프로파일

- Airbus SAS

- Aurora Flight Sciences

- Bell Textron Inc.

- Embraer SA

- Garmin Aviation

- GE Aviation

- GKN Aerospace

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Honywell

- Joby Aviation

- Lilium GmbH

- Opener, Inc.

- Safran

- Siemens

- Thales Group

- The Boeing Company

The Global Advanced Air Mobility Market generated USD 11.5 billion in 2024 and is projected to grow at a CAGR of 20.6% between 2025 and 2034. As the world intensifies its efforts to reduce carbon emissions and combat climate change, the transportation sector is undergoing a transformative shift toward cleaner solutions. Advanced air mobility is emerging as a game-changer, offering sustainable air transport options that reduce traffic congestion, enhance transportation efficiency, and minimize environmental impacts. The increasing integration of electric propulsion systems, autonomous technologies, and innovative vehicle designs is accelerating the adoption of AAM solutions.

Governments and regulatory authorities across the globe are supporting these advancements through favorable policies and investments, enabling rapid certification and commercialization of AAM technologies. Furthermore, the growing interest from urban planners and transportation authorities in incorporating AAM systems into smart city frameworks is driving market growth. With the rise of urbanization and increasing demand for faster and more efficient travel solutions, AAM is expected to revolutionize regional and urban mobility by offering seamless, point-to-point transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $73.5 Billion |

| CAGR | 20.6% |

The piloted advanced air mobility segment, valued at USD 3.2 billion in 2024, is witnessing robust growth as it blends human expertise with technological innovations to deliver safe and reliable urban air transportation. Piloted AAM vehicles offer an added layer of safety by leveraging the skills of experienced pilots, ensuring smooth operations even in complex or densely populated environments. Additionally, the integration of existing aviation infrastructure and the implementation of favorable regulatory frameworks are expediting the certification process, paving the way for faster deployment and wider acceptance of these technologies. As the industry moves toward autonomous solutions, piloted AAM vehicles are serving as a bridge to build public trust and refine operational processes.

The AAM market is categorized by vehicle types, including electric vertical take-off and landing (eVTOL) aircraft, short take-off and landing (STOL) aircraft, and conventional fixed-wing aircraft. In 2024, the eVTOL segment accounted for 50.4% of the market share, driven by the growing adoption of electric and hybrid propulsion systems. eVTOL aircraft are gaining traction due to their ability to meet passenger transportation requirements while adhering to stringent safety and operational standards. The development of eVTOL technology is expected to play a pivotal role in shaping the future of advanced air mobility, as these vehicles offer the potential for scalable, cost-effective, and environmentally sustainable transportation solutions.

The U.S. advanced air mobility market, valued at USD 8.3 billion in 2024, is positioned as a global leader fueled by a strong technological innovation ecosystem and the presence of prominent aerospace companies. With significant investments in research and development and a well-established infrastructure for testing and deploying new technologies, the U.S. is driving the advancement and adoption of AAM solutions. The country's proactive regulatory environment, combined with continuous collaboration between public and private sector stakeholders, is accelerating the commercialization of advanced air mobility technologies and positioning the U.S. as a frontrunner in the global AAM landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and traffic congestion

- 3.2.1.2 Changing consumer preferences

- 3.2.1.3 Investment and government support

- 3.2.1.4 Strategic partnerships and collaborations

- 3.2.1.5 Expansion of use cases and applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and safety challenges

- 3.2.2.2 Public acceptance and perception

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pilot operated

- 5.3 Autonomous/Remotely operated

Chapter 6 Market Estimates and Forecast, By Vehicle Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 eVTOL (Electric Vertical Takeoff and Landing) aircraft

- 6.3 STOL (Short Takeoff and Landing) aircraft

- 6.4 Conventional fixed-wing aircraft

Chapter 7 Market Estimates and Forecast, By Propulsion Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gasoline

- 7.2.1 Turbine engines (Turbo)

- 7.2.2 Reciprocating (Piston) engines

- 7.3 Electric propulsion

- 7.4 Hybrid propulsion

Chapter 8 Market Estimates and Forecast, By Range, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 100 km

- 8.3 100 km – 250 km

- 8.4 250 km – 500 km

- 8.5 More than 500 km

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cargo transport

- 9.3 Passenger transport

- 9.4 Mapping & surveying

- 9.5 Special mission

- 9.6 Surveillance & monitoring

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Commercial

- 10.3 Government & military

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Airbus S.A.S.

- 12.2 Aurora Flight Sciences

- 12.3 Bell Textron Inc.

- 12.4 Embraer S.A.

- 12.5 Garmin Aviation

- 12.6 GE Aviation

- 12.7 GKN Aerospace

- 12.8 Guangzhou EHang Intelligent Technology Co. Ltd.

- 12.9 Honywell

- 12.10 Joby Aviation

- 12.11 Lilium GmbH

- 12.12 Opener, Inc.

- 12.13 Safran

- 12.14 Siemens

- 12.15 Thales Group

- 12.16 The Boeing Company