|

시장보고서

상품코드

1721536

가스 연소 화학 보일러 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Gas Fired Chemical Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

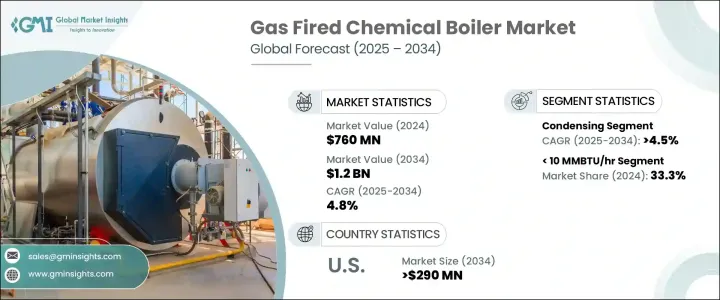

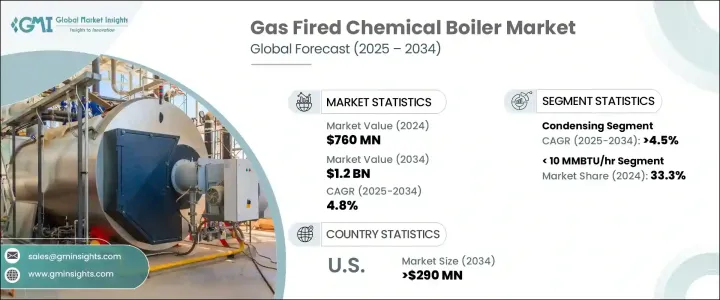

세계의 가스 연소 화학 보일러 시장은 2024년 7억 6,000만 달러에 달했으며 CAGR 4.8%를 나타내 2034년에는 12억 달러에 이를 것으로 예측됩니다. 세계의 산업계가 업무의 근대화를 진행해 기존의 고배출 가스 시스템으로부터의 이행을 진행하는 가운데 가스 연소 화학 보일러가 강한 지지를 모으고 있습니다. 다른 프로세스 집약적인 산업에 중요한 솔루션이 되고 있습니다. 환경 규정 준수에 대한 의식이 높아짐에 따라, 개조 활동이 활발해지고, 산업계는 구식의 설비를 고효율의 가스 보일러로 대체하는 움직임을 강화하고 있습니다. 화석연료와 비교해 비용대비 효과가 높기 때문에 특히 가스 인프라가 갖추어져 있는 지역에서는 매력이 늘고 있습니다. 제조업체 각사도 제품의 기술 혁신을 우선하고 있어 내부식성 재료, 컴팩트 설계, 설치나 유지관리를 간소화하는 모듈러 시스템 등의 특징을 갖추고 있습니다.

에너지 효율이 높은 난방시스템으로의 변화가 진행되고 있기 때문에 다양한 산업분야에서 수요가 높아지고 있습니다. 에너지 절약의 혜택을 받고 있습니다. 화학 생산 시설의 확장과 근대화는 효율적인 증기 발생에의 요구의 높아짐과 더불어, 가스 연소 화학 보일러의 성장 궤도를 한층 더 밀어주고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 7억 6,000만 달러 |

| 예측 금액 | 12억 달러 |

| CAGR | 4.8% |

응축형 가스 연소 화학 보일러 분야는 2034년까지의 CAGR이 4.5%를 나타낼 것으로 예측되어 대폭적인 성장이 전망되고 있습니다. 에너지 절약 기술의 강화와 지속가능성을 추진하는 정부의 적극적인 대처가 이 부문의 성장을 뒷받침하는 데 중요한 역할을 하고 있습니다.

10-25MMBTU/hr의 용량 범위는 안정된 수요가 예상되며, 예측 기간 중의 CAGR은 4%를 나타낼 것으로 전망됩니다.

2034년까지 연평균 복합 성장률(CAGR) 4%를 나타낼 것으로 예측됩니다.

세계의 가스 연소 화학 보일러 시장 주요 기업은 Viessmann, Thermax, Hurst Boiler & Welding, Clayton Industries, Babcock & Industries 등이 있습니다. 이러한 기업은 전략적 혁신에 주력하고 있으며, 스마트 제어, 응축 기술, 확장 가능한 솔루션을 통합하고 진화하는 고객의 요구에 부응하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 전략적 전망

- 혁신 및 지속가능성 전망

제5장 시장 규모와 예측 : 용량별(2021-2034년)

- 주요 동향

- 10 MMBTU/시 미만

- 10-25 MMBTU/시

- 25-50 MMBTU/시

- 50-75 MMBTU/시

- 75-100 MMBTU/시

- 100-175 MMBTU/시

- 175-250 MMBTU/시

- 250 MMBTU/시 이상

제6장 시장 규모와 예측 : 제품별(2021-2034년)

- 주요 동향

- 화관

- 수관

제7장 시장 규모와 예측 : 기술별(2021-2034년)

- 주요 동향

- 응축

- 불응축

제8장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 영국

- 폴란드

- 이탈리아

- 스페인

- 오스트리아

- 독일

- 스웨덴

- 러시아

- 아시아태평양

- 중국

- 인도

- 필리핀

- 일본

- 한국

- 호주

- 인도네시아

- 중동 및 아프리카

- 사우디아라비아

- 이란

- 아랍에미리트(UAE)

- 나이지리아

- 남아프리카

- 라틴아메리카

- 아르헨티나

- 칠레

- 브라질

제9장 기업 프로파일

- ALFA LAVAL

- Ariston Holding

- Babcock & Wilcox Enterprises

- Babcock Wanson

- BDR Thermea Group

- Bosch Industriekessel

- Clayton Industries

- Cochran

- DAIKIN INDUSTRIES

- Danstoker

- FERROLI

- Forbes Marshall

- Fulton

- Hurst Boiler &Welding

- Miura America

- Rentech Boiler Systems

- Thermax

- Thermodyne Boilers

- Vaillant Group

- VIESSMANN

The Global Gas Fired Chemical Boiler Market reached USD 760 million in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.2 billion by 2034. This growth is being propelled by the global shift toward more efficient, cleaner, and environmentally conscious energy sources, especially within industrial sectors that demand reliable and sustainable heating systems. As global industries continue to modernize their operations and transition away from conventional, high-emission systems, gas-fired chemical boilers are gaining strong traction. Their ability to deliver enhanced thermal performance, reduce carbon emissions, and integrate with smart technologies positions them as a key solution for chemical manufacturing plants and other process-intensive industries. A rise in retrofitting activities, combined with greater awareness of environmental compliance, is pushing industrial players to replace outdated equipment with high-efficiency gas-fired boilers. Moreover, the cost-effectiveness of natural gas compared to other fossil fuels adds to the appeal, especially in regions with favorable gas infrastructure. Manufacturers are also prioritizing product innovation, with features such as corrosion-resistant materials, compact designs, and modular systems that simplify installation and maintenance.

The increasing shift toward energy-efficient heating systems is fueling demand across diverse industrial sectors. Many manufacturers are now embedding digital technologies into their boiler systems to support real-time monitoring, performance optimization, and predictive maintenance. As a result, industries are benefiting from improved operational reliability and energy savings. The expansion and modernization of chemical production facilities, coupled with the rising need for efficient steam generation, are further supporting the growth trajectory of gas-fired chemical boilers. Rising environmental regulations are also encouraging industries to adopt cleaner technologies, accelerating the deployment of advanced boiler systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $760 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.8% |

The condensing gas-fired chemical boiler segment is expected to witness substantial growth, with a projected CAGR of 4.5% through 2034. This momentum is driven by surging energy costs and more stringent regulatory frameworks that urge industries to curb emissions. Enhanced energy conservation technologies and supportive government initiatives promoting sustainability are playing a critical role in bolstering segment growth.

The 10-25 MMBTU/hr capacity range is expected to see consistent demand, registering a CAGR of 4% during the forecast period. These units are ideal for small to mid-sized chemical facilities due to their compact footprint, ease of operation, and superior energy efficiency. Real-time condition monitoring allows for on-demand maintenance, improving uptime and extending equipment life while reducing long-term operational costs.

North America gas-fired chemical boiler market is projected to grow at a CAGR of 4% through 2034. Stringent environmental regulations and initiatives to reduce industrial emissions are prompting the widespread adoption of low-emission gas-fired systems. Technologies such as remote diagnostics and predictive maintenance are optimizing energy use and reducing unplanned downtimes, making advanced boiler systems increasingly popular among industrial operators.

Key players in the global gas fired chemical boiler market include Viessmann, Thermax, Hurst Boiler & Welding, Clayton Industries, Babcock & Wilcox Enterprises, Bosch Industriekessel, Babcock Wanson, Vaillant Group, Ariston Holding, and Daikin Industries. These companies are focusing on strategic innovation, integrating smart controls, condensing technologies, and scalable solutions to meet evolving customer needs. Many are also expanding their service capabilities and entering new geographies to strengthen their market footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 75 - 100 MMBTU/hr

- 5.7 100 - 175 MMBTU/hr

- 5.8 175 - 250 MMBTU/hr

- 5.9 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 Fire-tube

- 6.3 Water-tube

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Argentina

- 8.6.2 Chile

- 8.6.3 Brazil

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 Ariston Holding

- 9.3 Babcock & Wilcox Enterprises

- 9.4 Babcock Wanson

- 9.5 BDR Thermea Group

- 9.6 Bosch Industriekessel

- 9.7 Clayton Industries

- 9.8 Cochran

- 9.9 DAIKIN INDUSTRIES

- 9.10 Danstoker

- 9.11 FERROLI

- 9.12 Forbes Marshall

- 9.13 Fulton

- 9.14 Hurst Boiler & Welding

- 9.15 Miura America

- 9.16 Rentech Boiler Systems

- 9.17 Thermax

- 9.18 Thermodyne Boilers

- 9.19 Vaillant Group

- 9.20 VIESSMANN