|

시장보고서

상품코드

1740749

전기자동차용 감속기 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Electric Vehicle Reducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

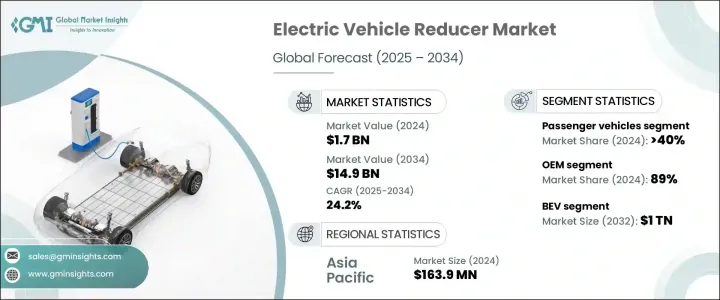

전기자동차용 감속기 세계 시장 규모는 2024년에 17억 달러로 평가되었고, CAGR 24.2%로, 2034년에는 149억 달러에 달할 것으로 예측되고 있습니다.

이 폭발적인 성장은 소비자와 기업 모두가 지속 가능한 운송을 점점 우선시하고 있으며, 전기 이동성으로의 세계 전환이 가속화되고 있는 것이 원동력이 되고 있습니다. 전 세계 각국 정부가 더 엄격한 배출가스 규제를 시행하고 전기차 도입에 매력적인 인센티브를 제공함에 따라 자동차 제조업체들은 이러한 수요 증가를 충족하기 위해 전기차 라인업을 빠르게 확장하고 있습니다. 이 변화는 종래의 자동차 제조를 재구축하고 있을 뿐만 아니라, EV 컴퍼넌트의 에코시스템 전체에 전례가 없는 기회를 만들어 가고 있습니다.

그 중에서도 EV용 감속기 수요가 급증하고 있습니다. 전기 자동차 생산이 소형 승용차에서 대형 상용 차량으로 확대됨에 따라 신뢰할 수 있는 고효율 감속기의 필요성이 그 어느 때보다 중요해지고 있습니다. OEM과 Tier-1 공급업체는 현재 진화하는 EV 아키텍처와 기대 성능에 따라 차세대 감속기 솔루션을 제공하기 위해 강한 압박에 노출되어 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 17억 달러 |

| 예측 금액 | 149억 달러 |

| CAGR | 24.2% |

전기자동차에 대한 세계 수요 증가는 전기 모터의 고속 회전을 휠 구동에 사용 가능한 토크로 변환하는 데 필수적인 EV용 감속기의 요구를 직접 뒷받침하고 있습니다. 전기 승용차, 상용차, 플릿 시스템의 생산이 대폭 증가하고 있으며, 감속기의 소비량이 증가하고 있습니다. 제조업체들은 성능, 내구성, 에너지 효율성을 위해 감속기를 최적화하여 이러한 수요에 대응하고 있습니다. 특히 상용차나 물류 용도에서는 에너지 손실을 최소화하면서 연속 운전에 대응할 수 있기 때문에 고급 다단식 감속기 수요가 높아지고 있습니다.

전기자동차는 라스트원마일의 배송, 라이드 헤일링 서비스, 대중교통에 크게 진출하고 있으며, EV 감속기 시장의 범위를 확대하고 있습니다. 요컨대 강력해지고 있습니다. 성능에 대한 기대는 높아지고 있으며, 다양한 차량 클래스의 요구를 충족시키는 확장 가능한 모듈식 솔루션에 대한 요구도 높아지고 있습니다.

차종별로는 시장은 승용차, 상용차, 오프 고속도로차, 이륜차, 삼륜차로 구분됩니다. 특히 도시에서는 청정에너지 자동차가 배출가스의 삭감, 연료의 절약, 유지관리 비용의 저감이라는 점에서 큰 이점을 가져오고 있습니다.

EV용 감속기 시장은 OEM과 애프터마켓 등 판매 채널에 따라 분류됩니다. 제품이기 때문에 OEM은 시장 확대에 있어 매우 중요한 역할을 하고 있습니다.

중국의 전기자동차용 감속기 시장은 2024년에 1억 6,390만 달러의 공헌이 되었고, 이 나라의 EV 생산에 있어서의 리더십을 반영하고 있습니다. 중국은 수직 통합 공급망, 대규모 생산 능력 및 경쟁력있는 가격 설정으로 감속기를 포함한 EV 부품 제조의 세계 허브가되었습니다. 대량 주문에 신속하고 비용 효율적으로 대응할 수 있기 때문에 중국은 세계 시장에서 압도적인 지위를 차지하고 있습니다.

EV용 감속기 세계 시장에서 주요 기업으로는 ZF Friedrichshafen, BorgWarner Inc., Robert Bosch, Schaeffler AG, GKN Automotive, Magna International, and Nidec Corporation 등이 있습니다. 이 회사들은 혁신에 힘을 쏟고 있으며 성능, 수명 및 통합 유연성을 향상시킨 차세대 감속기를 개발하고 있습니다. 자동차 제조업체와의 전략적 제휴를 통해 특정 EV 플랫폼을 위한 감속기 시스템을 맞춤화할 수 있어 시장에서의 입지를 더욱 견고하게 만들고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- 부품 제조업체

- 시스템 통합자 및 기술 공급자

- 최종 사용자

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 가격 분석

- 지역별

- EV별

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기자동차 판매의 급속한 성장

- 상용차 및 플릿 차량의 전동화

- EV 드라이브 트레인 기술의 진보

- 정부의 규제와 인센티브

- 업계의 잠재적 위험 및 과제

- 재료 공급의 제약

- EV 드라이브 트레인 부품의 높은 초기 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추정 및 예측 : 유형별, 2021-2034

- 주요 동향

- 단단 감속기

- 다단 감속기

제6장 시장 추정 및 예측 : EV로, 2021-2034

- 주요 동향

- 전기자동차

- PHEV

- 연료전지자동차

- 하이브리드 자동차

제7장 시장 추정 및 예측 : 판매 채널별, 2021-2034

- 주요 동향

- OEM

- 애프터마켓

제8장 시장 추정 및 예측 : 차량별, 2021-2034

- 주요 동향

- 승용차

- 세단

- SUV

- 해치백

- 상용차

- 소형 상용차

- MCV

- HCV

- 오프로드 자동차

- 이륜차와 삼륜차

제9장 시장 추정 및 예측 : 지역별, 2021-2034

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Aichi Machine Industry

- BorgWarner

- GKN Automotive

- Hyundai Transys

- Jatco

- JTEKT

- Magna International

- Nidec Corporation

- Punch Powertrain

- Ricardo plc

- Robert Bosch

- RSB Global

- Schaeffler

- TATA Autocamp

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

- Zhejiang Wanliyang

The Global Electric Vehicle Reducer Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 14.9 billion by 2034. This explosive growth is driven by the accelerating global transition toward electric mobility, as both consumers and corporations increasingly prioritize sustainable transportation. As governments across the globe roll out stricter emission regulations and offer attractive incentives for EV adoption, automakers are rapidly expanding their electric vehicle lineups to meet this rising demand. The shift is not only reshaping traditional vehicle manufacturing but also creating unprecedented opportunities across the EV component ecosystem.

Among these, the demand for EV reducers has surged, as these critical components play a vital role in optimizing drivetrain performance by converting high-speed motor output into manageable torque for the wheels. As electric vehicle production scales up-from compact passenger cars to heavy-duty commercial fleets-the need for reliable, high-efficiency reducers is becoming more crucial than ever. Original equipment manufacturers and tier-1 suppliers are now under intense pressure to deliver next-generation reducer solutions that align with evolving EV architectures and performance expectations. This rising momentum positions the reducer market as a key enabler in the broader electrification landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 24.2% |

The rising global demand for electric vehicles has directly boosted the need for EV reducers, which are essential in converting the high rotational speed of electric motors to usable torque for driving wheels. As adoption rates grow, the production of electric passenger cars, commercial vehicles, and fleet systems is increasing significantly, leading to higher consumption of reducers. Manufacturers are responding to this demand by optimizing reducers for performance, durability, and energy efficiency. Particularly in commercial and logistics applications, advanced multi-stage reducers are in high demand due to their ability to handle continuous operations while minimizing energy losses. Fleet operators are increasingly seeking high-torque, low-maintenance solutions that reduce the total cost of ownership and enhance drivetrain reliability, which further underscores the importance of efficient reducer systems.

Electric vehicles are making substantial inroads in last-mile delivery, ride-hailing services, and public transportation, expanding the scope of the EV reducer market. Suppliers are under growing pressure to innovate, producing compact, high-torque-density reducer designs that seamlessly integrate into both light-duty and heavy-duty EV platforms. The performance expectations are rising, and so is the need for scalable, modular solutions that meet the demands of various vehicle classes. As a result, major suppliers are heavily investing in R&D to improve energy efficiency and reduce mechanical losses in reducer systems, reinforcing their role in the EV value chain.

In terms of vehicle type, the market is segmented into passenger cars, commercial vehicles, off-highway vehicles, and two- and three-wheelers. In 2024, passenger vehicles led the market with USD 700 million in revenue, capturing a 40% market share. This dominance is largely due to the rapid expansion of electric car sales, especially in urban areas where clean energy vehicles offer substantial benefits in terms of emissions reduction, fuel savings, and lower maintenance costs. Automakers are embedding reducers into purpose-built EV platforms to enhance driving performance and efficiency.

The EV reducer market is also categorized by sales channels, including original equipment manufacturers (OEMs) and the aftermarket. OEMs dominated in 2024, accounting for 89% of total sales. Because reducers are core drivetrain components typically installed during vehicle assembly, OEMs play a pivotal role in market expansion. Global EV manufacturers such as Tesla, BYD, and Volkswagen are driving demand for custom-engineered reducers that meet strict performance benchmarks, fueling OEM-led growth across all regions.

The China Electric Vehicle Reducer Market contributed USD 163.9 million in 2024, reflecting the country's leadership in EV production. China's vertically integrated supply chain, massive production capabilities, and competitive pricing make it a global hub for EV component manufacturing, including reducers. The ability to fulfill high-volume orders quickly and cost-effectively positions China as a dominant player in the global market.

Key players in the global EV reducer market include ZF Friedrichshafen, BorgWarner Inc., Robert Bosch, Schaeffler AG, GKN Automotive, Magna International, and Nidec Corporation. These companies are heavily focused on technological innovation, developing next-generation reducers that deliver improved performance, longevity, and integration flexibility. Strategic collaborations with automakers allow them to tailor reducer systems for specific EV platforms, further solidifying their market position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators and technology providers

- 3.2.4 End-users

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price analysis

- 3.7.1 By region

- 3.7.2 By EV

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rapid growth in electric vehicle sales

- 3.10.1.2 Electrification of commercial and fleet vehicles

- 3.10.1.3 Advancements in EV drivetrain technology

- 3.10.1.4 Government regulations & incentives

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Material supply constraints

- 3.10.2.2 High initial costs of EV drivetrain components

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single-stage reducers

- 5.3 Multi-stage reducers

Chapter 6 Market Estimates & Forecast, By EV, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 FCEV

- 6.5 HEV

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedan

- 8.2.2 SUV

- 8.2.3 Hatchback

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Off highway vehicle

- 8.5 Two and three wheelers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aichi Machine Industry

- 10.2 BorgWarner

- 10.3 GKN Automotive

- 10.4 Hyundai Transys

- 10.5 Jatco

- 10.6 JTEKT

- 10.7 Magna International

- 10.8 Nidec Corporation

- 10.9 Punch Powertrain

- 10.10 Ricardo plc

- 10.11 Robert Bosch

- 10.12 RSB Global

- 10.13 Schaeffler

- 10.14 TATA Autocamp

- 10.15 Valeo

- 10.16 Vitesco Technologies

- 10.17 ZF Friedrichshafen

- 10.18 Zhejiang Wanliyang