|

시장보고서

상품코드

1740750

연포장 기계 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Flexible Packaging Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

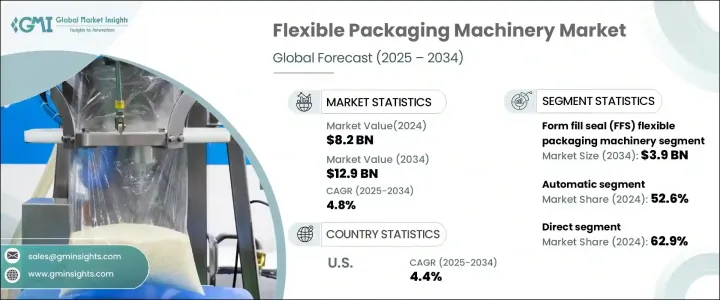

세계의 연포장 기계 시장은 2024년에 82억 달러로 평가되었으며, 라이프 스타일 변화, 급속한 도시화, 포장 식품에 대한 소비자의 선호도가 높아지면서 CAGR 4.8%로, 2034년까지는 129억 달러에 달할 것으로 예측되고 있습니다.

신흥 경제국의 중간소득층은 가공이 끝나고 곧바로 먹을 수 있는 제품을 요구하고 있어 이것이 현대적인 포장 기술의 채택을 뒷받침하고 있습니다. 자동차는 광범위한 머티리얼과 포장 유형을 효율적으로 처리할 수 있는 고속 자동화 시스템에 눈을 돌리고 있습니다.

현재의 장비는 원활한 포맷 변경에 대응하고 생분해성 재료와 복합재료를 취급하고 최소한의 인적 개입으로 동작할 것으로 기대되고 있습니다. 모듈화된 기계로 끌어 올리고 있습니다. 자동화는 생산성을 높일 뿐만 아니라 정확도 향상, 폐기물 삭감, 지속가능성 벤치마크 준수 개선도 실현합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작금액 | 82억 달러 |

| 예측 금액 | 129억 달러 |

| CAGR | 4.8% |

2024년 자동 포장 기계 부문의 점유율은 52.6%였습니다. 워크플로우를 간소화하고 산출물의 일관성을 높이고 인건비를 줄이는 능력은 식품, 의약품, 개인 관리 등 산업에 필수적입니다. 이 시스템은 지능형 제어 기능, 원격 진단 기능, 실시간 성능 모니터링 기능을 통합하여 효율성을 높이고 다운타임을 줄입니다. 이 혁신으로 업계 표준은 자동화된 스마트 패키징 환경으로 전환하고 있습니다.

시장은 유통에 의해 직접 판매와 간접 판매로 구분됩니다. 2024년에는 직접 판매 부문이 62.9%의 점유율을 차지했습니다. 장비를 최종 사용자에게 직접 판매함으로써 제조업체는 맞춤형 솔루션, 신속한 지원, 판매 후 강력한 서비스를 제공할 수 있습니다. 중개인을 생략함으로써 공급업체는 고객과의 직접적인 커뮤니케이션을 유지하고, 서비스 제공을 개선하고, 특정 생산 요구에 시스템을 맞출 수 있습니다. 또한 기술 업그레이드 및 프로세스 최적화도 시간이 지남에 따라 쉽게 배포할 수 있습니다.

미국의 연포장기계 시장은 정밀도, 위생, 속도가 중요한 식품 및 음료, 의약품, 퍼스널케어 등 여러 분야에 걸친 왕성한 수요를 배경으로 2034년까지 연평균 복합 성장률(CAGR) 4.4%로 성장할 것으로 예측됩니다. 제조 인프라가 결합되어 미국은 기술 혁신과 생산 능력의 양면에서 경쟁 우위에 서 있습니다. 선진적인 자동화 기술, 스마트 시스템의 통합, 세계의 컴플라이언스 기준을 충족하는 능력에 힘입어 미국은 포장 기계의 주요 수출국이기도 합니다.

MULTIVAC, Coesia Group, Optima Packaging Group, Ishida Co., Ltd., Haysen Flexible Systems와 같은 주요 기업은 장기적인 성장을 보장하기 위해 몇 가지 핵심 전략을 사용합니다. 현장 도달범위를 확대하기 위한 전략적 제휴 등이 포함되어 있으며, 그 중 많은 부분이 합병과 시설 확장을 통해 세계적인 발자국을 강화하는 한편, 지속가능성, 에너지 효율, 최소한의 폐기물 생산을 위해 기계 설계를 최적화하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 소매업체

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 포장 식품·가공 식품 수요 증가

- 기술적 진보

- 지속 가능한 포장에 대한 주목의 고조

- 업계의 잠재적 리스크 및 과제

- 높은 초기 투자 및 유지비

- 다양한 포장재의 취급의 복잡성

- 성장 촉진요인

- 성장 가능성 분석

- 무역 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추정 및 예측 : 기회 유형별, 2021년-2034년

- 주요 동향

- Form Fill Seal(FFS) 기계

- 가방 포장 기계

- 파우치 포장기

- 판지 기계

- 포장기

- 라벨링 머신

- 기타

제6장 시장 추정 및 예측 : 자동화별, 2021년-2034년

- 주요 동향

- 반자동

- 전자동

- 매뉴얼

제7장 시장 추정 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- 식품?음료

- 의약품

- 퍼스널케어?화장품

- 홈 케어 제품

- 공업제품

- 기타

제8장 시장 추정 및 예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- 직접

- 간접

제9장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Barry-Wehmiller Companies

- Coesia Group

- GEA Group

- Hayssen Flexible Systems

- IMA Group

- Ishida Co.,Ltd.

- KHS GmbH

- Mespack

- MULTIVAC

- Optima Packaging Group

- PFM Packaging Machinery

- ProMach

- Syntegon

- TNA Solutions

- W&H(Windmoller &Holscher)

The Global Flexible Packaging Machinery Market was valued at USD 8.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 12.9 billion by 2034, fueled by shifting lifestyles, rapid urbanization, and rising consumer preferences for packaged food. Middle-income groups in emerging economies demand processed and ready-to-eat products, which drives the adoption of modern packaging technologies. Lightweight and cost-effective formats such as sachets, pouches, and bags are favored for their ease of use and transport. As production volumes continue to climb, manufacturers are turning to high-speed, automated systems that can handle a wide range of materials and packaging types efficiently. These trends reflect a growing need for flexibility and speed in production lines, encouraging the adoption of advanced machinery that meets evolving consumer expectations and regulatory demands.

Current equipment is expected to support seamless format changes, handle biodegradable and composite materials, and operate with minimal human intervention. Increased demand for customized packaging, shorter product cycles, and greater product variation have pushed the industry toward more intelligent and modular machinery. Automation not only enhances output but also ensures greater accuracy, reduced waste, and improved compliance with sustainability benchmarks. This shift enables producers to respond faster to market changes while maintaining high operational efficiency and product quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 billion |

| Forecast Value | $12.9 Billion |

| CAGR | 4.8% |

In 2024, the automatic packaging machines segment held a 52.6% share. Their ability to streamline workflows, improve output consistency, and reduce labor costs has made them essential for industries such as food, pharmaceuticals, and personal care. These systems integrate intelligent control features, remote diagnostics, and real-time performance monitoring, which enhances efficiency and reduces downtime. This transformation is shifting industry standards toward automated, smart packaging environments.

The market is segmented by distribution into direct and indirect channels. In 2024, the direct sales segment held 62.9% share. Selling equipment directly to end-users helps manufacturers offer customized solutions, faster support, and stronger post-sale service. By cutting out intermediaries, suppliers can maintain direct communication with clients, improving service delivery and tailoring systems to specific production needs. This also allows for easier deployment of technical upgrades and process optimization over time.

United States Flexible Packaging Machinery Market is expected to maintain a CAGR of 4.4% through 2034 backed by strong demand across multiple sectors, including food and beverage, pharmaceuticals, and personal care, where precision, hygiene, and speed are critical. Extensive R&D investments, combined with a well-established manufacturing infrastructure, give the U.S. a competitive edge in both innovation and output capacity. The country continues to be a major exporter of packaging machinery, supported by advanced automation technologies, integration of smart systems, and the ability to meet global compliance standards.

Key players such as MULTIVAC, Coesia Group, Optima Packaging Group, Ishida Co., Ltd., and Hayssen Flexible Systems use several core strategies to secure long-term growth. These include ramping up investment in AI-driven automation, expanding product lines to handle multi-format packaging, and entering strategic alliances to boost market reach. Many are enhancing their global footprints through mergers and facility expansions while optimizing machine design for sustainability, energy efficiency, and minimal waste production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.3.4 Demand-side impact (selling price)

- 3.2.3.5 Price transmission to end markets

- 3.2.3.6 Market share dynamics

- 3.2.3.7 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for packaged and processed foods

- 3.7.1.2 Technological advancements

- 3.7.1.3 Increasing focus on sustainable packaging

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial investment and maintenance costs

- 3.7.2.2 Complexity in handling diverse packaging materials

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Trade analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Form fill seal (FFS) machines

- 5.3 Bagging machines

- 5.4 Pouch packaging machines

- 5.5 Cartoning machines

- 5.6 Wrapping machines

- 5.7 Labeling machines

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Homecare products

- 7.6 Industrial products

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Barry-Wehmiller Companies

- 10.2 Coesia Group

- 10.3 GEA Group

- 10.4 Hayssen Flexible Systems

- 10.5 IMA Group

- 10.6 Ishida Co., Ltd.

- 10.7 KHS GmbH

- 10.8 Mespack

- 10.9 MULTIVAC

- 10.10 Optima Packaging Group

- 10.11 PFM Packaging Machinery

- 10.12 ProMach

- 10.13 Syntegon

- 10.14 TNA Solutions

- 10.15 W&H (Windmoller & Holscher)