|

시장보고서

상품코드

1740752

탄소 네거티브 포장 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Carbon-negative Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

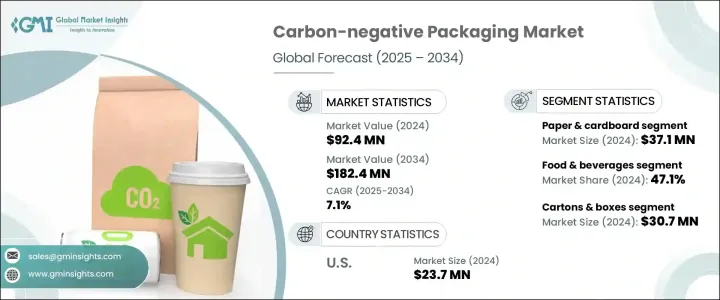

세계의 탄소 네거티브 포장 시장은 2024년 9,240만 달러로 평가되었고, 바이오 베이스 폴리머, 생분해성 복합재료, 탄소 포착 이용(CCU)의 기술 혁신과 함께, 플라스틱 폐기물 및 탄소 배출에 대한 규제 압력 증가에 의해 CAGR 7.1%로 성장하여 2034년에는 1억 8,240만 달러에 달할 것으로 추정됩니다.

지속가능성에 대한 세계의 주목이 높아짐에 따라 모든 산업의 기업이 환경에 미치는 영향을 최소화하기 위해 포장 전략을 재구성하고 있습니다.

이 변화에 박차를 가하는 것은 규제의 의무화, 투자자의 기대, 환경 의식이 높은 브랜드를 선호하는 소비자의 기호의 진화입니다. 기업은 지속 가능한 패키징을 단순한 컴플라이언스 요건으로 만드는 것이 아니라 브랜드 충성도를 높이고 새로운 시장 기회를 이끌어내는 경쟁 우위로 파악하고 있습니다. 더 많은 기업들이 ESG(환경, 사회, 거버넌스) 목표를 다루고 있는 가운데 탄소 네거티브 포장 산업은 재료, 디자인 및 공급망 최적화의 혁신을 위해 많은 투자 유입을 목표로 하고 있습니다. 브랜드는 탄소 중립과 그 앞을 내다보는 적극적인 단계를 밟는 것으로, 환경 스튜어드십이 점점 성공을 정의하는 마켓플레이스에서 자사를 강하게 위치시킬 수 있다는 것을 알고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 9,240만 달러 |

| 예측 금액 | 1억 8,240만 달러 |

| CAGR | 7.1% |

지속가능성이 기업의 중심적인 초점이 됨에 따라 포장업계는 변모를 이루고 있습니다. 소비자, 투자자 및 규제 기관에서보다 책임있는 관행을 채택하도록 압력이 증가하고 있기 때문에 기업은 점점 환경 친화적 인 대체 포장으로 전환하고 있습니다. 이를 통해 브랜드의 명성을 높일 뿐만 아니라 환경에 대한 책임에 대한 헌신을 보여줄 수 있습니다.

시장은 재료의 유형에 따라 분류되며, 주요 부문에는 생분해성 폴리머, 종이 및 골판지, 바이오 베이스 플라스틱, 유기 섬유 등이 포함됩니다. 많은 기업, 특히 전자상거래, 식품배송, 퍼스널케어 업계는 지속가능성 목표를 달성하고 친환경 포장 옵션을 요구하는 소비자 수요를 충족하기 위해 FSC 인증 및 재생지 기반 포장을 선택하고 있습니다.

포장의 유형에는 병이나 병, 트레이나 용기, 카톤이나 상자, 가방이나 파우치, 포장지나 필름 등이 있습니다. 카톤과 박스는 지속가능성이 중요한 브랜드 차별화 요인인 전자상거래, 소매, 푸드서비스 분야에서 특히 선호되고 있습니다.

미국의 탄소 네거티브 포장 시장의 2024년 시장 규모는 2,370만 달러로, 환경에 배려한 패키징에 대한 소비자 수요와 ESG 목표에 대한 기업의 강한 헌신이 원동력이 되고 있습니다. 주 레벨에서 플라스틱 사용 금지나 공급망의 배출량에 대한 감시 강화 등 환경에 배려한 정책이 지지를 모으는 가운데 브랜드는 지속 가능한 패키징을 채용하는 경향을 강화하고 있습니다.

세계의 탄소 네거티브 포장 업계의 주요 기업은 Tetra Pak International SA, Huhtamaki, Elopak, Footprint 등이 있습니다. 이러한 기업은 규제 압력과 소비자 선호도에 따라 증가하는 지속 가능한 패키징에 대한 수요를 충족시키는 최첨단 솔루션 개발에 주력하고 있습니다. 지위를 굳히기 위해 각사는 혁신과 협업을 중시하고 있습니다.

기술적 신흥 기업과의 전략적 파트너십과 패키징의 효율성과 지속가능성을 향상시키기 위한 지속적인 노력을 통해 이러한 기업들은 경쟁의 한 걸음 더 나아갈 수 있습니다. 비즈니스 전략을 세계 지속가능성 목표에 맞추어 시장의 인지도와 명성을 높이고, 보다 폭넓은 고객층을 끌어들이고, 급성장하는 탄소 네거티브 포장 분야에서의 점유율을 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 미래의 전망

- 제조업자

- 리셀러

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 탄소 배출과 플라스틱 폐기물에 대한 규제 압력

- 기업의 ESG 헌신과 넷 제로 목표

- 바이오 베이스 폴리머, 탄소 회수 이용(CCU), 생분해성 복합재료에 있어서의 혁신

- 순환형 경제와 제로웨이스트의 대처

- 친환경 포장 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용과 제한된 규모의 경제

- 성능 및 기능 제한

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 재료별, 2021-2034년

- 주요 동향

- 생분해성 폴리머

- 종이 및 골판지

- 바이오 베이스 플라스틱

- 유기 섬유

- 기타

제6장 시장 추계 및 예측 : 포장 형태별, 2021-2034년

- 주요 동향

- 병

- 트레이 및 용기

- 판지 및 상자

- 가방 및 파우치

- 포장지 및 필름

- 기타

제7장 시장 추계 및 예측 : 최종 이용 산업별, 2021-2034년

- 주요 동향

- 식음료

- 퍼스널케어 및 화장품

- 헬스케어 및 의약품

- 일렉트로닉스

- 기타

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- 360 Containers

- Bunzl UK Ltd

- Elopak

- Emmerson Packaging

- Footprint

- Genpak

- Georg Utz Holding AG

- Get Bamboo

- Green Side of Pink

- Huhtamaki

- Pregis

- Tetra Pak International SA

The Global Carbon-Negative Packaging Market was valued at USD 92.4 million in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 182.4 million by 2034, driven by increasing regulatory pressure on plastic waste and carbon emissions, along with innovations in bio-based polymers, biodegradable composites, and carbon capture utilization (CCU). As the global focus on sustainability intensifies, businesses across industries are reimagining their packaging strategies to minimize environmental impact. Packaging remains a major contributor to a company's carbon footprint, and with rising demand for greener alternatives, organizations are rapidly adopting carbon-negative solutions.

This shift is fueled by regulatory mandates, investor expectations, and evolving consumer preferences that favor eco-conscious brands. Companies are seeing sustainable packaging not just as a compliance requirement but as a competitive advantage that can boost brand loyalty and unlock new market opportunities. As more companies commit to ESG (Environmental, Social, and Governance) goals, the carbon-negative packaging industry is witnessing significant investment inflows for innovation in materials, design, and supply chain optimization. Brands are realizing that taking proactive steps towards carbon neutrality and beyond can strongly position them in a marketplace where environmental stewardship increasingly defines success.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $92.4 Million |

| Forecast Value | $182.4 Million |

| CAGR | 7.1% |

As sustainability becomes a central focus for businesses, the packaging industry is undergoing a transformation. Packaging, being a key contributor to a company's carbon footprint, is now under scrutiny, with many businesses reevaluating their strategies to reduce environmental impact. The growing pressure from consumers, investors, and regulatory bodies to adopt more responsible practices has driven companies to increasingly switch to eco-friendly packaging alternatives. By doing so, they not only enhance their brand reputation but also show a commitment to environmental responsibility. This growing focus on sustainability has led to a surge in investments aimed at developing and implementing green packaging solutions. Businesses are turning to materials such as biodegradable polymers, recyclable plastics, and paperboard, which are more aligned with circular economy principles.

The market is categorized based on material types, with key segments including biodegradable polymers, paper and cardboard, bio-based plastics, organic fibers, and others. Paper and cardboard are the leading materials, valued at USD 37.1 million in 2024, due to their recyclability, availability, and the growing demand for plastic-free packaging. Many businesses, especially e-commerce, food delivery, and personal care industries, opt for FSC-certified and recycled paper-based packaging to meet sustainability targets and satisfy consumer demand for eco-friendly packaging options.

Packaging types include bottles and jars, trays and containers, cartons and boxes, bags and pouches, wrappers and films, and others. In 2024, the cartons and boxes segment generated USD 30.7 million. These packaging materials are popular for their strength, branding potential, and recyclability, as well as their ability to sequester carbon. Cartons and boxes are particularly favored in e-commerce, retail, and food service sectors, where sustainability is a key brand differentiator. Their carbon-negative characteristics make them ideal for companies looking to improve their sustainability credentials while offering a high-quality, eco-friendly packaging option.

The U.S. Carbon-Negative Packaging Market was valued at USD 23.7 million in 2024, driven by consumer demand for environmentally conscious packaging and strong corporate commitments to ESG goals. With eco-friendly policies gaining traction, including state-level plastic bans and heightened scrutiny of supply chain emissions, brands are increasingly adopting sustainable packaging. This has spurred innovation in carbon-sequestering materials and bioplastics from established packaging companies and emerging tech startups.

Key players in the Global Carbon-Negative Packaging Industry include Tetra Pak International S.A., Huhtamaki, Elopak, and Footprint. These companies are focused on developing cutting-edge solutions that meet the growing demand for sustainable packaging driven by regulatory pressures and consumer preferences. To solidify their position in the market, companies emphasize innovation and collaboration. Many invest heavily in research and development to create new bio-based materials and explore innovative packaging designs that reduce carbon emissions.

Strategic partnerships with technology startups, as well as ongoing efforts to improve packaging efficiency and sustainability, allow these companies to stay ahead of the competition. Additionally, some are expanding their product portfolios to include customizable solutions tailored to meet specific industry requirements, such as food and beverage, e-commerce, or cosmetics. By aligning their business strategies with global sustainability goals, these companies are enhancing their market visibility and reputation, attracting a broader customer base, and increasing their share of the rapidly growing carbon-negative packaging sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Regulatory pressure on carbon emissions and plastic waste

- 3.7.1.2 Corporate ESG commitments and net-zero goals

- 3.7.1.3 Innovations in bio-based polymers, carbon capture utilization (CCU), and biodegradable composites

- 3.7.1.4 Circular economy and zero-waste initiatives

- 3.7.1.5 Growing demand for eco-friendly packaging

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production costs and limited economies of scale

- 3.7.2.2 Performance and functional limitations

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Biodegradable polymers

- 5.3 Paper & cardboard

- 5.4 Bio-based plastics

- 5.5 Organic fibers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles & jars

- 6.3 Trays & containers

- 6.4 Cartons & boxes

- 6.5 Bags & pouches

- 6.6 Wrappers & films

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Personal care & cosmetics

- 7.4 Healthcare & pharmaceuticals

- 7.5 Electronics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 360 Containers

- 9.2 Bunzl UK Ltd

- 9.3 Elopak

- 9.4 Emmerson Packaging

- 9.5 Footprint

- 9.6 Genpak

- 9.7 Georg Utz Holding AG

- 9.8 Get Bamboo

- 9.9 Green Side of Pink

- 9.10 Huhtamaki

- 9.11 Pregis

- 9.12 Tetra Pak International S.A.