|

시장보고서

상품코드

1740766

자동차용 무선 모듈 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Wireless Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

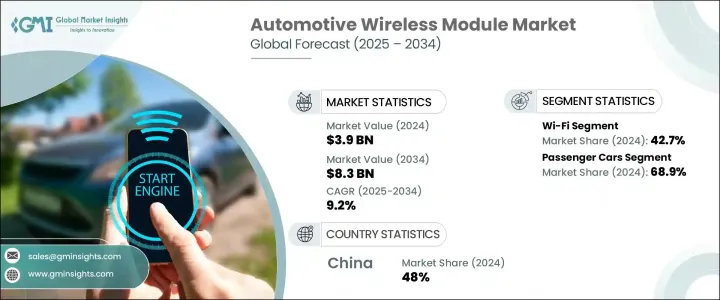

세계의 자동차용 무선 모듈 시장 규모는 2024년 39억 달러로, 커넥티드카에 대한 소비자 수요 증가와 5G 및 V2X 통신 등 차세대 무선 기술의 급속한 전개로 CAGR 9.2%로 성장해 2034년까지 83억 달러에 이를 것으로 추정됩니다.

자동차 산업이 디지털 전환으로 크게 쉬프트 하는 중, 무선 모듈은 보다 스마트하고 안전하고, 보다 커넥티드인 드라이빙 체험을 제공하는데 있어서 필수적인 컴퍼넌트가 되고 있습니다.

자동차 제조업체는 편의성, 안전성 및 성능을 높이기 위해 무선 연결 기능을 두 배로 늘리고 있습니다. 전동화, 커넥티드 서비스에 대한 주목이 높아짐에 따라, 광대역폭과 저지연의 통신 시스템에 대한 수요가 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 39억 달러 |

| 예측 금액 | 83억 달러 |

| CAGR | 9.2% |

상시 연결 차량으로의 이동은 자동차 업계 전체의 기대를 재정의합니다. 오늘날의 자동차 구매자는 기존의 텔레매틱스 이상을 요구하고 있습니다. 그들은 라이브 교통 데이터에 대한 액세스, 모바일 앱 기반 차량 제어, 스트리밍 엔터테인먼트, 실시간 차량 건강 상태 업데이트를 요구합니다. 이러한 기능은 차량, 클라우드 및 기타 연결된 인프라 간의 중단 없는 상호 작용을 보장하는 강력한 무선 통신 모듈에 의존합니다. 5G와 V2X(Vehicle-to-Everything) 통신의 보급은 첨단 무선 솔루션의 필요성을 더욱 향상시키고 있습니다. 이러한 기술은 차량, 인프라, 보행자 및 보다 광범위한 이동성 생태계 간의 초고신뢰성, 저지연 연결을 약속합니다. 안전 규제가 진화하고 자동화 수준이 높아짐에 따라 일관성 있는 고속 데이터 전송의 필요성이 높아질 뿐 아니라 자동차 제조업체는 모든 모델에 무선 모듈을 우선적으로 통합해야 한다고 강요하고 있습니다.

많은 연결 옵션이 있는 가운데 Wi-Fi는 계속 자동차용 무선 모듈 시장을 선도하고 있으며, 2024년에는 42.7%의 점유율을 차지하고 있습니다. Wi-Fi는 OTA(Over-The-Air) 업데이트, 비디오 스트리밍, 네비게이션, 자동차 연결 등 데이터량이 많은 용도에 최적의 기술입니다. Wi-Fi 모듈을 사용하여 실시간 진단을 실시해, 서비스 센터에 나가지 않고 소프트웨어의 기능 강화를 실현하고 있습니다.전기자동차나 하이브리드 차에서는 Wi-Fi 대응 시스템이 배터리의 사용 상황의 감시, 성능의 최적화, 충전소과의 원활한 통신에도 도움이 되고 있습니다.

자동차용 무선 모듈 시장은 승용차가 압도적으로 많아, 2024년의 점유율은 68.9%입니다. 자동차 기능은 운전 경험의 일부로 익숙해지고 있습니다. 자동차 제조업체는 이러한 기능을보다 효과적으로 제공하고 종합적인 고객 만족을 높이기 위해 무선 모듈을 차량 아키텍처에 통합하고 있습니다.

중국의 자동차용 무선 모듈 시장은 2024년에 7억 7,860만 달러를 창출해 세계 점유율 48%를 차지합니다. 커넥티드 모빌리티와 자율적 모빌리티에 대한 적극적인 노력으로 인해 기술에 익숙한 전기자동차에 대한 동국 수요 증가는 정부의 두꺼운 우대 조치와 급속한 5G 인프라 전시 개방과 함께 V2X와 무선 통신 모듈의 높은 보급률을 뒷받침하고 있습니다 국내 자동차 제조업체는 이 기세를 이용해 스마트 기능을 통합해, 국내외 시장에서 존재감을 높이고 있습니다. 자동차 일렉트로닉스에의 지속적인 투자와 디지털 전환의 중시에 의해 중국은 무선 차량 접속의 세계적 리더로서의 지위를 더욱 강고히 하고 있습니다.

Qualcomm Technologies, Mobileye, VALEO, NVIDIA, Aisin Seiki, Denso, Robert Bosch, Continental, BorgWarner, and ZF Friedrichshafen 등의 주요 기업은 기술 혁신과 전략적 파트너십에 주력함으로써 시장에서의 존재감을 높이고 있습니다. 생산의 현지화와 클라우드 기반의 서비스 제공의 확대에 의해 커넥티비티, 자동화, 실시간의 데이터 교환에 의해 급속하게 변화하는 시장 환경 속에서 우위에 서는 것을 목표로 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 제조업자

- 원재료 공급자

- 자동차 OEM

- 유통 채널

- 최종 용도

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(고객에 대한 비용)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 가격 분석

- 추진

- 지역

- 영향요인

- 성장 촉진요인

- 커넥티드카 수요 증가

- 5G와 V2X 통신의 채용 증가

- IoT와 스마트 모빌리티의 진보

- 자동차 기능에 대한 소비자 수요 증가

- 업계의 잠재적 위험 및 과제

- 고급 무선 모듈의 고비용

- 사이버 보안 및 데이터 프라이버시 우려

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 접속성별, 2021-2034년

- 주요 동향

- Wi-Fi

- Bluetooth

- 셀룰러

- 기타

제6장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 세단

- 해치백

- SUV

- 상용차

- 경형

- 중형

- 헤비 듀티

제7장 시장 추계 및 예측 : 추진력별, 2021-2034년

- 주요 동향

- 가솔린

- 디젤

- 전기

- PHEV

- 하이브리드 자동차

- 연료전지자동차

제8장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 네비게이션

- 텔레매틱스

- 인포테인먼트

- 차량 안전 및 긴급 서비스

- 기타

제9장 시장 추계 및 예측 : 판매채널별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Aisin Seiki

- Autotalks

- BorgWarner

- Continental

- Delphi Technologies

- Denso

- Harman International

- Huawei Technologies

- Infineon Technologies

- Magna International

- Mobileye

- NVIDIA

- NXP Semiconductors

- Panasonic

- Qualcomm Technologies

- Renesas Electronics

- Robert Bosch

- Skyworks Solutions

- VALEO

- ZF Friedrichshafen

The Global Automotive Wireless Module Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 8.3 billion by 2034, driven by increasing consumer demand for connected vehicles and the rapid deployment of next-generation wireless technologies like 5G and V2X communication. As the automotive industry experiences a major shift toward digital transformation, wireless modules are becoming essential components in delivering smarter, safer, and more connected driving experiences. From enabling seamless infotainment systems to supporting predictive maintenance and remote diagnostics, these modules are reshaping how vehicles interact with their environment and users.

Automakers are doubling down on wireless connectivity features to enhance convenience, safety, and performance. Today's consumers are not just looking for advanced engines or sleek designs-they expect their vehicles to offer the same level of connectivity as their smartphones. The integration of high-speed wireless technologies is transforming the way drivers and passengers interact with their vehicles, creating new value propositions for automakers. The increasing focus on autonomous driving, electrification, and connected services is fueling the demand for high-bandwidth, low-latency communication systems. Wireless modules are now seen as the backbone of intelligent transportation systems, enabling features like real-time navigation, fleet tracking, remote software updates, and smart city integration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 9.2% |

The shift toward always-connected vehicles is redefining expectations across the automotive landscape. Car buyers today demand more than traditional telematics-they want access to live traffic data, mobile app-based vehicle control, streaming entertainment, and real-time vehicle health updates. These capabilities rely on robust wireless communication modules that ensure uninterrupted interaction between the vehicle, cloud, and other connected infrastructure. The growing rollout of 5G and V2X (vehicle-to-everything) communication is further intensifying the need for advanced wireless solutions. These technologies promise ultra-reliable, low-latency connections between vehicles, infrastructure, pedestrians, and the broader mobility ecosystem. As safety regulations evolve and automation levels rise, the need for consistent, high-speed data transmission will only grow-pushing automakers to prioritize wireless module integration in every model.

Among the many connectivity options available, Wi-Fi continues to lead the automotive wireless module market, commanding a 42.7% share in 2024. This dominance is expected to continue, with strong potential for double-digit growth throughout the forecast period. Wi-Fi remains the go-to technology for data-heavy applications like over-the-air (OTA) updates, video streaming, navigation, and in-vehicle connectivity. Automakers are using Wi-Fi modules to perform real-time diagnostics and deliver software enhancements without requiring physical visits to service centers. In electric and hybrid vehicles, Wi-Fi-enabled systems also help monitor battery usage, optimize performance, and enable seamless communication with charging stations. As the push for smarter, greener vehicles gains momentum, the role of Wi-Fi in managing and analyzing energy systems is becoming increasingly critical.

Passenger vehicles dominate the automotive wireless module market, representing a 68.9% share in 2024. This segment leads the market thanks to the rapid evolution and standardization of connected features across all vehicle classes-from premium sedans to compact hatchbacks. Consumers are now accustomed to having cloud-based infotainment systems, app-based controls, predictive diagnostics, and voice-assisted functions as part of their driving experience. Automakers are embedding wireless modules into vehicle architecture to deliver these features more effectively and boost overall customer satisfaction. As competition intensifies, even entry-level models are being equipped with advanced connectivity solutions, raising the baseline expectations for in-car technology.

The China Automotive Wireless Module Market generated USD 778.6 million in 2024, capturing a 48% share globally. China's dominance stems from its aggressive push toward connected and autonomous mobility, supported by the world's largest automotive manufacturing ecosystem. The country's rising demand for tech-savvy electric vehicles, coupled with generous government incentives and rapid 5G infrastructure rollout, is fueling high adoption of V2X and wireless communication modules. Domestic automakers are leveraging this momentum to integrate smart features and expand their presence in both domestic and international markets. China's continued investment in automotive electronics and its emphasis on digital transformation are expected to further cement its position as a global leader in wireless vehicle connectivity.

Leading companies such as Qualcomm Technologies, Mobileye, VALEO, NVIDIA, Aisin Seiki, Denso, Robert Bosch, Continental, BorgWarner, and ZF Friedrichshafen are accelerating their market presence by focusing on innovation and strategic partnerships. These players are enhancing their wireless platforms to support 5G and V2X applications, integrating AI capabilities, and rolling out scalable, power-efficient modules for EVs and autonomous vehicles. By localizing production and expanding cloud-based service offerings, they aim to stay ahead in a fast-changing market landscape driven by connectivity, automation, and real-time data exchange.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End Use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for connected vehicles

- 3.10.1.2 Rising adoption of 5G and V2X communication

- 3.10.1.3 Advancements in IoT and smart mobility

- 3.10.1.4 Increased consumer demand for in-car features

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of advanced wireless modules

- 3.10.2.2 Cybersecurity and data privacy concerns

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wi-Fi

- 5.3 Bluetooth

- 5.4 Cellular

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchback

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.4.1 PHEV

- 7.4.2 HEV

- 7.4.3 FCEV

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Telematics

- 8.4 Infotainment

- 8.5 Vehicle safety and emergency services

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 Autotalks

- 11.3 BorgWarner

- 11.4 Continental

- 11.5 Delphi Technologies

- 11.6 Denso

- 11.7 Harman International

- 11.8 Huawei Technologies

- 11.9 Infineon Technologies

- 11.10 Magna International

- 11.11 Mobileye

- 11.12 NVIDIA

- 11.13 NXP Semiconductors

- 11.14 Panasonic

- 11.15 Qualcomm Technologies

- 11.16 Renesas Electronics

- 11.17 Robert Bosch

- 11.18 Skyworks Solutions

- 11.19 VALEO

- 11.20 ZF Friedrichshafen