|

시장보고서

상품코드

1740822

바이폴라 전기 수술기기 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Bipolar Electrosurgical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

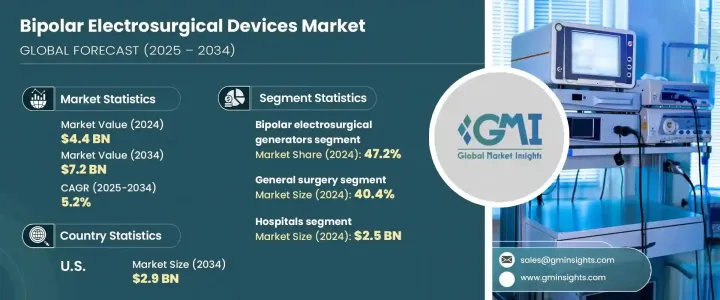

세계 바이폴라 전기 수술기기 시장은 2024년에는 44억 달러로 평가되었으며 CAGR 5.2%로 성장했으며 2034년에는 72억 달러에 이를 것으로 추정됩니다.

저침습 수술에 대한 수요가 환자와 외과 의사들 사이에서 높아지는 가운데, 바이폴라 전기 수술은 현대 수술 워크 플로우에 필수적입니다. 현재 진행중인 저침습 접근으로의 전환은 병원과 수술센터에서 바이폴라 전기 수술 기술의 채용을 크게 증가시키고 있습니다.

바이폴라 전기 수술기기는 주위 조직에 대한 위험을 억제하면서 탁월한 정밀도로 절단과 응고를 모두 수행하도록 설계되어 있습니다. 정밀도와 조직 보전에 대한 주목의 고조는 신경외과, 정형외과, 부인과 등의 외과 분야에서의 사용 확대를 지지해, 시장 확대를 한층 더 밀어주고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 44억 달러 |

| 예측 금액 | 72억 달러 |

| CAGR | 5.2% |

이 장치는 바이폴라 구성을 통해 적용되는 고주파 전기 에너지를 사용하여 작동합니다. 이 중 바이폴라 전기 수술 발전기는 2024 년에 47.2%로 가장 높은 판매 점유율을 차지합니다. 핵심이 되는 에너지원으로서 기능해, 모든 전기외과 셋업에 불가결한 것이 되고 있습니다.

바이폴라 전기 수술 도구는 또한 집게, 가위, 프로브 또는 전극으로 나뉩니다. 제너레이터는 자본 집약적이며 시스템 기능에 필수적이기 때문에 제품 기반 세분화에서는 지배적인 지위를 유지하고 있습니다.

용도별로는 일반외과, 뇌신경외과, 심혈관외과, 부인과외과, 기타 전문분야로 분류됩니다. 고령자는 변성 질환이나 만성 질환의 빈도가 높기 때문에 외과 수술을 받을 가능성이 높고, 바이폴라 장치와 같은 신뢰성이 높고 안전한 수술 기구 수요를 밀어 올리고 있습니다. 정확한 절개를 가능하게 하는 효율성에 의해 일반 수술에서 좋아해 사용되고 있습니다.

최종 사용자별로는 시장은 병원, 외래수술센터, 전문클리닉, 학술기관 및 연구기관으로 구분됩니다. 바이폴라 장비는 열 확산의 최소화, 출혈 감소, 우발적인 화상 감소와 같은 주요 이점을 제공하며 더 나은 임상 결과와 치료 기간 단축을 지원합니다.

지역별로는 북미가 시장 동향의 형성에 매우 중요한 역할을 하고 있습니다. 습관병이 급증하고 수술 건수가 증가하고 있습니다. 만성 질환이 만연함에 따라 효율적이고 정확도가 높은 수술 기구의 필요성이 높아지고 있습니다.

경쟁 구도으로는 세계 기업과 지역 기업이 혼재하여 높아지는 수술 수요에 대응한 솔루션을 제공합니다. 연속성을 유지하기 위해 지속적인 기술 혁신, 제품 맞춤화, 가격 전략을 통해 경쟁하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 저침습 수술 수요 증가

- 만성 질환과 외과적 개입 증가

- 전기외과기기의 기술적 진보

- 외래수술센터(ASC)의 확장

- 업계의 잠재적 위험 및 과제

- 고급 전기 수술 시스템의 높은 비용

- 화상, 신경 손상, 수술에 의한 연기 등의 합병증의 위험

- 성장 촉진요인

- 성장 가능성 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후의 검토 사항 트럼프 정권의 관세

- 무역에 미치는 영향

- 업계 밸류체인 분석

- 원재료 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 경쟁 대시보드

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 바이폴라 전기 수술용 발전기

- 바이폴라 전기 수술 기구

- 바이폴라 포셉

- 바이폴라 시저즈

- 바이폴라 프로브와 전극

- 액세서리와 소모품

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 일반 외과

- 뇌신경외과

- 부인과 수술

- 심장혈관 수술

- 기타 용도

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 전문 클리닉

- 학술연구기관

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 라틴아메리카

- 멕시코

- 브라질

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Applied Medical

- B Braun

- Boston Scientific

- Bovie Medical

- BOWA Medical

- ConMed

- Encision

- Erbe Elektromedizin

- Johnson and Johnson

- KLS Martin Group

- Medtronic

- Olympus

- Smith and Nephew

- Stryker

- Zimmer Biomet

The Global Bipolar Electrosurgical Devices Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 7.2 billion by 2034. As the demand for minimally invasive procedures gains momentum among patients and surgeons alike, bipolar electrosurgery has become an integral part of modern surgical workflows. These procedures offer substantial benefits, including smaller incisions, reduced blood loss, quicker discharge times, and faster recovery. The ongoing shift towards minimally invasive approaches has significantly increased the adoption of bipolar electrosurgical technologies in hospitals and surgical centers.

Bipolar electrosurgical instruments are designed to perform both cutting and coagulation with exceptional precision while limiting harm to the surrounding tissue. This translates to a lower rate of post-operative infections and complications. With advancements in vessel sealing capabilities, improved thermal control, and ergonomic tool designs, these instruments continue to enhance procedural outcomes. The heightened focus on precision and tissue conservation supports their growing use in surgical fields such as neurosurgery, orthopedics, gynecology, and others, further driving market expansion. The adoption of newer devices compatible with robotic and laparoscopic systems also reinforces their position in standardized surgical protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 5.2% |

These devices operate using high-frequency electrical energy applied through a bipolar configuration, where the current flows only through the tissue between two forceps-like electrodes. This design ensures localized energy delivery and minimal tissue trauma. The market is segmented based on product types, with categories including bipolar electrosurgical generators, bipolar electrosurgical instruments, and accessories and consumables. Among these, bipolar electrosurgical generators accounted for the highest revenue share at 47.2% in 2024. These generators act as the core energy source for all connected instruments and accessories, making them essential for any electrosurgical setup. Their high cost compared to reusable instruments and accessories contributes significantly to overall market revenue.

Bipolar electrosurgical instruments are further divided into forceps, scissors, and probes or electrodes. While these tools are widely used across various surgical procedures, their affordability relative to generators places them as mid-level revenue contributors within the segment. Generators, being capital-intensive and indispensable for system functionality, maintain a dominant hold on product-based segmentation.

Based on application, the market is categorized into general surgery, neurosurgery, cardiovascular surgery, gynecological surgery, and other specialized fields. General surgery led the segment with a market share of 40.4% in 2024. The prevalence of age-related conditions such as gallbladder disease, appendicitis, and hernias has grown alongside the expanding global elderly population. Older adults are more likely to undergo surgical procedures due to the higher frequency of degenerative and chronic illnesses, which boosts the demand for reliable and safe surgical tools like bipolar devices. Their efficiency in managing bleeding and enabling precise incisions makes them a preferred choice across general surgery departments.

By end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and academic or research institutions. Hospitals dominated this segment, with revenue amounting to USD 2.5 billion in 2024. Their focus on enhancing patient safety, improving procedural accuracy, and reducing recovery time has spurred investments in advanced surgical equipment. Bipolar devices offer key advantages such as minimal thermal spread, reduced bleeding, and fewer accidental burns, supporting better clinical outcomes and shorter procedure durations. As hospitals continue to upgrade to equipment that is compatible with cutting-edge surgical systems, including robotics and laparoscopic tools, the demand for bipolar electrosurgical devices is expected to climb.

Regionally, North America plays a pivotal role in shaping market trends. The bipolar electrosurgical devices market in the United States alone is projected to rise from USD 1.8 billion in 2024 to USD 2.9 billion by 2034. A surge in lifestyle-related diseases, including cardiovascular disorders, diabetes, and obesity, has led to a growing number of surgeries. As chronic conditions become more prevalent, the need for efficient, precision-driven surgical instruments becomes more pressing. Bipolar electrosurgical units meet these clinical demands effectively, reinforcing their value across U.S. healthcare facilities.

The competitive landscape of the bipolar electrosurgical devices market features a blend of global and regional players offering tailored solutions to meet rising surgical demands. Leading companies such as Medtronic, Johnson & Johnson, B. Braun, Stryker, and Olympus together represent approximately 65% of the global market. These organizations compete through continuous innovation, product customization, and pricing strategies to maintain relevance across both developed and emerging markets. In cost-sensitive regions, domestic players challenge multinational brands by delivering affordable, quality devices, prompting global leaders to adapt their approach while ensuring compliance with safety and performance standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of chronic diseases and surgical interventions

- 3.2.1.3 Technological advancements in electrosurgical devices

- 3.2.1.4 Expansion of outpatient surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced electrosurgical systems

- 3.2.2.2 Risk of complications such as burns, nerve damage, surgical smoke

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Industry value chain analysis

- 3.6 Raw material analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive dashboard

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bipolar electrosurgical generators

- 5.3 Bipolar electrosurgical instruments

- 5.3.1 Bipolar forceps

- 5.3.2 Bipolar scissors

- 5.3.3 Bipolar probes and electrodes

- 5.4 Accessories and consumables

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Neurosurgery

- 6.4 Gynecological surgery

- 6.5 Cardiovascular surgery

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Medical

- 9.2 B Braun

- 9.3 Boston Scientific

- 9.4 Bovie Medical

- 9.5 BOWA Medical

- 9.6 ConMed

- 9.7 Encision

- 9.8 Erbe Elektromedizin

- 9.9 Johnson and Johnson

- 9.10 KLS Martin Group

- 9.11 Medtronic

- 9.12 Olympus

- 9.13 Smith and Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet