|

시장보고서

상품코드

1740826

투명 포장 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Transparent Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

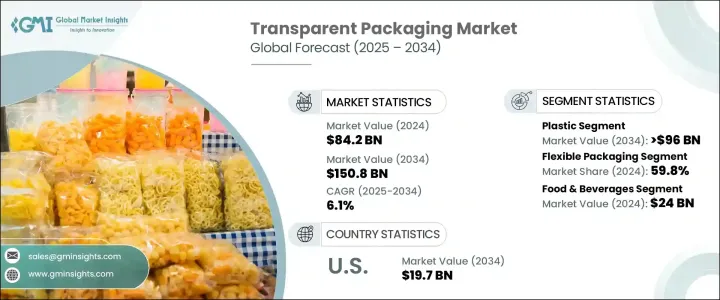

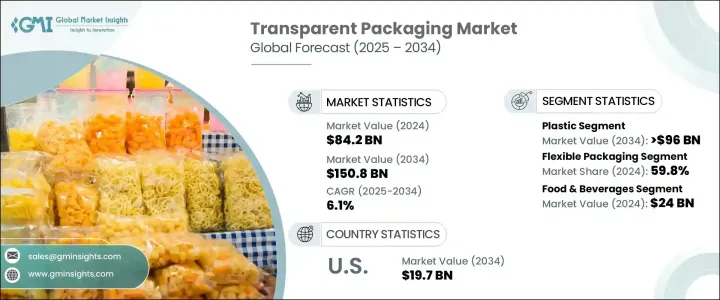

세계의 투명 포장 시장은 2024년 842억 달러였고, 전자상거래 분야의 급속한 확대와 제품의 시인성을 높이고 소비자의 신뢰를 구축하는 패키지에 대한 수요 증가를 배경으로 CAGR 6.1%로 성장해 2034년까지 1,508억 달러에 달할 것으로 예측되고 있습니다.

소비자의 선호도가 진화함에 따라 브랜드는 제품을 보호할 뿐만 아니라 쇼핑객과 시각적으로 연결되는 패키지를 선호합니다. 투명 포장은 특히 식품, 음식, 퍼스널케어, 일렉트로닉스 등의 분야에서 제품의 품질, 신선도, 진정성을 명확하게 전달하는 데 필수적입니다. 경쟁이 치열한 시장에서 차별화를 시도하려는 기업에게 투명한 패키지는 중요한 마케팅 도구입니다. 또한 지속 가능한 솔루션에 대한 동향은 시장 상황을 재구성하고 있으며 제조업체는 환경 기준에 맞게 환경 의식이 높아지는 소비자층에 대응하기 위해 재활용 가능한 소재와 생분해성 소재에 초점을 맞추었습니다. 투명 포장 솔루션은 현대 소비자에게 호소하는 내구성, 지속가능성, 고급스러운 아름다움을 제공하면서 온라인 및 오프라인 쇼핑 경험의 격차를 메우고 옴니 채널 소매 전략에서 중요한 역할을 수행합니다.

폴리에틸렌 테레프탈레이트(PET), 폴리에틸렌(PE), 폴리프로필렌(PP) 등의 투명 포장 소재는 뛰어난 투명성, 탄력성, 재활용성으로 큰 지지를 얻고 있습니다. 또한, 지속가능성을 중시하는 만큼, 기업은 환경에 관한 의무나 소비자의 기대에 부응하기 위해, 생분해성 소재나 리사이클 가능한 소재를 사용한 기술 혁신에 임하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 842억 달러 |

| 예측 금액 | 1,508억 달러 |

| CAGR | 6.1% |

최근의 무역 정책이 투명 포장 시장에 장애물을 가져오고 있습니다. 이를 해결하기 위해 기업은 공급망을 다양 화하고 대체 공급업체를 찾고 관세의 영향을 관리하고 경쟁력을 유지하기 위해 국내 생산 능력을 강화하고 있습니다.

PET, PE, PP 재료를 포함한 플라스틱 분야는 플라스틱의 경량성, 비용 효율성, 내구성에 힘입어 2034년까지 960억 달러를 창출할 것으로 예측되고 있습니다.

연포장은 PE, PP, PET 소재의 범용성과 비용 효율성에 견인되어 2024년에는 59.8%의 점유율을 차지했으며, 시장을 독점했습니다.

미국의 투명 포장 시장은 2034년까지 197억 달러에 이를 것으로 예측되고 있으며, 이는 전자상거래 활동의 급증과 환경 친화적인 패키징에 대한 수요 증가가 뒷받침하고 있습니다.

세계의 투명 포장 업계의 주요 기업은 Futamura Group, NatureWorks LLC, Amcor plc, Biome Bioplastics, Bio Futura, Corbion, Genpak, IIC AG, FKuR, ITC Packaging, Novamont SpA, Sealed Air Corporation, J. Landworth Company,Stora Enso,TIPA LTD,Tetra Pak International SA,Walki Group Oy,Xiamen Changsu Industrial Co. 등이 있습니다. 공급망의 다양화, 자동화 촉진, 무역 정책의 시프트의 주시, 데이터 주도형 전략의 활용, 지속 가능한 소재와 혁신적인 패키지 디자인과 같은 부가가치 제공에 주력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전자상거래 산업의 성장

- 지속 가능한 포장의 인기 증가

- 포장재의 진보

- 의약품 부문 확대

- 프리미엄 및 고급 패키지 수요 급증

- 업계의 잠재적 위험 및 과제

- 환경 문제와 플라스틱 폐기물에 대한 규제 압력

- 높은 생산 비용과 재료 제한

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 재료별, 2021-2034년

- 주요 동향

- 플라스틱

- PET(폴리에틸렌테레프탈레이트)

- PP(폴리프로필렌)

- PVC(폴리염화비닐)

- 바이오플라스틱(PLA, PHA)

- 재활용 플라스틱

- 유리

- 하이브리드

제6장 시장 추계 및 예측 : 포장 형태별, 2021-2034년

- 주요 동향

- 경질 포장

- 병

- 트레이 및 용기

- 클램쉘

- 연질 포장

- 파우치 및 사쉐

- 가방 및 랩

- 필름

- 기타

제7장 시장 추계 및 예측 : 최종 이용 산업별, 2021-2034년

- 주요 동향

- 식품 및 음료

- 음식

- 신선식품

- 가공식품

- 유제품

- 베이커리 및 과자류

- 음료

- 물 및 청량음료

- 알코올 음료

- 주스 및 유제품 음료

- 음식

- 소비재

- 일렉트로닉스

- 가정용품

- 의약품

- 의약품

- 의료기기

- 퍼스널케어 및 화장품

- 스킨케어

- 헤어 케어

- 메이크업

- 기타

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Amcor plc

- Bio Futura

- Biome Bioplastics

- Corbion

- FKuR

- Futamura Group

- Genpak

- IIC AG

- ITC Packaging

- J. Landworth Company

- NatureWorks LLC

- Novamont SpA

- Sealed Air Corporation

- Stora Enso

- Tetra Pak International SA

- TIPA LTD

- Walki Group Oy

- Xiamen Changsu Industrial Co.,Ltd.

The Global Transparent Packaging Market was valued at USD 84.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 150.8 billion by 2034, driven by the rapid expansion of the e-commerce sector and the rising demand for packaging that enhances product visibility and builds consumer trust. As consumer preferences evolve, brands are increasingly prioritizing packaging that not only protects products but also visually connects with shoppers. Transparent packaging has become essential for delivering a clear view of product quality, freshness, and authenticity, especially across sectors like food, beverages, personal care, and electronics. With companies striving to differentiate themselves in a highly competitive marketplace, clear packaging has emerged as a vital marketing tool. The trend toward sustainable solutions is also reshaping the market landscape, with manufacturers focusing on recyclable and biodegradable materials to align with environmental standards and meet the growing eco-conscious consumer base. Transparent packaging solutions are playing a critical role in omnichannel retail strategies, bridging the gap between online and offline shopping experiences while offering durability, sustainability, and premium aesthetics that appeal to modern consumers.

Transparent packaging materials, including polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP), are gaining significant traction for their excellent clarity, resilience, and recyclability. The shift toward online shopping has intensified the need for packaging that showcases products effectively without compromising protection. In addition, a strong emphasis on sustainability is pushing companies to innovate with biodegradable and recyclable materials to satisfy environmental mandates and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.2 Billion |

| Forecast Value | $150.8 Billion |

| CAGR | 6.1% |

Recent trade policies have created hurdles for the transparent packaging market. The U.S. administration's tariffs on imports from countries like China and Mexico have pushed up the cost of key raw materials such as PET, PE, and PP resins. Rising production costs are leading to higher prices for transparent packaging solutions. In response, companies are diversifying supply chains, seeking alternative suppliers, and ramping up domestic production capabilities to manage the tariff impact and maintain competitiveness.

The plastics segment, which includes PET, PE, and PP materials, is forecasted to generate USD 96 billion by 2034, fueled by plastics' lightweight, cost-efficiency, and durability. PET and PP, in particular, are prized for their exceptional transparency, allowing consumers to inspect products without breaking seals, thus enhancing product appeal and trust. Innovations in recyclable and biodegradable plastics are also making plastic packaging a more sustainable and attractive choice for eco-conscious buyers.

Flexible packaging dominated the market, holding a 59.8% share in 2024, driven by the versatility and cost-efficiency of PE, PP, and PET materials. Lightweight and resilient, flexible packaging is well-suited for pharmaceuticals, personal care, and food and beverage products, offering tamper resistance, resealability, and enhanced product visibility.

The U.S. Transparent Packaging Market is projected to reach USD 19.7 billion by 2034, fueled by surging e-commerce activities and the growing demand for eco-friendly packaging. The food and beverage sector remains the top contributor, with transparent, sealable packaging boosting consumer confidence and supporting the rising consumption of organic and ready-to-eat foods.

Key players in the Global Transparent Packaging Industry include Futamura Group, NatureWorks LLC, Amcor plc, Biome Bioplastics, Bio Futura, Corbion, Genpak, IIC AG, FKuR, ITC Packaging, Novamont S.p.A., Sealed Air Corporation, J. Landworth Company, Stora Enso, TIPA LTD, Tetra Pak International S.A., Walki Group Oy, and Xiamen Changsu Industrial Co., Ltd. Companies are navigating tariff challenges by diversifying supply chains, boosting automation, closely monitoring trade policy shifts, leveraging data-driven strategies, and focusing on value-added offerings such as sustainable materials and innovative packaging designs to maintain a competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in e-commerce industry

- 3.3.1.2 Rising popularity of sustainable packaging

- 3.3.1.3 Advancements in packaging materials

- 3.3.1.4 Expansion of the pharmaceutical sector

- 3.3.1.5 Surge in premium & luxury packaging demand

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns & regulatory pressure on plastic waste

- 3.3.2.2 High production costs & material limitations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Million Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 PET (polyethylene terephthalate)

- 5.2.2 PP (polypropylene)

- 5.2.3 PVC (polyvinyl chloride)

- 5.2.4 Bioplastics (PLA, PHA)

- 5.2.5 Recycled plastics

- 5.3 Glass

- 5.4 Hybrid

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 ($ Mn & Million Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Bottles & jars

- 6.2.2 Trays & containers

- 6.2.3 Clamshells

- 6.3 Flexible packaging

- 6.3.1 Pouches & sachets

- 6.3.2 Bags & wraps

- 6.3.3 Films

- 6.3.4 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Million Tons)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.2.1 Food

- 7.2.1.1 Fresh food

- 7.2.1.2 Processed food

- 7.2.1.3 Dairy products

- 7.2.1.4 Bakery & confectionery

- 7.2.2 Beverage

- 7.2.2.1 Water & soft drinks

- 7.2.2.2 Alcoholic beverages

- 7.2.2.3 Juices & dairy drinks

- 7.2.1 Food

- 7.3 Consumer goods

- 7.3.1 Electronics

- 7.3.2 Household products

- 7.4 Pharmaceuticals

- 7.4.1 Pharmaceuticals

- 7.4.2 Medical devices

- 7.5 Personal care & cosmetics

- 7.5.1 Skincare

- 7.5.2 Haircare

- 7.5.3 Makeup

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Million Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Bio Futura

- 9.3 Biome Bioplastics

- 9.4 Corbion

- 9.5 FKuR

- 9.6 Futamura Group

- 9.7 Genpak

- 9.8 IIC AG

- 9.9 ITC Packaging

- 9.10 J. Landworth Company

- 9.11 NatureWorks LLC

- 9.12 Novamont S.p.A.

- 9.13 Sealed Air Corporation

- 9.14 Stora Enso

- 9.15 Tetra Pak International S.A.

- 9.16 TIPA LTD

- 9.17 Walki Group Oy

- 9.18 Xiamen Changsu Industrial Co., Ltd.