|

시장보고서

상품코드

1740842

특수 카본블랙 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Specialty Carbon Black Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

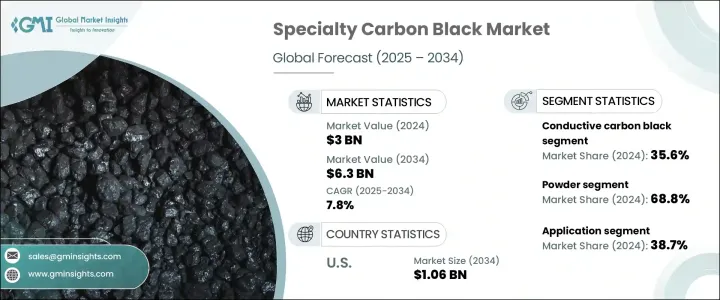

세계의 특수 카본블랙 시장은 2024년에는 30억 달러로 평가되었으며 CAGR 7.8%를 나타내 2034년에는 63억 달러에 이를 것으로 추정됩니다.

이 시장은 전도성, 내자외선성, 기계적 내구성 향상 등 특정 특성을 가진 고성능 첨가제를 필요로 하는 여러 산업에서 이용이 증가하고 있기 때문에 꾸준한 기세를 보이고 있습니다. 첨단 배터리 기술의 특수 카본블랙의 채용이 증가하고 있는 것입니다. 이 수요는 자동차에서 농업에 이르기까지 지속 가능하고 효율적인 재료 솔루션에 대한 관심이 높아지고 있습니다. 또, 시장 참가 기업은 현재 진행중인 차세대 소재의 개발에 있어서도, 특수 카본블랙의 가능성을 인정하고 있어, 혁신 파이프라인에 있어서, 특수 카본블랙은 불가결한 요소가 되고 있습니다.

2024년 특수 카본블랙 시장은 형상별로 분말과 과립으로 구분되어 합계 시장 가치는 30억 달러에 달했습니다. 플라스틱 분야도 파우더 특수 카본블랙의 주요한 소비자이며, 특히 외형의 균일성과 구조적 완전성이 요구되는 정밀 용도로 사용되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 30억 달러 |

| 예측 금액 | 63억 달러 |

| CAGR | 7.8% |

시장은 등급별로 분류되어 주요 부문은 전도성 카본블랙, 섬유 카본블랙, 기타 유형입니다. 전하 유지를 개선해, 중요한 용도의 부품의 수명을 연장하는 효과가 있기 때문입니다.

용도별로는 고무산업이 2024년 세계 수요의 38.7%를 차지하여 최대 시장 점유율을 차지했습니다. 특수 카본블랙을 고무 컴파운드에 배합하는 것으로, 제품의 수명, 표면 안정성, 보호 기능이 향상해, 다양한 고무 베이스 제품의 생산 사이클이 요하는 재료가 되고 있습니다.

지역별로는 미국이 세계의 특수 카본블랙 시장에서 큰 점유율을 차지하고 있으며, 2024년에는 시장 전체의 16.1%를 차지했습니다. 시장 실적은 첨단 제조 에코시스템, 자동차 및 에너지 저장 분야 수요, 지속 가능한 재료 혁신에 대한 지속적인 투자와 밀접한 관련이 있습니다.

특수 카본블랙 업계의 경쟁 구도는 전략적 제휴, 제품 혁신, 지역 확대를 통해 시장 점유율 확대에 적극적으로 임하는 세계 기업의 존재에 의해 형성되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국

- 주요 수입국

참고 : 위의 무역 통계는 주요 국가에 대해서만 제공됩니다.

- 이익률 분석

- 공급자의 상황

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전도성 용도 수요 증가

- 확대하는 자동차 부문과 경량화의 경향

- 플라스틱 및 폴리머 산업의 성장

- 급성장하는 전기자동차(EV)와 에너지 저장 시장

- 고성능 코팅이나 도료로의 사용이 증가

- 폴리머 복합재료의 진보

- 업계의 잠재적 위험 및 과제

- 원재료비의 상승과 공급체인의 불안정성

- 탄소 배출에 관한 엄격한 환경 규제

- 대체 재료(그래핀, 실리카, 나노튜브)와의 경쟁

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 형태별(2021-2034년)

- 주요 동향

- 분말

- 과립

제6장 시장 추계·예측 : 그레이드별(2021-2034년)

- 주요 동향

- 전도성 카본블랙

- 섬유 카본블랙

- 식품 등급 카본블랙

- 기타

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 고무

- 플라스틱

- 인쇄 잉크 및 토너

- 페인트 및 코팅

- 배터리 전극

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Asahi Carbon Co. Ltd.

- Atlas Organics Private Limited

- Birla Carbon

- Black Bear Carbon BV

- Cabot Corporation

- Continental Carbon Company

- Denka Company Limited

- Himadri Specialty Chemical Ltd

- Omsk Carbon Group

- Orion Engineered Carbons GmbH

- Phillips Carbon Black Limited

- Ralson

- Tokai Carbon Co.Ltd.

The Global Specialty Carbon Black Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 6.3 billion by 2034. The market is witnessing steady momentum due to increasing utilization across several industries demanding high-performance additives with specific attributes like electrical conductivity, ultraviolet resistance, and enhanced mechanical durability. One of the primary growth drivers is the rising adoption of specialty carbon black in advanced battery technologies, particularly in energy storage systems where consistent performance and stability are critical. A parallel growth trend is observed in the plastics and polymer industries, which are incorporating specialty carbon black for its reinforcing and conductive properties in packaging materials and various high-performance plastic components. This demand is further supported by increased interest in sustainable and efficient material solutions across sectors ranging from automotive to agriculture. The use of specialty carbon black in agricultural films and industrial sacks adds another layer of demand in outdoor applications, where UV protection and physical resilience are essential. Market participants are also recognizing its potential in the ongoing development of next-generation materials, which positions specialty carbon black as a vital component in the innovation pipeline.

In terms of form, the specialty carbon black market in 2024 was segmented into powder and granules, with a combined market value of USD 3 billion. Powder-based specialty carbon black dominated the segment, accounting for 68.8% of the total share. This form is widely used in the production of conductive materials, high-efficiency coatings, and lithium-ion battery components, where fine particle dispersion and material compatibility are essential for performance. The plastics sector is also a key consumer of powder specialty carbon black, particularly in precision applications where visual uniformity and structural integrity are required. Although the granule form currently holds a smaller portion of the market, it is gradually gaining traction due to its dust-free properties and improved processing performance, making it a desirable option for clean and efficient industrial environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 7.8% |

The market is also categorized by grade, with the major segments including conductive carbon black, fiber carbon black, food-grade carbon black, and others. In 2024, conductive carbon black emerged as the leading segment, representing 35.6% of the overall market. The preference for this grade is largely driven by its effectiveness in enhancing electrical conductivity, improving charge retention, and extending the operational life of components in critical applications. It continues to gain popularity in the evolving energy sector and advanced material development for electronic applications. Fiber carbon black follows closely in the segment breakdown, maintaining strong relevance in high-durability material production.

By application, the rubber industry held the largest market share in 2024, accounting for 38.7% of the global demand. This dominance stems from its broad use in both tire and non-tire rubber products, where reinforcement and environmental resistance are essential. The integration of specialty carbon black in rubber compounds improves product lifespan, surface stability, and protective functionality, making it a cornerstone material in the production cycle of various rubber-based goods.

Geographically, the United States accounted for a significant share of the global specialty carbon black market, capturing 16.1% of the total market in 2024. This share translates to a market value of USD 490 million, with projections indicating growth to approximately USD 1.06 billion by 2034. The strong market performance in the U.S. is closely linked to its advanced manufacturing ecosystem, demand from the automotive and energy storage sectors, and ongoing investments in sustainable material innovations. Government-backed initiatives promoting bio-based alternatives are also contributing to a steady increase in adoption and domestic production capabilities.

The competitive structure of the specialty carbon black industry is shaped by the presence of several global players actively working to expand their market share through strategic alliances, product innovations, and regional expansions. Companies are focusing on enhancing their supply chains, improving product quality, and addressing sustainability goals to differentiate themselves in a rapidly evolving market landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Supplier landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for conductive applications

- 3.8.1.2 Expanding automotive sector and lightweighting trend

- 3.8.1.3 Growth in plastics and polymers industry

- 3.8.1.4 Booming electric vehicle (EV) and energy storage market

- 3.8.1.5 Increasing use in high-performance coatings and paints

- 3.8.1.6 Advancements in polymer composite materials

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High raw material costs and supply chain volatility

- 3.8.2.2 Stringent environmental regulations on carbon emissions

- 3.8.2.3 Competition from alternative materials (graphene, silica, and nanotubes)

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

Chapter 6 Market Estimates and Forecast, By Grade, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conductive carbon black

- 6.3 Fiber carbon black

- 6.4 Food-grade carbon black

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rubber

- 7.3 Plastics

- 7.4 Printing inks & toners

- 7.5 Paints & coatings

- 7.6 Battery electrodes

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Asahi Carbon Co. Ltd.

- 9.2 Atlas Organics Private Limited

- 9.3 Birla Carbon

- 9.4 Black Bear Carbon B.V.

- 9.5 Cabot Corporation

- 9.6 Continental Carbon Company

- 9.7 Denka Company Limited

- 9.8 Himadri Specialty Chemical Ltd

- 9.9 Omsk Carbon Group

- 9.10 Orion Engineered Carbons GmbH

- 9.11 Phillips Carbon Black Limited

- 9.12 Ralson

- 9.13 Tokai Carbon Co., Ltd.