|

시장보고서

상품코드

1740844

바이오폴리머 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Biopolymer Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

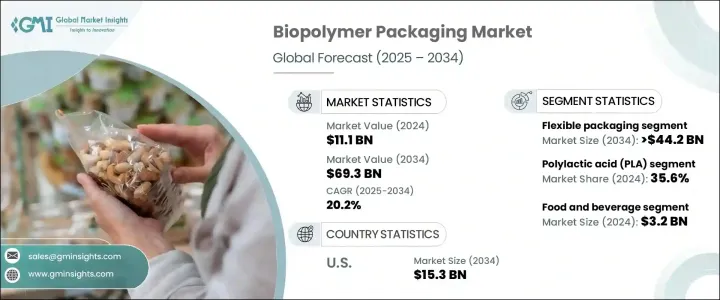

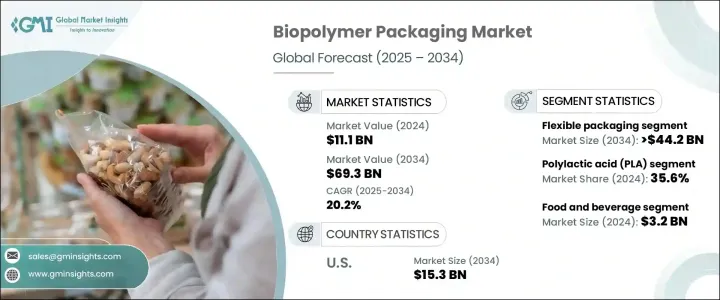

세계의 바이오폴리머 포장 시장 규모는 2024년에 111억 달러로 평가되었고 지속 가능한 포장 솔루션에 대한 수요가 급증함에 따라 CAGR 20.2%를 나타내 2034년에는 693억 달러에 이를 것으로 예측되고 있습니다.

환경 의식이 각 업계에서 강화됨에 따라 기업은 생태 발자국을 최소화 할 필요가 있습니다.

기술의 진보는 또한 바이오폴리머 소재를 보다 비용효율이 높고, 범용성이 있어 입수하기 쉽고 중요한 역할을 하고 있습니다. 향후 포장 솔루션과 직접 경쟁할 수 있도록 재료 강도, 장벽 특성 및 커스터마이징 능력을 강화하는 데 주력하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 111억 달러 |

| 예측 금액 | 693억 달러 |

| CAGR | 20.2% |

기업이 지속가능성을 브랜드 아이덴티티나 소비자의 취향과 연결해 생각하는 경향이 강해짐에 따라 바이오폴리머 포장의 인기가 높아지고 있습니다. 경계 책임에 대한 광범위한 헌신을 반영하며, 이러한 재료를 지원하는 기술이 성숙함에 따라 생산 공정이 더욱 합리화되고 비용이 절감되고 바이오 폴리머는 기존 플라스틱의 대체품으로 추가 실행 가능합니다.

시장은 또한 조달 전략의 변화도 눈에 띄고 있습니다. 주요 브랜드는 지속 가능한 포장에 비싼 가격을 지불하지 않고 중소 기업은 선택의 폭이 좁음에도 불구하고 현지에서 조달된 원재료를 이용하도록 되어 있습니다. 토너십은 중요한 성장 전략으로 떠오르고 있으며 기업이 맞춤형 환경 친화적인 포장 솔루션을 제공하는 데 도움이 되고 있습니다.

파우치, 필름, 랩 등의 연포장 포맷이 바이오폴리머 포장 분야를 지배해 2034년까지 442억 달러를 창출할 것으로 예측되고 있습니다. 높은 배리어성 바이오폴리머 재료는 환경에 미치는 영향을 최소화하면서 제품 보호를 보장하기 위해 점점 더 많이 사용되고 있습니다.

폴리부틸렌 석시네이트(PBS) 부문은 2024년에 13.3% 시장 점유율을 획득했습니다. 어떤 용도에 선호되는 재료가 되고 있습니다. PBS는 산업 환경에서도 가정의 퇴비화 환경에서도 분해할 수 있기 때문에 지속가능성이 중시되는 종래의 플라스틱에 대신하는 이상적인 소재로서 자리매김되고 있습니다.

독일의 바이오폴리머 포장 시장은 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 20.3%를 나타낼 것으로 예측됩니다. 독일의 강력한 환경 정책과 순환형 경제에의 헌신이, 생분해성 대체품 수요를 촉진하고 있습니다.

세계의 바이오폴리머 포장 업계 주요 기업으로는 Tetra Pak International SA, United Biopolymers SA, NatureWorks, LLC, Genpak, Greendot Biopak, Sphere Group, CJ Biomaterials Inc. Danimer Scientific, Vegware Global, Accredo Packaging, Mondi 그룹 등이 있습니다. 주요 기업은 바이오폴리머 재료 프로바이더와의 전략적 제휴를 통해 시장 포지션을 강화해, 주문제작으로 경쟁력 있는 솔루션을 제공할 수 있도록 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 업계에 미치는 영향요인

- 성장 촉진요인

- 성장하는 지속 가능한 포장 산업

- 일회용 플라스틱에 관한 정부의 규제와 금지

- 바이오폴리머 기술의 진보

- 순환형 경제와 폐기물 관리 정책

- E-Commerce의 확대와 지속 가능한 포장의 요구

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용과 제한된 규모의 경제

- 폐기물 관리와 재활용 인프라의 과제

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 재료별(2021-2034년)

- 주요 동향

- 전분 혼합물

- 폴리락트산(PLA)

- 폴리부틸렌 숙신산염(PBS)

- 폴리부틸렌 아디페이트 테레프탈레이트(PBAT)

- 폴리하이드록시알카노에이트(PHA)

- 기타

제6장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 동향

- 경질 포장

- 병 및 자

- 트레이 및 용기

- 클램쉘

- 연질 포장

- 파우치 및 향 주머니

- 가방 및 랩

- 필름

- 기타

제7장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식품 및 음료

- 음식

- 신선한 식품

- 가공 식품

- 유제품

- 베이커리 및 제과류

- 음료

- 물 및 청량음료

- 알코올 음료

- 주스 및 유제품 음료

- 음식

- 소비재

- 일렉트로닉스

- 가정용품

- 의약품

- 의약품

- 의료기기

- 퍼스널케어 및 화장품

- 스킨 케어

- 헤어 케어

- 메이크업

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Accredo Packaging

- CJ Biomaterials Inc.

- Danimer Scientific

- Genpak

- Greendot Biopak

- Mondi Group

- NatureWorks, LLC

- Sphere Group

- Tetra Pak International SA

- United Biopolymers SA

- Vegware Global

The Global Biopolymer Packaging Market was valued at USD 11.1 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 69.3 billion by 2034, driven by the surging demand for sustainable packaging solutions. As environmental consciousness intensifies across industries, companies are under growing pressure to minimize their ecological footprint, and biopolymer packaging is emerging as a go-to solution. Unlike conventional plastic packaging, biopolymers offer compostable and recyclable alternatives that align with global sustainability goals. With consumers prioritizing eco-friendly choices and regulatory bodies tightening rules around plastic usage, businesses are moving fast to integrate greener packaging options.

Technological advancements are also playing a critical role by making biopolymer materials more cost-effective, versatile, and accessible. These developments are breaking long-standing barriers to adoption, enabling even price-sensitive industries to embrace sustainable packaging. As market players step up investments in R&D, they are focusing on enhancing material strength, barrier properties, and customization capabilities to compete directly with traditional packaging solutions. Biopolymer packaging is no longer just a niche market-it is fast becoming a mainstream requirement, reshaping packaging strategies across sectors like food and beverages, healthcare, personal care, and beyond.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.1 Billion |

| Forecast Value | $69.3 Billion |

| CAGR | 20.2% |

Biopolymer packaging is gaining traction as companies increasingly tie sustainability to brand identity and consumer preference. Many manufacturers are actively shifting toward biopolymer solutions, reflecting their broader commitment to environmental responsibility. As the technology behind these materials matures, production processes are becoming more streamlined, reducing costs and making biopolymers an even more viable alternative to conventional plastics.

The market is also witnessing a shift in sourcing strategies. Larger brands are now willing to pay a premium for sustainable packaging, while smaller businesses are tapping into locally sourced raw materials despite facing a narrower selection. Partnerships between manufacturers and biopolymer material suppliers are emerging as a critical growth strategy, helping companies offer customized, eco-friendly packaging solutions. These collaborations are also fueling innovations that drive cost-efficiency and scalability, which in turn are boosting adoption rates across industries.

Flexible packaging formats such as pouches, films, and wraps are expected to dominate the biopolymer packaging space, projected to generate USD 44.2 billion by 2034. This growth is largely fueled by strong demand from industries like food and beverages, personal care, and pharmaceuticals. High-barrier biopolymer materials are increasingly being used to ensure product protection while minimizing environmental impact. Innovations in digital printing are enhancing packaging customization, reducing material waste, and further strengthening the market appeal of biopolymer packaging.

The polybutylene succinate (PBS) segment captured a 13.3% market share in 2024. PBS stands out for its exceptional biodegradability, thermal stability, and flexibility, making it a preferred material for applications like food packaging and agricultural films. Its ability to decompose in both industrial and home composting environments positions PBS as an ideal alternative to traditional plastics where sustainability is non-negotiable.

The Germany Biopolymer Packaging Market is projected to grow at a CAGR of 20.3% from 2025 to 2034. Germany's strong environmental policies and commitment to a circular economy are propelling demand for biodegradable alternatives. Incentives for businesses adopting eco-friendly packaging and ambitious EU-level targets for carbon footprint reduction are further driving the market shift from fossil-based plastics to renewable materials.

Key players in the global biopolymer packaging industry include Tetra Pak International SA, United Biopolymers SA, NatureWorks, LLC, Genpak, Greendot Biopak, Sphere Group, CJ Biomaterials Inc., Danimer Scientific, Vegware Global, Accredo Packaging, and Mondi Group. Leading companies are strengthening their market positions through strategic partnerships with biopolymer material providers, allowing them to deliver tailored and competitive solutions. With a strong focus on R&D investments, these players aim to enhance production efficiency, cost-effectiveness, and product performance to stay ahead in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing sustainable packaging industry

- 3.3.1.2 Government regulations & bans on single-use plastics

- 3.3.1.3 Advancements in biopolymer technology

- 3.3.1.4 Circular economy & waste management policies

- 3.3.1.5 Expansion in e-commerce & sustainable packaging needs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High production costs & limited economies of scale

- 3.3.2.2 Challenges in waste management & recycling infrastructure

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Starch blends

- 5.3 Polylactic acid (PLA)

- 5.4 Polybutylene succinate (PBS)

- 5.5 Polybutylene adipate terephthalate (PBAT)

- 5.6 Polyhydroxyalkanoates (PHA)

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Bottles & jars

- 6.2.2 Trays & containers

- 6.2.3 Clamshells

- 6.3 Flexible packaging

- 6.3.1 Pouches & sachets

- 6.3.2 Bags & wraps

- 6.3.3 Films

- 6.3.4 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.2.1 Food

- 7.2.1.1 Fresh food

- 7.2.1.2 Processed food

- 7.2.1.3 Dairy products

- 7.2.1.4 Bakery & confectionery

- 7.2.2 Beverage

- 7.2.2.1 Water & soft drinks

- 7.2.2.2 Alcoholic beverages

- 7.2.2.3 Juices & dairy drinks

- 7.2.1 Food

- 7.3 Consumer goods

- 7.3.1 Electronics

- 7.3.2 Household products

- 7.4 Pharmaceuticals

- 7.4.1 Pharmaceuticals

- 7.4.2 Medical devices

- 7.5 Personal care & cosmetics

- 7.5.1 Skincare

- 7.5.2 Haircare

- 7.5.3 Makeup

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accredo Packaging

- 9.2 CJ Biomaterials Inc.

- 9.3 Danimer Scientific

- 9.4 Genpak

- 9.5 Greendot Biopak

- 9.6 Mondi Group

- 9.7 NatureWorks, LLC

- 9.8 Sphere Group

- 9.9 Tetra Pak International SA

- 9.10 United Biopolymers SA

- 9.11 Vegware Global