|

시장보고서

상품코드

1740871

자동차 소결 브레이크 패드 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Sintered Brake Pads Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

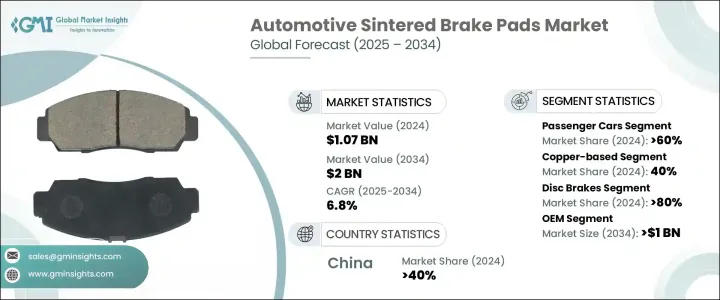

세계의 자동차 소결 브레이크 패드 시장은 2024년에는 10억 7,000만 달러로 평가되었고, 2034년에는 CAGR 6.8%를 나타내 20억 달러에 이를 것으로 예측되고 있습니다.

이는 주로 트럭이나 버스와 같은 상용차에서 내구성이 뛰어나고 고성능인 브레이크 시스템에 대한 수요가 급증하고 있는 것이 요인입니다. 기능의 최적화와 안전성의 강화를 향한 시프트가 진행되고 있어 소결 브레이크 패드는 기술 혁신의 최전선에 위치하고 있습니다. 능을 발휘하는 브레이크 부품을 점점 우선시 하고 있습니다. 지속가능성에 대한 우려가 강해짐에 따라, 제조업체 각사는 환경 친화적인 소재나 제조 공정을 채용하게 되어, 소결 브레이크 패드 시장 규모는 세계적으로 더욱 확대하고 있습니다.

소결 브레이크 패드는 매우 높은 온도와 압력 하에서 금속 입자를 융합시켜 제조되므로 고밀도로 내구성이 높은 부품을 만들 수 있습니다. 열, 마찰, 마모에 탁월한 내구성을 발휘합니다. 패드는 젖은 노면, 젖은 노면, 거친 노면에서도 뛰어난 제동 효율을 유지하기 위해 오프로드나 전천후형 드라이빙에도 적합합니다. 교환 횟수의 저감을 실현하고 있습니다.소결 브레이크 패드는 변동하는 하중이나 극단적인 온도 조건하에서도 안정된 제동력을 발휘하기 위해, 소비자용과 상용차용의 양쪽의 부문으로 채용되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 10억 7,000만 달러 |

| 예측 금액 | 20억 달러 |

| CAGR | 6.8% |

차종별로 보면, 자동차 소결 브레이크 패드 시장은 승용차, 상용차, 이륜차로 구분됩니다. 2024년 시장 점유율은 승용차가 60%를 차지했고 2034년에는 10억 달러에 이를 것으로 예측됩니다. 이런 이점은 연비 효율이 높고 유지보수에 어려움이 적은 브레이크 시스템에 대한 소비자의 지향성을 반영합니다. 소결 브레이크 패드는 안정적이고 안정적인 성능을 발휘하고 마모를 줄이기 위해 매일 도시 지역에서 통근하거나 가끔 고속도로를 이용하는 드라이브에 이상적입니다. 수명이 연장됨에 따라 전체 유지 보수 비용이 절감되고 차량의 내구성이 향상되므로 가치 부문의 구매층뿐만 아니라 고급 차량 소유자에게도 강력하게 호소할 수 있습니다.

시장 세분화에서 시장은 구리계, 세라믹계, 철계, 탄소계 등으로 분류됩니다. 구리 기반 소결 브레이크 패드는 2024년에 40% 점유율로 시장을 선도했습니다. 열 안정성과 전도성이 뛰어나므로 고속·고부하 용도에 적합합니다. 이 패드는 제동 정확도와 내구성을 양도 할 수 없는 스포츠카, 상용 트럭, 오프로드 자동차에 널리 사용됩니다. 구리 기반 패드는 교체 빈도를 줄임으로써 운행 회사와 자가용 자동차 소유자에게 상당한 비용 절감을 가져오고 인기가 점점 높아지고 있습니다.

2024년 아시아태평양의 자동차 소결 브레이크 패드 시장은 인도, 태국, 인도네시아 등 신흥국에서 자동차 부문의 급속한 확대가 원동력이 되어 40%라는 압도적인 점유율을 차지했습니다. 급격한 도시화, 가처분 소득 증가, 자동차 소유자 증가에 의해 OEM(상대처 상표 제품 제조) 제조업체에 대한 소결 브레이크 패드 등의 최고급 부품의 채용 압력이 강해지고 있습니다. 동시에, 이 지역에서는 상용차와 이륜차의 판매가 늘어나고 있으며, 특히 안전성과 효율성의 향상에 열심인 대중교통기관 및 물류 차량 수요가 더욱 높아지고 있습니다.

자동차 소결 브레이크 패드 시장을 형성하는 주요 기업은 닛신 보, Knorr-Bremse, Brembo, Tenneco, Bosch, Haldex, ADVICS, MAT Holdings, 아이신 정기, 눈보라 브레이크 등이 있습니다. 이러한 기업은 성능 향상, 내구성 향상, 환경 영향을 줄이는 첨단 소결 브레이크 패드를 전개하기 위해 연구 개발 이니셔티브에 적극적으로 투자하고 있습니다. 동시에, 점점 더 엄격해지는 배기가스 규제에 적합한 신소재의 개발도 포함됩니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 가격 동향

- 코스트 내역 분석

- 영향요인

- 성장 촉진요인

- 스포츠카나 고급차에 있어서의 고성능 브레이크 시스템 수요 증가

- 세계 상용차 및 화물 운송 부문의 성장

- 내구성과 내열성의 향상을 목적으로 한 소결 패드의 오토바이에의 채용 증가

- 대형 브레이크 솔루션을 필요로 하는 건설 및 광업 업계의 확대

- 업계의 잠재적 위험 및 과제

- 소결 패드는 유기 또는 반금속의 대체품에 비해 높은 비용

- 소결 재료의 공격적인 성질에 의해 브레이크 디스크의 마모가 증가

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계·예측 : 재료별(2021-2034년)

- 주요 동향

- 구리

- 세라믹

- 철

- 탄소

- 기타

제6장 시장 추계·예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- LCV

- MCV

- HCV

- 이륜차

- 오토바이

- 스쿠터 및 모페드

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 디스크 브레이크

- 드럼 브레이크

제8장 시장 추계·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

- 도매업체

- 소매점

- 온라인 소매 플랫폼

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- ADVICS

- Aisin Seiki

- Akebono Brake

- ASK Automotive

- Bosch

- Brake Parts

- Brembo

- EBC Brakes

- Haldex

- Hawk Performance

- Hitachi Chemical

- ICER Brakes

- ITT

- Knorr-Bremse

- MAT Holdings

- Miba

- Nisshinbo

- Sangsin Brake

- SBS Friction

- Tenneco

The Global Automotive Sintered Brake Pads Market was valued at USD 1.07 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 2 billion by 2034, primarily fueled by the surging demand for durable and high-performance braking systems, especially in commercial vehicles like trucks and buses. As global logistics and freight mobility continue to expand, the need for reliable, long-lasting braking solutions has never been more critical. Growing infrastructure development, rising investments in transportation networks, and a consistent surge in e-commerce activities have directly impacted the growth of commercial vehicles on the road, significantly boosting the demand for sintered brake pads. Moreover, the automotive sector's ongoing shift towards performance optimization and safety enhancement has placed sintered brake pads at the forefront of innovation. Automakers and fleet operators increasingly prioritize brake components that can withstand extreme conditions, minimize maintenance cycles, and deliver consistent performance across varied terrains. As sustainability concerns intensify, manufacturers are also innovating with eco-friendly materials and processes, further broadening the market scope for sintered brake pads globally.

Sintered brake pads are manufactured by fusing metallic particles under extremely high temperatures and pressures, resulting in dense, highly durable components. This method gives the pads exceptional resistance to heat, friction, and wear, even under the most intense braking scenarios. They excel in rapid deceleration, steep descents, and heavy towing situations, where maintaining consistent performance is crucial. Sintered brake pads also maintain superior braking efficiency in wet, muddy, or rough terrains, making them a preferred choice for off-road and all-weather driving conditions. Their robust structure helps minimize deformation, ensuring a longer lifespan and fewer replacements. The ability of sintered brake pads to deliver stable braking under fluctuating loads and temperature extremes has cemented their position as the go-to option for both consumer and commercial vehicle segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.07 Billion |

| Forecast Value | $2 Billion |

| CAGR | 6.8% |

In terms of vehicle types, the automotive sintered brake pads market is segmented into passenger cars, commercial vehicles, and two-wheelers. In 2024, the passenger car segment accounted for a 60% market share and is projected to generate USD 1 billion by 2034. This dominance reflects the growing consumer inclination toward fuel-efficient, low-maintenance braking systems. Sintered brake pads deliver consistent, reliable performance and reduce wear, making them ideal for daily urban commutes and occasional highway drives. Their extended lifespan results in lower overall maintenance costs and greater vehicle durability, appealing strongly to value-segment buyers as well as luxury vehicle owners.

When it comes to material segmentation, the market is divided into copper-based, ceramic-based, iron-based, carbon-based, and others. Copper-based sintered brake pads led the market with a 40% share in 2024. Their excellent thermal stability and conductivity make them ideal for high-speed and heavy-load applications. These pads are widely used in sports cars, commercial trucks, and off-road vehicles where braking precision and durability are non-negotiable. By reducing the frequency of replacements, copper-based pads offer substantial cost savings for fleet operators and private vehicle owners alike, reinforcing their growing popularity.

The Asia Pacific Automotive Sintered Brake Pads Market held a commanding 40% share in 2024, driven by the rapid expansion of the automobile sector in emerging economies like India, Thailand, and Indonesia. Soaring urbanization, rising disposable incomes, and an increasing number of car owners have intensified the pressure on original equipment manufacturers (OEMs) to incorporate top-tier components such as sintered brake pads. At the same time, the growing sales of commercial vehicles and two-wheelers across the region have further fueled demand, particularly among public transport systems and logistics fleets keen on enhancing safety and efficiency.

Leading players shaping the automotive sintered brake pads market include Nisshinbo, Knorr-Bremse, Brembo, Tenneco, Bosch, Haldex, ADVICS, MAT Holdings, Aisin Seiki, and Akebono Brake. These companies are aggressively investing in research and development initiatives to roll out advanced sintered brake pads that offer improved performance, greater durability, and reduced environmental impact. Innovations include the development of new materials that comply with increasingly stringent emission standards while simultaneously enhancing safety. Strategic partnerships and alliances with automotive manufacturers and suppliers are also helping companies extend their market reach, strengthen product portfolios, and access new customer bases in a highly competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.5 Supply chain reconfiguration

- 3.4.5.1 Pricing and product strategies

- 3.4.5.2 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Price trends

- 3.10 Cost breakdown analysis

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for high-performance braking systems in sports and luxury vehicles

- 3.11.1.2 Growth in global commercial vehicle and freight transportation sectors

- 3.11.1.3 Increased adoption of sintered pads in motorcycles for durability and heat resistance

- 3.11.1.4 Expanding construction and mining industries requiring heavy-duty braking solutions

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Higher cost of sintered pads compared to organic or semi-metallic alternatives

- 3.11.2.2 Increased brake disc wear due to the aggressive nature of sintered materials

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Ceramic

- 5.4 Iron

- 5.5 Carbon

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Two-wheelers

- 6.4.1 Motorcycles

- 6.4.2 Scooters & mopeds

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Disc brakes

- 7.3 Drum brakes

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

- 8.3.1 Wholesale distributors

- 8.3.2 Retail stores

- 8.3.3 Online retail platforms

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ADVICS

- 10.2 Aisin Seiki

- 10.3 Akebono Brake

- 10.4 ASK Automotive

- 10.5 Bosch

- 10.6 Brake Parts

- 10.7 Brembo

- 10.8 EBC Brakes

- 10.9 Haldex

- 10.10 Hawk Performance

- 10.11 Hitachi Chemical

- 10.12 ICER Brakes

- 10.13 ITT

- 10.14 Knorr-Bremse

- 10.15 MAT Holdings

- 10.16 Miba

- 10.17 Nisshinbo

- 10.18 Sangsin Brake

- 10.19 SBS Friction

- 10.20 Tenneco