|

시장보고서

상품코드

1740876

육상 지구물리학 서비스 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Land Based Geophysical Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

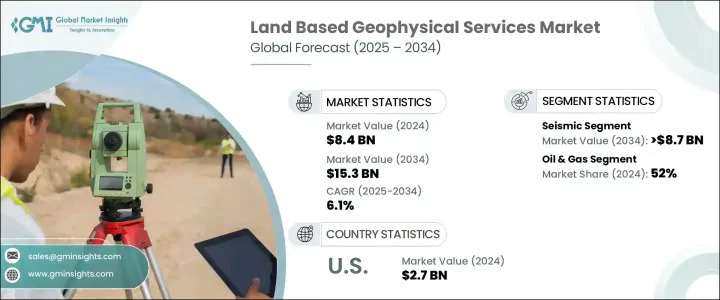

세계의 육상 지구물리학 서비스 시장은 2024년에 84억 달러로 평가되었으며, 급속한 도시화, 활황을 주는 건설 활동, 정밀한 지하 데이터에 대한 수요의 급증을 배경으로 CAGR 6.1%를 나타내 2034년에는 153억 달러에 달할 것으로 예측되고 있습니다.

세계의 도시가 확대되고 현대화됨에 따라 안전하고 탄력적인 인프라의 필요성이 커지고 있습니다. 평가하고 지진 위험을 완화하기 위해 점점 더 첨단 지구물리학 기술에 의존하고 있습니다.

환경 문제에 대한 관심, 규제 프레임 워크 강화 및 재해에 강한 인프라의 긴급 요구가 시장 수요를 더욱 밀어 올리고 있습니다. 기업은 속도, 지속가능성, 정확성을 우선하는 진화하는 시장에서 경쟁력을 유지하기 위해 AI 통합 솔루션, 모바일 측량 유닛, 원격 감지 플랫폼에 많은 투자를 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 84억 달러 |

| 예측 금액 | 153억 달러 |

| CAGR | 6.1% |

세계 각국의 정부는 재해에 강한 인프라와 재해 경감에 대한 투자를 강화하고 있으며, 선진적인 육상 지구물리학 서비스에 대한 일관된 수요를 뒷받침하고 있습니다. 비용과 환경 문제로 인해 점점 더 불가능해지고 혁신적인 지구 물리 솔루션의 기회가 탄생하고 있습니다.

환경 보전은 매우 중요한 요소가 되고 있으며, 이해 관계자는 토지의 매립, 자원 채굴, 환경 정화 프로젝트에 있어서, 비침습적이고 환경 친화적인 측량 방법을 선호하게 되어 있습니다. 역동적인 선택으로, 정부의 무역 정책의 변화는 장비 조달과 서비스 모델에 영향을 미치고 있으며, 공급자는 비용 효율적인 기술 중심의 전략을 채택할 필요가 있습니다.

지진 탐사 분야는 이미징 해상도 향상과 타임랩스 지진 탐사 기술의 이용 확대에 힘입어 2034년까지 87억 달러에 이를 것으로 예상되고 있습니다. 탐사에 필수적인 고해상도 지하 데이터의 골드 표준이기도 합니다.

석유 및 가스 부문는 2024년의 최종 용도 부문에서 52%의 점유율을 차지했고 중력·자기 탐사가 굴착 비용의 삭감과 탐사 성과의 향상에 중요한 역할을 계속하고 있습니다.

미국의 육상 지구물리학 서비스 시장은 2024년에 27억 달러로 평가되었고, 대규모 인프라 투자와 지속 가능하고 전기화된 조업을 촉진하는 규제상의 인센티브가 원동력이 되고 있습니다. 더 기술은 지하 유틸리티의 매핑과 건설의 안전에 널리 이용되고 있습니다.

경쟁 구도를 형성하는 주요 기업은 CGG, Fugulo, SLB, Getech Group, Abitibi Geophysics, Weatherford, TGS, PGS, Gardline, Ramboll Group, Dawson Geophysical Company, SAExploration, Spectrum Geophysics등입니다. 각사는 리얼타임 데이터 분석, AI 통합, 신흥 시장에의 진출에 주력해, 그 지위를 강화하고 있습니다. 지속 가능한 조사 방법에 대한 투자와 함께, 에너지 및 광업 부문과의 전략적 제휴가 성장 전략의 핵심이 되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 전략적 전망

- 혁신 및 지속가능성 전망

제5장 시장 규모와 예측 : 기술별(2021-2034년)

- 주요 동향

- 지진

- 자기

- 전자기

- Gradiometric

- 기타

제6장 시장 규모와 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 석유 및 가스

- 광업

- 농업

- 기타

제7장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 노르웨이

- 러시아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이라크

- 이란

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

제8장 기업 프로파일

- Abitibi Geophysics

- CGG

- Dawson Geophysical Company

- Fugro

- Gardline

- Getech Group

- PGS

- Ramboll Group

- SAExploration

- SLB

- Spectrum Geophysics

- TGS

- Weatherford

The Global Land Based Geophysical Services Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 15.3 billion by 2034, driven by rapid urbanization, booming construction activities, and surging demand for precise subsurface data. As cities worldwide expand and modernize, the need for safe, resilient infrastructure is intensifying. Builders, developers, and urban planners are increasingly relying on advanced geophysical technologies to map underground utilities, assess ground stability, and mitigate seismic risks before launching large-scale projects. The role of land based geophysical services has shifted from a supportive function to a core element of planning, engineering, and risk management strategies.

Rising environmental concerns, tighter regulatory frameworks, and the urgent need for disaster-resilient infrastructure are further boosting market demand. Technological innovation is also reshaping the industry, with stakeholders seeking real-time, non-invasive survey methods that provide faster, safer, and more accurate results. As emerging economies ramp up urban development and resource exploration projects, the appetite for cost-effective and eco-conscious geophysical services is accelerating. Companies are investing heavily in AI-integrated solutions, mobile survey units, and remote sensing platforms to stay competitive in an evolving market that prioritizes speed, sustainability, and precision.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $15.3 Billion |

| CAGR | 6.1% |

Governments worldwide are stepping up investments in resilient infrastructure and disaster mitigation, helping fuel consistent demand for advanced land based geophysical services. Customers today expect smarter survey technologies that deliver accurate insights without disrupting the environment. In emerging regions, traditional land exploration methods are increasingly unviable due to operational costs and environmental challenges, creating opportunities for innovative geophysical solutions. Players are responding with AI-powered platforms that meet evolving safety and sustainability standards while delivering real-time data for better decision-making.

Environmental stewardship is becoming a crucial factor, pushing stakeholders to prefer non-invasive, eco-friendly surveying methods for land reclamation, resource extraction, and environmental cleanup projects. In developing regions, operational hurdles and high exploration costs make geophysical services an attractive option for efficient mineral and energy resource identification. Shifts in government trade policies are also impacting equipment sourcing and service models, pushing providers to adopt cost-efficient, technology-driven strategies. The need for real-time, high-precision subsurface insights is driving a fundamental shift in how the industry approaches exploration and development.

The seismic segment is expected to reach USD 8.7 billion by 2034, supported by advancements in imaging resolution and the growing use of time-lapse seismic technologies. Seismic services remain the gold standard for high-definition subsurface data, critical to hydrocarbon exploration. Magnetic and electromagnetic surveys are gaining traction, especially in hard-to-reach mining areas where accurate geological mapping is essential.

The oil and gas sector dominated the end-use segment with a 52% share in 2024, where gravity and magnetic surveys continue to play a vital role in reducing drilling costs and improving exploration outcomes. Rising demand for critical minerals needed in electronics and renewable energy industries is also fueling greater adoption of geophysical services in mining applications.

The U.S. Land Based Geophysical Services Market stood at USD 2.7 billion in 2024, powered by major infrastructure investments and regulatory incentives promoting sustainable and electrified operations. Seismic refraction and ground-penetrating radar technologies are widely used for underground utility mapping and construction safety. In Canada, the push for non-invasive, environmentally sensitive survey methods is also gaining ground, particularly for natural resource assessment and environmental reclamation.

Key players defining the competitive landscape include CGG, Fugro, SLB, Getech Group, Abitibi Geophysics, Weatherford, TGS, PGS, Gardline, Ramboll Group, Dawson Geophysical Company, SAExploration, and Spectrum Geophysics. Companies are focusing on real-time data analytics, AI integration, and expanding into emerging markets to strengthen their positions. Strategic partnerships with energy and mining sectors, along with investments in sustainable survey methods, are becoming core growth strategies. Innovation in mobile survey units and remote sensing technologies is emerging as a major differentiator in a market driven by precision and speed.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Seismic

- 5.3 Magnetic

- 5.4 Electromagnetic

- 5.5 Gradiometric

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Mining

- 6.4 Agriculture

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Norway

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 Iraq

- 7.5.4 Iran

- 7.5.5 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Abitibi Geophysics

- 8.2 CGG

- 8.3 Dawson Geophysical Company

- 8.4 Fugro

- 8.5 Gardline

- 8.6 Getech Group

- 8.7 PGS

- 8.8 Ramboll Group

- 8.9 SAExploration

- 8.10 SLB

- 8.11 Spectrum Geophysics

- 8.12 TGS

- 8.13 Weatherford