|

시장보고서

상품코드

1740965

구조 심장 장치 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Structural Heart Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

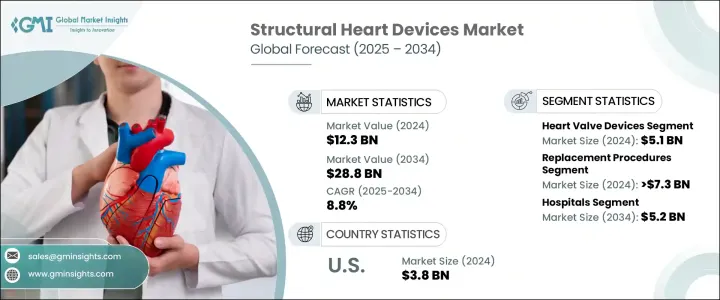

세계의 구조 심장 장치 시장은 2024년에 123억 달러로 평가되었고, 2034년에는 288억 달러에 이를 것으로 추정되되며, CAGR 8.8%로 성장할 전망입니다.

이러한 지속적인 성장은 심혈관 질환의 발생률 증가, 의료 서비스 접근성 확대, 최소 침습적 치료 기술의 광범위한 채택에 의해 촉진되고 있습니다. 전 세계적으로 고령화 인구가 증가함에 따라 고혈압, 당뇨병과 같은 만성 질환의 유병률이 높아져 구조 심장 질환으로 진단받는 환자 수가 직접적으로 증가하고 있습니다. 특히 판막 관련 문제, 선천성 심장 결함, 심장 구조에 영향을 미치는 질환이 더욱 빈번하게 발생하고 있어 첨단 치료 솔루션에 대한 요구가 더욱 커지고 있습니다. 또한 인식 제고, 조기 진단, 기술 발전으로 인해 심혈관 부문의 환자 치료가 크게 변화했습니다.

2023년 세계 시장은 113억 달러에 이르렀으며, 이는 상승세를 반영하는 수치입니다. 제품 유형 중 심장 판막 장치는 2024년에 51억 달러로 가장 높은 매출을 올렸습니다. 이러한 성장은 개심 수술의 필요성을 최소화하면서 적절한 심장 판막 기능을 회복하도록 설계된 현대적이고 내구성이 뛰어난 장치의 사용이 증가했기 때문일 수 있습니다. 다른 주요 제품 부문에는 구조 개입을 가능하게 하는 다양한 지원 기술과 함께 판막 성형 링, 폐색기, 전달 시스템 등이 있습니다. 혁신으로 이러한 도구의 안전성과 효과가 지속적으로 향상됨에 따라 임상의는 개별 환자의 필요에 따라 치료를 맞춤화할 수 있는 더 많은 옵션을 갖게 되었습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 123억 달러 |

| 예측 금액 | 288억 달러 |

| CAGR | 8.8% |

심근병증 및 판막 질환과 같은 구조 심장 질환은 즉각적이고 효율적인 관리가 필요하기 때문에 기기 성능 및 시술 기법의 기술적 향상에 중점을 두고 있습니다. 최소 침습적 접근법의 개발은 특히 회복 시간과 입원 기간을 줄여주는 경카테터 판막 교체술과 같은 시술에서 혁신적인 효과를 가져왔습니다. 이러한 방법이 더욱 정교해짐에 따라 환자 치료 결과가 개선되고 합병증이 감소하여 의료 시스템 전반에 걸쳐 더 많은 채택이 이루어지고 있습니다. 또한 최첨단 재료, 실시간 이미징 기능, 인체공학적 설계의 통합으로 복잡한 시술 중 의사의 정확도가 높아져 더 나은 치료 결과를 얻을 수 있게 되었습니다.

절차적 관점에서 시장은 수리 및 교체 절차로 세분화됩니다. 2024년에는 교체 절차가 73억 달러 이상의 매출을 차지하며 이 부문을 지배했습니다. 교체 방법에 대한 선호도가 높아지는 것은 정밀도를 높이고 시술 위험을 줄이는 비수술 및 로봇 보조 기술의 지속적인 발전에서 비롯된 것입니다. 이러한 개선은 장기적인 내구성과 환자의 삶의 질 향상을 우선시하는 치료법으로 치료 패러다임의 전환을 뒷받침했습니다. 또한 교체 시술은 임상 연구와 실제 데이터를 통해 그 효과를 입증하여 의료 서비스 제공자들 사이에서 더 폭넓게 사용되고 있습니다.

최종 용도에서는 병원은 2024년 구조 심장 장치의 최대 소비처로 부상했으며 예측 기간이 끝날 때까지 52억 달러의 매출을 창출할 것으로 예상됩니다. 병원은 숙련된 인력, 최신 심장 장치 및 진단 기능을 잘 갖추고 있어 대량의 심혈관 시술을 처리할 수 있습니다. 구조 심장 치료의 복잡성이 증가함에 따라 병원은 최첨단 도구와 시스템을 사용하여 포괄적인 치료를 제공하는 데 있어 중심적인 역할을 계속하고 있습니다. 또한 병원은 의뢰 및 수술 후 치료를 위한 주요 허브로서 시장에서의 입지를 더욱 강화하고 있습니다.

미국은 2024년 38억 달러의 시장 매출을 기록했으며 2025년부터 2034년까지 7.7%의 연평균 성장률을 보일 것으로 예상됩니다. 미국의 우위는 첨단 의료 인프라, 새로운 의료 기술의 조기 도입, 구조 개입에 대한 유리한 환급 정책에 의해 크게 뒷받침됩니다. 특히 노년층에서 심장 판막 장애 사례가 증가함에 따라 덜 침습적인 판막 교체 요법에 대한 수요가 증가하고 있습니다. 또한, 주요 시장 플레이어의 강력한 입지와 기기 설계 및 시술 워크플로우의 지속적인 혁신이 전 세계적으로 시장 성장을 견인하고 있습니다.

전 세계 구조 심장 장치 시장은 5개 주요 기업이 전체 시장 점유율의 약 75%를 차지하며 경쟁이 치열한 것이 특징입니다. 이러한 주요 기업들은 제품 성능을 개선하고 복잡한 시술을 간소화하기 위해 연구 개발에 지속적으로 투자하고 있습니다. 실시간 시각화 향상부터 수술 워크플로우 간소화에 이르기까지 제조업체는 결과를 최적화하고 임상 생산성을 높이는 직관적이고 효율적이며 환자 친화적인 솔루션으로 의사를 지원하는 데 주력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 심혈관 질환의 부담 증가

- 기술 발전

- 유리한 환급 시나리오

- 최소 침습 시술에 대한 선호도 증가

- 업계의 잠재적 위험 및 과제

- 엄격한 규제 정책

- 잠재적인 합병증 및 부작용

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 상환 시나리오

- 가격 분석(2024년)

- 기술의 상황

- 장래 시장 동향

- Porter's Five Forces 분석

- GAP 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 심장 판막 장치

- 수술용 심장 판막

- 경 카테터 심장 판막

- 판막 성형 링

- 폐색기 및 전달 시스템

- 기타 제품

제6장 시장 추계 및 예측 : 절차별(2021-2034년)

- 주요 동향

- 교체 절차

- 외과적 대동맥판 치환술(SAVR)

- 경 카테터 대동맥판 치환술(TAVR)

- 경 카테터 승모판 치환술(TMVR)

- 기타 교환 절차

- 수리 절차

- 좌심이 폐쇄(LAAC)

- 경 카테터 승모판 수복술(TMVr)

- 경 카테터 삼첨판 수복술(TTVr)

- 판막 성형술

- 기타 수리 절차

제7장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 심장 카테터 검사실

- 기타 용도

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Abbott

- AtriCure

- BIOMERICS

- Boston Scientific

- BRAILE

- CryoLife

- Edwards

- JENAVALVE

- LEPU MEDICAL

- LivaNova

- Medtronic

- NUMED

The Global Structural Heart Devices Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 28.8 billion by 2034. This consistent growth is fueled by the increasing incidence of cardiovascular diseases, expanding access to healthcare services, and the widespread adoption of minimally invasive treatment techniques. As aging populations rise globally, chronic health conditions such as hypertension and diabetes become more prevalent, directly contributing to the increasing number of patients diagnosed with structural heart disorders. In particular, valve-related issues, congenital heart defects, and conditions impacting the heart's structure are becoming more frequent, intensifying the demand for advanced treatment solutions. Moreover, greater awareness, early diagnosis, and technological advances have significantly transformed patient care in the cardiovascular segment.

In 2023, the global market stood at USD 11.3 billion, reflecting its upward trajectory. Among the product types, heart valve devices generated the highest revenue in 2024, valued at USD 5.1 billion. This growth can be attributed to the increasing use of modern, durable devices designed to restore proper heart valve function while minimizing the need for open-heart surgery. Other key product segments include annuloplasty rings, occluders, and delivery systems, along with various supportive technologies that enable structural interventions. As innovation continues to enhance the safety and effectiveness of these tools, clinicians have more options for customizing treatment to individual patient needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 8.8% |

Structural heart conditions such as cardiomyopathies and valve diseases demand immediate and efficient management, which has led to a strong emphasis on technological enhancements in device performance and procedural techniques. The development of minimally invasive approaches has had a transformative effect, especially with procedures such as transcatheter valve replacements that reduce recovery time and hospital stays. As these methods become more refined, patient outcomes are improving and complications are decreasing, driving greater adoption across healthcare systems. The integration of cutting-edge materials, real-time imaging capabilities, and more ergonomic designs have also elevated physician accuracy during complex interventions, allowing for better therapeutic results.

From a procedural standpoint, the market is segmented into repair and replacement procedures. Replacement procedures dominated the segment in 2024, accounting for more than USD 7.3 billion in revenue. The increasing preference for replacement methods stems from ongoing advances in non-surgical and robotic-assisted techniques that offer enhanced precision and reduced procedural risks. These improvements have supported a shift in treatment paradigms toward therapies that prioritize long-term durability and improved quality of life for patients. Replacement procedures also benefit from clinical studies and real-world data that validate their effectiveness, encouraging broader use among healthcare providers.

In terms of end use, hospitals emerged as the largest consumers of structural heart devices in 2024 and are projected to generate USD 5.2 billion by the end of the forecast period. Hospitals are well-equipped with skilled personnel, modern cardiac units, and diagnostic capabilities, enabling them to handle high volumes of cardiovascular procedures. With the increasing complexity of structural heart treatments, hospitals continue to play a central role in delivering comprehensive care using state-of-the-art tools and systems. They are also the primary hubs for referrals and post-surgical care, further strengthening their position in the market.

The United States accounted for USD 3.8 billion in market revenue in 2024 and is expected to grow at a CAGR of 7.7% between 2025 and 2034. The country's dominance is largely supported by its advanced healthcare infrastructure, early adoption of novel medical technologies, and favorable reimbursement policies for structural interventions. Rising cases of heart valve disorders, especially among older adults, are increasing the demand for less invasive valve replacement therapies. Additionally, the strong presence of key market players and ongoing innovation in device design and procedural workflows continue to drive market growth across the country.

The global structural heart devices market is characterized by high competition, with five major companies holding approximately 75% of the total market share. These leading firms are continuously investing in research and development to improve product performance and simplify complex interventions. From enhancing real-time visualization to streamlining surgical workflows, manufacturers are focused on supporting physicians with intuitive, efficient, and patient-friendly solutions that optimize outcomes and boost clinical productivity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing burden of cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Rising preference for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 Potential complications and adverse events

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.8 Technology landscape

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 GAP analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Heart valve devices

- 5.2.1 Surgical heart valves

- 5.2.2 Transcatheter heart valves

- 5.3 Annuloplasty rings

- 5.4 Occluders and delivery systems

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Replacement procedures

- 6.2.1 Surgical aortic valve replacement (SAVR)

- 6.2.2 Transcatheter aortic valve replacement (TAVR)

- 6.2.3 Transcatheter mitral valve replacement (TMVR)

- 6.2.4 Other replacement procedures

- 6.3 Repair procedures

- 6.3.1 Left atrial appendage closure (LAAC)

- 6.3.2 Transcatheter mitral valve repair (TMVr)

- 6.3.3 Transcatheter tricuspid valve repair (TTVr)

- 6.3.4 Valvuloplasty

- 6.3.5 Other repair procedures

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Cardiac catheterization labs

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 AtriCure

- 9.3 BIOMERICS

- 9.4 Boston Scientific

- 9.5 BRAILE

- 9.6 CryoLife

- 9.7 Edwards

- 9.8 JENAVALVE

- 9.9 LEPU MEDICAL

- 9.10 LivaNova

- 9.11 Medtronic

- 9.12 NUMED