|

시장보고서

상품코드

1740983

리튬 티타늄 산화물 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Lithium Titanium Oxide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

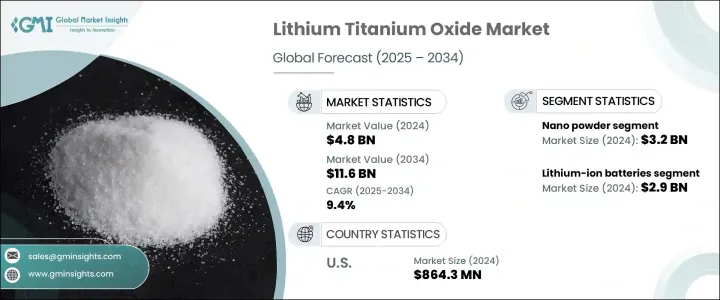

세계의 리튬 티타늄 산화물 시장은 2024년 48억 달러로 평가되었고, 에너지 저장 시스템(ESS)과 전기자동차(EV) 수요 급증에 힘입어 2034년에는 116억 달러에 이를 것으로 추정되며, CAGR 9.4%로 성장할 전망입니다.

전 세계 산업이 청정 에너지와 효율적인 저장 솔루션으로 전환함에 따라 이 시장은 강력한 모멘텀을 경험하고 있습니다. 초고속 충전 기능, 긴 수명, 뛰어난 열 안정성으로 인정받는 LTO 배터리는 소비자 가전, 그리드 스토리지, 자동차 용도에서 그 성능을 인정받아 점점 더 선호되고 있습니다.

재생 에너지 채택이 가속화됨에 따라 안정적이고 효율적인 그리드 스토리지 시스템에 대한 필요성이 그 어느 때보다 커지면서 LTO 배터리는 글로벌 에너지 인프라 현대화의 핵심 요소로 자리매김하고 있습니다. 정부가 더 엄격한 탄소 중립 목표를 시행하고 산업계가 탈탄소화에 집중하면서 고성능의 지속 가능한 배터리 기술에 대한 수요는 LTO 제조업체에게 엄청난 기회를 창출하고 있습니다. 안전, 수명, 빠른 충전에 대한 강조가 커지면서 항공우주, 방위, 대형 운송과 같은 분야에서 LTO의 매력은 더욱 높아지고 있습니다. 시장 참여자들은 빠르게 생산량을 확대하고, 연구에 투자하고, 전략적 제휴를 맺어 LTO 배터리의 상업 용도 확대를 활용하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 48억 달러 |

| 예측 금액 | 116억 달러 |

| CAGR | 9.4% |

또한 자동차 부문은 특히 전기자동차 생산의 급속한 확대로 인해 LTO 시장을 발전시키는 데 중요한 역할을 하고 있습니다. LTO 배터리는 빠른 충전 기능, 뛰어난 열 안정성, 긴 수명 주기로 인해 전기차 용도에서 신뢰할 수 있는 대안으로 인식되고 있으며, 엄격한 조건에서 일관된 성능을 요구하는 고성능 및 상업용 전기자동차에 매우 적합합니다. 글로벌 자동차 제조업체들이 탈탄소화와 지속 가능한 혁신에 집중하면서 LTO 배터리는 차량, 버스, 도심 모빌리티 플랫폼을 위한 실용적인 솔루션으로 부상하고 있습니다. 성능 저하를 최소화하면서 수천 번의 충전-방전 주기를 견딜 수 있는 이 배터리는 환경 및 경제적 목표에 부합하는 장기적인 운영 비용을 절감하여 상당한 가치를 더합니다.

LTO 시장은 등급과 배터리 유형에 따라 세분화됩니다. 2024년에는 나노 분말 LTO가 32억 달러의 매출을 기록하며 시장을 장악했습니다. 나노 분말을 사용하면 LTO 배터리의 표면적 대 부피 비율이 향상되어 용량, 사이클 안정성, 충방전 속도와 같은 전기화학적 특성이 향상됩니다. 향상된 전도도와 균일한 입자 크기 분포 덕분에 나노 분말은 에너지 저장 시스템과 전기자동차에 이상적인 소재입니다.

또한 시장은 배터리 유형별로 분류되며, 리튬 이온 배터리가 가장 큰 점유율을 차지하고 있습니다. 2024년 리튬 이온 배터리 부문은 29억 달러로 59.6%의 점유율을 차지할 것으로 예상됩니다. LTO 배터리는 안전성, 수명, 고속 충전 면에서 뛰어나지만 기존 리튬 이온 배터리에 비해 에너지 밀도가 낮고 비용이 높아 널리 채택되는 데 한계가 있습니다. 하지만 리튬 티타늄 배터리의 뚜렷한 장점으로 인해 그 수요는 계속 증가하고 있습니다.

미국의 리튬 티타늄 산화물 시장은 산업 전반에서 고성능 에너지 저장에 대한 수요 증가에 힘입어 2024년에 8억 6,430만 달러로 평가되었습니다. LTO 배터리는 뛰어난 신뢰성, 안전성, 극한의 온도에서 작동하는 능력으로 인해 자동차, 항공우주 및 재생 에너지 부문에 이상적이라는 점에서 강력한 견인력을 얻고 있습니다.

세계의 리튬 티타늄 산화물 업계의 주요 기업으로는 BTR New Material Group, NEI Corporation, Microvast Holdings, Ossila, SAT Nano Technology Material 등이 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원자재)

- 주요 원자재의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원자재)

- 영향을 받는 주요 기업

- 전략적 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국

- 주요 수입국

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기자동차 및 청정 에너지 솔루션에 대한 수요 증가

- LTO 배터리의 우수한 성능과 긴 수명

- 에너지 저장 시스템에서 LTO 채택 증가

- 업계의 잠재적 위험 및 과제

- 기존 리튬 이온 배터리에 비해 높은 생산 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 나노 분말

- 미크론 분말

제6장 시장추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 리튬 이온 배터리

- 리튬 티타늄 산화물 배터리

- 기타

제7장 시장추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제8장 기업 프로파일

- BTR New Material Group

- Microvast Holdings

- NEI Corporation

- Ossila

- SAT Nano Technology Material

- Stanford Advanced Materials

- Tokyo Chemical Industry India

- Xiamen AOT Electronics Technology

- Xiamen TOB New Energy Technology

- Xiamen Tmax Battery Equipments

The Global Lithium Titanium Oxide Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 11.6 billion by 2034, fueled by surging demand from energy storage systems (ESS) and electric vehicles (EVs). The market is experiencing strong momentum as industries worldwide pivot toward clean energy and efficient storage solutions. LTO batteries, recognized for their ultra-fast charging capabilities, long cycle life, and superior thermal stability, are becoming increasingly favored for their performance in consumer electronics, grid storage, and automotive applications.

As renewable energy adoption accelerates, the need for stable and efficient grid storage systems has never been greater, positioning LTO batteries as a critical component in modernizing global energy infrastructure. With governments implementing stricter carbon neutrality goals and industries focusing on decarbonization, the demand for high-performance, sustainable battery technologies is creating massive opportunities for LTO manufacturers. The growing emphasis on safety, longevity, and quick turnaround charging further boosts the appeal of LTO across sectors like aerospace, defense, and heavy-duty transportation. Market players are rapidly scaling production, investing in research, and forging strategic alliances to leverage the expanding commercial applications of LTO batteries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 9.4% |

Moreover, the automotive sector is playing a major role in driving the LTO market forward, especially with the rapid expansion of electric vehicle production. LTO batteries are increasingly seen as a reliable alternative in EV applications due to their fast-charging capabilities, excellent thermal stability, and extended life cycles, making them highly suitable for high-performance and commercial electric vehicles that demand consistent performance under rigorous conditions. As global automakers intensify their focus on decarbonization and sustainable innovation, LTO batteries are emerging as a practical solution for fleets, buses, and urban mobility platforms. Their ability to endure thousands of charge-discharge cycles with minimal degradation adds significant value by reducing long-term operational costs, aligning with both environmental and economic goals.

The LTO market is segmented based on grade and battery type. Nano powder LTO dominated the market in 2024, contributing USD 3.2 billion. The use of nanopowders improves the surface area-to-volume ratio of LTO batteries, enhancing their electrochemical properties such as capacity, cycle stability, and charge/discharge rates. Improved conductivity and uniform particle size distribution make nanopowders an ideal material choice for energy storage systems and electric vehicles.

The market is also categorized by battery type, with lithium-ion batteries holding the largest share. In 2024, the lithium-ion battery segment accounted for USD 2.9 billion, representing a 59.6% share. While LTO batteries excel in safety, longevity, and fast charging, their lower energy density and higher cost compared to conventional lithium-ion batteries limit widespread adoption. However, their demand continues to rise due to their distinct advantages.

The U.S. Lithium Titanium Oxide Market reached USD 864.3 million in 2024, propelled by rising demand for high-performance energy storage across industries. LTO batteries are gaining strong traction due to their outstanding reliability, safety, and ability to operate under extreme temperatures, making them ideal for the automotive, aerospace, and renewable energy sectors.

Key players in the Global Lithium Titanium Oxide Industry include BTR New Material Group, NEI Corporation, Microvast Holdings, Ossila, and SAT Nano Technology Material. These companies are continuously innovating manufacturing processes, enhancing application technologies, expanding R&D investments, and forging strategic partnerships to strengthen their position in the rapidly growing LTO market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

- 3.4 Profit margin analysis

- 3.5 Key news and initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for electric vehicles and clean energy solutions

- 3.7.1.2 Superior performance and long cycle life of LTO batteries

- 3.7.1.3 Increasing adoption of LTO in energy storage systems

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 High production costs compared to conventional lithium-ion batteries

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Nano powder

- 5.3 Micron powder

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lithium-ion batteries

- 6.3 Lithium-titanate battery

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BTR New Material Group

- 8.2 Microvast Holdings

- 8.3 NEI Corporation

- 8.4 Ossila

- 8.5 SAT Nano Technology Material

- 8.6 Stanford Advanced Materials

- 8.7 Tokyo Chemical Industry India

- 8.8 Xiamen AOT Electronics Technology

- 8.9 Xiamen TOB New Energy Technology

- 8.10 Xiamen Tmax Battery Equipments