|

시장보고서

상품코드

1741047

자동차용 데이터 로거 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Data Logger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

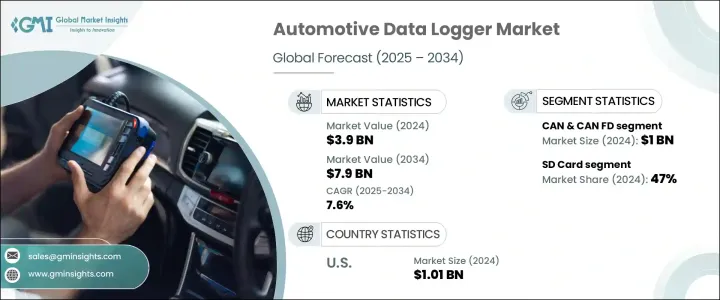

세계의 자동차용 데이터 로거 시장 규모는 2024년 39억 달러로 평가되었고, CAGR 7.6%로 성장할 전망이며, 2034년 79억 달러에 이를 것으로 추정됩니다.

이 성장은 커넥티드카 기술의 급속한 개발, 안전성 및 배기 가스 규제 강화, 첨단 차량 진단 및 텔레매틱스 수요 증가에 의해 형성되고 있습니다. 세계의 자동차 제조업체가 전기 자동차나 무인 점포로 이행하는 가운데, 데이터 로거는 승용차와 상용차 양쪽의 카테고리에서 성능 데이터의 수집, 보존, 분석에 있어서 중심적인 역할을 하고 있습니다. 이러한 장치는 배터리 관리 시스템, 인포테인먼트 유닛, ADAS, ECU 등의 다양한 구성 요소에서 데이터를 가져와 실시간 추적과 시스템 평가에 필수적인 도구입니다. 이러한 장치를 사용하면 차량의 효율성과 안전성을 확보하는 데 필수적인 예지보전, 소프트웨어 디버깅, 규제 준수, 운전자 행동 인사이트가 강화됩니다. 자동차 업계에서 IoT와 클라우드 기반 생태계의 영향력이 높아짐에 따라 최신 데이터 로거는 원격 조작과 무선 업데이트를 지원하는 역량이 높아지고 있으며 커넥티드 모빌리티와 차량 관리 시스템에 대한 원활한 통합을 제공하고 있습니다.

통신 프로토콜의 관점에서 시장은 CAN & CAN FD, LIN, FlexRay, 이더넷으로 구분됩니다. 이 중 CAN & CAN FD 카테고리는 2024년 시장을 선도하여 약 10억 달러의 수익을 창출했습니다. 이러한 프로토콜의 우위성은 자동차 업계 전체에서 오랜 기간에 걸쳐 채용되어 온 것에 기인하고 있습니다. CAN은, 수십년에 걸쳐 신뢰성이 높은 차재 통신 규격으로서, 엔진 제어 및 차량 안전성 등의 분야에서 중요한 시스템간의 교환을 촉진해 왔습니다. 업그레이드된 CANFD 버전은 더 높은 데이터 처리량을 가능하게 하며, 특히 최신 운전자 보조 시스템과 관련된 보다 데이터 집약적인 기능을 지원합니다. CAN & CAN FD는 그 광범위한 유용성, 비용 효율성, 저레이턴시 기능에 의해, 차재 진단 및 테스트 애플리케이션에 불가결한 존재로 남아 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 39억 달러 |

| 예측 금액 | 79억 달러 |

| CAGR | 7.6% |

연결 유형별로 시장을 살펴보면 USB, Bluetooth/Wi-Fi, SD 카드 등이 있습니다. 2024년 시장 점유율은 47%로 SD 카드 부문이 앞섰습니다. 이러한 경향은 SD 카드의 신뢰성, 사용 편의성, 저렴한 가격에 의한 것입니다. 컴팩트한 포맷으로 대용량 스토리지를 제공하는 SD 카드는 테스트나 시험 중 방대한 양의 차량 데이터를 기록하기에 적합합니다. 그 플러그 앤 플레이 설계는 셋업을 간소화하고 오프라인 환경에서의 데이터 추출을 가능하게 하기 때문에 무선 인프라가 제한되어 있거나 간섭의 영향을 받기 쉬운 프리프로덕션 단계에서의 귀중한 툴이 됩니다.

컴포넌트별로 분류하면 시장은 하드웨어와 소프트웨어로 나뉘며, 2024년에는 하드웨어가 압도적인 점유율을 차지했습니다. 이 부문은 자동차용 데이터 로깅 시스템의 핵심을 이루는 것으로 데이터 수집용 마이크로프로세서, 데이터 저장용 대용량 메모리, 데이터 무결성 유지를 위한 시그널 컨디셔너, 실시간 모니터링용 센서 인터페이스로 구성됩니다. 이러한 구성 요소는 CAN, FlexRay, 이더넷 등의 프로토콜을 사용하여 데이터 로거와 차량 시스템 간의 통신을 가능하게 합니다. 제조사들은 전기차 및 자율주행차 시스템의 복잡화에 대응하기 위해 이러한 하드웨어 플랫폼을 지속적으로 강화하고 있으며, 실제 환경에서 멀티채널, 고속, 멀티프로토콜 기능에 대한 수요가 높아지고 있습니다.

용도에 따라 시장은 판매 전과 판매 후의 용도로 나뉘어져 있습니다. 2024년에는 판매 전 부문이 지배적인 분야로 떠올랐습니다. 데이터 로거는 차량이 시장에 나오기 전에 성능, 안전성, 환경 기준에 대한 적합성을 검증하기 위해 널리 사용되고 있습니다. 엔지니어는 파워트레인을 최적화하고 ADAS 기능을 교정하며 전기 모델의 배터리 효율을 검증하기 위해 설계와 테스트 단계에서 정확한 데이터 획득에 의존하고 있습니다. 판매 후 부문은 진단 및 예지보전에서의 역할에 의해 성장하고 있는 것, 현재 시장 전체의 점유율에서 차지하는 비율은 작습니다.

최종 사용자의 관점에서 시장은 OEM, 서비스 스테이션, 규제 당국 및 기타를 포함합니다. OEM 부문이 2024년 최대 점유율을 차지한 것은 제조사들이 차량 개발 라이프사이클을 통해 데이터 로거에 계속 의존하고 있기 때문입니다. 프로토 타입에서 최종 검증까지 데이터 로거는 품질 기준이 일관되게 충족되는지 확인하는 데 사용됩니다. 자동차가 점점 더 복잡한 기술을 도입함에 따라 OEM은 ECU 검증부터 차세대 시스템 통합까지 모든 것을 관리하기 위해 정교한 데이터 로깅 솔루션에 투자하고 있습니다.

지역별로는 미국이 북미 시장을 선도해 2024년에는 10억 1,000만 달러의 수익을 기록했으며, 예측 기간 중 CAGR은 6.4%로 예측됩니다. 이 나라의 강한 지위는, 급속한 기술 도입, 강고한 연구 인프라, 전동 모빌러티나 커넥티드 모빌러티에의 추진의 고조에 기인합니다. 미국 전역의 연구소, 시험 시설, 제조업체는 기술 혁신, 컴플라이언스, 시스템 검증을 지원하기 위해 최첨단 데이터 로깅 기기를 계속 도입하고 있습니다.

업계 전반에서는 합병, 전략적 제휴, 센서 기술 및 실시간 분석에 대한 투자를 통해 기업이 전진하고 있습니다. 진단과 성능 추적을 합리화하는 스마트한 IoT 대응, 무선 접속의 데이터 로거에 대한 시프트가 진행되고 있습니다. 이러한 기술 혁신은, 자동차의 밸류 체인 전체에 걸쳐, 신뢰성을 향상시켜, 보다 엄격한 규제 요구에 대응해, 보다 지속 가능하고 인텔리전트한 차량 설계를 서포트하는데 도움이 되고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 하드웨어 제공업체

- 소프트웨어 제공업체

- 기술 공급자

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 트럼프 정권의 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에 대한 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 무역에 미치는 영향

- 기술 및 혁신의 상황

- 특허 분석

- 규제 상황

- 이용 사례

- 주요 뉴스 및 대처

- 영향요인

- 성장 촉진요인

- 전기차 생산 및 자율주행차 테스트 증가

- 현대 자동차의 ADAS 기능 수요 증가

- 실시간 차량 데이터에 대한 수요 증가

- 환경에 대한 영향을 경감하기 위한 배출 기준 급증

- 차량 관리 솔루션 수요 증가

- 업계의 잠재적 위험 및 과제

- 고도의 데이터 로거 개발에 필요한 훈련을 받은 인재의 부족

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- 소프트웨어

제6장 시장 추계 및 예측 : 채널별(2021-2034년)

- 주요 동향

- CAN 및 CAN FD

- 인

- 플렉스 레이

- 이더넷

제7장 시장 추계 및 예측 : 접속별(2021-2034년)

- 주요 동향

- SD 카드

- Bluetooth 및 Wi-Fi

- USB

제8장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 판매 전

- 판매 후

- ADAS와 안전성

- 자동차 보험

- 차량 관리

- OBD

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- 서비스 스테이션

- 규제기관

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 베네룩스

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 동남아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Aptiv

- Continental

- Danlaw

- Delphi

- Dewesoft

- dSPACE

- Elektrobit

- HEM Data

- Influx Technology

- Intrepid

- IPETRONIK

- Kistler

- MathWorks

- National Instruments

- NSM Solutions

- Racelogic

- Robert Bosch

- TT Tech

- Vector Informatik

- Xilinx

The Global Automotive Data Logger Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 7.9 billion by 2034. This growth is being shaped by the fast-paced development of connected car technologies, heightened safety and emissions regulations, and the rising demand for advanced vehicle diagnostics and telematics. As automakers worldwide transition toward electric and autonomous platforms, data loggers are playing a central role in gathering, storing, and analyzing performance data across both passenger and commercial vehicle categories. These devices are essential tools for real-time tracking and system evaluations, capturing data from various components like battery management systems, infotainment units, ADAS, and ECUs. Their use enhances predictive maintenance, software debugging, regulatory compliance, and driver behavior insights, which are all crucial for ensuring vehicle efficiency and safety. With the rising influence of IoT and cloud-based ecosystems in the automotive landscape, modern data loggers are increasingly capable of supporting remote operations and over-the-air updates, offering seamless integration into connected mobility and fleet management systems.

In terms of communication protocols, the market is segmented into CAN & CAN FD, LIN, FlexRay, and Ethernet. Among these, the CAN & CAN FD category led the market in 2024, generating approximately USD 1 billion in revenue. The dominance of these protocols stems from their longstanding adoption across the automotive industry. CAN has been a reliable in-vehicle communication standard for decades, facilitating critical system interactions in areas like engine control and vehicle safety. The upgraded CAN FD version allows higher data throughput and supports more data-intensive functions, especially those involving modern driving assistance systems. Their widespread utility, cost-efficiency, and low-latency capabilities continue to make CAN & CAN FD indispensable for in-vehicle diagnostics and testing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 7.6% |

Looking at the market by connection type, options include USB, Bluetooth/Wi-Fi, and SD card. The SD card segment took the lead with a 47% market share in 2024. This preference is due to the SD card's reliability, ease of use, and affordability. Offering high-capacity storage in a compact format, SD cards are well-suited for logging vast volumes of vehicle data during tests and trials. Their plug-and-play design simplifies setup and allows data extraction in offline environments, making them valuable tools in pre-production phases where wireless infrastructure might be limited or vulnerable to interference.

When categorized by component, the market is divided into hardware and software, with hardware taking the dominant share in 2024. This segment represents the core of automotive data logging systems, consisting of microprocessors for data acquisition, high-capacity memory for data storage, signal conditioners to maintain data integrity, and sensor interfaces for real-time monitoring. These components enable communication between data loggers and vehicle systems using protocols like CAN, FlexRay, and Ethernet. Manufacturers continue to enhance these hardware platforms to meet the rising complexity of electric and autonomous vehicle systems, increasing demand for multi-channel, high-speed, and multi-protocol capabilities in real-world conditions.

Based on application, the market is split into pre-sale and post-sale uses. The pre-sale segment emerged as the dominant area in 2024. Data loggers are widely used before a vehicle reaches the market to validate performance, safety, and compliance with environmental standards. Engineers depend on accurate data capture during the design and testing stages to optimize powertrains, calibrate ADAS features, and verify battery efficiency in electric models. Though the post-sale segment is growing due to its role in diagnostics and predictive maintenance, it currently accounts for a smaller portion of the overall market share.

In terms of end users, the market includes OEMs, service stations, regulatory authorities, and others. The OEM segment held the largest share in 2024, as manufacturers continue to rely heavily on data loggers throughout the vehicle development lifecycle. From prototyping to final validation, data loggers are used to ensure quality standards are consistently met. As vehicles incorporate increasingly complex technologies, OEMs are investing in sophisticated data logging solutions to manage everything from ECU validation to next-gen system integration.

Regionally, the United States led the North American market, recording USD 1.01 billion in revenue in 2024, with a projected CAGR of 6.4% during the forecast period. The country's strong position stems from rapid technological adoption, robust research infrastructure, and an increasing push toward electric and connected mobility. Research labs, test facilities, and manufacturers across the U.S. continue to deploy cutting-edge data logging equipment to support innovation, compliance, and system validation.

Across the industry, companies are advancing through mergers, strategic collaborations, and investments in sensor technologies and real-time analytics. There's a growing shift toward smart, IoT-enabled, and wirelessly connected data loggers that streamline diagnostics and performance tracking. These innovations are helping organizations across the automotive value chain improve reliability, meet stricter regulatory demands, and support more sustainable and intelligent vehicle designs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Hardware providers

- 3.1.1.2 Software providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing electric vehicle production and autonomous vehicle testing

- 3.8.1.2 Rising demand for ADAS features in modern vehicles

- 3.8.1.3 Increasing demand for real-time vehicle data

- 3.8.1.4 Surge in emission norms to reduce environmental impact

- 3.8.1.5 Rising demand for fleet management solutions

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of a trained workforce for the development of advanced data loggers

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 CAN & CAN FD

- 6.3 LIN

- 6.4 FlexRay

- 6.5 Ethernet

Chapter 7 Market Estimates & Forecast, By Connection, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 SD Card

- 7.3 Bluetooth/Wi-Fi

- 7.4 USB

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Pre-sale

- 8.3 Post-sale

- 8.3.1 ADAS and safety

- 8.3.2 Automotive insurance

- 8.3.3 Fleet management

- 8.3.4 OBD

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Service station

- 9.4 Regulatory bodies

- 9.5 others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Benelux

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Southeast Asia

- 10.4.6 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Continental

- 11.3 Danlaw

- 11.4 Delphi

- 11.5 Dewesoft

- 11.6 dSPACE

- 11.7 Elektrobit

- 11.8 HEM Data

- 11.9 Influx Technology

- 11.10 Intrepid

- 11.11 IPETRONIK

- 11.12 Kistler

- 11.13 MathWorks

- 11.14 National Instruments

- 11.15 NSM Solutions

- 11.16 Racelogic

- 11.17 Robert Bosch

- 11.18 TT Tech

- 11.19 Vector Informatik

- 11.20 Xilinx