|

시장보고서

상품코드

1750263

화장품 튜브 포장 시장 : 기회, 성장 촉진요인, 업계 동향 분석, 예측(2025-2034년)Cosmetic Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

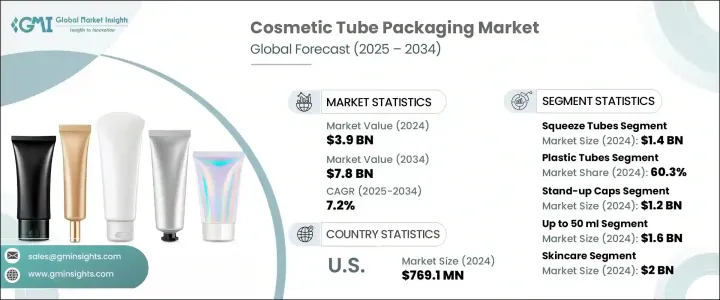

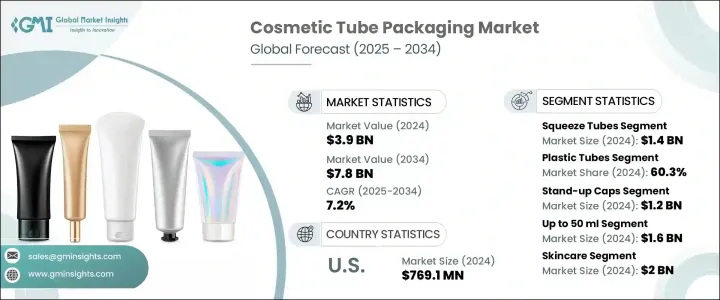

세계의 화장품 튜브 포장 시장 규모는 2024년 39억 달러로 평가되었고, 스킨케어와 퍼스널케어 제품에 대한 수요 증가, 전자상거래 확대, 기능적이고 지속가능한 포장에 대한 주목 증가 등을 배경으로 CAGR 7.2%로 성장해 2034년까지 78억 달러에 달할 것으로 예측됩니다.

소비자가 보습제, 미용액, 선스크린과 같은 제품을 포함한 스킨 케어에 점점 더 주목을 받으면서 제품의 안전성, 편리성 및 휴대성을 보장하는 포장의 필요성이 커지고 있습니다. 지속가능한 솔루션으로의 전환은 제조 업체에 환경 친화적인 재료의 채용을 촉구하고 있습니다.

지속 가능한 솔루션에 대한 수요가 증가함에 따라 제조업체는 화장품 포장에 환경 친화적인 재료를 채택했습니다. 제품의 인기에 의해 각 브랜드는 미적 매력이 뛰어나, 환경에 배려한 포장을 만들 필요에 강요되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 39억 달러 |

| 예측 금액 | 78억 달러 |

| CAGR | 7.2% |

스퀴즈 튜브 분야는 이 시장에서 최대이며, 2024년에는 14억 달러를 차지했습니다. 스퀴즈 튜브는 또한 제품의 시각적 매력을 높이는 고급 장식 방법을 가능하게 하고, 소비자에게 보다 매력적인 것으로 합니다.

플라스틱 튜브 부문은 2024년에 60.3%의 점유율을 차지했습니다. 지속가능성에 대한 이니셔티브가 증가함에 따라, HDPE나 포스트 컨슈머 레진(PCR)과 같은 환경 친화적인 플라스틱에 대한 수요가 높아지고 있습니다.

미국의 화장품 튜브 포장 시장 규모는 스킨 케어와 클린 뷰티 제품 수요 급증으로 2024년에 7억 6,910만 달러에 달했습니다. 엄격한 규제 프레임워크과 환경 문제에 대한 소비자의 의식 증가는 각 브랜드에 단일 재료로 재활용 가능한 튜브로의 이행을 촉진하여 시장의 성장을 더욱 가속화하고 있습니다.

세계 화장품 튜브 포장 업계의 주요 기업으로는 Albea SA, Berry Global Inc., Hoffmann Neopac AG, Amcor Ltd., Essel Propack Limited 등이 있습니다. 이러한 기업은 지속가능성에 초점을 맞추고 혁신적인 포장 솔루션을 도입하고 소비자 수요 변화에 대응하기 위해 제품 포트폴리오를 확대하여 시장 지위를 적극적으로 강화하기 위해 Amcor Ltd. 및 Berry Global Inc.와 같은 기업은 환경 친화적인 튜브 및 단일 재료 포장과 같은 지속 가능한 포장 솔루션을 개발하는 데 주력하고 있습니다. 한편 Essel Propack Limited와 Hoffmann Neopac AG는 소비자의 안전성과 제품 무결성 증가 동향에 맞추어 에어리스 튜브 및 부정 개봉 방지 튜브에 대한 수요 증가에 대응하기 위해 생산 능력을 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 스킨케어 및 퍼스널케어 제품 수요의 급증

- 전자상거래와 소비자 직접 판매 채널의 성장

- 부가가치 기능을 갖춘 기능적인 포장의 대두

- 튜브 제조에 있어서의 기술의 진보

- 프리미엄 및 틈새 화장품 브랜드의 확대

- 업계의 잠재적 위험과 과제

- 원재료 가격 변동

- 엄격한 환경 규제와 플라스틱 사용에 대한 감시 강화

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 스퀴즈 튜브

- 트위스트 업 튜브

- 스틱 튜브

- 에어리스 튜브

- 기타

제6장 시장 추계 및 예측 : 재질별(2021-2034년)

- 주요 동향

- 플라스틱 튜브

- 알루미늄 튜브

- 라미네이트 튜브

- 종이 기반 튜브

제7장 시장 추계 및 예측 :캡 유형별(2021-2034년)

- 주요 동향

- 스탠드업 캡

- 노즐 캡

- 페즈 캡

- 플립 탑 캡

- 기타

제8장 시장 추계 및 예측 : 용량별(2021-2034년)

- 주요 동향

- 50ml 이하

- 51-100ml

- 101-150ml

- 150ml 초과

제9장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 스킨케어

- 헤어 케어

- 메이크업

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Albea Group

- ALPLA Group

- Aluminum Packaging Group(APG)

- Amcor plc

- APC Packaging

- Berlin Packaging

- Berry Global Group

- CCL Industries Inc.

- Cosmogen

- Cosmopak Corp.

- CTL Packaging

- Essel Propack Ltd.

- FusionPKG

- HCP Packaging

- HCT Packaging

- Hoffmann Neopac AG

- Huhtamaki Oyj

- Libo Cosmetics Co. Ltd.

- Mpack Poland Sp. z oo

- PR Packagings Ltd

- Prutha Packaging Pvt.Ltd..

- Quadpack Industries

- Tubex

- UKPACKCHINA

- VisiPak Inc.

The Global Cosmetic Tube Packaging Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 7.8 billion by 2034, driven by the rising demand for skincare and personal care products, the expansion of e-commerce, and a growing emphasis on functional and sustainable packaging. As consumers become increasingly focused on skincare, including products like moisturizers, serums, and sunscreens, the need for packaging that ensures product safety, convenience, and portability has intensified. Furthermore, the shift toward sustainable solutions pushes manufacturers to adopt eco-friendly materials. The increasing popularity of high-end skincare and clean beauty products has led brands to focus on creating visually appealing and environmentally responsible packaging.

In response to the growing demand for sustainable solutions, manufacturers turn to eco-friendly materials for cosmetic packaging. This shift is particularly evident in the cosmetic industry, where the popularity of high-end skincare and clean beauty products is prompting brands to create packaging that is both aesthetically appealing and environmentally responsible. As consumers become more eco-conscious, packaging that combines function and sustainability is becoming a priority.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.2% |

The squeeze tubes segment is the largest in this market, accounting for USD 1.4 billion in 2024. These tubes are favored for their ease of use, versatility, and cost-effectiveness. They are particularly popular for personal care products because they offer hygienic packaging and can accommodate liquid and semi-solid formulations. Squeeze tubes also allow for advanced decorating methods that enhance the visual appeal of products, making them more attractive to consumers. Another notable trend is the increasing demand for mono-material recyclable tubes, particularly among premium brands, as consumers and manufacturers prioritize sustainability.

The plastic tubes segment held a 60.3% share in 2024. Their flexibility, lightweight nature, and relatively low production costs make them ideal for a wide range of cosmetic products. As sustainability efforts gain momentum, the demand for eco-friendly plastics, such as HDPE and post-consumer resin (PCR), is rising. These materials help reduce plastic waste, making them an attractive option for brands aiming to align with the growing trend of sustainability in packaging.

U.S. Cosmetic Tube Packaging Market was valued at USD 769.1 million in 2024 due to the surge in demand for skincare and clean beauty products. Additionally, the increasing preference for functional packaging solutions, such as airless and tamper-proof tubes, is driving market expansion. Strict regulatory frameworks and growing consumer awareness regarding environmental issues are encouraging brands to transition to mono-material, recyclable tubes, further accelerating the growth of the market.

Key players in the Global Cosmetic Tube Packaging Industry include Albea S.A., Berry Global Inc., Hoffmann Neopac AG, Amcor Ltd., and Essel Propack Limited. These companies are actively enhancing their market positions by focusing on sustainability, introducing innovative packaging solutions, and expanding their product portfolios to meet the changing demands of consumers. To strengthen their market position, companies like Amcor Ltd. and Berry Global Inc. are focusing on the development of sustainable packaging solutions, such as eco-friendly tubes and mono-material packaging. Albea S.A. is increasing its investment in advanced tube technologies, emphasizing recyclable materials. Meanwhile, Essel Propack Limited and Hoffmann Neopac AG are expanding their production capabilities to meet the growing demand for airless and tamper-proof tubes, aligning with the rising trend of consumer safety and product integrity.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for skincare and personal care products

- 3.7.1.2 Growth in e-commerce and direct-to-consumer channels

- 3.7.1.3 Rise of functional packaging with value-added features

- 3.7.1.4 Increasing technological advancements in tube manufacturing

- 3.7.1.5 Expansion of premium and niche cosmetic brands

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in the prices of raw materials

- 3.7.2.2 Stringent environmental regulations and rising scrutiny on plastic usage

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Squeeze tubes

- 5.3 Twist-up tubes

- 5.4 Stick tubes

- 5.5 Airless tubes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Plastic tubes

- 6.3 Aluminum tubes

- 6.4 Laminate tubes

- 6.5 Paper-based tubes

Chapter 7 Market Estimates & Forecast, By Cap Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Stand-up caps

- 7.3 Nozzle caps

- 7.4 Fez caps

- 7.5 Flip-top caps

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Up to 50 ml

- 8.3 51 ml to 100 ml

- 8.4 101 ml to 150 ml

- 8.5 Above 150 ml

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Skincare

- 9.3 Haircare

- 9.4 Makeup

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Albea Group

- 11.2 ALPLA Group

- 11.3 Aluminum Packaging Group (APG)

- 11.4 Amcor plc

- 11.5 APC Packaging

- 11.6 Berlin Packaging

- 11.7 Berry Global Group

- 11.8 CCL Industries Inc.

- 11.9 Cosmogen

- 11.10 Cosmopak Corp.

- 11.11 CTL Packaging

- 11.12 Essel Propack Ltd.

- 11.13 FusionPKG

- 11.14 HCP Packaging

- 11.15 HCT Packaging

- 11.16 Hoffmann Neopac AG

- 11.17 Huhtamaki Oyj

- 11.18 Libo Cosmetics Co. Ltd.

- 11.19 Mpack Poland Sp. z o.o.

- 11.20 P.R. Packagings Ltd

- 11.21 Prutha Packaging Pvt.Ltd..

- 11.22 Quadpack Industries

- 11.23 Tubex

- 11.24 UKPACKCHINA

- 11.25 VisiPak Inc.