|

시장보고서

상품코드

1750302

정량 배합 흡입기 시장 : 기회, 촉진요인, 업계 동향 분석, 예측(2025-2034년)Fixed-dose Combination Inhalers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

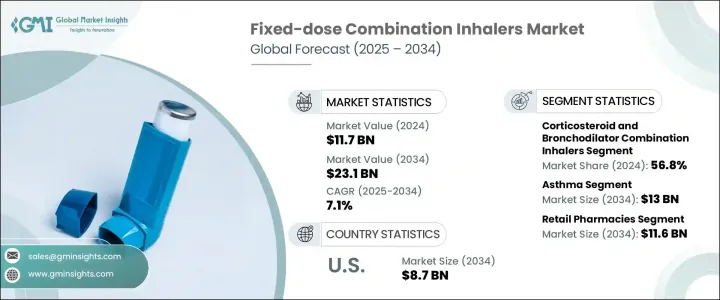

세계의 정량 배합 흡입기 시장은 2024년 117억 달러로 평가되었으며 CAGR 7.1%로 성장해 2034년 231억 달러에 이를 것으로 추정됩니다.

이러한 흡입기는 2종 이상의 유효 의약품 성분을 미리 설정된 비율로 1개의 장치에서 공급하는 것으로, 만성 호흡기 질환을 관리하는 환자에게 합리적인 접근법을 제공합니다. 병용 치료 프로토콜을 준수하는 의사 증가, 규제 인가 증가, 흡입기 기술의 진보에 의해 더욱 추진되고 있습니다. 호흡기 질환은 특히 중등도에서 중증의 경우에, 일관된 장기 관리를 필요로 하기 때문에 정량 배합 흡입기는 복수의 개별 흡입기를 사용하는 것에 비해, 편리함과 컴플라이언스를 향상시킵니다.

병용 요법으로의 이동은 국제 임상 지침의 업데이트에도 영향을 받았으며, 증상이 가벼운 환자에게도 병용 흡입제가 권장됩니다. 이 정량 배합 흡입기는 코르티코스테로이드에 의해 염증을 억제하는 동시에 기관지 확장제로 기류를 개선하여 치료 효과를 높입니다. 단일 장치에 의한 투여의 편의성은 처방된 치료의 충고를 향상시키는 데 중요한 역할을 합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 117억 달러 |

| 예측 금액 | 231억 달러 |

| CAGR | 7.1% |

배합별로, 시장은 코르티코스테로이드와 기관지확장제의 배합흡입제, 장시간 작용성 β작용제(LABA)와 흡입 코르티코스테로이드(ICS)의 배합흡입제, 3종 배합흡입제, 기타 배합흡입제로 분류됩니다. 2024년에는 코르티코스테로이드와 기관지확장제의 배합흡입제가 56.8%로 최대 판매 점유율을 차지하며 지속적인 호흡기 증상을 관리하는데 있어서 이러한 제제가 임상적으로 널리 선호되는 것이 원동력이 되고 있습니다. 이 흡입제는 기도의 염증을 억제하고, 기류를 개선하는데 특히 효과적입니다.

적응증별로 시장은 천식, 만성 폐색성 폐질환, 기타 질병으로 구분됩니다. 천식으로 진단받는 사람이 세계적으로 증가하고 있으며 특히 어린이 사이에서 증가하는 것이이 부문의 이점에 크게 기여합니다. 만성적이고 재발성 질환으로 증상이 안정되어 있는 시기에서도 지속적인 치료가 필요하게 되는 경우가 많습니다.

이러한 흡입기의 유통은 주로 소매 약국, 병원 약국, 온라인 약국을 통해 이루어지고 있습니다. 소매 약국은 이러한 지속적인 요구를 충족시키는 데 필요한 편의성과 접근성을 제공합니다.

지역별로는 북미가 계속 주요 시장이며 미국이 큰 역할을 하고 있습니다. 미국의 의사는 흡입약의 병용을 우선하는 근거에 근거한 치료 전략에 따르고 있어, 처방율의 상승으로 연결되어 있습니다.

세계적으로 시장은 과점적인 구조를 유지하고 있으며, 소수의 주요 기업이 경쟁 구도를 지배하고 있습니다. 신흥국에서는 제네릭 의약품 제조업체와 지역 제조업체가 가격에 민감한 사람들의 요구에 부응하여 비용 효율적인 대체품을 제공함으로써 지지를 모으고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 천식 및 만성 호흡기 질환의 발생률 증가

- 병용 요법의 사용을 지지하는 가이드라인

- 흡입기 기술의 진보

- 복합흡입요법 승인 증가

- 업계의 잠재적 위험 및 과제

- 정량 배합 흡입기의 고비용

- 부적절한 사용과 부작용에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술의 상황

- 장래 시장 동향

- 갭 분석

- 특허 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 배합별, 2021-2034년

- 주요 동향

- 코르티코스테로이드와 기관지 확장제 배합

- 장시간 작용형 β 자극제와 흡입 코르티코스테로이드 배합

- 3종 배합

- 기타

제6장 시장 추계 및 예측 : 적응증별, 2021-2034년

- 주요 동향

- 천식

- 만성 폐색성 폐질환

- 기타

제7장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 소매 약국

- 병원 약국

- 온라인 약국

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 라틴아메리카

- 멕시코

- 브라질

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- AstraZeneca

- Boehringer Ingelheim

- Chiesi Farmaceutici

- Cipla

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Lupin

- Mylan(Viatris)

- Novartis

- Orion

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Vectura Group

- Zydus Group

The Global Fixed-Dose Combination Inhalers Market was valued at USD 11.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 23.1 billion by 2034. These inhalers deliver two or more active pharmaceutical ingredients in a pre-set ratio through a single device, offering a streamlined approach for patients managing chronic respiratory conditions. With respiratory illnesses like asthma and chronic obstructive pulmonary disease (COPD) becoming more prevalent globally, the demand for combination therapies has grown significantly. This trend is further propelled by evolving clinical guidelines, growing physician adherence to combination treatment protocols, increasing regulatory approvals, and advancements in inhaler technologies. As respiratory conditions require consistent and long-term management, particularly in moderate to severe cases, fixed-dose inhalers offer enhanced convenience and compliance compared to using multiple separate inhalers.

The shift toward combination therapies is also influenced by updates in international clinical guidelines, which now recommend combination inhalers even for patients with mild symptoms. This has led to a noticeable uptick in inhaler usage across all severity levels. These fixed-dose inhalers enhance treatment efficacy by reducing inflammation through corticosteroids while simultaneously improving airflow using bronchodilators. The convenience of single-device administration plays a critical role in increasing adherence to prescribed treatments. With the growing burden of chronic respiratory diseases, healthcare providers are prioritizing combination therapies to deliver better clinical outcomes and minimize the risk of exacerbations. The market is also benefiting from ongoing innovations in inhaler designs that simplify usage for both patients and caregivers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 7.1% |

In terms of combination types, the market is categorized into corticosteroid and bronchodilator combination inhalers, long-acting beta-agonist (LABA) and inhaled corticosteroid (ICS) inhalers, triple combination inhalers, and other combinations. In 2024, corticosteroid and bronchodilator combination inhalers held the largest revenue share at 56.8%, driven by widespread clinical preference for these formulations in managing persistent respiratory symptoms. These inhalers are particularly effective in reducing airway inflammation and improving airflow, which are central to managing both asthma and COPD. The dual action not only improves symptom control but also reduces the need for rescue medications, making them a preferred choice among healthcare providers.

Based on indication, the market is segmented into asthma, chronic obstructive pulmonary disorder, and other conditions. The asthma segment accounted for the largest share at 57.4% in 2024 and is projected to reach a value of USD 13 billion by 2034. The increasing number of individuals diagnosed with asthma globally, especially among children, is significantly contributing to this segment's dominance. Asthma is a chronic and relapsing illness that often requires continuous therapy even during periods of symptom stability. This drives repeat purchases of fixed-dose inhalers and supports consistent revenue generation. Additionally, the updated clinical approach of prescribing combination inhalers for as-needed use has expanded the eligible patient base, further propelling growth in this segment.

The distribution of these inhalers is primarily through retail pharmacies, hospital pharmacies, and online pharmacies. Among these, retail pharmacies dominated the market and are anticipated to reach a value of USD 11.6 billion by 2034. Chronic respiratory diseases necessitate regular medication refills, and retail pharmacies offer the convenience and accessibility required to meet these ongoing needs. Their widespread presence in urban and suburban regions ensures patients have easy access to their prescriptions and pharmacist consultations, which improves adherence and supports steady market growth.

Regionally, North America continues to be a leading market, with the U.S. playing a major role. The fixed-dose combination inhalers market in the U.S. was valued at USD 4.5 billion in 2024 and is projected to grow to USD 8.7 billion by 2034. The high prevalence of asthma and COPD, along with strong compliance with clinical treatment protocols, is fueling demand. Physicians in the U.S. follow evidence-based treatment strategies that prioritize combination inhalers, leading to higher prescription rates. Furthermore, extensive pharmacy networks across the country enhance product availability and refill convenience, contributing to increased usage.

Globally, the market maintains an oligopolistic structure, with a few key players dominating the competitive landscape. Around 75% of the total market share is held by four major pharmaceutical companies with strong respiratory portfolios and device expertise. These firms continue to invest heavily in research and development to maintain their competitive edge. Meanwhile, generic and regional manufacturers are gaining traction in emerging economies by offering cost-effective alternatives, catering to the needs of price-sensitive populations. The market is also witnessing a growing inclination toward once-daily dosing options and triple therapy combinations, supported by innovations in inhaler devices that enhance usability and patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of asthma and chronic respiratory diseases

- 3.2.1.2 Favorable guidelines supporting the use of combination therapy

- 3.2.1.3 Advancements in inhaler technologies

- 3.2.1.4 Growing approval of combination inhaler therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of fixed dose combination inhalers

- 3.2.2.2 Concerns related to improper use and side effects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Regulatory landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Combination, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroid and bronchodilator combination inhalers

- 5.3 Long-acting beta agonist and inhaled corticosteroid combination inhalers

- 5.4 Triple combination

- 5.5 Other combinations

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Asthma

- 6.3 Chronic obstructive pulmonary disorder

- 6.4 Other indications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Hospital pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AstraZeneca

- 9.2 Boehringer Ingelheim

- 9.3 Chiesi Farmaceutici

- 9.4 Cipla

- 9.5 GlaxoSmithKline

- 9.6 Glenmark Pharmaceuticals

- 9.7 Hikma Pharmaceuticals

- 9.8 Lupin

- 9.9 Mylan (Viatris)

- 9.10 Novartis

- 9.11 Orion

- 9.12 Sun Pharmaceutical Industries

- 9.13 Teva Pharmaceuticals

- 9.14 Vectura Group

- 9.15 Zydus Group