|

시장보고서

상품코드

1755253

ADAS 소프트웨어 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)ADAS Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

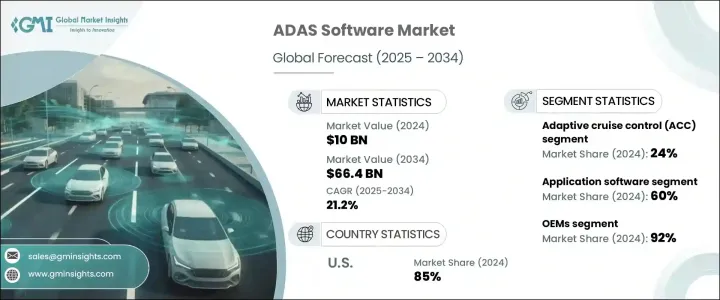

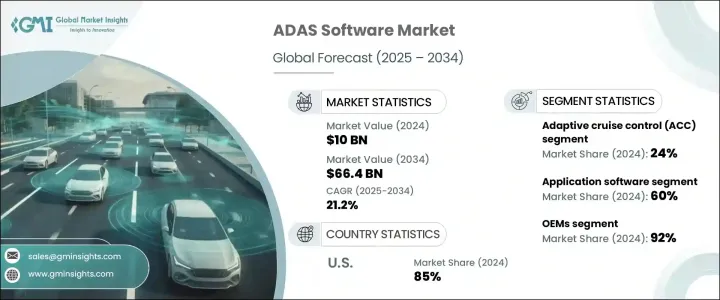

세계의 ADAS 소프트웨어 시장 규모는 2024년 100억 달러로 평가되었고, 2034년에는 664억 달러에 이를 것으로 예측되며, CAGR 21.2%로 성장할 전망입니다. 이러한 상당한 성장은 주로 도로 안전에 대한 소비자의 인식이 높아지고 자동 지원 기능을 갖춘 차량에 대한 수요가 증가함에 따라 촉진되고 있습니다. 자동 차선 유지 및 제동 지원과 같은 기능에 대한 수요 증가로 ADAS 기술은 현대 차량의 필수 요소가 되었습니다. 또한, 위성, 카메라, 라이다(Lidar) 기술 등 센서 시스템의 기술 혁신은 이러한 시스템을 더 효율적이고 신뢰성 있으며 접근하기 쉽게 만들어 전체 성능을 향상시키며 운영 비용을 줄이는 데 기여했습니다.

시장 성장의 또 다른 주요 촉진요인은 ADAS 플랫폼에 인공 지능 및 기계 학습이 통합된 것입니다. 이러한 기능을 통해 차량은 실시간 데이터를 처리하고 예측적인 결정을 내릴 수 있어 상황 인식 및 대응 능력이 크게 향상됩니다. 전 세계 규제 기관이 차량 안전 요구 사항을 더욱 엄격하게 시행함에 따라 자동차 회사는 규정 준수를 위해 첨단 지원 시스템을 통합해야 하는 압박을 받고 있습니다. 또한 소비자들은 반자율 주행 경험을 선호하고 있어 정교한 운전자 지원 기능이 빠르게 채택되고 있습니다. 그 결과, 차량의 자율성 수준을 높이기 위한 노력이 제조업체들로 하여금 점점 더 복잡해지는 주행 기능을 지원할 수 있는 소프트웨어에 막대한 투자를 하도록 유도하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 100억 달러 |

| 예측 금액 | 664억 달러 |

| CAGR | 21.2% |

운전 지원 기능의 복잡성이 증가함에 따라 소프트웨어는 자동 긴급 대응, 스마트 내비게이션, 차량 위치 파악과 같은 시스템을 구현하는 데 중요한 역할을 합니다. 자동차 제조업체들은 ADAS 소프트웨어를 더 광범위한 차량 아키텍처에 원활하게 통합하는 데 주력하고 있습니다. 지능적이고 반응성이 뛰어난 시스템에 대한 수요가 증가함에 따라 소프트웨어는 경쟁이 치열한 차량 시장에서 차별화 요소가 되었습니다. 실시간 센서 융합 및 AI 기반의 상황별 의사 결정에 대한 지속적인 혁신이 ADAS 솔루션의 미래를 결정할 것입니다.

구성 요소별로 ADAS 소프트웨어 시장은 소프트웨어 플랫폼, 미들웨어, 애플리케이션 소프트웨어 및 운영 체제로 구분됩니다. 2024년에는 애플리케이션 소프트웨어 부문이 전체 매출의 약 60%를 차지하며 가장 큰 시장 점유율을 차지했습니다. 또한 예측 기간 동안 연평균 22% 이상의 성장률을 보일 것으로 예상됩니다. 이 부문은 차량 센서 및 알고리즘 기반 의사 결정 프로세스와 직접 상호 작용을 가능하게 하기 때문에 시장에서 중요한 위치를 차지하고 있습니다. 실시간 기능의 주요 요소로서 응용 소프트웨어는 모든 차량 유형에서 고급 운전자 보조 기능을 효과적으로 실행합니다.

시스템별로는 차선 이탈 경고(LDW), 적응형 크루즈 컨트롤(ACC), 자동 긴급 제동(AEB), 주차 보조, 사각지대 감지(BSD), 야간 시야 시스템, 교통 표지판 인식(TSR) 등으로 분류됩니다. 적응형 크루즈 컨트롤은 2024년에 24%의 매출 점유율로 시장을 주도했습니다. 이러한 우위는 특히 교통량이 많거나 고속 주행 조건에서 안전한 차량 간 거리를 유지하고 운전자의 편안함을 향상시키는 데 필수적인 역할 덕분입니다. 부분 자동화를 제공하는 차량에 대한 전 세계의 선호도는 도시 및 고속도로 주행 환경에서 이러한 시스템의 인기를 더욱 높였습니다.

차량 유형별로 분석할 때 ADAS 소프트웨어 시장은 상용차와 승용차로 나뉩니다. 승용차는 통합 안전 및 편의 기술에 대한 수요가 높아짐에 따라 2024년에 시장을 지배했습니다. 이러한 동향은 구매자들이 안전 기능이 강화된 차량을 적극적으로 찾고 있는 중형 및 보급형 부문에서 특히 두드러집니다. 자동차 제조업체들이 소비자의 기대에 부응하기 위해 제품군을 확대함에 따라 개인용 차량에 ADAS 기능을 대량으로 통합하는 것이 계속해서 주요 성장 동력이 될 것입니다.

최종 용도별로 시장은 OEM과 애프터마켓으로 구분됩니다. OEM은 2024년 약 92%의 압도적인 시장 점유율을 차지했습니다. 이는 차량 생산 과정에서 ADAS 소프트웨어를 통합할 수 있는 능력으로 인해 최적화, 데이터 보안 강화, 사용자 경험의 원활함이 실현되기 때문입니다. 자동차 제조사들은 차량 구매자들의 지능형 안전 기술에 대한 수요 증가를 인식하고 이러한 기능을 표준 사양으로 적극적으로 도입하고 있습니다.

지역별로는 2024년 ADAS 소프트웨어 시장에서 미국이 약 USD 30억 달러를 기록하며 북미 시장의 약 85%를 차지했습니다. 이 지역의 성장은 정부 안전 정책과 차량 보조 기능 의무화 지원과 밀접하게 연결되어 있습니다. 또한 국내 혁신과 국가 안보에 대한 강조로 인해 자체 개발 ADAS 기술에 대한 투자도 증가하고 있습니다.

또한, 많은 자동차 회사와 1차 공급업체들이 독점적인 소프트웨어 생태계 개발을 목표로 하고 있어, 시장은 수직 통합으로 전환되고 있습니다. 이러한 접근 방식은 호환성, 보안 및 시스템 제어를 개선하는 동시에 제3자 개발자에 대한 의존도를 줄입니다. 또 다른 중요한 동향은 R&D를 강화하고 혁신을 가속화하기 위해 AI 기업, 반도체 제조업체 및 클라우드 서비스 제공업체와 전략적 협력을 맺는 것입니다. 이러한 파트너십을 통해 확장성이 확보되고, 기업들은 전 세계 시장의 다양한 규제 및 도로 요구 사항에 맞게 ADAS 솔루션을 조정할 수 있게 됩니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역 및 국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 산업에 미치는 영향요인

- 성장 촉진요인

- 자율주행 및 반자율주행 차량에 대한 수요 증가

- AI와 머신러닝의 통합 강화

- 센서 및 연결 기술의 기술적 발전

- 급속한 도시화와 스마트 모빌리티의 대처

- 차량 내 안전 및 편의성에 대한 소비자 수요

- 산업의 잠재적 리스크 및 과제

- 높은 개발 및 통합 비용

- 센서 융합 및 실시간 처리의 복잡성

- 시장 기회

- 전기자동차(EV)와의 통합

- 클라우드 네이티브 플랫폼의 상승

- OEM 소프트웨어 공급업체와의 파트너십

- AI와 머신러닝의 통합

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 지속가능성과 환경 측면

- 지속 가능한 사례

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 친환경 활동

- 탄소 발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확대계획과 자금조달

제5장 시장 추정 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 소프트웨어 플랫폼

- 미들웨어

- 애플리케이션 소프트웨어

- 운영체제

제6장 시장 추정 및 예측 : 시스템별(2021-2034년)

- 주요 동향

- 적응형 크루즈 컨트롤(ACC)

- 차선 이탈 경보(LDW)

- 자동 긴급 제동(AEB)

- 사각지대 감지(BSD)

- 주차 보조

- 교통 표지판 인식(TSR)

- 야간 시야 시스템

- 기타

제7장 시장 추정 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV(스포츠용 다목적차)

- MPV(다목적차)

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(HCV)

- 대형 상용차(HCV)

제8장 시장 추정 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추정 및 예측 : 자율도별(2021-2034년)

- 주요 동향

- 레벨 1(운전 지원)

- 레벨 2(부분적인 자동화)

- 레벨 3(조건부 자동화)

- 레벨 4(선진적 자동화)

- 레벨 5(완전 자동화)

제10장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 싱가포르

- 말레이시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Ambarella

- Aptiv

- Baidu Apollo

- Bosch

- Continental

- Innoviz Technologies

- Luminar Technologies

- Magna International

- Mobileye(Intel)

- Nvidia

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Sony

- Tesla

- Valeo

- Velodyne Lidar(Ouster)

- Waymo(Alphabet)

- XPeng

- ZF Friedrichshafen

The Global ADAS Software Market was valued at USD 10 billion in 2024 and is estimated to grow at a CAGR of 21.2% to reach USD 66.4 billion by 2034. This significant expansion is largely fueled by rising consumer awareness regarding road safety and a growing appetite for vehicles equipped with automated support features. Increasing demand for functionalities such as automated lane keeping and braking assistance has made ADAS technologies a mainstream requirement in modern vehicles. In addition, technological innovations in sensor systems, including satellite, camera, and Lidar technologies, have made these systems more efficient, reliable, and accessible, ultimately enhancing overall performance while reducing operational costs.

Another major driver of market growth is the integration of artificial intelligence and machine learning into ADAS platforms. These capabilities allow vehicles to process real-time data and make predictive decisions, significantly improving situational awareness and responsiveness. With global regulatory bodies enforcing more stringent vehicle safety requirements, automotive companies are under pressure to incorporate advanced assistance systems to meet compliance. Consumers are also leaning toward semi-autonomous driving experiences, prompting a rapid adoption of sophisticated driver-assist features. As a result, the push toward higher levels of vehicle autonomy is encouraging manufacturers to invest heavily in software that can support increasingly complex driving functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10 Billion |

| Forecast Value | $66.4 Billion |

| CAGR | 21.2% |

The growing complexity of driver-assistance features means software plays a critical role in enabling systems like automated emergency response, smart navigation, and vehicle positioning. Automakers are focused on achieving seamless integration of ADAS software within the broader vehicle architecture. The rise in demand for intelligent, responsive systems has turned software into a differentiator in competitive vehicle offerings. Continued innovation in real-time sensor fusion and AI-driven contextual decision-making will shape the future of ADAS solutions.

By component, the ADAS software market is segmented into software platform, middleware, application software, and operating system. In 2024, the application software segment accounted for the largest market share, contributing approximately 60% of total revenue. It is also anticipated to grow at a CAGR exceeding 22% throughout the forecast period. This segment holds a critical position in the market as it enables direct interaction with vehicle sensors and algorithm-based decision-making processes. As the primary element responsible for real-time functionality, application software ensures the effective execution of advanced driver-assistance features across all vehicle types.

In terms of systems, the market is categorized into lane departure warning (LDW), adaptive cruise control (ACC), automatic emergency braking (AEB), parking assistance, blind spot detection (BSD), night vision systems, traffic sign recognition (TSR), and others. Adaptive cruise control led the market in 2024, holding a 24% revenue share. This dominance is attributed to its essential role in maintaining safe vehicle spacing and enhancing driver comfort, especially in traffic-heavy or high-speed conditions. The global preference for vehicles that offer partial automation has amplified the popularity of such systems in both urban and highway driving scenarios.

When analyzed by vehicle type, the ADAS software market is divided into commercial vehicles and passenger cars. Passenger cars dominated the market in 2024, driven by heightened demand for integrated safety and convenience technologies. This trend is especially strong in the mid-range and entry-level segments, where buyers are actively seeking vehicles with enhanced safety features. The mass integration of ADAS functionality in personal vehicles continues to be a key growth driver as automakers expand offerings to meet consumer expectations.

Based on end use, the market is split between original equipment manufacturers (OEMs) and aftermarket players. OEMs held a commanding share of around 92% in 2024. This is due to their capability to integrate ADAS software during vehicle production, which results in better optimization, increased data security, and a seamless user experience. Automakers are proactively embedding these features as standard, recognizing the growing demand for intelligent safety technologies among car buyers.

Regionally, the United States led the ADAS software market in 2024, generating approximately USD 3 billion and representing about 85% of the North American share. The growth in this region is closely tied to government safety initiatives and regulatory support for mandatory vehicle assistance features. Additionally, the focus on domestic innovation and national security has led to increased investment in homegrown ADAS technologies.

The market is also witnessing a shift toward vertical integration, as many automotive companies and Tier 1 suppliers aim to develop proprietary software ecosystems. This approach improves compatibility, security, and system control while reducing reliance on third-party developers. Another significant trend involves strategic collaborations with AI firms, semiconductor producers, and cloud service providers to strengthen R&D and accelerate innovation. These partnerships enable scalability and allow companies to adapt ADAS solutions to meet varying regulatory and road requirements across global markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 System

- 2.2.4 Vehicle

- 2.2.5 End use

- 2.2.6 Level of autonomy

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for autonomous and semi-autonomous vehicles

- 3.2.1.2 Increased integration of AI and machine learning

- 3.2.1.3 Technological advancements in sensors and connectivity

- 3.2.1.4 Rapid urbanization and smart mobility initiatives

- 3.2.1.5 Consumer demand for in-vehicle safety and convenience

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and integration costs

- 3.2.2.2 Complexity in sensor fusion and real-time processing

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with electric vehicles (EVs)

- 3.2.3.2 The rise of cloud-native platforms

- 3.2.3.3 OEM-software supplier partnerships

- 3.2.3.4 AI and machine learning integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Software platform

- 5.3 Middleware

- 5.4 Application software

- 5.5 Operating system

Chapter 6 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Adaptive cruise control (ACC)

- 6.3 Lane departure warning (LDW)

- 6.4 Automatic emergency braking (AEB)

- 6.5 Blind spot detection (BSD)

- 6.6 Parking assistance

- 6.7 Traffic sign recognition (TSR)

- 6.8 Night vision system

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs (Sport utility vehicles)

- 7.2.4 MPVs (Multi-purpose vehicles)

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (HCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 OEM (Original equipment manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Level of autonomy, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Level 1 (Driver assistance)

- 9.3 Level 2 (Partial automation)

- 9.4 Level 3 (Conditional automation)

- 9.5 Level 4 (High automation)

- 9.6 Level 5 (Full automation)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ambarella

- 11.2 Aptiv

- 11.3 Baidu Apollo

- 11.4 Bosch

- 11.5 Continental

- 11.6 Innoviz Technologies

- 11.7 Luminar Technologies

- 11.8 Magna International

- 11.9 Mobileye (Intel)

- 11.10 Nvidia

- 11.11 NXP Semiconductors

- 11.12 Qualcomm

- 11.13 Renesas Electronics

- 11.14 Sony

- 11.15 Tesla

- 11.16 Valeo

- 11.17 Velodyne Lidar (Ouster)

- 11.18 Waymo (Alphabet)

- 11.19 XPeng

- 11.20 ZF Friedrichshafen