|

시장보고서

상품코드

1755300

산업용 경질 포장 시장 : 기회, 촉진요인, 업계 동향 분석 및 예측(2025-2034년)Rigid Industrial Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

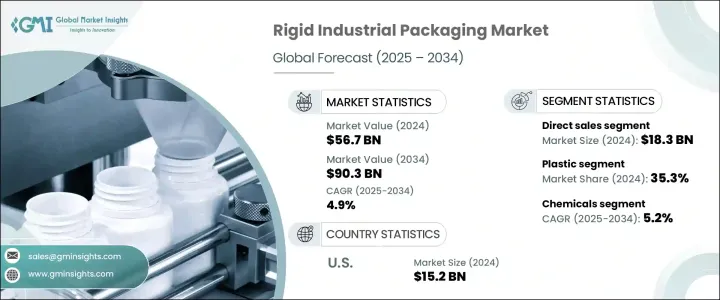

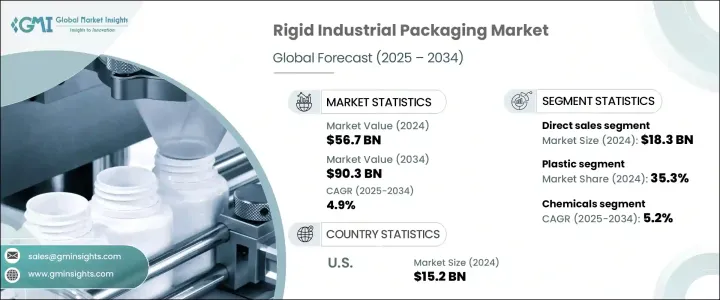

세계의 산업용 경질 포장 시장은 2024년 567억 달러로 평가되었고 화학, 자동차, 의약품, 식품 가공 등 주요 산업의 안정적인 수요에 촉진되고 2034년에는 903억 달러에 이를 것으로 추정되며, CAGR 4.9%로 성장할 전망입니다.

중간 벌크 컨테이너(IBC), 드럼, 배럴과 같은 경질 포장 솔루션은 위험 물질과 비위험 물질을 안전하고 효율적으로 운송하는 데 계속해서 중요한 역할을 하고 있습니다. 이 부문의 장기적인 성장은 화학 제품 수출의 확대와 위험 물질 운송에 관한 전 세계의 규제 강화에 의해 뒷받침되고 있습니다. 이러한 변화로 인해 기업들은 규정 준수 기준을 충족하면서 비용 효율성과 지속 가능성을 보장하는 고성능의 내구성 있는 포장 솔루션에 투자할 필요가 있습니다. 수입 알루미늄과 강철에 대한 관세 인상으로 생산 비용이 상승하고 공급망이 중단되었지만, 시장은 가격 전략 재조정과 국내 공급원 탐색을 통해 적응해 왔습니다. 산업 발전과 강력한 산업 간 통합은 전 세계 경질 포장재 제조업체의 성장 모멘텀을 유지하고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 567억 달러 |

| 예측 금액 | 903억 달러 |

| CAGR | 4.9% |

자동차, 농업, 석유 화학, 건설과 같은 부문이 확장됨에 따라 내구성, 안전성 및 비용 효율성이 뛰어난 포장 솔루션에 대한 수요도 함께 증가하고 있습니다. 이러한 산업은 극한 환경 조건에서도 제품 무결성을 유지할 수 있는 대량 운송 및 보관 시스템이 필요하기 때문에 경질 포장이 필수적입니다. 또한, 전 세계 제조 생태계가 통합됨에 따라 포장 형식이 표준화되고 물류가 간소화되며 운영 효율성이 촉진되고 있습니다.

2023년에 드럼 부문은 154억 달러의 매출을 올렸으며, 이는 석유 및 화학 부문에서 액체 제품에 선호되는 용기로서의 확고한 위치를 반영한 결과입니다. 이 드럼은 특히 대량 운송에 필요한 안전 규정을 준수하는 안전하고 쌓을 수 있으며 재사용이 가능한 솔루션을 제공합니다. 보관, 취급 및 운송 분야에서 강도와 효율성이 높기 때문에 높은 평가를 받고 있습니다.

플라스틱 기반의 경질 포장 부문은 2024년에 35.3%의 점유율을 차지할 것으로 예상됩니다. 플라스틱이 인기를 끌고 있는 이유는 부식 방지, 경량성, 식품 및 화학 등 다양한 최종 사용 부문에 대한 적응성 때문입니다. 재활용이 가능하고 친환경적인 플라스틱의 혁신은 지속 가능한 산업용 포장재에 대한 수요 증가에 부응하여 시장 지위를 더욱 강화하고 있습니다.

미국의 산업용 경질 포장 2024년 시장 규모는 152억 달러로, 이 산업들은 고강도 용기에 크게 의존하고 있습니다. 미국의 친환경 재료에 대한 집중과 고급 물류 인프라 확장은 재사용 가능한 경질 포장재의 채택을 촉진하는 유리한 조건을 조성하고 있습니다. 개선된 인프라와 디지털화된 운송 네트워크는 환경적 및 운영적 목표를 충족하는 고성능 포장재의 광범위한 채택을 지원합니다.

이 분야의 주요 업체로는 SCHUTZ GmbH & Co. KGaA, Mauser Packaging Solutions 및 Greif, Inc.가 있습니다. 산업용 경질 포장재 시장에서 경쟁 우위를 유지하기 위해 기업들은 재사용이 가능하고 지속 가능한 소재의 혁신을 우선으로 하고, 전 세계 공급망의 회복력을 강화하고 있습니다. 또한 효율성을 높이고 운영 비용을 절감하기 위해 스마트 포장 기술과 자동화 제조 공정에 투자하고 있습니다. 화학, 식품, 제약 산업의 주요 고객과의 파트너십을 통해 특정 준수 및 안전 기준을 충족하는 맞춤형 제품 개발이 가능합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 산업 고찰

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 산업에 미치는 영향

- 공급측의 영향(원료)

- 주요 원료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원료)

- 영향을 받는 주요 기업

- 전략적인 산업 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 시책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 신흥 경제국의 산업화 진행

- 화학 및 석유화학 산업의 호황

- 지속가능성과 재사용성의 동향

- 엄격한 안전 및 운송 규정

- 산업용 제품에 대한 전자상거래의 성장

- 산업의 잠재적 리스크 및 과제

- 원료 가격의 변동

- 재사용 가능한 솔루션에 대한 높은 초기 투자 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추정 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 드럼

- 중간 벌크 컨테이너(IBC)

- 버킷

- 캔

- 상자와 병

- 기타

제6장 시장 추정 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 플라스틱

- 금속

- 섬유

- 목재

제7장 시장 추정 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 리셀러

- 온라인 B2B 플랫폼

- 기타

제8장 시장 추정 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 화학

- 제약

- 식품

- 농업

- 자동차

- 가전

- 기타

제9장 시장 추정 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Balmer Lawrie

- Berry Global

- DS Smith Rigid

- Greif

- HOYER

- Mauser Packaging Solutions

- Mauser-Werke

- Nefab

- Rikutec Group

- Schoeller Allibert

- SCHUTZ

- Thielmann Group

- Time Technoplast

- Tosca Services

The Global Rigid Industrial Packaging Market was valued at USD 56.7 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 90.3 billion by 2034, driven by the consistent demand from key industries such as chemicals, automotive, pharmaceuticals, and food processing. Rigid packaging solutions like intermediate bulk containers (IBCs), drums, and barrels continue to play a crucial role in transporting both hazardous and non-hazardous materials safely and efficiently.

The long-term growth of the sector is supported by expanding chemical exports and stricter global regulations regarding the transport of dangerous substances. These shifts push companies to invest in high-performance, durable packaging solutions that meet compliance standards while ensuring cost-effectiveness and sustainability. Although tariffs on imported aluminum and steel raised production costs and disrupted supply chains, the market has adapted by recalibrating pricing strategies and exploring domestic sourcing. Industrial development and robust cross-sector integration keep the momentum strong for rigid packaging producers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.7 Billion |

| Forecast Value | $90.3 Billion |

| CAGR | 4.9% |

As sectors like automotive, agriculture, petrochemicals, and construction expand, the demand for durable, safe, and cost-efficient packaging solutions rises in parallel. These industries require high-volume transportation and storage systems that maintain product integrity under extreme environmental conditions, making rigid packaging indispensable. Moreover, integrating global manufacturing ecosystems prompts standardized packaging formats, streamlining logistics, and driving operational efficiencies.

In 2023, the drums segment generated USD 15.4 billion, reflecting its solid role as a preferred container for liquid products across the oil and chemical sectors. These drums offer safe, stackable, and reusable solutions that comply with safety regulations, especially for bulk transport. They are highly valued for their strength and efficiency in storage, handling, and transit applications.

Plastic-based rigid packaging segment is expected to contribute 35.3% share in 2024. The popularity of plastic stems from its corrosion resistance, lightweight, and adaptability across end-use sectors, including food and chemicals. Innovations in recyclable and eco-friendly plastics further strengthen its market position, aligning with the rising demand for sustainable industrial packaging alternatives.

U.S. Rigid Industrial Packaging Market was valued at USD 15.2 billion in 2024 fueled by the pharmaceutical and chemical sectors, which rely heavily on high-integrity containers. The country's focus on eco-conscious materials and expanding advanced logistics infrastructure create favorable conditions for reusable rigid packaging. Enhanced infrastructure and digitalized shipping networks support the wide adoption of high-performance packaging that meets environmental and operational goals.

The leading players in this space include SCHUTZ GmbH & Co. KGaA, Mauser Packaging Solutions, and Greif, Inc. To maintain a competitive edge in the rigid industrial packaging market, companies prioritize innovation in reusable and sustainable materials while enhancing their global supply chain resilience. They invest in smart packaging technologies and automated manufacturing processes to increase efficiency and reduce operational costs. Partnerships with key clients across chemical, food, and pharma industries allow tailored product development that meets specific compliance and safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising industrialization across emerging economies

- 3.7.1.2 Boom in chemical and petrochemical industries

- 3.7.1.3 Sustainability and reusability trends

- 3.7.1.4 Stringent safety and transport regulations

- 3.7.1.5 Growth in E-commerce for industrial goods

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 High initial investment for reusable solutions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Drums

- 5.3 Intermediate Bulk Containers (IBCs)

- 5.4 Pails

- 5.5 Cans

- 5.6 Boxes & bins

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Fiber

- 6.5 Wood

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors

- 7.4 Online B2B platforms

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Chemicals

- 8.3 Pharmaceuticals

- 8.4 Food & beverage ingredients

- 8.5 Agriculture

- 8.6 Automotive

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balmer Lawrie

- 10.2 Berry Global

- 10.3 DS Smith Rigid

- 10.4 Greif

- 10.5 HOYER

- 10.6 Mauser Packaging Solutions

- 10.7 Mauser-Werke

- 10.8 Nefab

- 10.9 Rikutec Group

- 10.10 Schoeller Allibert

- 10.11 SCHUTZ

- 10.12 Thielmann Group

- 10.13 Time Technoplast

- 10.14 Tosca Services