|

시장보고서

상품코드

1766168

탄소섬유 랩 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Carbon Fiber Wraps (Construction) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

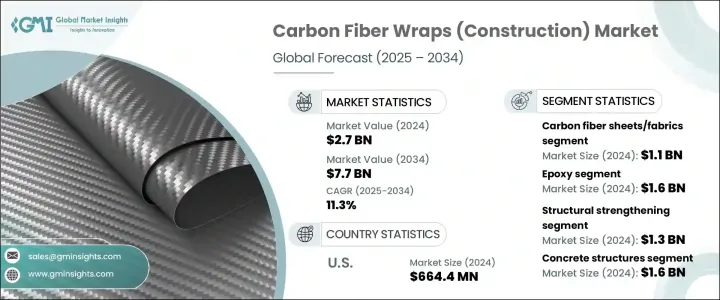

세계의 탄소섬유 랩 시장은 2024년에는 27억 달러로 평가되었고, 2034년에는 77억 달러에 이르며 CAGR은 11.3%를 나타낼 것으로 전망됩니다.

이 강력한 성장의 배경에는 선진 경제국가와 신흥경제국 모두에서 노후화된 인프라의 강화·수복이 시급해지고 있는 경우가 있습니다. 전면적인 교환보다 실용적이고 파괴가 적은 대안으로서 탄소섬유 랩을 채용하는 경향을 강화하고 있습니다.

경량으로 내식성이 뛰어나 원래 건축의 특징을 바꾸지 않고 내구성 있는 강화이 가능하기 때문에 특히 출입이 제한되는 장소나 섬세한 건축 구역에 적합합니다. 따라서 채용이 더욱 진행되고 있습니다. 탄소섬유 랩은 구조물의 유연성과 전단력에 대한 내성을 향상시켜 재해에 대한 내성을 대폭 강화합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 27억 달러 |

| 예측 금액 | 77억 달러 |

| CAGR | 11.3% |

탄소섬유 시트/패브릭 부문은 2024년에 11억 달러를 창출했고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 10.9%를 나타낼 것으로 예측됩니다. 섬유 유형의 범주에서는 설치의 용이성, 높은 강도 대 중량비, 다양한 표면에 대한 적합성으로 인해 이러한 제품이 우위를 차지하고 있습니다. 기둥, 슬래브의 강화에 이상적입니다. 이 모양은 공공 및 민간 인프라의 수리 및 리노베이션 응용 분야에 널리 사용됩니다.

에폭시 수지 부문은 2024년에 16억 달러에 이르렀고, 2025-2034년에는 CAGR 11.6%를 나타낼 것으로 예측되고 있습니다. 에폭시 수지의 신뢰성은 시장의 리더십을 지원하고 있습니다. 한편, 폴리우레탄 수지나 비닐에스테르 수지는 보다 높은 유연성과 뛰어난 내식성이 요구되는 용도으로 지지를 모으고 있습니다.

미국의 탄소섬유 랩 시장은 2024년에 6억 6,440만 달러로 평가되었고 2034년까지 연평균 복합 성장률(CAGR) 11%를 나타낼 것으로 예측됩니다. 수요 급증의 배경에는 인프라 갱신에 대한 지속적인 투자와 최신 안전성과 내구성에 대한 규제에 대한 엄격한 준수가 있습니다. 또한, 개조 공사의 신소재의 통합이나 혁신적인 건설회사의 존재가, 시장을 한층 더 밀어주고 있습니다.

세계의 탄소섬유 랩 시장 주요 기업은 Mapei SpA, Mitsubishi Chemical Corporation, Sika AG, Teijin Limited, Toray Industries, Inc.가 포함됩니다. 시장 포지션을 강화하기 위해 탄소섬유 랩 분야의 주요 기업은 다양한 전략을 결합하고 있습니다. 각 회사는 다양한 구조 요건에 대응하기 위해 다양한 섬유 패브릭과 맞춤형 수지 시스템을 포함한 제품 라인을 확대하고 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소 발자국의 고려

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추정·예측 : 섬유 유형별(2021-2034년)

- 주요 동향

- 탄소섬유 시트/원단

- 탄소섬유 테이프

- 탄소섬유 로드

- 사전 경화 탄소섬유 라미네이트

- 기타

제6장 시장 추정·예측 : 수지 유형별(2021-2034년)

- 주요 동향

- 에폭시

- 폴리우레탄

- 비닐에스테르

- 폴리에스터

- 기타

제7장 시장 추정·예측 : 용도별(2021-2034년)

- 주요 동향

- 구조적 강화

- 굴곡 강화

- 전단 강화

- 기둥 구속

- 축 방향 강화

- 내진 강화

- 개보수

- 부식 손상 수리

- 충격 손상 수리

- 화재 피해 수리

- 폭발 보호

- 기타

제8장 시장 추정·예측 : 구조 유형별(2021-2034년)

- 주요 동향

- 콘크리트 구조물

- 석조 구조물

- 철골 구조물

- 목조 구조물

- 기타

제9장 시장 추정·예측 : 용도별(2021-2034년)

- 주요 동향

- 교량 및 고속도로

- 건물 및 구조물

- 상업용 건물

- 주거용 건물

- 산업용 건물

- 상하수도 인프라

- 해양 구조물

- 역사 및 유산 구조물

- 기타

제10장 시장 추정·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 프로파일

- Sika AG

- Mapei SpA

- Fyfe Co. LLC(Aegion Corporation)

- Simpson Strong-Tie Company Inc.

- Master Builders Solutions(MBCC Group)

- SGL Carbon SE

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- Teijin Limited

- Hexcel Corporation

- Structural Technologies, LLC

- Composite Group Chelyabinsk

- Chomarat Group

- Owens Corning

- Nippon Steel Chemical Co. Ltd.

The Global Carbon Fiber Wraps (Construction) Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 7.7 billion by 2034. This robust growth is driven by the urgent need to strengthen and rehabilitate aging infrastructure across both developed and emerging economies. As countless bridges, buildings, and transportation networks deteriorate due to age, governments and private developers are increasingly turning to carbon fiber wraps as a more practical and less disruptive alternative to full-scale replacements. These wraps offer easier application, lower costs, and quicker turnaround, making them a favorable option for structural upgrades.

Their lightweight nature, corrosion resistance, and ability to deliver durable reinforcement without altering original architectural features make them especially suitable for limited-access or sensitive construction zones. In regions prone to seismic activity, the growing emphasis on earthquake preparedness has further boosted adoption, supported by updated regulatory frameworks. Carbon fiber wraps improve a structure's flexibility and resistance to shear forces, significantly enhancing its disaster resilience capabilities. These factors continue to drive steady market demand, especially in infrastructure retrofitting and structural rehabilitation sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 billion |

| Forecast Value | $7.7 billion |

| CAGR | 11.3% |

The carbon fiber sheets and fabrics segment generated USD 1.1 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2034. Within the fiber type category, these products dominate due to their ease of installation, high strength-to-weight ratio, and compatibility with various surfaces. Their ability to mold over complex geometries allows for uniform load distribution, making them ideal for reinforcing beams, columns, and slabs. This form is widely used in repair and retrofitting applications for both public and private infrastructure. Their versatility and adaptability position them as the preferred solution in structural enhancement projects.

The epoxy resin segment reached USD 1.6 billion in 2024 and is expected to grow at a CAGR of 11.6% during 2025-2034. Epoxy resins are the primary bonding agent for carbon fiber wraps, valued for their high tensile strength, chemical resistance, and excellent adhesion properties. Their compatibility with multiple structural substrates enhances the wrap's performance and long-term structural integrity. Epoxy's reliability in seismic retrofitting, structural reinforcement, and restoration projects continues to support its market leadership. Meanwhile, polyurethane and vinyl ester resins are gaining traction in applications that demand higher flexibility or superior corrosion resistance. Polyurethane is well-suited for dynamic environments where structures face variable loading and thermal conditions.

U.S. Carbon Fiber Wraps (Construction) Market was valued at USD 664.4 million in 2024 and is projected to grow at a CAGR of 11% through 2034. The surge in demand is fueled by continued investment in infrastructure renewal and strict compliance with modern safety and durability regulations. Federal and state-level initiatives aimed at strengthening bridges, highways, and public facilities have increased the adoption of advanced materials. Additionally, the integration of new materials in retrofitting and the presence of innovative construction companies further propel the market. The country's advanced engineering landscape also contributes to the rising use of carbon fiber wraps in both new and restoration projects.

Leading companies in the Global Carbon Fiber Wraps (Construction) Market include Mapei S.p.A., Mitsubishi Chemical Corporation, Sika AG, Teijin Limited, and Toray Industries, Inc. To reinforce their market positions, key players in the carbon fiber wraps (construction) sector are employing a combination of strategies. Companies are investing in R&D to improve resin compatibility, enhance bonding performance, and extend the lifespan of wrap materials. Strategic partnerships with construction firms and infrastructure contractors are also being formed to accelerate project deployment and boost market reach. Firms are expanding their product lines to include different fiber weaves and customized resin systems to suit varying structural requirements. In addition, many are emphasizing sustainability by developing environmentally friendly resins and promoting low-carbon construction practices. Training programs and technical support offerings are being expanded to help end-users adopt these systems efficiently.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fiber type

- 2.2.3 Resin type

- 2.2.4 Application

- 2.2.5 Structure type

- 2.2.6 End use sector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carbon fiber sheets/fabrics

- 5.3 Carbon fiber tapes

- 5.4 Carbon fiber rods

- 5.5 Pre-cured carbon fiber laminates

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Epoxy

- 6.3 Polyurethane

- 6.4 Vinyl ester

- 6.5 Polyester

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Structural strengthening

- 7.2.1 Flexural strengthening

- 7.2.2 Shear strengthening

- 7.2.3 Column confinement

- 7.2.4 Axial strengthening

- 7.3 Seismic retrofitting

- 7.4 Rehabilitation and repair

- 7.4.1 Corrosion damage repair

- 7.4.2 Impact damage repair

- 7.4.3 Fire damage repair

- 7.5 Blast protection

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Structure Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Concrete structures

- 8.3 Masonry structures

- 8.4 Steel structures

- 8.5 Timber structures

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use Sector, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Bridges and highways

- 9.3 Buildings and structures

- 9.3.1 Commercial buildings

- 9.3.2 Residential buildings

- 9.3.3 Industrial buildings

- 9.4 Water and wastewater infrastructure

- 9.5 Marine structures

- 9.6 Historical and heritage structures

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Sika AG

- 11.2 Mapei S.p.A.

- 11.3 Fyfe Co. LLC (Aegion Corporation)

- 11.4 Simpson Strong-Tie Company Inc.

- 11.5 Master Builders Solutions (MBCC Group)

- 11.6 SGL Carbon SE

- 11.7 Toray Industries, Inc.

- 11.8 Mitsubishi Chemical Corporation

- 11.9 Teijin Limited

- 11.10 Hexcel Corporation

- 11.11 Structural Technologies, LLC

- 11.12 Composite Group Chelyabinsk

- 11.13 Chomarat Group

- 11.14 Owens Corning

- 11.15 Nippon Steel Chemical Co., Ltd.