|

시장보고서

상품코드

1766191

OTC 연속 혈당 모니터링 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)OTC Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

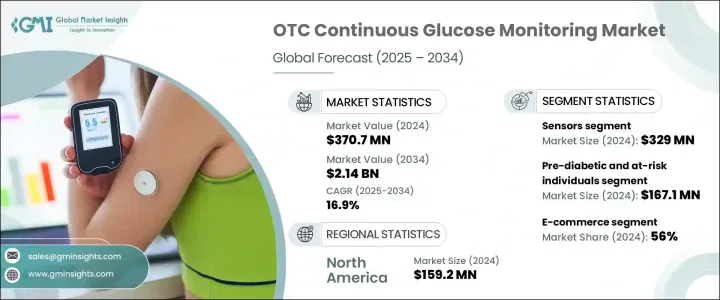

세계의 OTC 연속 혈당 모니터링 시장은 2024년에 3억 7,070만 달러로 평가되었으며, 2034년에는 21억 4,000만 달러에 이르며, CAGR은 16.9%를 나타낼 것으로 전망됩니다.

처방전없이 구입할 수 있는 OTC CGM은 당뇨병 관리뿐만 아니라 보다 광범위한 건강 모니터링 응용 분야에서 점점 더 중요한 역할을 수행하고 있습니다. 개인의 건강 정보에 대한 수요가 높아짐에 따라, 이러한 시스템은 예방 헬스케어나 개인에 맞춘 영양 관리를 위해 받아들여지고 있습니다. CGM은 더 사용하기 쉽고 더 많은 사람들이 사용할 수 있습니다.

제조업체와 디지털 플랫폼은 소비자의 전반적인 제품 경험을 향상시키기 위해 점점 더 협력하고 있습니다. 건강에 대한 인사이트를 실시간으로 이용할 수 있게 되어, 일일의 선택이 포도당치나 건강 전반에 어떠한 영향을 미치는지를 이해하는데 도움이 됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 3억 7,070만 달러 |

| 예측 금액 | 21억 4,000만 달러 |

| CAGR | 16.9% |

센서 부문은 2024년에 3억 2,900만 달러가 되었고, 최대의 점유율을 차지했습니다. 컴팩트하고, 쾌적하고 사용하기 쉬운 웨어러블에의 기호의 고조가, 보다 혁신적인 센서의 개발에 박차를 가하고 있습니다. 축소 가능한 일렉트로닉스 등의 선진 소재가 내장되어, 쾌적성과 측정 정밀도가 향상하고 있습니다. 이러한 센서를 웨어러블이나 스마트폰과 통합하는 것으로, 리얼타임의 접속과 데이터 전송이 가능하게 되어, 유저 경험이 향상해, CGM의 이용 범위가 넓어집니다.

전자상거래 부문은 2024년에 56%의 점유율을 차지했습니다. 이 성장의 원동력이 되고 있는 것은 소비자 행동의 변화이며, 건강 지향이 높은 사람들은 기존의 소매점이나 임상 장소를 우회하여 웰니스 기기를 온라인으로 구입하는 것을 선호합니다. CGM에 대한 직접 액세스를 제공하고 디지털 건강에 대한 여행에 큰 자율성을 제공합니다. 이 DTC 접근 방식을 통해 브랜드는 온라인 채널을 통해 개인화된 교육 및 지원을 제공하고 고객과 더 효과적으로 참여할 수 있습니다.

미국의 OTC 연속 혈당 모니터링 시장은 2034년까지 11억 달러에 이를 것으로 예측됩니다. CGM의 승인을 포함한 FDA에 의한 규제의 진보는 이러한 장치의 보급을 더욱 촉진하고 있습니다. 그리고 개인화된 건강에 대한 인사이트를 얻을 수 있습니다.

OTC 연속 혈당 모니터링 시장 주요 기업으로는 Abbott Laboratories, Dexcom, January AI, Levels Health, Limbo(Vitals in View), Nutrisense, Sinocare, Ultrahuman Healthcare, Veri, Zoe 등이 있습니다. OTC 연속 혈당 모니터링 시장에서의 프레즌스를 강화하기 위해 각 회사는 몇 가지 전략을 채용하고 있습니다. 나사를 소비자에게 제공합니다. 또한 전자상거래로의 전환은 많은 제조업체에 받아들여지고 있으며, 온라인 채널을 통해 보다 폭넓은 소비자층에 직접 도달할 수 있게 되어 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 신진 대사 건강과 웰빙에 대한 소비자의 관심 증가

- 소비자 직접 판매(DTC)과 구독 모델의 확대

- 기술의 진보와 AI를 활용한 통찰

- 예방 헬스케어와 장수의 동향의 변화

- 업계의 잠재적 위험 및 과제

- 고액의 비용과 한정된 보험 적용

- 규제 및 데이터 프라이버시에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

- 소비자 유형별 수량(2024년)

- 기술의 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 센서별

- 플랫폼/앱별

- 지역별 기업 시장 랭킹

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추정·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 센서

- 플랫폼/앱

제6장 시장 추정·예측 : 소비자 유형별(2021-2034년)

- 주요 동향

- 비당뇨병 건강 애호가

- 당뇨병 전 단계 및 위험에 처한 개인

- 기타 소비자 유형

제7장 시장 추정·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 병원 약국

- 소매 약국

- 전자상거래

제8장 시장 추정·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 세계 기타 지역

제9장 기업 프로파일

- Abbott Laboratories

- Dexcom

- January AI

- Levels Health

- Limbo(Vitals in View)

- Nutrisense

- Sinocare

- Ultrahuman Healthcare

- Veri

- Zoe

The Global OTC Continuous Glucose Monitoring Market was valued at USD 370.7 million in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 2.14 billion by 2034. OTC CGMs, which are available for purchase without a prescription, are playing an increasingly significant role not only in managing diabetes but also in broader health monitoring applications. These devices allow consumers to track their glucose levels in real-time, which empowers them to make informed decisions about their diet, exercise, and overall wellness. As the demand for personal health information grows, these systems are being embraced for preventive healthcare and personalized nutrition. With advancements in sensor technology, compact design, longer wearability, and seamless integration with smartphones and AI platforms, OTC CGMs are becoming more user-friendly and accessible to a wider audience.

Manufacturers and digital platforms are increasingly joining forces to improve the overall product experience for consumers. By integrating advanced analytics and offering personalized lifestyle coaching, these collaborations are creating a more engaging and value-driven experience for users. Consumers now have access to insights about their health in real-time, helping them understand how their daily choices impact their glucose levels and overall well-being. This personalized feedback is not just limited to monitoring glucose levels but extends to creating actionable health goals, such as optimizing diet, exercise, and sleep patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $370.7 Million |

| Forecast Value | $2.14 Billion |

| CAGR | 16.9% |

The sensor segment holds the largest share valued at USD 329 million in 2024. The increasing preference for compact, comfortable, and easy-to-use wearables is fueling the development of more innovative sensors. These sensors now incorporate advanced materials such as graphene, flexible polymers, and stretchable electronics to improve comfort and measurement accuracy. The integration of these sensors with wearables and smartphones allows real-time connectivity and data transfer, enhancing the user experience and broadening the scope of CGM usage.

The e-commerce segment held 56% share in 2024. This growth is driven by a shift in consumer behavior, where health-conscious individuals prefer purchasing wellness devices online, bypassing traditional retail and clinical settings. E-commerce platforms offer consumers direct access to OTC CGMs, providing greater autonomy over their digital health journey. This direct-to-consumer approach also enables brands to engage with customers more effectively, offering personalized education and support through online channels.

United States OTC Continuous Glucose Monitoring Market is projected to reach USD 1.1 billion by 2034. The rising interest in preventive health, particularly among non-diabetic individuals, is driving this demand. People are increasingly using CGMs to optimize their diet, exercise, and metabolic performance. Regulatory advancements by the FDA, including approvals for OTC CGMs, are further facilitating the widespread adoption of these devices. The integration of CGMs with smartphones and health apps is also boosting consumer confidence in self-management, enabling users to monitor their glucose levels seamlessly and gain personalized health insights. This trend is supported by the high adoption of digital health tools in the U.S., with consumers increasingly seeking personalized health data.

Key players in the OTC Continuous Glucose Monitoring Market include Abbott Laboratories, Dexcom, January AI, Levels Health, Limbo (Vitals in View), Nutrisense, Sinocare, Ultrahuman Healthcare, Veri, and Zoe. To strengthen their presence in the OTC continuous glucose monitoring market, companies have adopted several strategies. First, they are focusing on enhancing the technology behind their sensors, integrating cutting-edge materials like flexible polymers and stretchable electronics to improve comfort and accuracy. Many companies are also entering strategic partnerships with digital health platforms to provide consumers with additional services, such as AI-powered analytics and personalized coaching. Furthermore, the shift towards e-commerce is being embraced by many manufacturers, allowing them to reach a broader consumer base directly through online channels. By investing in user-friendly designs, providing educational resources, and streamlining the purchase process, these companies aim to increase product adoption and build strong customer loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer interest in metabolic health and wellness

- 3.2.1.2 Expansion of direct-to-consumer (DTC) and subscription models

- 3.2.1.3 Technological advancements and AI-powered insights

- 3.2.1.4 Shifts in preventive healthcare and longevity trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs and limited insurance coverage

- 3.2.2.2 Regulatory and data privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the World

- 3.5 Volume by consumer type, 2024

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By sensor

- 4.2.2 By platform/app

- 4.3 Company market ranking, by region

- 4.4 Company matrix analysis

- 4.5 Competitive analysis of major market players

- 4.6 Competitive positioning matrix

- 4.7 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Sensors

- 5.3 Platforms/Apps

Chapter 6 Market Estimates and Forecast, By Consumer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Non-diabetic health enthusiasts

- 6.3 Pre-diabetic and at-risk individuals

- 6.4 Other consumer types

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the World

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Dexcom

- 9.3 January AI

- 9.4 Levels Health

- 9.5 Limbo (Vitals in View)

- 9.6 Nutrisense

- 9.7 Sinocare

- 9.8 Ultrahuman Healthcare

- 9.9 Veri

- 9.10 Zoe