|

시장보고서

상품코드

1766216

자동차 햅틱 피드백 시스템 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Haptic Feedback System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

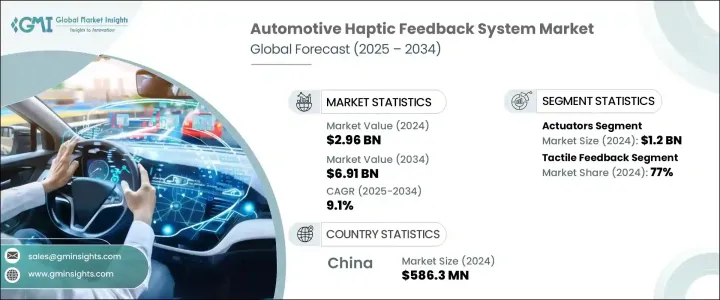

세계의 자동차 햅틱 피드백 시스템 시장 규모는 2024년에 29억 6,000만 달러로 평가되었고, CAGR 9.1%를 나타내 2034년에는 69억 1,000만 달러에 달할 것으로 예측되고 있습니다.

디지털 동향과 ADAS(첨단 운전자 보조 시스템)의 대두에 의해 다양한 자동차 용도로 햅틱스의 이용이 확대되고 있습니다. 제조업체는 사용자 경험을 향상시키기 위해 정교한 햅틱 피드백을 스티어링 휠, 터치 스크린 및 센터 콘솔에 통합합니다. 전기자동차와 자율 주행 차량에 대한 수요 증가는 이러한 자동차가 고급 휴먼 머신 인터페이스에 크게 의존하고 있기 때문에이 채용을 더욱 가속화하고 있습니다. 소비자는 현재 개인화되고 응답성이 높은 기능을 기대하고 있으며 자동차 제조업체는 최첨단 햅틱 솔루션에 대한 투자를 촉구하고 있습니다. 북미와 유럽이 이 기술의 채택을 이끌고 있지만, 아시아태평양은 자동차 생산 증가와 기술에 익숙한 소비자들에게 견인되어 가장 빠르게 성장할 전망입니다.

정부의 규제와 안전 기준도 운전자의 주의 산만을 줄이고 교통 안전을 향상시키는 것을 강조함으로써 시장 성장을 뒷받침하고 있습니다. 햅틱 피드백 시스템은 차선 편차 및 충돌 경고와 같은 중요한 상황에서 운전자에게 경고를 제공하므로 운전자는 시선을 벗어나지 않고 도로에 집중할 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 29억 6,000만 달러 |

| 예측 금액 | 69억 1,000만 달러 |

| CAGR | 9.1% |

액추에이터 분야는 2024년 매출액이 12억 달러로 평가되었고 시장을 선도했습니다. 액추에이터 수요가 증가하고 있습니다. 이 구성 요소는 가상 컨트롤의 물리적 버튼 느낌을 재현하여 운전의 안전과 편안함을 높이는 빠르고 정확한 피드입니다. 커넥티드카나 자율주행차의 대두에 의해 신뢰성이 높고 순간의 햅틱 피드백에의 요구가 높아지고 있어, 액추에이터가 시장에서 우위의 지위를 굳히고 있습니다.

햅틱 피드백 분야는 2024년에 77%의 점유율을 차지했습니다. 터치 기반의 휴먼 머신 인터페이스(HMI)는 직관적이고 사용하기 쉬운 컨트롤을 제공하여 드라이버의 주의력을 유지하고 주의 산만을 경감합니다. 사용되는 힘 피드백과 비교하여 햅틱 피드백은 비용 효율적이고 구현하기 쉽습니다. 자동차 제조업체 사이에서 인기 있는 선택이 되고 있습니다. 프리미엄 자동차에서는 응답성이 높고 직관적인 유저 인터페이스에 수요가 높아지고 있어 햅틱 피드백 시장 점유율을 크게 밀어 올리고 있습니다.

아시아태평양 자동차 햅틱 피드백 시스템 시장은 54%의 점유율을 차지하고 있습니다. 중국의 이점은 견고한 제조거점, 급속한 자동차 생산량 증가, ADAS 및 인포테인먼트 기술의 광범위한 채용으로 인해 발생합니다. 중국, 일본, 한국의 강력한 자동차 부문은 차세대 자동차에의 햅틱·시스템의 통합에 공헌하고 있습니다. 자동차 기술 혁신에 있어서의 중국의 리더십은 정부의 이니셔티브, 다액의 연구개발 투자, 커넥티드카나 전기자동차에 대한 소비자 수요 증가에 의해 지지되고 있습니다.

자동차 햅틱 피드백 시스템 시장에서 활약하는 주요 기업으로는 Bosch, Texas Instruments, ALPS Alpine, Denso, Continental, Panasonic Automotive, Immersion, TDK, Aptiv, ZF Friedrichshafen 등이 있습니다. 자동차 햅틱 피드백 시스템 시장은 시장 점유율을 유지·확대하기 위해 기술 혁신에 주력하고 있습니다. 파트너십과 협업을 통해 제품 개발과 신차 모델에 대한 통합을 가속화하고 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 고급 인포테인먼트 및 HMI 시스템에 대한 수요 증가

- 성장 촉진요인-의 안전과 주의 산만의 경감에 중점

- 프리미엄 기능에 대한 소비자의 선호도 증가

- 햅틱 기술의 기술적 진보

- 업계의 잠재적 위험 및 과제

- 높은 통합 비용

- 시스템 설계와 통합의 복잡성

- 시장 기회

- 터치 기반 인터페이스와 미니멀리스트 인테리어로의 전환

- 안전 및 운전 지원 용도의 확장

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 가격 동향

- 지역별

- 구성 요소별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 코스트 내역 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소 발자국의 고려

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 액추에이터

- 컨트롤러

- 소프트웨어

- 센서

제6장 시장 추계·예측 : 피드백별(2021-2034년)

- 주요 동향

- 햅틱 피드백

- 포스 피드백

제7장 시장 추계·예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차

- 중형 상용차

- 대형 상용차

- 전기자동차(EV)

제8장 시장 추계·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 기계식 햅틱

- 초음파 햅틱

- 전자기 햅틱

- 전기 활성 폴리머(EAP)

- 기타

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- ALPS Alpine

- Analog Devices

- Aptiv

- Bosch

- Continental

- Denso

- Immersion

- Johnson Electric

- Methode Electronics

- Microchip Technology

- Neonode

- Nidec

- Panasonic Automotive

- Precision Microdrives

- Stanley Electric

- Synaptics

- TDK

- Texas Instruments

- Valeo

- ZF Friedrichshafen

The Global Automotive Haptic Feedback System Market was valued at USD 2.96 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 6.91 billion by 2034. The rise of digital trends and advanced driver-assistance systems (ADAS) has expanded the use of haptics across various automotive applications. Manufacturers are integrating sophisticated haptic feedback into steering wheels, touchscreens, and center consoles to enhance user experience. The growing demand for electric and autonomous vehicles further accelerates this adoption, as these cars rely heavily on advanced human-machine interfaces. Consumers now expect personalized, responsive features, prompting automakers to invest in cutting-edge haptic solutions. North America and Europe lead the adoption of this technology, while the Asia-Pacific region is poised to grow the fastest, driven by increasing vehicle production and tech-savvy consumers.

Government regulations and safety standards also fuel market growth by emphasizing reduced driver distraction and improved road safety. Haptic feedback systems alert drivers during critical situations, such as lane departures or collision warnings, allowing them to stay focused on the road without diverting their gaze.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.96 Billion |

| Forecast Value | $6.91 Billion |

| CAGR | 9.1% |

The actuators segment led the market with revenues of USD 1.2 billion in 2024. Actuators play a crucial role in delivering real-time tactile responses, generating vibrations, and touch sensations in steering wheels, infotainment displays, and touchscreens. As advanced driver-assistance systems and touch interfaces become more prevalent, demand for high-performance actuators grows. These components provide fast, precise feedback that enhances driving safety and comfort by replicating the feel of physical buttons on virtual controls. With the rise of connected and autonomous vehicles, the need for reliable and instantaneous haptic feedback is increasing, solidifying actuators' dominant market position.

The tactile feedback segment accounted for a 77% share in 2024. This technology uses subtle vibrations or pulses to mimic touch sensations on surfaces like infotainment units, touchscreens, and climate control panels. Touch-based human-machine interfaces (HMIs) help drivers stay attentive and reduce distraction by offering intuitive and easy-to-use controls. Compared to force feedback, which simulates resistance and is mostly used in steering systems, tactile feedback is more cost-effective and simpler to implement. Its compact size, efficiency, and reliability make capacitive touch technology a popular choice among automakers for virtual buttons, gear selectors, and seat adjustments. The increasing demand for responsive and intuitive user interfaces in premium vehicles has significantly driven the market share of haptic feedback.

Asia-Pacific Automotive Haptic Feedback System Market held a 54% share. China leads this regional market with a valuation of USD 586.3 million in 2024. China's prominence stems from a robust manufacturing base, rapid vehicle production growth, and widespread adoption of ADAS and infotainment technologies. The strong automotive sectors in China, Japan, and South Korea contribute to the integration of haptic systems in next-generation vehicles. China's leadership in automotive innovation is supported by government initiatives, substantial R&D investments, and rising consumer demand for connected and electric vehicles. As the country pushes towards intelligent mobility and autonomous driving, haptic feedback systems are being adopted at an accelerated pace.

Key players active in the Automotive Haptic Feedback System Market include Bosch, Texas Instruments, ALPS Alpine, Denso, Continental, Panasonic Automotive, Immersion, TDK, Aptiv, and ZF Friedrichshafen. Companies in the automotive haptic feedback system market focus on innovation to maintain and grow their market share. They invest heavily in R&D to develop more advanced, responsive, and energy-efficient actuators and tactile feedback technologies. Strategic partnerships and collaborations with automakers and technology firms help accelerate product development and integration into new vehicle models. Expanding geographic reach through joint ventures and establishing local manufacturing hubs allows companies to tap into fast-growing regions, particularly in Asia-Pacific. Players emphasize creating customizable, scalable solutions to cater to the diverse needs of electric and autonomous vehicles.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced infotainment and HMI systems

- 3.2.1.2 Focus on driver safety and reduction of distractions

- 3.2.1.3 Increasing consumer preference for premium features

- 3.2.1.4 Technological advancements in haptic technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of integration

- 3.2.2.2 Complexity in system design and integration

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward touch-based interfaces and minimalist interiors

- 3.2.3.2 Expansion of safety and driver assistance applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Actuators

- 5.3 Controllers

- 5.4 Software

- 5.5 Sensors

Chapter 6 Market Estimates & Forecast, By Feedback, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Tactile feedback

- 6.3 Force feedback

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles

- 7.3.2 Medium commercial vehicles

- 7.3.3 Heavy commercial vehicles

- 7.4 Electric vehicles (EVs)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Mechanical haptics

- 9.3 Ultrasonic haptics

- 9.4 Electromagnetic haptics

- 9.5 Electroactive polymers (EAP)

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ALPS Alpine

- 11.2 Analog Devices

- 11.3 Aptiv

- 11.4 Bosch

- 11.5 Continental

- 11.6 Denso

- 11.7 Immersion

- 11.8 Johnson Electric

- 11.9 Methode Electronics

- 11.10 Microchip Technology

- 11.11 Neonode

- 11.12 Nidec

- 11.13 Panasonic Automotive

- 11.14 Precision Microdrives

- 11.15 Stanley Electric

- 11.16 Synaptics

- 11.17 TDK

- 11.18 Texas Instruments

- 11.19 Valeo

- 11.20 ZF Friedrichshafen