|

시장보고서

상품코드

1766217

저지방 케피어 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Low Fat Content Kefir Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

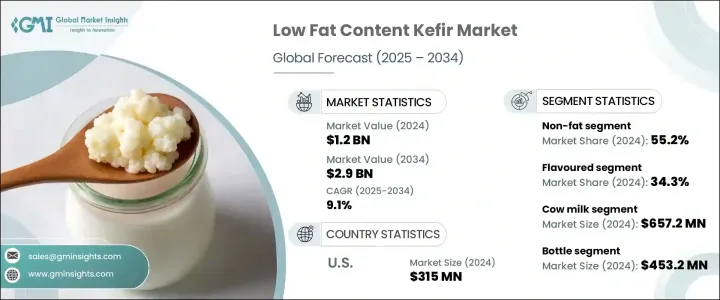

세계의 저지방 케피어 시장은 2024년에는 12억 달러로 평가되었고 CAGR 9.1%를 나타내며 2034년에는 29억 달러에 이를 것으로 추정됩니다.

이 성장은 체중 관리에 대한 소비자의 관심 증가와 소화기계와 면역계의 건강을 촉진하는 영양가 높은 유제품에 대한 수요 증가와 일치하고 있습니다. 특히 밀레니얼 세대와 도시의 전문직 사이에서 편리하고 기능적인 저지방 영양 옵션에 대한 수요가 높아지고 있습니다.

유기농, 목초 사육, 유당 미사용 저지방 유제품은 전자상거래와 건강식품 소매 채널의 확대에 힘입어 보다 널리 입수할 수 있게 되어 왔습니다. 저지방 케피어에 프로바이오틱스, 비타민, 미네랄을 첨가하여 강화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 12억 달러 |

| 예측 금액 | 29억 달러 |

| CAGR | 9.1% |

탈지 케피어 분야는 2024년에 55.2%의 점유율을 차지했고 2034년까지 연평균 복합 성장률(CAGR) 9.2%를 나타낼 것으로 예측됩니다. 낮은 칼로리로 건강한 유제품에 대한 수요 증가가 이 부문의 성장을 견인하고 있습니다. 저지방 식단의 수용으로 알려진 북미와 유럽에서 특히 두드러집니다. 지방 케피어는 지방분이 없음에도 불구하고 크림 같은 질감과 풍부한 맛이 있기 때문에 특히 레이디 투 음료와 이동 중에 기능성 음료 카테고리에서 인기가 있습니다.

맛 케피어 분야는 2024년에 34.3%의 점유율을 획득했으며, 2034년까지 연평균 복합 성장률(CAGR) 9.4%의 급성장이 예측되고 있습니다. 과일, 꿀, 바닐라 등의 천연 향이 케피어에 널리 어필해, 젊은 소비자나 케피어 초보자를 매료하고 있습니다. 구매를 촉구하고 반복 구매를 통해 고객의 충성심을 키웁니다. 한편, 무향료 또는 일반 케피어는 건강 지향 소비자와 스무디의 기초로 사용하기를 선호하는 소비자들 사이에서 뿌리 깊은 인기를 유지합니다. 클린 라벨 운동과 건강 강조 표시에 의한 기술 혁신이 오가닉 케피어의 인기를 밀어 올리고 있지만, 저렴한 가격과 입수의 용이함으로부터, 기존의 케피어가 여전히 우세합니다. 텍스처와 고단백질로 알려진 그리스풍 케피어가 인기를 끌고 있습니다. 또한, 냉동 케피어는 기능성 디저트의 대체품으로서 대두해 왔고, 시장에 있어서의 제품의 범용성을 넓히고 있습니다.

2024년 미국의 저지방 케피어 시장 규모는 3억 1,500만 달러로 평가되었고 2034년까지 연평균 복합 성장률(CAGR) 9.2%를 나타낼 것으로 예측됩니다. 온라인 채널 등 확립된 소매 인프라가 편의성과 접근성을 높이고 있습니다.

세계의 저지방 케피어 시장 주요 기업으로는 Wallaby Yogurt Company, Maple Hill Creamery, LLC, Green Valley Creamery, Danone SA, Lifeway Foods, Inc. 등이 있습니다. 시장 포지션을 강화하기 위해 저지방 케피어 분야의 기업들은 기술 혁신과 제품 차별화에 중점을 둡니다. 소비자의 다양한 요구에 부응하기 위해 유기농, 유당 미사용, 목초 사육 등의 새로운 제법의 개발에 투자하고 있습니다. 맛의 유형을 늘리고 프로바이오틱스, 비타민, 미네랄을 더해 강화한 제품은 매력과 반복구매율을 높이는데 도움이 됩니다. 시장 리더는 강력한 유통망을 구축하고 전자상거래와 건강에 특화된 소매 채널을 활용하여 입수 용이성을 향상시킵니다. 건강 전문가와 독감과의 협업은 제품의 신뢰성과 소비자의 신용을 촉진합니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 제조 공정 분석

- 우유의 준비와 표준화

- 발효 공정

- 맛의 첨가와 배합

- 포장과 품질관리

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 지방 함유량별(2021-2034년)

- 주요 경향

- 무지방(지방분 0-0.5%)

- 저지방(지방분 1-2%)

- 저지방(지방분 2-3%)

- 기타

제6장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 경향

- 플레인/무향

- 맛

- 과일 맛

- 바닐라

- 초콜릿

- 기타 맛

- 유기농

- 기존

- 그리스 스타일

- 냉동

- 기타 제품 유형

제7장 시장 추계·예측 : 공급원별(2021-2034년)

- 주요 경향

- 우유

- 염소 우유

- 양 우유

- 식물 기반 대안

- 코코넛 기반

- 아몬드 기반

- 콩 기반

- 귀리 기반

- 기타 식물 기반 대안

- 기타 정보원

제8장 시장 추계·예측 : 포장 형태별(2021-2034년)

- 주요 경향

- 병

- 플라스틱병

- 유리병

- 파우치

- 테트라팩

- 컵 및 용기

- 기타 포장 형태

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 경향

- 슈퍼마켓 및 하이퍼마켓

- 편의점

- 전문점

- 건강식품점

- 천연 제품 소매 업체

- 기타 전문점

- 온라인 소매

- 푸드서비스

- 카페 및 레스토랑

- 스무디 및 주스 바

- 기타 푸드서비스 채널

- 직접 판매

- 기타 유통 채널

제10장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 경향

- 아침 식사

- 간식

- 운동 후

- 디저트 대안

- 요리 및 레시피 재료

- 기타 소비 기회

제11장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제12장 기업 프로파일

- Andechser Natur

- Biotiful Dairy Ltd.

- Danone SA

- Evolve Kefir

- Green Valley Creamery

- Harmonica

- Lifeway Foods, Inc.

- Maple Hill Creamery, LLC

- Miil

- Redwood Hill Farm &Creamery

- Valio Ltd.

- Wallaby Yogurt Company

The Global Low Fat Content Kefir Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 2.9 billion by 2034. This growth aligns with the increasing consumer focus on weight management and the rising demand for nutritious dairy products that promote digestive and immune health. Low-fat kefir appeals to consumers seeking high-protein, low-saturated-fat probiotic beverages. Lifestyle changes, particularly among millennials and urban professionals, have driven demand for convenient, functional, low-fat nutrition options. The market is evolving with a growing preference for clean-label dairy products, presenting opportunities for both traditional dairy and plant-based kefir producers.

Organic, grass-fed, and lactose-free low-fat options are becoming more widely available, supported by expanding e-commerce and health food retail channels. Consumers increasingly prefer products with low sugar content and clean-label attributes, prompting brands to fortify low-fat kefir with added probiotics, vitamins, and minerals. Technological advances in fermentation, precision probiotic strains, and microencapsulation ensure probiotic stability, boosting product quality and shelf life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9.1% |

Non-fat kefir segment held a 55.2% share in 2024 and is expected to grow at a CAGR of 9.2% through 2034. The rising demand for low-calorie and healthier dairy choices is driving this segment's growth. Individuals managing conditions like diabetes, heart disease, or cholesterol increasingly prefer non-fat kefir, which delivers high protein and probiotic benefits without the fat content found in other dairy products. This trend is particularly notable in North America and Europe, regions known for embracing clean-label and low-fat diets. Lactose-intolerant consumers also favor non-fat kefir when it is fortified with lactase or produced from lactose-free milk. The creamy texture and rich flavor of non-fat kefir, despite its lack of fat, have made it popular, especially in ready-to-drink and on-the-go functional beverage categories.

Flavored kefir segment captured a 34.3% share in 2024 and is projected to grow at a faster CAGR of 9.4% by 2034. Its widespread appeal comes from the incorporation of natural flavors like fruits, honey, and vanilla, which attract younger consumers and those new to kefir. Flavored varieties encourage first-time purchases and foster customer loyalty through repeat buying. Meanwhile, unflavored or plain kefir maintains a strong following among health-conscious consumers and those who prefer to use it as a smoothie base. The clean-label movement and innovation driven by health claims have boosted the popularity of organic kefir, though conventional kefir remains dominant due to affordability and accessibility. Greek-style kefir, known for its thicker texture and higher protein content, is gaining traction. Additionally, frozen kefir is emerging as a functional dessert alternative, broadening the product's versatility in the market.

United States Low Fat Content Kefir Market was valued at USD 315 million in 2024 and is forecast to grow at a CAGR of 9.2% through 2034. The country's leadership stems from strong consumer demand for low-calorie, probiotic-rich dairy products that support health and wellness. Major companies have developed extensive distribution networks, offering innovative and appealing products tailored to health-conscious consumers. The well-established retail infrastructure-including supermarkets, hypermarkets, and online channels-adds convenience and accessibility. Moreover, growing consumer awareness about functional foods that improve digestion and immunity fuels the popularity of low-fat kefir. The U.S. market's focus on clean-label and organic offerings further strengthens consumer trust and loyalty.

Leading companies in the Global Low Fat Content Kefir Market include Wallaby Yogurt Company, Maple Hill Creamery, LLC, Green Valley Creamery, Danone S.A., and Lifeway Foods, Inc. To strengthen their market positions, companies in the low-fat kefir sector focus heavily on innovation and product differentiation. They invest in developing new formulations that include organic, lactose-free, and grass-fed options to meet diverse consumer needs. Expanding flavor varieties and fortified products with added probiotics, vitamins, and minerals help boost appeal and repeat purchase rates. Market leaders build strong distribution networks, leveraging e-commerce and health-focused retail channels to improve accessibility. Collaborations with health experts and influencers promote product credibility and consumer trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fat content

- 2.2.3 Product type

- 2.2.4 Sources

- 2.2.5 Packaging type

- 2.2.6 Distribution channel

- 2.2.7 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Manufacturing process analysis

- 3.13.1 Milk preparation & standardization

- 3.13.2 Fermentation process

- 3.13.3 Flavour addition & formulation

- 3.13.4 Packaging & quality control

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fat Content, 2021 - 2034 (USD Million) (Thousand Liters)

- 5.1 Key trend

- 5.2 Non-fat (0–0.5% fat)

- 5.3 Low-fat (1–2% fat)

- 5.4 Reduced-fat (2–3% fat)

- 5.5 Other fat content levels

Chapter 6 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 6.1 Key trend

- 6.2 Plain/unflavoured

- 6.3 Flavoured

- 6.3.1 Fruit flavors

- 6.3.2 Vanilla

- 6.3.3 Chocolate

- 6.3.4 Other flavors

- 6.4 Organic

- 6.5 Conventional

- 6.6 Greek-style

- 6.7 Frozen

- 6.8 Other product types

Chapter 7 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Million) (Thousand Liters)

- 7.1 Key trend

- 7.2 Cow milk

- 7.3 Goat milk

- 7.4 Sheep milk

- 7.5 Plant-based alternatives

- 7.5.1 Coconut-based

- 7.5.2 Almond-based

- 7.5.3 Soy-based

- 7.5.4 Oat-based

- 7.5.5 Other plant-based alternatives

- 7.6 Other sources

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 8.1 Key trend

- 8.2 Bottles

- 8.2.1 Plastic bottles

- 8.2.2 Glass bottles

- 8.3 Pouches

- 8.4 Tetra packs

- 8.5 Cups & tubs

- 8.6 Other packaging types

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Liters)

- 9.1 Key trend

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.4.1 Health food stores

- 9.4.2 Natural product retailers

- 9.4.3 Other specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Smoothie & juice bars

- 9.6.3 Other foodservice channels

- 9.7 Direct sales

- 9.8 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Liters)

- 10.1 Key trend

- 10.2 Breakfast

- 10.3 Snacking

- 10.4 Post-workout

- 10.5 Dessert alternative

- 10.6 Cooking & recipe ingredient

- 10.7 Other consumption occasions

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Andechser Natur

- 12.2 Biotiful Dairy Ltd.

- 12.3 Danone S.A.

- 12.4 Evolve Kefir

- 12.5 Green Valley Creamery

- 12.6 Harmonica

- 12.7 Lifeway Foods, Inc.

- 12.8 Maple Hill Creamery, LLC

- 12.9 Miil

- 12.10 Redwood Hill Farm & Creamery

- 12.11 Valio Ltd.

- 12.12 Wallaby Yogurt Company