|

시장보고서

상품코드

1766221

라벨링 및 코딩 장비 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Labeling and Coding Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

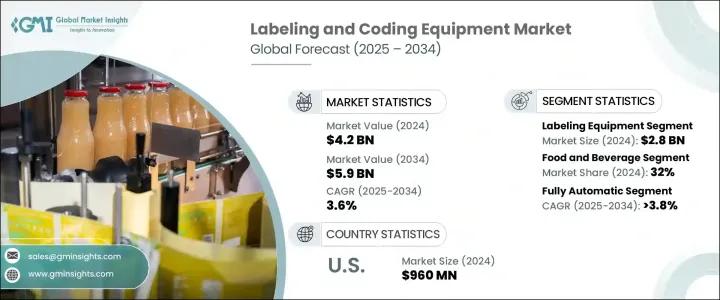

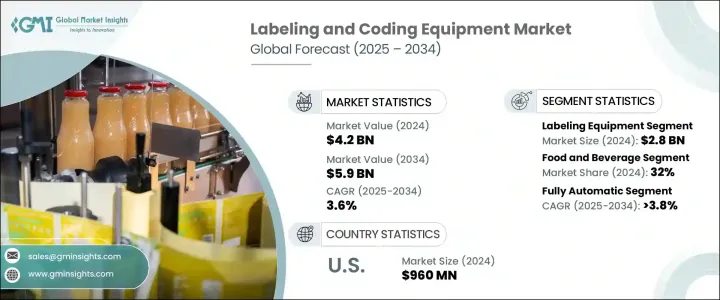

세계의 라벨링 및 코딩 장비 시장 규모는 2024년에 42억 달러에 달했고, CAGR 3.6%를 나타내며 2034년에는 59억 달러에 이를 것으로 예측됩니다.

시장 성장의 원동력이 되는 것은 전자상거래와 물류의 지속적인 확대, 기술의 진보, 정밀도와 품질 보증에 대한 주력입니다. 효율성과 정확성이 크게 향상되었습니다. 또한 인공지능(AI)과 사물인터넷(IoT)의 조합이 업계에 혁명을 일으켜 다운타임과 운영비용을 줄이는 실시간 모니터링, 예지보전, 보다 고급 자동화를 제공합니다.

라벨링 및 코딩 장비는 화학, 화장품, 의약품, 식품, 농업, 전자 제품 등 다양한 산업에서 용기, 병, 바이알 병에 라벨을 붙이는 데 필수적입니다. 자동 라벨링 장비 시장은 빠르고 효율적인 자동 라벨링 시스템 수요가 증가함에 따라 급속히 확대되고 있습니다. 특히 아시아태평양과 북미와 같은 중간층 증가와 가처분 소득 증가가 이러한 산업의 확대를 견인하고 있는 지역에서는 잘못된 라벨이 부착된 제품을 자동으로 배제할 수 있는 이러한 기계 수요가 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 42억 달러 |

| 예측 금액 | 59억 달러 |

| CAGR | 3.6% |

2024년 라벨링 장비 분야는 28억 달러를 창출했고 2034년까지 연평균 복합 성장률(CAGR) 3.9%를 나타낼 것으로 예측됩니다. 이 지속적인 성장의 주요 요인은 라벨링 장비의 상당한 기술 진보입니다. 인공지능(AI) 및 머신 비전 시스템 통합과 같은 기술 혁신으로 라벨링 프로세스가 크게 강화되었습니다. 이러한 기술은 기계가 라벨을 스캔하고 잠재적인 오류나 오정렬을 실시간으로 감지할 수 있게 하고, 라벨이 적절하게 부착되고 규제 기준을 충족하는지 확인합니다. 이 수준의 자동화는 인적 실수를 최소화할 뿐만 아니라 엄격한 산업 규정 준수를 보장하며 이러한 기계를 보다 신뢰성 있고 효율적으로 만듭니다.

식음료 부문은 2024년에 32%의 점유율을 차지했습니다. 이 규정은 제품의 추적성을 보장하고 소비자에게 정확한 정보를 제공하기 위해 열 잉크젯 및 레이저 코딩을 제공합니다. 기계 등의 고도의 라벨링 시스템의 도입을 식음료 분야의 제조업체에 촉구하고 있습니다. 이러한 기술은 규제 준수를 확실히 할 뿐만 아니라, 생산 효율도 향상시킵니다.

미국의 라벨링 및 코딩 장비 시장은 82%의 점유율을 차지했으며, 2024년에는 9억 6,000만 달러를 창출했습니다. 세계 전자상거래, 무역 협정에 힘입어 현저한 성장을 이루고 있으며, 미국에 본사를 둔 제조업자와 소매업체가 혁신적인 물류 솔루션에 투자하도록 촉구하고 있습니다.

세계의 라벨링 및 코딩 장비 시장에서 사업을 전개하는 유명 기업은 Ambrose Packaging, CVC Technologies, BellatRx, BW Integrated Systems, Markem-Imaje, Hitachi IESA, Videojet 등이 있습니다. 이러한 기업은 다양한 업계 수요 증가에 대응하기 위해 보다 효율적이고 신뢰성이 높은 라벨링 솔루션을 개발하기 위해 항상 기술 혁신을 실시했습니다. 각 회사는 다양한 업계에 대응하는 고급 코딩 및 라벨링 시스템 등 사용자 정의 가능한 다양한 솔루션을 제공함으로써 제품 포트폴리오를 확대하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전자상거래와 물류 확대

- 기술의 진보

- 업계의 잠재적 위험 및 과제

- 초기 투자와 유지비가 높아

- 사이버 보안 및 데이터 무결성의 위험

- 기회

- 제품 추적성에 대한 수요 증가

- 지속가능성과 환경친화적인 포장 증가

- 성장 촉진요인

- 성장 가능성 분석

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 유형별

- 규제 상황

- 표준 및 규정 준수 요건

- 지역 규제 틀

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 라벨링 장비

- 감압식 라벨러

- 인쇄 및 부착 라벨링 시스템

- 슬리브 라벨러

- 기타(롤 공급 라벨러 등)

- 코딩 장비

- 잉크젯 코딩기

- 열전사 코더

- 레이저 코더

- 기타(열전사 잉크젯 프린터 등)

제6장 시장 추계·예측 : 동작 모드별(2021-2034년)

- 주요 동향

- 수동

- 반자동

- 전자동

제7장 시장 추계·예측 : 인쇄 매체별(2021-2034년)

- 주요 동향

- 1차 포장

- 2차 포장

- 3차 포장

제8장 시장 추계·예측 : 최종 이용 산업별(2021-2034년)

- 주요 동향

- 식음료

- 제약

- 화장품 및 퍼스널케어

- 일렉트로닉스

- 물류 및 소매

- 기타

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Ambrose Packaging

- BellatRx

- BW Integrated Systems

- CVC Technologies

- Domino Printing Sciences

- HERMA

- Hitachi IESA

- Leibinger

- Markem-Imaje

- Pack Leader USA

- PrintJet Corporation

- ProMach

- Sneed Coding Solutions

- Squid Ink

- Videojet

The Global Labeling and Coding Equipment Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 5.9 billion by 2034. The market growth is being driven by the continued expansion of e-commerce and logistics, technological advancements, and a focus on precision and quality assurance. Improvements in printing technologies, such as laser coding, thermal inkjet, and continuous inkjet printing, have significantly increased the effectiveness and accuracy of labeling processes. Furthermore, the combination of artificial intelligence (AI) and the Internet of Things (IoT) has revolutionized the industry, offering real-time monitoring, predictive maintenance, and higher levels of automation that reduce downtime and operating costs.

Labeling and coding equipment is essential in various industries such as chemicals, cosmetics, pharmaceuticals, food and beverage, agriculture, and electronics, where it is used to attach labels on containers, bottles, and vials. The market for automatic labeling machines is expanding rapidly due to the rising demand for high-speed, efficient, and automated labeling systems. These machines, capable of rejecting mislabeled products automatically, are in high demand, especially in regions such as Asia Pacific and North America, where the growing middle class and increased disposable income are driving the expansion of these industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 3.6% |

In 2024, the labeling equipment segment generated USD 2.8 billion, and it is anticipated to grow at a CAGR of 3.9% throughout 2034. A key factor behind this continued growth is the significant technological progress in labeling equipment. Innovations such as the integration of artificial intelligence (AI) and machine vision systems have significantly enhanced labeling processes. These technologies enable machines to scan labels and detect potential errors or misalignments in real-time, ensuring that labels are properly applied and that they meet regulatory standards. This level of automation not only minimizes human error but also ensures compliance with stringent industry regulations, making these machines more reliable and efficient.

The food & beverage segment held a 32% share in 2024. The demand for precise and high-speed labeling technologies is driven by the growing emphasis on compliance with food safety regulations, including the FDA's Food Safety Modernization Act (FSMA) and the European Union's labeling standards. These regulations have pushed manufacturers in the food and beverage sector to adopt advanced labeling systems, such as thermal inkjet and laser coding machines, to ensure product traceability and provide consumers with accurate information. Not only do these technologies help ensure regulatory compliance, but they also boost production efficiency. With faster printing speeds, reduced downtime, and fewer labeling errors, they play an essential role in improving the overall packaging process, thereby enhancing product turnaround times and ensuring that goods are labeled correctly and swiftly for the market.

United States Labeling and Coding Equipment Market held an 82% share and generated USD 960 million in 2024. The rapid growth of e-commerce and logistics, combined with advancements in technology, is a key driver of the U.S. labeling and coding equipment market. The logistics industry, fueled by rising customer demands, global e-commerce, and trade agreements, has seen significant growth, encouraging U.S.-based manufacturers and retailers to invest in innovative logistics solutions. This shift is enabling companies to leverage their supply chain capabilities for greater service delivery.

Some of the prominent companies operating in the Global Labeling and Coding Equipment Market include Ambrose Packaging, CVC Technologies, BellatRx, BW Integrated Systems, Markem-Imaje, Hitachi IESA, and Videojet. These companies are constantly innovating to develop more efficient and reliable labeling solutions to cater to the increasing demand from various industries. To strengthen their market position, companies in the labeling and coding equipment industry are adopting several strategies. These include a strong focus on technological advancements such as AI integration and machine vision systems, which improve the precision and speed of labeling processes. Companies are also expanding their product portfolios by offering a diverse range of customizable solutions, including advanced coding and labeling systems that cater to various industries. Furthermore, strategic partnerships and acquisitions are being used to increase market penetration and expand the geographical reach of these companies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 End use industry

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce and logistics

- 3.2.1.2 Technological advancement

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Cybersecurity and data integrity risks

- 3.2.3 Opportunities

- 3.2.3.1 Growing demand for product traceability

- 3.2.3.2 Rising sustainability and eco-friendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Labeling equipment

- 5.2.1 Pressure-sensitive labelers

- 5.2.2 Print-and-apply labeling systems

- 5.2.3 Sleeve labelers

- 5.2.4 Others (roll-fed labelers etc.)

- 5.3 Coding equipment

- 5.3.1 Inkjet coding machine

- 5.3.2 Thermal transfer coders

- 5.3.3 Laser coders

- 5.3.4 Others (thermal inkjet printers etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Print Medium, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceutical

- 8.4 Cosmetics and personal care

- 8.5 Electronics

- 8.6 Logistics and retail

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ambrose Packaging

- 11.2 BellatRx

- 11.3 BW Integrated Systems

- 11.4 CVC Technologies

- 11.5 Domino Printing Sciences

- 11.6 HERMA

- 11.7 Hitachi IESA

- 11.8 Leibinger

- 11.9 Markem-Imaje

- 11.10 Pack Leader USA

- 11.11 PrintJet Corporation

- 11.12 ProMach

- 11.13 Sneed Coding Solutions

- 11.14 Squid Ink

- 11.15 Videojet