|

시장보고서

상품코드

1766255

수축 슬리브 라벨링기 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Shrink Sleeve Labeling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

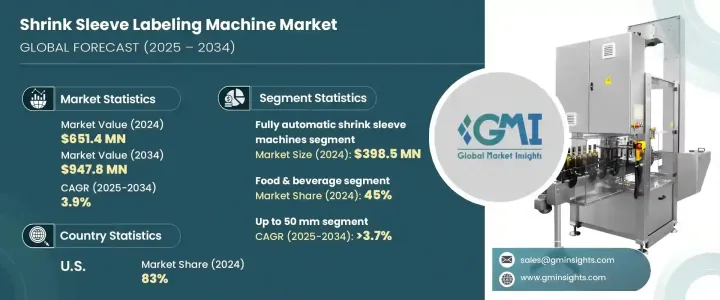

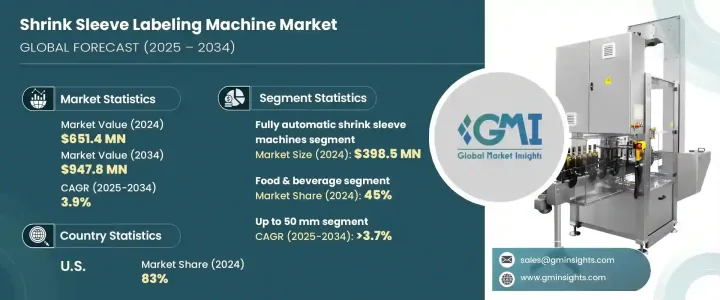

세계의 수축 슬리브 라벨링기 시장은 2024년 6억 5,140만 달러로 평가되었고 CAGR 3.9%로 성장하여 2034년까지 9억 4,780만 달러에 이를 것으로 예측되고 있습니다.

이 성장 궤도는 자동화 기술의 지속적인 혁신과 함께 제품 패키징 개선에 대한 수요가 증가하는 주요 요인입니다.

수축 슬리브 라벨링 기술의 진화는 제품의 미관과 브랜딩을 크게 바꿔 다양한 업종의 기업에 빠르고 효율적이고 적응성이 높은 라벨링 기계의 도입을 촉구하고 있습니다. 히트 터널 기구나 자동화 프레임워크의 진보도, 도입 페이스를 가속시키고 있습니다. 또한, 업계는 포장의 안전성에 대한 규제나 소비자의 요구의 고조에 대응하고 있어, 슈링크 슬리브기의 추가 업그레이드를 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 6억 5,140만 달러 |

| 예측 금액 | 9억 4,780만 달러 |

| CAGR | 3.9% |

전자동 수축 슬리브 라벨링 기계는 2024년 3억 9,850만 달러의 수익을 올렸고, 세계 시장을 선도하고 예측 기간 동안 CAGR 4.1%를 보일 것으로 예측됩니다. 이 기계는 수작업 개입없이 중단없는 대량 생산 라인을 지원하는 능력으로 널리 받아 들여집니다. 신속한 라벨 부착이 가능해져 다운타임의 삭감과 효율 향상에 기여하고 있습니다. 이러한 시스템은 속도, 정밀도, 재현성이 불가결한 대규모 제조 환경에서 특히 인기가 있습니다.

세미 오토매틱 유형은 규모가 작지만 중소기업에는 여전히 적합합니다. 다양한 형상이나 사이즈의 제품을 취급하는 비즈니스에 최적이며, 수작업에 의한 라벨링 프로세스로부터 이행하는 제조업체에 있어서, 비용 대비 효과적인 엔트리 포인트가 됩니다.

수동식 수축 슬리브 라벨링기는 특별 주문품이나 소량 생산이 필요한 경우 등 틈새 시장에서 계속 활약하고 있습니다.

최종 용도의 관점에서 보면, 2024년에는 식음료산업이 45%의 점유율로 세계 시장을 독점했고, 이 부문은 2034년까지 연평균 복합 성장률(CAGR) 4.2%를 보일 것으로 예측됩니다. 수축 라벨링 기계는 360도 완전한 브랜딩을 가능하게 하고, 이 분야의 제조업체에 있어서 중요한 세일즈 포인트가 되고 있습니다. 또, 변조 방지 기능을 갖추고 있기 때문에 제품 패키징에 안전성과 보증의 레이어가 추가되어 수요를 한층 더 촉진하고 있습니다.

화장품 및 퍼스널케어 분야도, 브랜드가 경쟁의 격렬한 소매 환경에서 눈에 띄도록 노력하고 있기 때문에 강력한 성장을 기록하고 있습니다. 친환경적인 패키징에 대한 주목이 높아지는 가운데, 많은 제조업체가 생분해성이나 리사이클 가능한 슬리브 소재를 선택하고 있어, 이들은 세계의 지속가능성의 목표에 합치하고 있습니다.

제약 산업 및 화학 산업에서는 엄격한 컴플라이언스 기준을 충족하고 배치 수준 식별 및 추적을 지원하기 위해 이러한 기계를 채택하고 있습니다.

용기 직경별로는 50mm까지의 부문이 2024년 시장 공헌으로 톱에 부상해, 시장 추계 및 예측 기간 중 CAGR은 3.7% 이상으로 예측됩니다. 퍼스널케어, 제약, 영양 보조 식품 산업에서 널리 사용되고 있습니다.

지역별로는 미국이 북미 시장을 리드해, 2024년의 지역별 수익의 83%를 차지했고, 수익은 1억 6,010만 달러에 달했습니다. 음식 식품 제조업체의 강한 존재감과 자동 포장을 위한 확립된 인프라가, 수축 슬리브 라벨링 장비 수요를 추진하고 있습니다.

이 시장에 진입한 기업은 시장에서의 존재감을 높이기 위해 연구개발에 대한 투자와 전략적 제휴를 적극적으로 실시했습니다. 통합 및 설정 시간 단축, 예측 유지 보수 및 기존 생산 라인으로의 원활한 통합을 가능하게 합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 기회

- 성장 가능성 분석

- 미래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 유형별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 틀

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 수동 수축 슬리브 기계

- 반자동 수축 슬리브 기계

- 전자동 수축 슬리브 기계

제6장 시장 추계 및 예측 : 용기 유형별, 2021-2034년

- 주요 동향

- 병

- 캔

- 항아리

- 기타 용기

제7장 시장 추계 및 예측 : 용기 직경별, 2021-2034년

- 주요 동향

- 최대 50mm

- 50-100mm

- 100-150mm

- 150mm 이상

제8장 시장 추계 및 예측 : 슬리브 용량별, 2021-2034년

- 주요 동향

- 최대 300 유닛/분

- 300-400 유닛/분

- 400-600 유닛/분

- 600 유닛/분 이상

제9장 시장 추계 및 예측 : 최종 이용 산업별, 2021-2034년

- 주요 동향

- 식품 및 음료

- 의약품

- 화장품 및 퍼스널케어

- 화학약품 및 비료

- 자동차

- 기타(영양 보조 식품 등)

제10장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 직접 판매

- 간접 판매

제11장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- Accutek Packaging Equipment

- Axon

- Bhagwati Labelling Technologies

- BW Integrated Systems

- Crown Packaging

- Dase-Sing Packaging

- Esleeve Enterprise

- Fuji Seal

- King Machine

- Magic Special Purpose Machineries

- Pack Leader USA

- PDC International

- Procus Machinery

- Quadrel

- XH Labeling Machine

The Global Shrink Sleeve Labeling Machine Market was valued at USD 651.4 million in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 947.8 million by 2034. This growth trajectory is primarily driven by the rising demand for improved product packaging, coupled with continuous innovation in automation technologies. With industries increasingly turning to smart labeling systems, manufacturers are witnessing a growing interest in advanced solutions that not only enhance labeling accuracy but also reduce operational inefficiencies.

The evolution of shrink sleeve labeling technology has significantly transformed product aesthetics and branding, pushing businesses across multiple verticals to embrace high-speed, efficient, and adaptable labeling machinery. As companies focus on visual appeal and brand identity, these machines play a pivotal role in delivering seamless full-body decoration on various types of containers. Advancements in heat tunnel mechanisms and automation frameworks are also accelerating the pace of adoption. Moreover, the industry is responding to increasing regulatory and consumer demand for packaging safety, prompting further upgrades in shrink sleeve equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $651.4 Million |

| Forecast Value | $947.8 Million |

| CAGR | 3.9% |

Fully automatic shrink sleeve labeling machines led the global market in 2024, generating revenue of USD 398.5 million and are expected to grow at a CAGR of 4.1% during the forecast period. These machines are gaining widespread acceptance due to their ability to support uninterrupted, high-volume production lines without manual intervention. Their integration with smart systems allows for rapid label application, along with built-in error detection and rejection mechanisms, contributing to reduced downtime and improved efficiency. These systems are especially popular in large-scale manufacturing environments where speed, accuracy, and repeatability are essential.

Semi-automatic variants, although more modest in scale, remain relevant for small and mid-sized enterprises. These machines are equipped with basic sensor-based technologies that can automatically apply shrink labels to bottles, vials, or containers without requiring manual precision. They are ideal for businesses handling diverse product shapes and sizes, and they offer a cost-effective entry point for manufacturers transitioning from manual labeling processes.

Manual shrink sleeve labeling machines continue to serve niche markets, particularly where customization or short-run production is necessary. Although they offer limited automation, they provide flexibility and are easy to operate, making them suitable for start-ups or low-volume production settings.

From an end-use perspective, the food and beverage industry dominated the global market with a 45% share in 2024, and the segment is projected to grow at a CAGR of 4.2% through 2034. This sector is experiencing rapid changes in consumer preferences, leading to a surge in packaged foods, flavored beverages, and convenient meal options. As a result, the need for dynamic labeling systems that can handle containers of varied sizes and shapes is increasing. Shrink sleeve labeling machines enable complete 360-degree branding, which is a key selling point for manufacturers in this space. Their ability to provide tamper-evident features also adds a layer of safety and assurance to the product packaging, further driving demand.

The cosmetics and personal care segment is also registering robust growth as brands strive to stand out in a highly competitive retail environment. Shrink sleeve machines allow for high-resolution printing on irregular container shapes, which is crucial for companies looking to enhance shelf appeal. With a growing focus on environmentally friendly packaging, many manufacturers are also opting for biodegradable and recyclable sleeve materials, which align well with global sustainability goals.

The pharmaceutical and chemical industries are adopting these machines to meet strict compliance standards and to support batch-level identification and tracking. In particular, the demand for highly precise, tamper-proof labeling solutions is spurring the adoption of advanced shrink sleeve systems in these sectors.

By container diameter, the up to 50 mm segment emerged as the top contributor to the market in 2024 and is estimated to grow at a CAGR of over 3.7% during the forecast period. Small-diameter containers such as tubes, vials, and sample bottles are extensively used in personal care, pharmaceutical, and nutraceutical industries. These applications require high-speed, compact labeling systems that can handle fragile packaging with precision, contributing to segment growth.

Regionally, the United States led the North American market, accounting for 83% of regional revenue in 2024, with earnings reaching USD 160.1 million. The strong presence of food and beverage manufacturers, combined with an established infrastructure for automated packaging, is fueling the demand for shrink sleeve labeling equipment. Technological upgrades and an increasing shift toward lean manufacturing have further enhanced the attractiveness of these machines for US-based firms.

Companies operating in this market are actively investing in R&D and forming strategic alliances to enhance their market presence. Technological improvements and automation-focused upgrades are helping firms stay ahead of changing industry requirements. For instance, industry players are integrating smart features into their machines, enabling faster setup times, predictive maintenance, and seamless integration into existing production lines. These strategies are not only helping companies meet customer expectations but also offering scalable solutions that adapt to emerging trends in packaging and labeling.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By container type

- 2.2.4 By container diameter

- 2.2.5 By sleeve capacity

- 2.2.6 By end use industry

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Manual shrink sleeve machines

- 5.3 Semi-automatic shrink sleeve machines

- 5.4 Fully automatic shrink sleeve machines

Chapter 6 Market Estimates & Forecast, By Container Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Cans

- 6.4 Jars

- 6.5 Other containers

Chapter 7 Market Estimates & Forecast, By Container Diameter, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50 mm

- 7.3 50 to 100 mm

- 7.4 100 to 150 mm

- 7.5 Above 150 mm

Chapter 8 Market Estimates & Forecast, By Sleeve Capacity, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Up to 300 units/min

- 8.3 300 to 400 units/min

- 8.4 400 to 600 units/min

- 8.5 Above 600 units/min

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverages

- 9.3 Pharmaceuticals

- 9.4 Cosmetics & personal care

- 9.5 Chemicals and fertilizers

- 9.6 Automotive

- 9.7 Others (nutraceuticals etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Accutek Packaging Equipment

- 12.2 Axon

- 12.3 Bhagwati Labelling Technologies

- 12.4 BW Integrated Systems

- 12.5 Crown Packaging

- 12.6 Dase-Sing Packaging

- 12.7 Esleeve Enterprise

- 12.8 Fuji Seal

- 12.9 King Machine

- 12.10 Magic Special Purpose Machineries

- 12.11 Pack Leader USA

- 12.12 PDC International

- 12.13 Procus Machinery

- 12.14 Quadrel

- 12.15 XH Labeling Machine