|

시장보고서

상품코드

1766263

건설용 휴대용 발전기 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Construction Portable Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

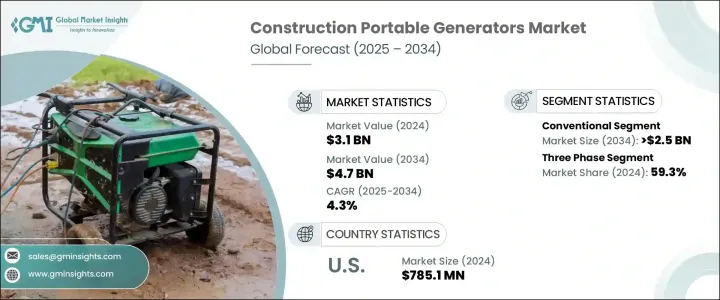

세계의 건설용 휴대용 발전기 시장은 2024년 31억 달러로 평가되었으며 CAGR 4.3%로 성장해 2034년에는 47억 달러에 이를 것으로 추정됩니다.

이러한 꾸준한 성장은 주로 세계 건설 사업에서 보다 깨끗하고 스마트하며 에너지 효율적인 전력 솔루션에 대한 수요 증가로 인한 것입니다. 배출량 감소, 연비 향상, 운송 용이성에 대한 업계의 기대 증가가 주요 제조업체의 제품 개발 전략을 형성하고 있습니다. 건설사업이 지속가능한 관행을 점차 채용함에 따라 배터리, 태양광 모듈, 인버터 기술을 조합한 하이브리드 시스템의 통합이 기세를 늘리고 있으며, 휴대용 발전기 도입에 유리한 상황이 생겨나고 있습니다.

도시의 건설활동은 급격히 증가하고 있으며, 특히 정부기관이 엄격한 배출기준을 부과하고 있는 지역에서는 기업이 그린빌딩 인증 준수에 적극적으로 임하고 있습니다. 동시에, 보다 깨끗한 대체 연료로의 시프트나, 듀얼 연료 시스템의 이용 확대에 의해 현장 전체에서 신뢰성이 높은 전력 액세스를 유지하면서, 환경에 대한 우려에 대처하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 31억 달러 |

| 예측 금액 | 47억 달러 |

| CAGR | 4.3% |

건설용 휴대용 발전기 시장은 제품 유형별로 기존 휴대용과 인버터 휴대용으로 구분됩니다. 지역과 신뢰할 수 있는 송전망에 대한 액세스가 제한된 지역에서 신뢰할 수 있는 전력 공급을 제공하는 데 뿌리를 두고 있습니다. 보다 조용한 엔진 동작부터 저연비 설계에 이르기까지 끊임없는 제품 개량으로 대규모 인프라에서 주택 프로젝트까지 다양한 건설 환경에서의 수용이 확대되고 있습니다.

시장은 또한 위상을 기반으로 단상과 삼상 시스템으로 나뉘어져 있습니다. 삼상 휴대용 발전기는 2024년 59.3%의 압도적인 시장 점유율을 차지했으며, 안정된 대용량 전력을 공급할 수 있어, 더 높은 전기부하를 필요로 하는 대규모 건설 용도에 적합하다고 하여 점점 선호되고 있습니다.

한편, 단상 건설용 휴대용 발전기는 2034년까지 4.2%라는 높은 성장률이 예측되고 있습니다. 뿐만 아니라 인체공학 기반의 디지털 디스플레이, 모바일 애플리케이션을 통한 무선 모니터링, 통합된 안전 기능 등의 제품 업그레이드를 통해 사용 편의성과 현장 신뢰성이 크게 향상되었으며, 이러한 장치가 점점 매력적인 선택이 되었습니다.

북미 전체에서는 미국이 여전히 업계 전반의 수익에 크게 기여하고 있습니다. 이 성장의 원동력은 도시 재개발과 리폼 증가, 가설 인프라 설치시의 모바일 전원의 필요성입니다.

세계 경쟁 구도를 선도하는 것은 Honda India Power Products, Generac Power Systems, Atlas Copco, Cummins, Yamaha Motor의 5개사입니다 이 기업은 전체 시장 점유율의 거의 50%를 차지하고 있습니다. 보다 깨끗한 기술에 대한 투자와 스마트 기능의 통합은 휴대용 전원 분야에서 신뢰할 수 있는 솔루션 제공업체로서의 지위를 더욱 견고하게 하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 전략적 대시보드

- 전략적 노력

- 경쟁 벤치마킹

- 혁신과 지속가능성의 정세

제5장 시장 규모와 예측 : 제품별, 2021-2034년

- 주요 동향

- 기존 휴대용

- 인버터 휴대용

제6장 시장 규모와 예측 : 연료 및 출력별, 2021-2034년

- 주요 동향

- 디젤

- 20kW 미만

- 20-50kW

- 50-100kW 이상

- 가솔린

- 2kW 미만

- 2-5kW

- 6-8kW

- 8-15kW 이상

- 기타

제7장 시장 규모와 예측 : 페이즈별, 2021-2034년

- 주요 동향

- 단상

- 삼상

제8장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 러시아

- 영국

- 독일

- 프랑스

- 스페인

- 오스트리아

- 이탈리아

- 아시아태평양

- 호주

- 일본

- 중국

- 인도

- 인도네시아

- 태국

- 말레이시아

- 싱가포르

- 한국

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 튀르키예

- 이란

- 오만

- 아프리카

- 이집트

- 나이지리아

- 알제리

- 남아프리카

- 모잠비크

- 라틴아메리카

- 멕시코

- 칠레

- 아르헨티나

- 브라질

제9장 기업 프로파일

- Allmand Bros

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Champion Power Equipment

- Cummins

- Deere & Company

- DEWALT

- DuroMax Power Equipment

- FIRMAN Power Equipment

- Generac Power Systems

- GENMAC

- HIMOINSA

- Honda India Power Products

- Kirloskar Oil Engines

- Rehlko

- Wacker Neuson

- Westinghouse Electric Corporation

- Yamaha Motor

- YANMAR HOLDINGS

The Global Construction Portable Generators Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.7 billion by 2034. This steady growth is primarily driven by rising demand for cleaner, smarter, and more energy-efficient power solutions across construction operations worldwide. Evolving industry expectations toward reduced emissions, enhanced fuel economy, and ease of transport are shaping the product development strategies of key manufacturers. As construction businesses increasingly adopt sustainable practices, the integration of hybrid systems-combining batteries, solar modules, and inverter technologies-is gaining momentum, creating a favorable landscape for portable generator deployments.

Urban construction activity continues to rise at a rapid pace, especially in regions where government bodies have imposed strict emission norms, and companies are actively working to comply with green-building certifications. The market benefits from consistent requirements for compact, low-noise, and lightweight generators ideal for confined or sensitive work environments. Technological advancements in generator engine performance-particularly those aligned with updated emission standards such as Stage V and Tier 4-are crucial in boosting product appeal. Simultaneously, the shift toward cleaner fuel alternatives and the growing use of dual-fuel systems are addressing environmental concerns while maintaining reliable power access across job sites. These evolving standards are fostering new opportunities in the mobile energy solutions space and encouraging rapid product innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.3% |

The construction portable generators market is segmented by product into conventional portable and inverter portable types. Among these, conventional units remain widely used and are projected to exceed USD 2.5 billion in revenue by 2034. Their popularity is rooted in the dependable power supply they provide, especially in regions frequently affected by weather-related outages or where reliable grid access is limited. Continuous product improvements, ranging from quieter engine operation to fuel-efficient designs, are increasing their acceptance across various construction settings, from large-scale infrastructure to residential projects.

The market is also divided based on phase into single-phase and three-phase systems. Three-phase portable generators held a dominant market share of 59.3% in 2024 and are increasingly preferred for their ability to deliver high-capacity, stable power, making them well-suited for larger construction applications requiring higher electrical loads. As power needs on construction sites become more sophisticated, this segment is expected to maintain its strong position throughout the forecast period.

In contrast, single-phase construction portable generators are projected to grow at a faster rate of 4.2% through 2034. These generators are becoming more popular among users who need steady, clean energy for lower-capacity tools or sensitive electronic equipment. Many models are now equipped with inverter technology, offering advanced control over output quality and energy consumption. Furthermore, product upgrades such as ergonomic digital displays, wireless monitoring through mobile applications, and integrated safety features are significantly improving usability and onsite reliability, making these units an increasingly attractive choice.

Across North America, the U.S. remains a major contributor to overall industry revenue. The country's construction portable generators market was valued at USD 687.6 million in 2022, USD 735.9 million in 2023, and reached USD 785.1 million in 2024. This growth is driven by an uptick in urban redevelopment, renovation initiatives, and the need for mobile power during temporary infrastructure setups. From equipment support on short-term projects to emergency use in disaster recovery operations, portable generators have become vital in ensuring uninterrupted workflow and safety on job sites.

Leading the global competitive landscape are five key players-Honda India Power Products, Generac Power Systems, Atlas Copco, Cummins, and Yamaha Motor. These companies account for nearly 50% of the total market share. Their dominance is fueled by their commitment to continuous innovation, a strong global distribution footprint, and diverse product offerings that are designed to meet the specific needs of construction professionals across various geographic markets. Their investments in cleaner technologies and integration of smart features are further reinforcing their positions as trusted solution providers in the portable power sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Conventional portable

- 5.3 Inverter portable

Chapter 6 Market Size and Forecast, By Fuel & Power Rating, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.2.1 < 20 kW

- 6.2.2 20 - 50 kW

- 6.2.3 > 50 - 100 kW

- 6.3 Gasoline

- 6.3.1 < 2 kW

- 6.3.2 2 kW - 5 kW

- 6.3.3 6 kW - 8 kW

- 6.3.4 > 8 kW - 15 kW

- 6.4 Others

Chapter 7 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 Australia

- 8.4.2 Japan

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Singapore

- 8.4.9 South Korea

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Mozambique

- 8.7 Latin America

- 8.7.1 Mexico

- 8.7.2 Chile

- 8.7.3 Argentina

- 8.7.4 Brazil

Chapter 9 Company Profiles

- 9.1 Allmand Bros

- 9.2 Atlas Copco

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Champion Power Equipment

- 9.6 Cummins

- 9.7 Deere & Company

- 9.8 DEWALT

- 9.9 DuroMax Power Equipment

- 9.10 FIRMAN Power Equipment

- 9.11 Generac Power Systems

- 9.12 GENMAC

- 9.13 HIMOINSA

- 9.14 Honda India Power Products

- 9.15 Kirloskar Oil Engines

- 9.16 Rehlko

- 9.17 Wacker Neuson

- 9.18 Westinghouse Electric Corporation

- 9.19 Yamaha Motor

- 9.20 YANMAR HOLDINGS