|

시장보고서

상품코드

1766282

양돈 사료 프로바이오틱 효모 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Swine Feed Probiotic Yeast Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

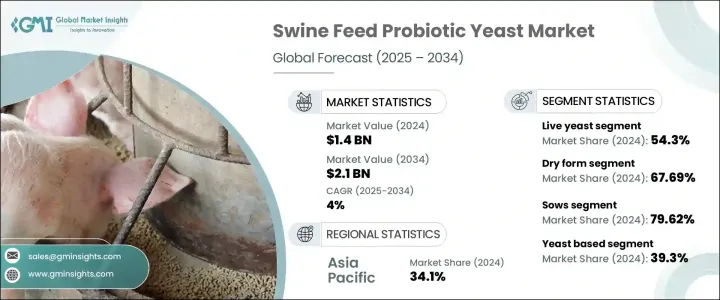

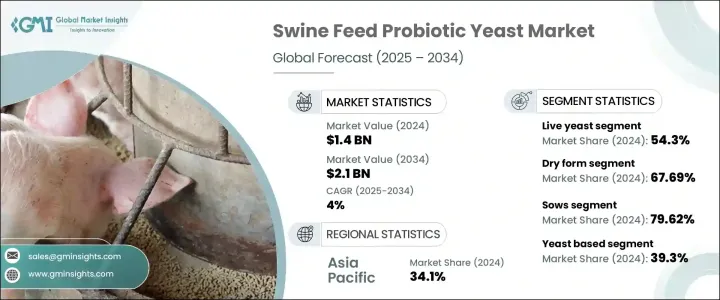

세계의 양돈 사료 프로바이오틱 효모 시장은 2024년에 14억 달러로 평가되었고 CAGR 4%를 나타내며 2034년에는 21억 달러에 이를 것으로 추정됩니다.

이 시장 성장의 원동력은 생산자가 기존의 항생제 첨가제에서 프로바이오틱 효모 기반의 동물사료로 이행하고 있다는 점입니다. 면역력을 높이고, 영양 흡수를 돕는 중요한 역할을 완수하고, 라이프 사이클을 통해 생산성의 향상과 가축의 건강에 공헌합니다. 또한, 항생제 내성에 대한 우려의 높아짐과 가축의 항생 물질 사용에 대한 규제 강화에 의해 프로바이오틱 효모 사료는 양돼지업에 있어서 보다 매력적인 것이 되고 있습니다.

게다가, 살아있는 효모 제품이 지속적으로 지원됨에 따라, 프로바이오틱 효모의 건조형과 액체형 모두 수요가 증가하고 있습니다. 자연사료 첨가물에 대한 요구의 고조에 대응할 뿐만 아니라, 지속가능성과 규제 준수에 대한 관심의 고조에도 부합하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 14억 달러 |

| 예측 금액 | 21억 달러 |

| CAGR | 4% |

2024년 살아있는 효모 부문은 54.3%의 점유율을 얻었으며, 8억 달러로 평가되었습니다. 이 변화는 동물 복지에 대한 우려 증가와 천연 첨가물을 지지하는 규제 변경의 결과입니다.

프로바이오틱 효모 부문의 건조 형태는 2024년에 67.69%의 점유율을 차지했습니다. 속도와 내구성이 우수하기 때문에 사료 생산자들 사이에서 널리 채택되고 있습니다.

2024년 아시아태평양의 양돈 사료 프로바이오틱 효모 시장 점유율은 34.1%를 나타냈고 중국, 베트남, 필리핀 등의 나라가 리드했습니다. 사용 돼지고기와 장의 건강과 면역력을 촉진하는 효모 기반 사료에 대한 소비자 수요가 시장 수요를 촉진하고 있습니다.

세계의 양돈 사료 프로바이오틱 효모 시장 주요 기업은 Chr. Hansen A/S, Koninklijke DSM NV, Archer Daniels Midland Company, Alltech Inc. Lallemand Inc. 등입니다. 이러한 기업들은 혁신, 제품 개발, 각 지역에서의 판매에 있어 주요 역할을 하고 있습니다. 시장에서의 지위를 강화하기 위해, 양돈 사료 프로바이오틱 효모 업계의 기업은 몇 가지 중요한 전략에 주력하고 있습니다. 첫째, 프로바이오틱 효모제품의 효율성을 높이기 위한 연구개발에 많은 투자를 하고 동물의 건강증진에 대한 수요 증가에 확실히 대응하고 있습니다. 사료 생산자와 축산 단체와의 전략적 파트너십은 시장에 도달하고 유통 경로를 확대하는 데 도움이 됩니다. 또한 이러한 기업들은 항생제를 사용하지 않는 자연 대체품에 대한 소비자의 선호도가 높아짐에 따라 지속가능하고 비용 효율적인 제품을 개발하기 위해 첨단 기술을 활용하고 있습니다. 게다가, 업계를 선도하는 많은 기업들은 지속가능성에 대한 노력에 힘을 쏟고 있으며, 제품이 친환경적임을 보장함으로써 친환경적인 고객층에 호소하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 제품별

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고 : 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 살아있는 효모

- 사용한 효모

- 효모 유도체

제6장 시장 추계·예측 : 종속별(2021-2034년)

- 주요 동향

- 사카로미세스

- 사카로미세스 세레비시에

- 사카로미세스 보라디

- 클루이 베로 미세스

- 피치아

- 기타 종속

제7장 시장 추계·예측 : 형태별(2021-2034년)

- 주요 동향

- 건조

- 액체

제8장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 모돈

- 이유자

- 재배자

- 피니셔

제9장 시장 추계·예측 : 기능별(2021-2034년)

- 주요 동향

- 영양 개선

- 장 건강 개선

- 면역력 강화

- 스트레스 감소

- 수확량 및 생산성 향상

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 프로파일

- Chr. Hansen A/S

- Koninklijke DSM NV

- Archer Daniels Midland Company(ADM)

- Alltech Inc.

- Lallemand Inc.

- Phileo by Lesaffre

- Cargill Incorporated

- Evonik Industries AG

- Novus International, Inc.

- Angel Yeast Co. Ltd.

- Novozymes A/S

- Associated British Foods plc

- Biorigin

- Leiber GmbH

- Biomin Holding GmbH

- Novonesis(formerly Novozymes)

- Aniamor Nutrition

- DuPont(IFF)

- Land O'Lakes, Inc.

- Nutreco NV

The Global Swine Feed Probiotic Yeast Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 2.1 billion by 2034. This market growth is driven by a shift toward probiotic yeast-based animal feed as producers move away from traditional antibiotic additives. As consumers increasingly demand high-quality, antibiotic-free pork products, there is a rising need for sustainable, organic alternatives that can enhance animal health. Probiotic yeast plays a vital role in improving gut health, boosting immunity, and aiding nutrient absorption, which contributes to higher productivity and healthier animals throughout the lifecycle. Additionally, the growing concerns over antibiotic resistance and tightening regulations on antibiotic use in livestock have made probiotic yeast feeds more attractive for swine farming.

Additionally, as live yeast products continue to gain traction, there is a growing demand for both dry and liquid forms of probiotic yeast. This increase in demand is driven by advancements in animal nutrition, where precision feeding solutions are becoming more prominent. These innovations are not only meeting the growing need for more effective, natural feed additives but are also aligning with the increasing focus on sustainability and regulatory compliance. The combination of new technologies and stricter regulations is pushing the market toward more tailored, efficient, and environmentally friendly approaches to animal health and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 4% |

In 2024, the live yeast segment captured a 54.3% share, valued at USD 800 million. The popularity of live yeast stems from its ability to improve digestion, increase nutrient absorption, and enhance immunity, making it a key substitute for antibiotic-based health promoters. This shift is a result of growing concerns about animal welfare and regulatory changes favoring natural additives. The live yeast segment is expected to continue growing steadily, with ongoing improvements in product design and development for specific applications.

The dry form of the probiotic yeast segment held a 67.69% share in 2024. This form is favored for its extended shelf life, easy storage, and compatibility with feed mixing, making it ideal for large-scale commercial pig farms. The dry segment is more cost-effective and durable, leading to wider adoption among feed producers. While the dry form remains dominant, liquid probiotic yeast is gradually gaining traction in operations where rapid microbial activity and enhanced absorption are prioritized.

Asia Pacific Swine Feed Probiotic Yeast Market held a 34.1% share in 2024, with countries like China, Vietnam, and the Philippines leading the way. High pork consumption and the expanding swine farming industry in this region are major drivers of growth. Furthermore, consumer demand for antibiotic-free pork and yeast-based feeds that promote gut health and immunity is fueling market demand. Governments in this region are enforcing strict regulations on antibiotic use in livestock, further boosting the demand for natural probiotic alternatives.

Key players in the Global Swine Feed Probiotic Yeast Market include Chr. Hansen A/S, Koninklijke DSM N.V., Archer Daniels Midland Company, Alltech Inc., and Lallemand Inc. These companies are leading the charge in innovation, product development, and distribution across various regions. To strengthen their market position, companies in the swine feed probiotic yeast industry focus on several key strategies. First, they invest heavily in research and development to improve the efficacy of probiotic yeast products, ensuring they meet the growing demand for enhanced animal health solutions. Strategic partnerships with feed producers and livestock organizations help to expand their market reach and distribution channels. Moreover, these companies are leveraging advanced technologies to create more sustainable, cost-effective products that align with the rising consumer preference for antibiotic-free, natural alternatives. Additionally, many of the industry's leading players are committed to sustainability initiatives, ensuring their products are environmentally friendly, thus appealing to a broader, eco-conscious customer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Live yeast

- 5.3 Spent yeast

- 5.4 Yeast derivatives

Chapter 6 Market Estimates and Forecast, By Genus, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Saccharomyces

- 6.2.1 Saccharomyces cerevisiae

- 6.2.2 Saccharomyces boulardii

- 6.3 Kluyveromyces

- 6.4 Pichia

- 6.5 Other genera

Chapter 7 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dry

- 7.3 Liquid

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Sows

- 8.3 Weaners

- 8.4 Growers

- 8.5 Finishers

Chapter 9 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Nutrition enhancement

- 9.3 Gut Health improvement

- 9.4 Immunity boosting

- 9.5 Stress reduction

- 9.6 Yield & productivity enhancement

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Chr. Hansen A/S

- 11.2 Koninklijke DSM N.V.

- 11.3 Archer Daniels Midland Company (ADM)

- 11.4 Alltech Inc.

- 11.5 Lallemand Inc.

- 11.6 Phileo by Lesaffre

- 11.7 Cargill Incorporated

- 11.8 Evonik Industries AG

- 11.9 Novus International, Inc.

- 11.10 Angel Yeast Co., Ltd.

- 11.11 Novozymes A/S

- 11.12 Associated British Foods plc

- 11.13 Biorigin

- 11.14 Leiber GmbH

- 11.15 Biomin Holding GmbH

- 11.16 Novonesis (formerly Novozymes)

- 11.17 Aniamor Nutrition

- 11.18 DuPont (IFF)

- 11.19 Land O'Lakes, Inc.

- 11.20 Nutreco N.V.