|

시장보고서

상품코드

1766306

상용 및 산업용 PV 인버터 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Commercial and Industrial PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

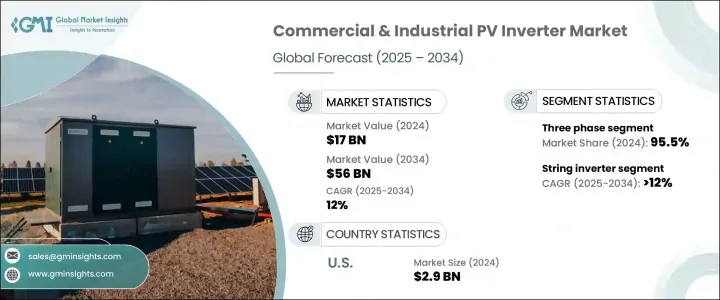

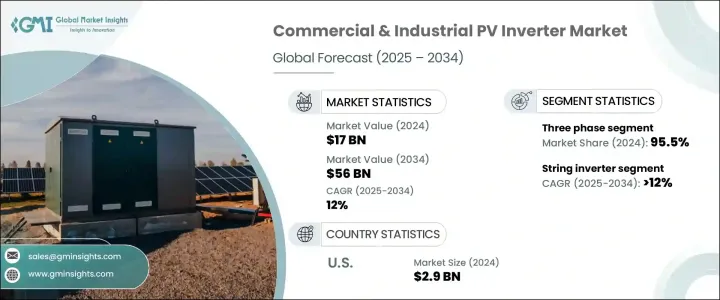

세계의 상용 및 산업용 PV 인버터 시장 규모는 2024년 170억 달러에 달했고, CAGR 12%로 성장해 2034년까지 560억 달러에 이를 것으로 추정됩니다.

이 성장을 가속하는 주요 요인은 전력 가격이 불안정해지고 기업이 보다 예측 가능하고 지속 가능한 에너지원을 요구하게 되었다는 것입니다. 태양에너지의 효율적인 변환과 일상 업무에의 통합을 확실히 하는데 중요한 역할을 하고 있습니다. 이 시프트는 주로, 운영 비용의 삭감, 에너지 효율의 향상, 지속가능성의 기준의 고조에 대응을 목적으로 하고 있습니다.

상업용 빌딩과 제조 장비에서 전력 수요가 급증하는 가운데, 태양광 인버터는 기업이 에너지 소비를 최적화하고, 피크 부하를 관리하고, 이산화탄소 감소 목표를 달성하는 데 도움이 되는 중요한 도구로 등장했습니다. 이를 반영하고 빌딩의 에너지 관리 시스템과의 통합이 보편화되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 170억 달러 |

| 예측 금액 | 560억 달러 |

| CAGR | 12% |

세계 각국의 정부와 민간 단체가 재생에너지 도입을 향해 보다 적극적인 목표를 내걸고 있으며, PV 인버터 수요를 더욱 밀어 올리고 있습니다. 넷 미터링 및 재생에너지 크레디트와 같은 정책은 특히 상업 및 산업 응용 분야에서 태양에너지 솔루션을 채택하기위한 긍정적인 비즈니스 사례를 계속 만들고 있습니다. 기후 변화와 에너지안보에 대한 의식이 높아짐에 따라 에너지 자급을 우선하는 기업이 늘어나고 있으며, 인버터는 그 전략에 필수적인 것으로 되어 컴팩트하고 고효율, 저전압 인버터 시스템이 유리합니다. 가용성으로써 태양광 기술이 보다 폭넓은 용도로 이용 가능하게 되어 공간과 인프라의 제약을 극복하는데 도움이 되고 있습니다.

그러나 무역 관련 과제, 특히 수입 태양전지 부품에 부과되는 관세는 시장의 기세에 약간의 제약을 가져올 것으로 예측됩니다. 장벽은 특히 경쟁가격의 고성능 인버터의 입수가 이미 한정되어 있는 경우에는 공급체인에도 부담을 줄 수 있습니다.

제품 유형별로 볼 때 시장은 스트링 인버터, 마이크로 인버터, 센트럴 인버터로 나뉩니다. 향상된 확장성을 통해 상업시설의 옥상 및 중규모 산업용 설비에 선호되는 옵션이 되었습니다.

시장 세분화에서는 상 구성 관점에서 단상 시스템과 삼상 시스템으로 구분됩니다. 금형 상업용 빌딩과 같은 대규모 용도의 사용을 확대하는 데 도움이 되고 있습니다.

지역별로는 미국이 주요 시장으로 부상하고 있으며, 상용 및 산업용 PV 인버터 산업은 2023년 25억 달러, 2022년 22억 달러에서 2024년에는 29억 달러에 달했습니다.

선도적인 제조업체는 생산 능력 확대, 연구 개발 및 고성능 용도를 위해 설계된 첨단 인버터 출시 등에 많은 투자를 실시했습니다. 특히 대규모 상업용 및 산업용 프로젝트를 확보하기 위해 태양광 발전 개발자 뿐만 아니라 엔지니어링, 조달, 건설 회사와의 공동 개발도 일반적으로 되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 에코시스템

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율

- 전략적 대시보드

- 전략적 노력

- 경쟁 벤치마킹

- 혁신과 지속가능성의 정세

제5장 시장 규모와 예측 : 제품별, 2021-2034년

- 주요 동향

- 스트링

- 마이크로

- 센트럴

제6장 시장 규모와 예측 : 상별, 2021-2034년

- 주요 동향

- 단상

- 삼상

제7장 시장 규모와 예측 : 접속성별, 2021-2034년

- 주요 동향

- 독립형

- 그리드

제8장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 이탈리아

- 폴란드

- 네덜란드

- 오스트리아

- 영국

- 프랑스

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 멕시코

- 칠레

제9장 기업 프로파일

- Canadian Solar

- Delta Electronics

- Darfon Electronics

- Eaton

- Fimer Group

- Ginlong Technologies

- GoodWe

- Growatt New Energy

- Huawei Technologies

- Schneider Electric

- SMA Solar Technology

- Sungrow

- SolarEdge Technologies

- Sineng Electric

- Tabuchi Electric

The Global Commercial and Industrial PV Inverter Market was valued at USD 17 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 56 billion by 2034. A major factor driving this growth is the rising instability in electricity prices, prompting businesses to seek more predictable and sustainable energy sources. Commercial and industrial facilities are increasingly turning to solar photovoltaic systems, with inverters playing a crucial role in ensuring the effective conversion and integration of solar energy into everyday operations. This shift is primarily aimed at reducing operational costs, improving energy efficiency, and meeting rising sustainability standards.

As power demands continue to surge across commercial buildings and manufacturing units, solar inverters have emerged as vital tools to help companies optimize their energy consumption, manage peak loads, and meet carbon reduction goals. Their integration with building energy management systems is becoming more common, reflecting the rising need for smarter energy solutions. Companies are not only driven by cost-saving motives but also by mounting pressure to reduce their environmental impact, which is reinforcing the demand for solar-based technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17 Billion |

| Forecast Value | $56 Billion |

| CAGR | 12% |

Governments and private organizations worldwide are setting more aggressive targets for renewable energy adoption, further fueling demand for PV inverters. These goals are supported by favorable regulations and incentive programs aimed at accelerating the shift to solar energy. Policies such as net metering and renewable energy credits continue to create a positive business case for adopting solar energy solutions, especially in commercial and industrial applications. As awareness of climate change and energy security rises, more enterprises are prioritizing energy independence, and inverters are becoming an essential part of that strategy. In addition, the growing availability of compact, high-efficiency, low-voltage inverter systems is making solar technology more viable for a wider range of applications, helping businesses overcome space and infrastructure limitations. This is particularly important for companies operating in urban areas where real estate and installation space come at a premium.

However, trade-related challenges, particularly tariffs imposed on imported solar components, are expected to pose some limitations on the market's momentum. Increased procurement costs for solar equipment can delay project timelines and result in budget overruns for commercial and industrial developers. These barriers could also strain the supply chain, especially when the availability of competitively priced high-performance inverters is already limited. Despite these headwinds, the overall outlook for the market remains strong due to consistent innovation and investments in inverter technology tailored for industrial-grade installations.

Based on product type, the market is divided into string, micro, and central inverters. The string inverter segment is projected to expand at a CAGR exceeding 12% through 2034. Demand for this category is primarily fueled by improvements in design, efficiency, and system scalability, making it a preferred choice for commercial rooftops and mid-sized industrial installations. As solar project developers seek more flexible and modular options, string inverters are becoming increasingly popular across various deployment scales.

In terms of phase configuration, the commercial and industrial PV inverter market is segmented into single phase and three phase systems. The three phase segment accounted for 95.5% of the global market share in 2024, supported by its growing use in large-scale applications such as factory complexes, warehouses, and multi-tenant commercial buildings. Three phase inverters are more efficient for handling high power loads and are better suited for integration with grid systems, which makes them ideal for large-scale installations.

Regionally, the United States has emerged as a key market, with its commercial and industrial PV inverter industry reaching USD 2.9 billion in 2024, up from USD 2.5 billion in 2023 and USD 2.2 billion in 2022. North America held a 17.3% share of the global market in 2024, and this is expected to increase by the end of the forecast period. A robust domestic manufacturing base and faster delivery timelines are helping to accelerate inverter adoption across commercial and industrial installations in the U.S. Market growth is also being reinforced by government-backed initiatives that promote clean energy and reward the use of domestically produced components.

Leading manufacturers are investing heavily in capacity expansion, research and development, and the launch of advanced inverters designed for high-performance applications. These companies are also extending their global reach through strategic partnerships and distribution networks that enable quicker response times and better local service. Collaborations with engineering, procurement, and construction firms, as well as solar developers, have become common, especially for securing large-scale commercial and industrial projects. Local manufacturing and support services continue to be key differentiators in markets with high growth potential.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Standalone

- 7.3 On grid

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Poland

- 8.3.4 Netherlands

- 8.3.5 Austria

- 8.3.6 UK

- 8.3.7 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Canadian Solar

- 9.2 Delta Electronics

- 9.3 Darfon Electronics

- 9.4 Eaton

- 9.5 Fimer Group

- 9.6 Ginlong Technologies

- 9.7 GoodWe

- 9.8 Growatt New Energy

- 9.9 Huawei Technologies

- 9.10 Schneider Electric

- 9.11 SMA Solar Technology

- 9.12 Sungrow

- 9.13 SolarEdge Technologies

- 9.14 Sineng Electric

- 9.15 Tabuchi Electric