|

시장보고서

상품코드

1766329

전기 및 증기 발생 폐열 회수 시스템 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Electricity and Steam Generation Waste Heat Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

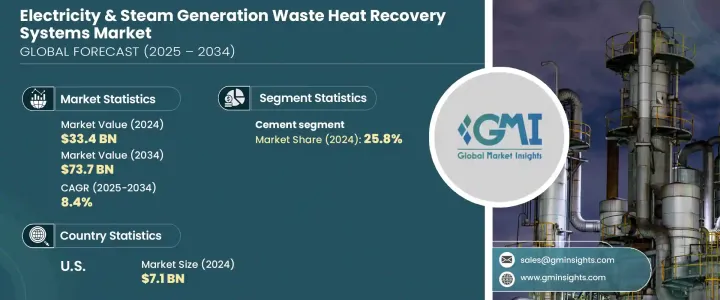

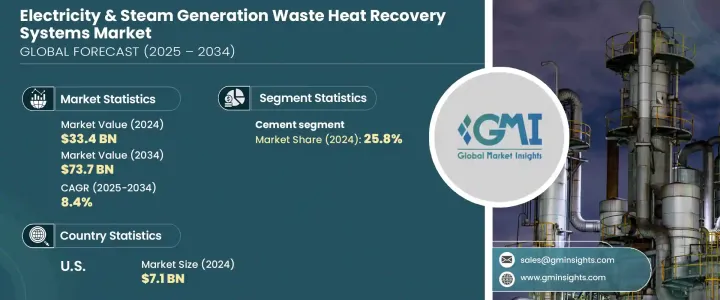

세계의 전기 및 증기 발생 폐열 회수 시스템 시장은 2024년 334억 달러로 평가되었으며 CAGR 8.4%로 성장하여 2034년 737억 달러에 이를 것으로 추정되고 있습니다.

이러한 급성장은 세계의 에너지 효율 중시 정책 전환과 환경 컴플라이언스의 엄격화에 크게 뒷받침되고 있습니다. 기업들이 에너지 효율을 향상시키면서 운전 경비의 절감을 목표로 하면서 산업 전체의 채용이 계속 확대되고 있습니다.

지역 난방 인프라에 전기을 공급하는 폐열 회수의 역할은 점점 더 중요해지고 있습니다. 도시가 보다 친환경적인 에너지 프레임워크의 도입을 모색하면서 이러한 솔루션은 순환적인 자원 이용과 보다 스마트한 에너지 계획을 위한 길을 제공합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 334억 달러 |

| 예측 금액 | 737억 달러 |

| CAGR | 8.4% |

증기 랭킨 사이클은 유리, 철강, 시멘트 등의 고온 제조 부문에서 열을 회수하기 위한 기본 요소로 인기를 모으고 있습니다.칼리나 사이클의 점유율은 작지만 높은 열효율을 필요로 하는 선택적인 용도를 위해 지속적으로 투자가 이루어지고 있습니다.

2024년 시멘트 분야의 점유율은 25.8%였습니다. 가장 에너지 집약적인 산업 중 하나로 알려진 시멘트 제조업체는 배출 목표를 달성하기 위해 폐열 회수 시스템의 채용을 늘리고 있습니다. 재생 가능 에너지 의무화(RPO)는 기업이 WHRS에 투자하는 강한 동기가 되고 있습니다.

미국의 전기 및 증기 발생 폐열 회수 시스템 시장은 2024년에 71억 달러에 이르렀으며, 북미가 21.3%의 점유율을 차지했습니다. 보다 깨끗한 에너지를 요구하는 움직임은 산업용 에너지 수요 증가와 함께 발전 및 증기 발생 응용 분야에서 이러한 시스템의 채택을 계속 추진하고 있습니다.

전기 및 증기 발생 폐열 회수 시스템 시장을 형성하는 주요 기업은 Siemens Energy, Climion, Mitsubishi Heavy Industries, Thermax Limited, Bosch Industriekessel GmbH, Fortum, IHI Corporation, Forbes Marshall, General Electric, Ormat, HRS, AURA, Viessman, Promec Engineering, Exergy International SRL, BIHL, Rentech Boilers, Sofinter S.p.A, Durr Group, Cochran 등이 있습니다.

전기 및 증기 발생 폐열 회수 시스템 시장의 기업은 시장에서의 존재감을 확고하게 하기 위해 기술 업그레이드와 통합 솔루션에 주력하고 있습니다. 철강, 시멘트, 석유 화학 등의 에너지를 다량 소비하는 부문과의 전략적 제휴를 통해 고객의 요구에 맞춘 맞춤형 설치를 실현하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 전략적 대시보드

- 전략적 노력

- 경쟁 벤치마킹

- 혁신과 기술의 상황

제5장 시장 규모와 예측 : 유형별(2021-2034년)

- 주요 동향

- 증기 랭킨 사이클

- 유기 랭킨 사이클

- 칼리나 사이클

제6장 시장 규모와 예측 : 온도별(2021-2034년)

- 주요 동향

- 230°C

- 230°C-650°C

- 650°C 이상

제7장 시장 규모와 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 석유 정제

- 시멘트

- 중금속 제조

- 화학약품

- 펄프 및 종이

- 식음료

- 유리

- 기타

제8장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

제9장 기업 프로파일

- AURA

- BIHL

- Bosch Industriekessel GmbH

- Climeon

- Cochran

- Durr Group

- Exergy International SRL

- Forbes Marshall

- Fortum

- General Electric

- HRS

- IHI Corporation

- Mitsubishi Heavy Industries Ltd.

- Ormat

- Promec Engineering

- Rentech Boilers

- Siemens Energy

- Sofinter Spa

- Thermax Limited

- Viessman

The Global Electricity and Steam Generation Waste Heat Recovery Systems Market was valued at USD 33.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 73.7 billion by 2034. This surge is largely supported by policy shifts emphasizing energy efficiency and stricter environmental compliance worldwide. Government support has proven instrumental in creating favorable conditions for the deployment of waste heat recovery technologies. Adoption across industrial operations continues to grow as businesses aim to cut operational expenses while improving overall energy performance. Supportive regulations, coupled with rising energy costs, are prompting industry to integrate recovery systems as a sustainable solution.

Waste heat recovery's role in powering district heating infrastructure is becoming increasingly relevant. These systems make use of residual thermal energy that would otherwise go unused during production processes or power generation. When redirected to centralized heating grids, this energy significantly reduces reliance on conventional fuels, thus lowering emissions. As cities seek to implement greener energy frameworks, these solutions offer a pathway to circular resource use and smarter energy planning. These benefits strengthen the market potential by appealing to energy planners focused on reducing waste and boosting system-wide performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.4 Billion |

| Forecast Value | $73.7 Billion |

| CAGR | 8.4% |

The steam Rankine cycle remains the cornerstone for recovering heat from high-temperature manufacturing sectors like glass, steel, and cement. Growing regulatory focus on lowering industrial carbon intensity is accelerating the modernization of these systems. Additionally, the Organic Rankine Cycle is gaining traction due to its suitability in low- to medium-temperature settings, supported by public investment. Although the Kalina Cycle holds a smaller share, it continues to receive funding for selective applications that require high thermal efficiency. Altogether, these cycles point to a broader international momentum around implementing cleaner energy conversion technologies for enhanced sustainability.

In 2024, the cement segment generated a 25.8% share. Known for being one of the most energy-intensive industries, cement producers are increasingly adopting waste heat recovery systems to meet emission goals. Incentive programs and renewable power obligations (RPOs) across various regions have provided strong motivation for companies to invest in WHRS. In some jurisdictions, energy generated through these systems qualifies as renewable, giving producers additional compliance and economic benefits.

United States Electricity & Steam Generation Waste Heat Recovery Systems Market reached USD 7.1 billion in 2024, with North America capturing a 21.3% share. A focus on energy policy reform, combined with the integration of renewable technologies, has played a pivotal role in increasing demand for waste heat recovery solutions across the region. The push for cleaner energy, coupled with rising industrial energy demand, continues to drive the adoption of these systems in electricity and steam generation applications.

Key players shaping the Electricity & Steam Generation Waste Heat Recovery Systems Market include Siemens Energy, Climeon, Mitsubishi Heavy Industries Ltd., Thermax Limited, Bosch Industriekessel GmbH, Fortum, IHI Corporation, Forbes Marshall, General Electric, Ormat, HRS, AURA, Viessman, Promec Engineering, Exergy International SRL, BIHL, Rentech Boilers, Sofinter S.p.A, Durr Group, and Cochran.

Companies in the electricity & steam generation waste heat recovery systems market are focusing on technology upgrades and integrated solutions to solidify their market presence. Many are investing in R&D to develop more compact, efficient systems that cater to both high- and low-temperature industrial processes. Strategic collaborations with energy-intensive sectors such as steel, cement, and petrochemicals are enabling customized installations tailored to client requirements. Firms are also expanding their geographic footprint through mergers, acquisitions, and partnerships, especially in regions with growing industrial bases.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam rankine cycle

- 5.3 Organic rankine cycle

- 5.4 Kalina cycle

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230 °C

- 6.3 230 °C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Petroleum refining

- 7.3 Cement

- 7.4 Heavy metal manufacturing

- 7.5 Chemical

- 7.6 Pulp & paper

- 7.7 Food & beverage

- 7.8 Glass

- 7.9 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 AURA

- 9.2 BIHL

- 9.3 Bosch Industriekessel GmbH

- 9.4 Climeon

- 9.5 Cochran

- 9.6 Durr Group

- 9.7 Exergy International SRL

- 9.8 Forbes Marshall

- 9.9 Fortum

- 9.10 General Electric

- 9.11 HRS

- 9.12 IHI Corporation

- 9.13 Mitsubishi Heavy Industries Ltd.

- 9.14 Ormat

- 9.15 Promec Engineering

- 9.16 Rentech Boilers

- 9.17 Siemens Energy

- 9.18 Sofinter S.p.a

- 9.19 Thermax Limited

- 9.20 Viessman