|

시장보고서

상품코드

1773325

흡입형 생물학적 제제 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측Inhalable Biologics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

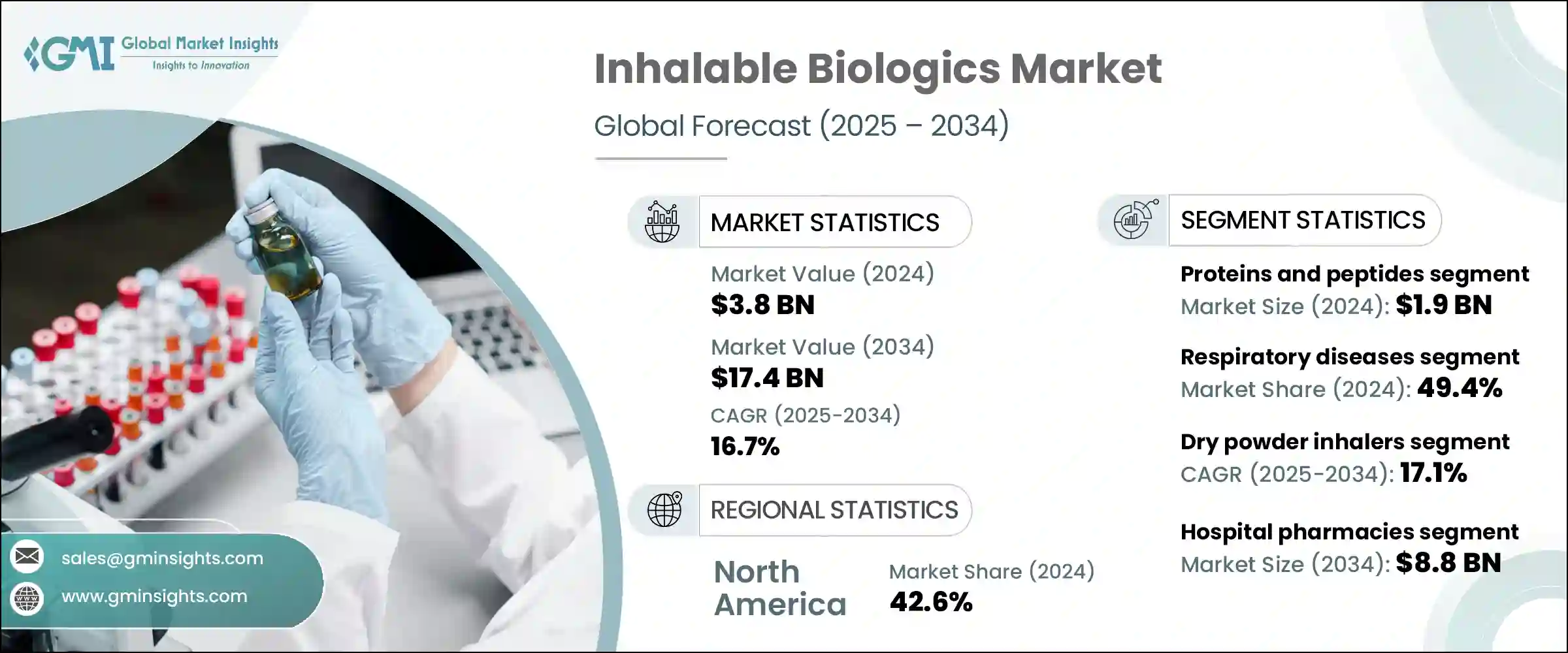

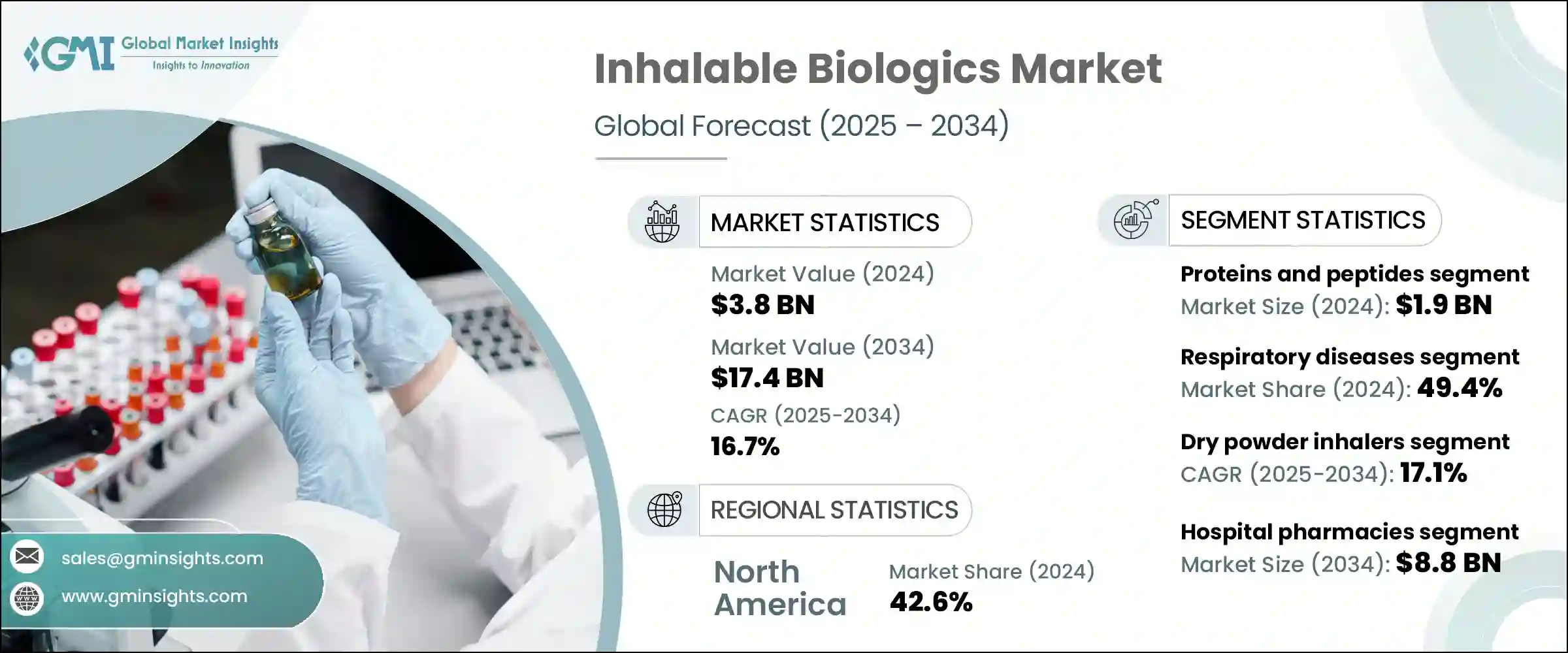

세계의 흡입형 생물학적 제제 시장은 2024년에는 38억 달러로 평가되었으며 CAGR 16.7%로 성장하여 2034년에는 174억 달러에 이를 것으로 추정됩니다.

이 성장은 천식, 낭포성 섬유증, 만성 폐색성 폐질환(COPD), 폐감염과 같은 만성 및 급성 호흡기질환의 이환율이 증가하는 것이 주요 요인입니다. 이에 따라 효과적인 치료 옵션의 필요성이 높아지고 있습니다. 미국 식품의약국(FDA)이나 유럽 의약품청(EMA)과 같은 규제기관은 이러한 의료 요구를 충족시키기 위해 흡입형 생물학적 제제의 개발과 승인을 적극적으로 지원하고 있습니다.

정부의 이니셔티브, 공개 회사와 바이오 의약품회사의 파트너십, 연구개발에 대한 많은 투자가 이러한 치료에 대한 액세스와 구매의 용이성을 개선함으로써 시장의 성장을 더욱 촉진하고 있습니다. 흡입형 생물학적 제제는 호흡기에 투여하기 위해 특화된 생물학적 제제의 생성, 제조 및 전달을 포함합니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 38억 달러 |

| 예측금액 | 174억 달러 |

| CAGR | 16.7% |

2024년에는 단백질과 펩티드 분야가 19억 달러의 평가액으로 시장을 선도했습니다. 단백질과 펩티드는 다양한 만성질환 가운데 특히 호흡기질환과 대사질환의 치료에 매우 매력적입니다.

드라이파우더 흡입기 부문은 2024년 CAGR 17.1%를 달성하였습니다. DPI는 스프레이와 MDI에 비해 편리하고 휴대성이 뛰어나 사용하기 편리한 옵션이기 때문에 특히 만성질환의 장기 치료에서 환자의 추가적인 순응도 향상으로 이어집니다. 단일클론항체, 백신, 펩티드와 같은 치료용 생물학적 제제를 폐의 깊은 곳까지 전달하는 DPI의 능력은 치료 효과를 높이므로 보급이 확산되고 있습니다.

미국의 흡입형 생물학적 제제 시장은 2024년에 14억 달러를 차지하였고, CAGR 16.7%로 꾸준히 성장하고 있습니다. 미국에서는 증가하는 대기오염으로 인해 코 막힘과 같은 호흡기질환이 증가하고 있으며 흡입형 생물학적 제제 수요를 촉진하고 있습니다. 미국 FDA는 규제 프레임워크나 희귀의약품 지정 등의 인센티브 프로그램을 통해, 흡입형 생물학적 제제의 개발과 승인을 장려하는 매우 중요한 역할을 하고 있습니다.

세계의 흡입형 생물학적 제제 시장에서 경쟁하는 주요 기업으로는 AstraZeneca, Mannkind, United Therapeutics, Chiesi Pharmaceuticals, Merxin, Boehringer Ingelheim, Kamada Pharmaceuticals, Teva Pharmaceutical, AbbVie, CanSino Biologics, F Roche 등이 있습니다. 이러한 주요 기업은 세계적으로 기술 혁신과 시장 확대를 추진하고 있으며 부작용을 최소화하면서 약물전달 효율과 환자 컴플라이언스를 극대화하는 차세대 흡입장치에 투자하고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 호흡기질환의 유병률의 상승

- 비침습적인 약물전달 방법에 대한 관심 증가

- 재택 및 자기관리요법 수요 증가

- 흡입기와 생물학적 제제의 기술적 진보

- 업계의 잠재적 리스크 및 과제

- 특정 흡입형 생물학적 제제의 안정성과 보존 기간이 한정됨

- 높은 개발 생산 비용

- 시장 기회

- 신흥시장의 현지 제조업에 대한 투자 증가

- 액세스와 저렴한 가격을 위한 민관 파트너십

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 파이프라인 분석

- 장래 시장 동향

- 기술의 상황

- 현재의 기술 동향

- 신흥기술

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 단백질과 펩티드

- 백신

- 단일클론항체

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 호흡기질환

- 감염증

- 당뇨병

제7장 시장 추계 및 예측 : 제형별(2021-2034년)

- 주요 동향

- 드라이파우더 흡입기

- 정량분무식 흡입기

- 스프레이

- 소프트미스트 흡입기

제8장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 병원약국

- 소매약국

- 온라인약국

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- AbbVie

- AstraZeneca

- Boehringer Ingelheim

- CanSino Biologics

- Chiesi Pharmaceuticals

- F-Hoffman Roche

- Kamada Pharmaceuticals

- Mannkind

- Merxin

- Teva Pharmaceutical

- United Therapeutics

The Global Inhalable Biologics Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 17.4 billion by 2034. This growth is largely driven by the rising incidence of both chronic and acute respiratory illnesses, including asthma, cystic fibrosis, chronic obstructive pulmonary disease (COPD), and pulmonary infections. Factors such as increasing pollution levels, an aging global population, tobacco use, and genetic predispositions are accelerating the prevalence of these conditions, thereby intensifying the need for effective therapeutic options. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are actively supporting the development and approval of inhalable biologics to meet these unmet medical needs.

Government initiatives, partnerships between public sectors and biopharmaceutical companies, and substantial investments in research and development are further encouraging market growth by improving the accessibility and affordability of these treatments. Collectively, these elements are paving the way for significant opportunities within this dynamic market. Inhalable biologics encompass the creation, manufacturing, and delivery of biologic therapies specifically designed for respiratory administration. These therapies are delivered through a variety of devices such as dry powder inhalers (DPIs), nebulizers, soft mist inhalers, and metered dose inhalers (MDIs).

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 16.7% |

The proteins and peptides segment led the market in 2024, with a valuation of USD 1.9 billion. These biological molecules are favored for their high potency, specificity, and biological effectiveness when administered via inhalation, offering a non-invasive alternative to traditional injections. The rapid therapeutic onset and ability to provide localized treatment make proteins and peptides highly attractive for managing a range of chronic illnesses, particularly respiratory and metabolic disorders. Their efficacy in treating conditions like COPD, asthma, and cystic fibrosis has driven consistent demand. Additionally, the growing prevalence of respiratory ailments continues to fuel the need for inhalable proteins and peptides.

The dry powder inhalers segment held a 17.1% CAGR in 2024. DPIs enjoy significant market share due to their excellent stability, as biologics can be formulated in a dry state, avoiding the need for cold chain storage required by liquid formulations. This characteristic makes DPIs especially valuable for manufacturers targeting global distribution, including regions with limited refrigeration infrastructure. DPIs also offer a convenient, portable, and user-friendly option compared to nebulizers and MDIs, leading to improved patient adherence, especially for long-term treatment of chronic diseases. The capacity of DPIs to deliver therapeutic biologics deeply into the lungs-such as monoclonal antibodies, vaccines, and peptides-boosts their therapeutic effectiveness and supports their widespread adoption.

U.S. Inhalable Biologics Market accounted for USD 1.4 billion in 2024 and is growing steadily at a CAGR of 16.7%. The increasing pollution levels in the U.S. are contributing to a rise in respiratory problems like asthma, allergies, and nasal congestion. Heightened consumer awareness about air pollution's detrimental effects on respiratory health is driving demand for inhalable biologics as preventive and therapeutic options. The U.S. FDA plays a pivotal role by encouraging the development and approval of inhalable biologics through regulatory frameworks and incentive programs such as the Orphan Drug Designation. This regulatory environment, combined with growing patient demand and innovation, is propelling market growth in the country.

Leading companies competing in the Global Inhalable Biologics Market include AstraZeneca, Mannkind, United Therapeutics, Chiesi Pharmaceuticals, Merxin, Boehringer Ingelheim, Kamada Pharmaceuticals, Teva Pharmaceutical, AbbVie, CanSino Biologics, and F-Hoffman Roche. These key players continue to drive innovation and market expansion globally. To secure and enhance their market positions, companies in the inhalable biologics sector emphasize continuous research and development focused on improving drug delivery technologies and biologic formulation stability. They invest in next-generation inhaler devices that maximize drug deposition efficiency and patient compliance while minimizing side effects. Strategic collaborations and partnerships with regulatory agencies, research institutions, and healthcare providers help accelerate product approvals and expand market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Dosage form

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Increasing preference for non-invasive drug delivery methods

- 3.2.1.3 Growing demand for home-based and self-administered therapies

- 3.2.1.4 Technological advancements in inhalation devices and biologics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited stability and shelf-life of certain inhalable biologics

- 3.2.2.2 High development and production costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing investment in local manufacturing in emerging markets

- 3.2.3.2 Public-private partnerships for access and affordability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Technology landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proteins and peptides

- 5.3 Vaccines

- 5.4 Monoclonal antibodies

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Respiratory diseases

- 6.3 Infectious diseases

- 6.4 Diabetes

Chapter 7 Market Estimates and Forecast, By Dosage Form, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dry powder inhalers

- 7.3 Metered dose inhalers

- 7.4 Nebulizers

- 7.5 Soft mist inhalers

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Boehringer Ingelheim

- 10.4 CanSino Biologics

- 10.5 Chiesi Pharmaceuticals

- 10.6 F-Hoffman Roche

- 10.7 Kamada Pharmaceuticals

- 10.8 Mannkind

- 10.9 Merxin

- 10.10 Teva Pharmaceutical

- 10.11 United Therapeutics