|

시장보고서

상품코드

1773402

하이니켈 양극재(NMC 811) 시장(2025-2034년) : 기회, 성장 촉진요인, 산업 동향 분석, 예측High-Nickel Cathodes (NMC 811) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

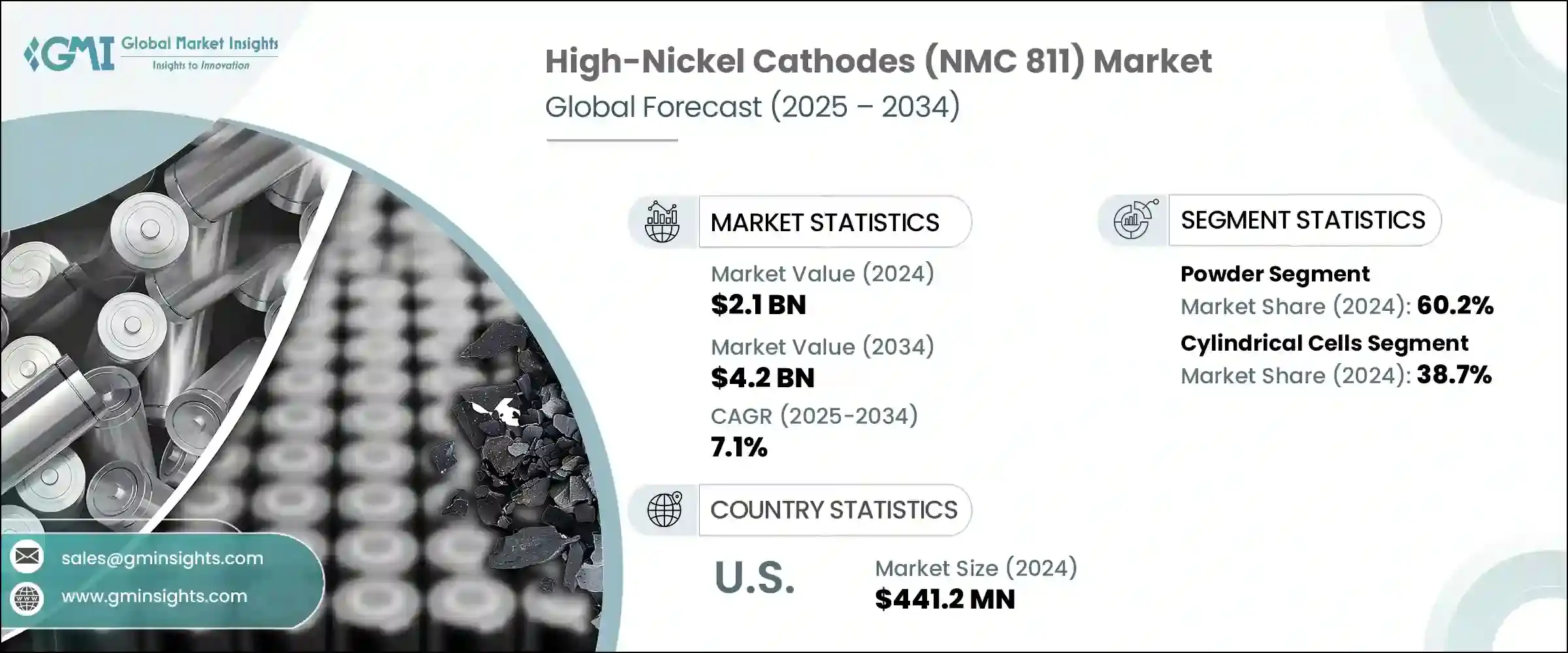

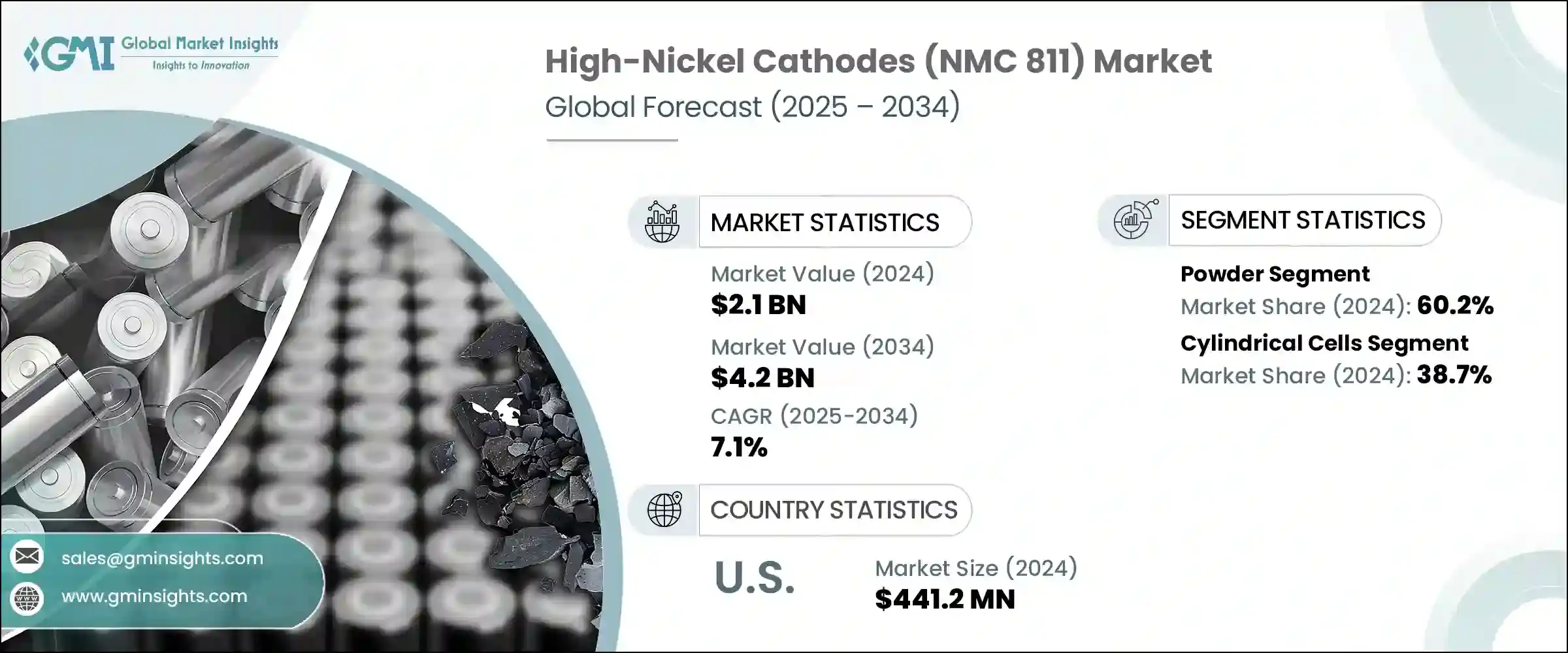

세계의 하이니켈 양극재(NMC 811) 시장은 2024년에 21억 달러로 평가되었으며 CAGR 7.1%로 성장하여 2034년에는 42억 달러에 이를 것으로 추정됩니다.

이 성장은 전기자동차와 대규모 에너지 저장에 사용되는 고성능 리튬이온 배터리의 요구가 급증하고 있기 때문입니다. NMC 811 양극재는 에너지 밀도와 열안정성이 뛰어납니다. 기업은 코발트 조달과 관련된 위험 노출을 최소화하면서 운행거리가 더 긴 EV에 대한 수요를 충족시키기 위해 니켈이 풍부한 화학물질에 주목하고 있습니다.

배터리 제조업체는 안정성 향상, 에너지 유지력 개선, 효율적인 열 성능을 가능하게 하는 양극재의 설계와 제조에 혁신을 도입하고 있습니다. 니켈-철-알루미늄과 같은 대체 조성도 코발트의 사용을 줄이기 위해 연구되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 21억 달러 |

| 예측금액 | 42억 달러 |

| CAGR | 7.1% |

분말 NMC 811 재료 부문은 2024년에 60.2%의 점유율을 차지했으며, 그 우위성은 리튬이온의 이동을 촉진하는 표면적의 크기에 따른 우수한 전기화학적 거동에 기인합니다. 기가팩토리를 통해 세계의 제조산업이 확대되는 가운데, 분말 유형은 자동화된 배터리 제조 시스템과의 호환성으로 보급이 확대되고 있습니다. 또한, 열화를 억제해 전지 수명을 연장하는 코팅이나 소결 공정에 견딜 수 있기 때문에 최신의 전지 기술에서 최선의 선택지가 되고 있습니다.

원통형 셀 부문은 2024년에 38.7%의 점유율을 차지했습니다. NMC 811 양극재를 통합함으로써 원통형 셀은 더 큰 에너지 출력과 향상된 열 제어능력을 실현할 수 있습니다.

미국의 2024년 하이니켈 양극재(NMC 811) 시장 규모는 4억 4,120만 달러를 달성하였습니다. 북미 전체의 성장은 미국이 견인하고 있으며, 미국은 국내 배터리 공급망과 EV 인프라에 많은 투자를 하고 있습니다. 정부에 의해 지원되는 미국은 하이니켈 화학을 지원하는 강력한 제조 생태계를 확립하고 있으며 NMC 811 양극재를 적극적으로 채용하고 있습니다. 전지 성능의 최적화와 재료의 윤리적 조달에 대한 관심 증가도 이 지역에서 시장 확대에 기여하고 있습니다.

하이니켈 양극재(NMC 811) 시장 기업은 LG Chem, L&F Co, Ningbo Ronbay New Energy Technology, Ecopro BM, Contemporary Amperex Technology 등을 포함하고 있으며, 모두 혁신, 비용 효율성, 제품 신뢰성으로 경쟁하고 있습니다. NMC 811 업계에서 경쟁력을 얻기 위해 주요 기업은 에너지 밀도를 개선하고 코발트 함량을 줄인 차세대 화학물질을 생산하기 위한 R&D 투자를 중시하고 있습니다. 공급망의 현지화와 후방 통합은 조달 위험을 억제하기 위해 우선시되고 있습니다.

목차

제1장 조사방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 가격 동향

- 지역별

- 형태별

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)

- 주요 수출국

- 주요 수입국

- 지속 가능성과 환경 측면

- 지속 가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경친화적인 노력

- 탄소발자국의 고려

제4장 경쟁구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 기업 매트릭스 분석

- 주요 시장기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 재료별(2021-2034년)

- 주요 동향

- 분말

- 과립

- 기타

제6장 시장 추계 및 예측 : 전지 유형별(2021-2034년)

- 주요 동향

- 원통형 셀

- 각기둥 셀

- 파우치 셀

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 전기자동차

- 배터리 전기자동차

- 플러그인 하이브리드 전기자동차

- 하이브리드 전기자동차

- 상용 전기자동차

- 에너지 저장 시스템

- 유틸리티 및 산업용 스토리지

- 주택용 스토리지

- 상업 및 산업용 스토리지

- 가전

- 스마트폰

- 노트북과 태블릿

- 웨어러블 디바이스

- 기타

- 전동공구

- 전동자전거와 전동스쿠터

- 의료기기

- 항공우주 및 방위

- 기타

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제9장 기업 프로파일

- Contemporary Amperex Technology

- Ecopro BM

- Haldor Topsoe

- L&F Co.

- LG Chem

- NEI Corporation

- Ningbo Ronbay New Energy Technology

- Sumitomo Metal Mining

- Tanaka Chemical Corporation

- Targray Technology International

- TOB New Energy

- Toda Kogyo

- Umicore

The Global High-Nickel Cathodes (NMC 811) Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 4.2 billion by 2034. This growth stems from the surging need for high-performance lithium-ion batteries used in electric vehicles and large-scale energy storage. With a composition of 80% nickel, 10% manganese, and 10% cobalt, NMC 811 cathodes offer superior energy density and thermal stability. Their rising adoption is largely influenced by industry efforts to reduce dependency on cobalt, which remains expensive and faces supply chain challenges. Companies are turning to nickel-rich chemistries to meet the demands of longer-range EVs while minimizing risk exposure linked to cobalt sourcing.

Battery manufacturers are embracing innovations in cathode design and production that allow for enhanced stability, improved energy retention, and efficient thermal performance. These technological advances are critical to supporting the next generation of battery-powered transportation and grid storage. Alternative compositions such as nickel-iron-aluminum, are also being researched to eliminate cobalt use. Enhanced material processing techniques have boosted the performance and scalability of high-nickel cathodes, making them a reliable option for a broad range of energy applications across global industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 7.1% |

The powder-based NMC 811 materials segment held a 60.2% share in 2024. Their dominance is attributed to their superior electrochemical behavior, driven by a larger surface area that facilitates better lithium-ion movement. The powdered form also offers higher packing density and consistent particle structure, improving production efficiency. As global manufacturing ramps up through gigafactories, the powder variant's compatibility with automated battery production systems supports its widespread deployment. Furthermore, its ability to endure coating and sintering processes that reduce degradation and extend battery life has made it a top choice for modern battery technologies.

The cylindrical cells segment accounted for 38.7% share in 2024. These cells are popular for their durability, ease of assembly, and standardized format, which enables seamless integration into mass production. With the incorporation of NMC 811 cathodes, cylindrical cells can deliver greater energy output and improved thermal regulation. Their structural strength makes them highly reliable for high-performance applications in electric vehicles, industrial tools, and other energy-demanding systems.

U.S. High-Nickel Cathodes (NMC 811) Market was valued at USD 441.2 million in 2024. Growth across North America is being led by the U.S., which is heavily investing in domestic battery supply chains and EV infrastructure. Backed by federal incentives, the country is establishing a strong manufacturing ecosystem that supports high-nickel chemistry. Major auto manufacturers are actively integrating NMC 811 cathodes to support advanced EVs with longer ranges and more sustainable battery components. Increasing interest in battery performance optimization and ethical sourcing of materials also contributes to market expansion in the region.

High-Nickel Cathodes (NMC 811) Market players include LG Chem, L&F Co, Ningbo Ronbay New Energy Technology, Ecopro BM, and Contemporary Amperex Technology all competing on innovation, cost-efficiency, and product reliability. To gain a competitive edge in the high-nickel cathodes (NMC 811) industry, major companies are emphasizing R&D investments to create next-gen chemistries with improved energy density and reduced cobalt content. They are scaling up production capabilities to meet surging EV demand and forging partnerships with automakers and battery manufacturers. Supply chain localization and backward integration are being prioritized to limit sourcing risks. Additionally, companies are optimizing powder morphology and particle coatings to enhance cycle life, improve charging speeds, and support compatibility with high-voltage systems-all while ensuring regulatory compliance and sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection method

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Form

- 2.2.3 Battery type

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruption

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS Code)

- 3.11.1 Major exporting countries

- 3.11.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiative

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LATAM

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.7 Mergers & acquisitions

- 4.8 Partnerships & collaborations

- 4.9 New product launches

- 4.10 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021–2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Battery Type, 2021–2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cylindrical cells

- 6.3 Prismatic cells

- 6.4 Pouch cells

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Electric vehicles

- 7.2.1 Battery electric vehicles

- 7.2.2 Plug-in hybrid electric vehicles

- 7.2.3 Hybrid electric vehicles

- 7.2.4 Commercial electric vehicles

- 7.3 Energy storage systems

- 7.3.1 Utility & industrial storage

- 7.3.2 Residential storage

- 7.3.3 Commercial & industrial storage

- 7.4 Consumer electronics

- 7.4.1 Smartphones

- 7.4.2 Laptops and tablets

- 7.4.3 Wearable devices

- 7.4.4 Others

- 7.5 Power tools

- 7.6 E-bikes and E-scooters

- 7.7 Medical devices

- 7.8 Aerospace and defense

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Contemporary Amperex Technology

- 9.2 Ecopro BM

- 9.3 Haldor Topsoe

- 9.4 L&F Co.

- 9.5 LG Chem

- 9.6 NEI Corporation

- 9.7 Ningbo Ronbay New Energy Technology

- 9.8 Sumitomo Metal Mining

- 9.9 Tanaka Chemical Corporation

- 9.10 Targray Technology International

- 9.11 TOB New Energy

- 9.12 Toda Kogyo

- 9.13 Umicore