|

시장보고서

상품코드

1773465

동물 신경변성질환 진단 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Veterinary Neurodegenerative Disease Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

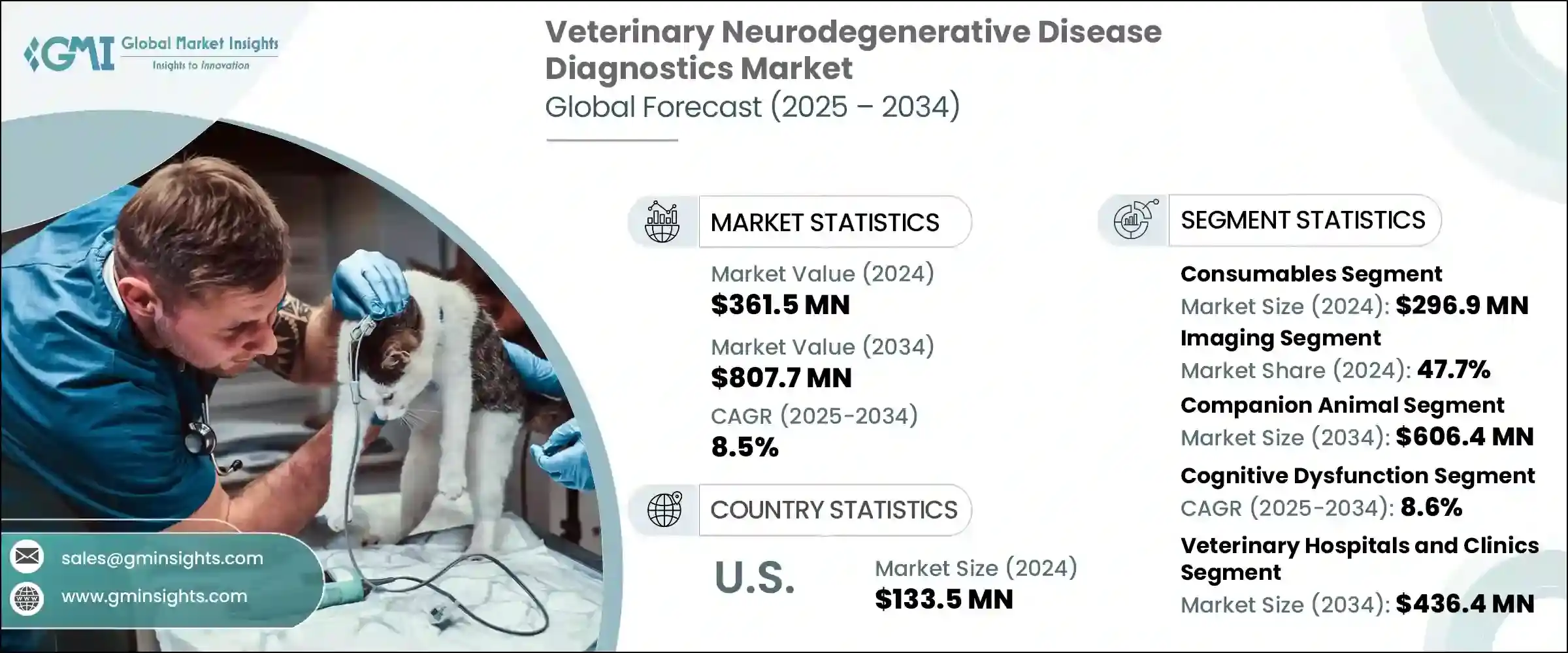

세계의 동물 신경변성질환 진단 시장은 2024년에는 3억 6,150만 달러가 되었고, CAGR 8.5%를 나타내, 2034년에는 8억 770만 달러에 이를 것으로 예측되고 있습니다.

2025년부터 2034년까지 연평균 8.5%의 성장률을 나타낼 것으로 예상되는 이러한 성장은 몇 가지 주요 요인에 의해 주도되고 있습니다. 수의학 신경학의 기술 발전은 진단 접근법을 재구성하는 데 중요한 역할을 합니다.

아시아태평양, 라틴아메리카, 아프리카의 일부 신흥 국가에서는 동물 병원과 이동 진료 유닛의 설립이 현저하게 증가하고 있습니다. 질병 예방에 초점을 맞춘 정부의 지원 정책도 관민의 투자를 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 3억 6,150만 달러 |

| 예측 금액 | 8억770만 달러 |

| CAGR | 8.5% |

동물 신경변성질환 진단 약물은 분석, 시약, 키트 및 기타 지원 구성 요소를 포함한 광범위한 장비 및 소모품으로 구성되어 있습니다. 소모품은 모든 진단 순서로 사용되므로, 항상 보충이 필요합니다.

검사 유형별로 시장은 영상 진단, 바이오마커 진단 검사, 기타 방법으로 분류됩니다. 즉각적으로 파악함으로써 신경학적 이상을 확인하는 데 중요한 역할을 하고 있습니다. 수의학적 환경에서의 CT와 MRI 기술의 통합이 진행됨에 따라 이러한 진단법의 가용성과 효능이 향상되어 시장 전체에서의 화상 진단의 우위성에 기여하고 있습니다.

동물 유형별로 보면 시장은 반려동물과 축산 동물로 구분됩니다. 신경질환에 대한 의식이 높아지고 반려동물 사육자의 전문진단에 대한 투자경향이 높아지고 있습니다.

적응증별로 분석하면 인지기능장애분야는 2034년까지 연평균 복합 성장률(CAGR) 8.6%를 나타낼 것으로 예측되며, 이는 동물에서의 노화와 관련된 신경쇠약의 발생이 증가하고 있는 것으로 배경에 있습니다. 이 질환은 특히 고령견에서 반려동물 주인과 수의사 전문가 사이에서 인지도가 높아지고 있습니다. 현재 진행 중인 연구와 새로운 진단 테스트의 개발을 통해 인지 문제를 보다 빠르고 정확하게 파악할 수 있어 수요 증가에 대응하고 있습니다.

최종 용도의 관점에서 시장은 동물 병원, 클리닉, 진단 실험실 및 기타 최종 사용자로 구분됩니다. 동물병원 및 클리닉은 2024년 주요 부문으로 떠올랐으며, 2034년에는 4억 3,640만 달러에 이를 것으로 예측됩니다. 이러한 기관은 일반적으로 고급 진단 도구와 대량의 샘플을 효율적으로 처리할 수 있는 숙련된 전문가를 갖추고 충분한 자원을 보유하고 있습니다. 정확하고 시기 적절한 진단을 제공하는 능력은 많은 주인에게 의존하는 존재입니다. 이미징 시스템과 신경 진단 인프라에 대한 투자는 이 분야에서의 이점을 더욱 견고하게 만듭니다.

지역별로 북미는 2024년 40.6%의 점유율로 세계 시장을 선도했습니다. 미국에서만 2024년 시장 규모는 1억 3,350만 달러에 이르렀고, 전년도 증가세가 계속되었습니다. 이 지역은 강력한 수의학 인프라, 높은 반려동물 사육률, 반려동물 건강에 대한 의식 증가 등의 혜택을 누리고 있습니다. 고급 동물 보건 서비스의 존재와 반려동물 보험의 보급도이 지역의 성장을 뒷받침하는 중요한 요소입니다. 게다가 도시와 농촌 지역에서 수의사 시설의 네트워크가 확대되고 있는 것도 시장 침투 확대에 기여하고 있습니다.

시장 상황경쟁 구도에는 세계 선도 기업과 지역 전문 기업이 혼합되어 있습니다. Health, Virbac, Zoetis 등의 주요 기업은 총 시장의 약 45%-50%를 차지하고 있습니다. 역량 확대와 같은 전략적 이니셔티브에 초점을 맞추고 그 지위를 강화하고 있습니다. 한편, 지역 및 지방공급자는 저렴한 가격의 진단 솔루션을 제공하고 시장에서의 존재를 확대하기 위해 합병과 제휴 등의 성장 전략을 채용함으로써 경쟁을 격화시키고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 동물에 있어서의 신경질환의 발생률 상승

- 동물 신경 생물학의 이해 향상

- 분자진단 및 화상 진단에 있어서의 기술 진보

- 펫의 사육수와 펫 헬스케어비 증가

- 반려동물 보험 적용 범위 확대

- 업계의 잠재적 위험 및 과제

- 검증이 끝난 바이오마커의 입수가 한정

- 수의 신경과 의사와 훈련을 받은 전문가의 부족

- 기회

- 수의사 인프라의 급속한 개발

- 진단에 있어서의 AI와 디지털 플랫폼 통합

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 현재의 기술 동향

- 신흥기술

- 장래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 소모품

- 기기

제6장 시장 추계·예측 : 검사 유형별(2021-2034년)

- 주요 동향

- 이미징

- MRI(자기 공명 화상)

- CT(컴퓨터 단층 촬영)

- 기타 화상 검사

- 바이오마커 진단 검사

- 뇌척수액(CSF) 바이오마커

- 혈액 기반 바이오마커

- 기타 바이오마커 진단 검사

- 기타 검사의 유형

제7장 시장 추계·예측 : 동물 유형별(2021-2034년)

- 주요 동향

- 반려동물

- 개

- 고양이

- 말

- 기타 반려동물

- 가축

- 소

- 양 및 염소

- 기타 가축

제8장 시장추계·예측 : 적응증별(2021-2034년)

- 주요 동향

- 인지기능장애

- 소뇌 위축증

- 해면상 뇌병증

- 기타 적응증

제9장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 동물병원 및 진료소

- 진단실험실

- 기타 용도

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- Antech Diagnostics

- Avacta Animal Health Limited

- ACUVET BIOTECH

- Carestream Health

- IDEXX Laboratories

- Life Diagnostics

- Neurologica Corporation

- Merck Animal Health

- MI : RNA Diagnostics

- Mercodia AB

- Neogen Corporation

- Randox Laboratories

- Siemens Healthineers

- Virbac

- Zoetis

The Global Veterinary Neurodegenerative Disease Diagnostics Market was valued at USD 361.5 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 807.7 million by 2034. This growth, occurring at a CAGR of 8.5% from 2025 to 2034, is being driven by several key factors. The rise in neurological disorders among animals, coupled with a surge in pet ownership and spending on animal healthcare, is pushing demand for accurate and accessible diagnostic tools. With both companion and livestock animal populations increasing rapidly across the globe, the need for advanced veterinary diagnostics has become more pressing than ever. Technological advancements in veterinary neurology are also playing a crucial role in reshaping diagnostic approaches. Innovations in imaging, biomarker testing, and the development of highly sensitive diagnostic kits have significantly improved the precision of disease detection.

Emerging economies in Asia-Pacific, Latin America, and parts of Africa are witnessing a notable boost in the establishment of veterinary clinics and mobile care units. These facilities are increasingly equipped with cutting-edge neurological diagnostic tools such as CT and MRI, helping improve diagnostic accuracy and treatment outcomes. Supportive government policies focused on animal health and disease prevention are also encouraging public-private investments. Major corporations in the veterinary healthcare space are expanding their service networks and entering into strategic partnerships with reference laboratories, enhancing the availability of diagnostics in underserved regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $361.5 Million |

| Forecast Value | $807.7 Million |

| CAGR | 8.5% |

Veterinary neurodegenerative disease diagnostics comprise a wide array of instruments and consumables, including assays, reagents, kits, and other supporting components. These are used to develop and apply diagnostic solutions that help in the identification and monitoring of neurological conditions in animals. The market, segmented by product type into consumables and instruments, saw the consumables category leading with a valuation of USD 296.9 million in 2024. Consumables are used in every diagnostic procedure and thus need constant replenishment. This repetitive use ensures a steady revenue stream and strengthens the demand for these products. Their single-use nature, ease of integration into veterinary workflows, and standardized formats offer convenience, consistency, and reliability-key factors that contribute to their widespread adoption in clinics and labs.

On the basis of test type, the market is categorized into imaging, biomarker diagnostic tests, and other methods. Imaging held the dominant market share of 47.7% in 2024. It plays a vital role in identifying neurological abnormalities by providing visual insights into structural issues associated with diseases like spinal degeneration or brain dysfunction. The increasing integration of CT and MRI technologies in veterinary settings has improved the availability and effectiveness of these diagnostic methods, contributing to the dominance of imaging in the overall market.

By animal type, the market is segmented into companion animals and livestock animals. The companion animal segment led the market in 2024 and is projected to reach USD 606.4 million by 2034. This segment benefits from rising pet ownership, increasing awareness of animal neurological conditions, and the growing tendency among pet owners to invest in specialized diagnostics. As age-related neurological disorders become more recognized in pets, the need for precise and early detection continues to grow, prompting further use of advanced diagnostic solutions.

When analyzed by indication, cognitive dysfunction segment is expected to register a CAGR of 8.6% through 2034, driven by the rising occurrence of age-related neurological decline in animals. This condition, particularly in older dogs, is gaining greater awareness among pet owners and veterinary professionals alike. Ongoing research and the development of new diagnostic tests are enabling the identification of cognitive issues with improved speed and accuracy, helping to meet growing demand.

In terms of end use, the market is segmented into veterinary hospitals and clinics, diagnostic laboratories, and other end users. Veterinary hospitals and clinics emerged as the leading segment in 2024 and are anticipated to reach USD 436.4 million by 2034. These institutions are typically well-resourced, with advanced diagnostic tools and skilled professionals capable of processing a high volume of samples efficiently. Their ability to deliver accurate and timely diagnoses makes them the go-to choice for many pet owners. Investments in imaging systems and neurodiagnostic infrastructure further solidify their dominance in this space.

Geographically, North America led the global market with a share of 40.6% in 2024. The United States alone reached a market value of USD 133.5 million in 2024, continuing its upward trend from previous years. The region benefits from strong veterinary infrastructure, high rates of pet ownership, and growing awareness regarding pet health. The presence of advanced animal healthcare services and increasing adoption of pet insurance policies are also important factors fueling regional growth. Additionally, the expanding network of veterinary facilities in both urban and rural areas contributes to broader market penetration.

The competitive landscape in the veterinary neurodegenerative disease diagnostics market features a mix of global giants and regional specialists. Leading companies such as IDEXX Laboratories, Merck Animal Health, Virbac, and Zoetis collectively hold approximately 45%-50% of the market. Their dominance is attributed to broad product portfolios, global reach, and consistent investment in technological innovation. These players are focusing on strategic initiatives like acquisitions, new product development, and geographic expansion to strengthen their positions. Meanwhile, regional and local providers are intensifying competition by offering affordable diagnostic solutions and adopting growth strategies such as mergers and collaborations to expand their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Test type

- 2.2.4 Animal type

- 2.2.5 Indication

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of neurological disorders in animals

- 3.2.1.2 Improved understanding of animal neurobiology

- 3.2.1.3 Technological advancements in molecular and imaging diagnostics

- 3.2.1.4 Growing pet ownership and pet healthcare spending

- 3.2.1.5 Expansion of companion animal insurance coverage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of validated biomarkers

- 3.2.2.2 Shortage of veterinary neurologists and trained professionals

- 3.2.3 Opportunities

- 3.2.3.1 Rapid veterinary infrastructure development

- 3.2.3.2 Integration of AI and digital platforms in diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging

- 6.2.1 MRI (magnetic resonance imaging)

- 6.2.2 CT (computed tomography)

- 6.2.3 Other imaging tests

- 6.3 Biomarker diagnostic tests

- 6.3.1 CSF (cerebrospinal fluid) biomarkers

- 6.3.2 Blood-based biomarkers

- 6.3.3 Other biomarker diagnostic tests

- 6.4 Other test types

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Sheep and goats

- 7.3.3 Other livestock animals

Chapter 8 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cognitive dysfunction

- 8.3 Cerebellar abiotrophy

- 8.4 Spongiform encephalopathies

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic laboratories

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Antech Diagnostics

- 11.2 Avacta Animal Health Limited

- 11.3 ACUVET BIOTECH

- 11.4 Carestream Health

- 11.5 IDEXX Laboratories

- 11.6 Life Diagnostics

- 11.7 Neurologica Corporation

- 11.8 Merck Animal Health

- 11.9 MI:RNA Diagnostics

- 11.10 Mercodia AB

- 11.11 Neogen Corporation

- 11.12 Randox Laboratories

- 11.13 Siemens Healthineers

- 11.14 Virbac

- 11.15 Zoetis