|

시장보고서

상품코드

1782162

염증성 장질환 치료 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Inflammatory Bowel Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

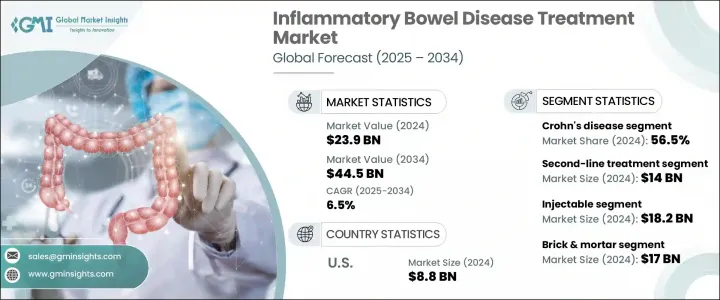

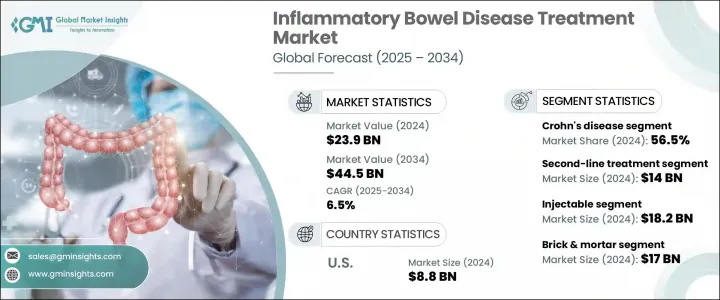

세계의 염증성 장질환(IBD) 치료 시장 규모는 2024년에 239억 달러로 평가되었고, CAGR 6.5%로 성장할 전망이며, 2034년에는 445억 달러에 이를 것으로 추정됩니다.

이 성장의 주요 요인은 크론 병과 궤양성 대장염을 포함한 IBD의 세계 유병률 상승과 조기 진단 및 치료 접근의 확대입니다. 식생활의 변화, 앉기 쉬운 라이프 스타일, 환경 요인이, 특히 선진국의 IBD 환자수의 증가에 기여하고 있습니다. 계몽 캠페인의 강화나 보다 유리한 진료 보수 체계에 의해, 진단율이나 환자의 애드히어런스가 향상되고 있습니다.

표적 생물학적 제제나 저분자 화합물 등의 치료 어프로치의 혁신에 의해 치료 성적이 현저하게 향상되어, 치료와 관련된 합병증이 감소하고 있습니다. 공적 자금이나 신속한 약사 심사 등의 형태로의 개발 지원도, 차세대 요법의 개발과 보급을 뒷받침하고 있습니다. 환자 수가 꾸준히 증가함에 따라 QOL을 개선하고 질병의 재연을 억제하는 장기적이고 효과적인 솔루션에 대한 수요가 계속 증가하고 있습니다. 이들 요인이 맞물려 IBD 치료는 향후 10년간 견고하고 역동적인 시장 환경을 형성하게 됩니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 239억 달러 |

| 예측 금액 | 445억 달러 |

| CAGR | 6.5% |

2024년 크론병 분야는 56.5%의 점유율을 차지했으며, 2025-2034년 CAGR 6.3%로 성장할 것으로 예측됩니다. 이 확대는 특히 북미와 유럽의 젊은 층 사이에서 새롭게 진단된 사례가 증가하고 있는 것이 주된 원인입니다. 크론병은 궤양성 대장염보다 복잡하고 장기적인 치료 접근을 필요로 하는 경향이 있습니다. 그 결과, 헬스케어 프로바이더는 면역억제제나 생물학적 제제와 같은 고가치의 치료약을 이용하게 되고 있습니다. 야누스키나아제 저해제나 항인테그린제 등 선진적인 치료제 클래스의 채택이 증가하고 있는 것은 이 질환의 관리 방법을 재정의하고 부문 성장에 크게 기여하고 있습니다.

주사 요법 분야는 2024년 182억 달러로 가장 높은 수익을 올렸으며 2034년까지 연평균 복합 성장률(CAGR) 6.4%를 유지할 것으로 예측됩니다. 이 분야는 생물학적 제제, 특히 단일클론항체의 보급이 견인하고 있으며, 일반적으로 주사에 의해 투여됩니다. 이 치료제들은 염증 경로를 정확하게 표적으로 함으로써 중등도에서 중증 IBD 치료의 기초가 되고 있습니다. 분자 수준에서 면역 활성을 조절하는 약제는 특히 기존의 약물요법에 반응하지 않는 환자에서 관해의 유지와 질환 재발 억제에 매우 효과적인 것으로 증명되었습니다. 장시간 작용형 주사제는 컴플라이언스율 향상과 환자 만족도 향상에도 기여하고 있습니다.

미국의 염증성 장질환 치료 2024년 시장 규모는 88억 달러로 평가되었습니다. 크론병과 궤양성 대장염의 이환율이 다양한 층에서 상승하고 있는 것이, 이 시장의 성장을 견인하고 있습니다. 진단 능력의 향상, 전문의에 대한 액세스 강화, 표적 치료의 확대 등이 시장 개발을 가속시키고 있습니다. 장시간 작용형의 피하 주사제나 서방형 제제 등의 혁신적인 약물전달 기술이 이용 가능하게 됨으로써, 치료의 어드히어런스가 향상하고 있습니다. 이러한 진보로 환자는 병리를 관리하기 쉬워지고 장기적인 관해를 유지하기 쉬워지기 때문에 첨단 치료제에 대한 수요가 더욱 높아지고 있습니다.

세계의 염증성 장 질환 치료 시장에서 사업을 전개하는 주요 기업으로는 Pfizer, Biogen, Takeda, Dr Falk, Johnson & Johnson, CELLTRION, AbbVie, Ferring, Merck, UCB, Novartis, Tillotts Pharma, Lilly, and Amgen. 등이 있습니다. 이러한 기업들은 전략적 투자와 혁신적인 의약품 개발을 통해 시장 방향에 계속 영향을 미치고 있습니다. IBD 치료 영역에서의 존재를 강화하기 위해, 주요 제약 기업은 연구 주도형 혁신, 규제 당국과의 참여, 공동 파트너십을 통해 다면적인 접근을 진행하고 있습니다.

각 회사는 효능이 향상되고 부작용이 적은 신규 생물학적 제제와 저분자를 개발하기 위해 임상시험에 많은 투자를 하고 있습니다. 라이선스 계약, 합병 및 인수를 통해 제품 파이프라인을 확장하는 것도 일반적인 전략입니다. 많은 기업들이 의료 당국과 긴밀하게 협력하여 조기 승인을 확보하고 폭넓은 상환 액세스를 확보하기 위해 노력하고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- IBD의 유병률 증가

- 기술적 진보

- 유리한 상환 정책

- IBD 증상의 인식 증가 및 조기 진단

- 업계의 잠재적 위험 및 과제

- 엄격한 규제 시나리오

- 높은 치료비

- 시장 기회

- 생물학적 제제 및 표적 요법의 채용 증가

- 신흥 시장으로 확대

- 성장 촉진요인

- 성장 가능성 분석

- 상환 시나리오

- 규제 상황

- 파이프라인 분석

- 투자 시나리오 전망

- 치료의 전환 패턴 및 순서의 동향

- 역학적 시나리오

- 장래 시장 동향 및 주된 시판 치료법

- 브랜드 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 세계

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 기업 매트릭스 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 치료 유형별(2021-2034년)

- 주요 동향

- 크론병

- 궤양성 대장염

제6장 시장 추계 및 예측 : 약제 클래스별(2021-2034년)

- 주요 동향

- 제1선택 치료

- 아미노살리실산염

- 코르티코스테로이드

- 제2선택 치료

- TNF 억제제

- IL 억제제

- JAK 억제제

- 항인테그린

- 병용 요법

- TNF 억제제 티오푸린

- 기타 병용 요법

제7장 시장 추계 및 예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 주사제

- 경구

제8장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 점포

- 전자상거래

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- AbbVie

- Amgen

- Biogen

- CELLTRION

- Dr Falk

- Ferring

- Johnson &Johnson

- Lilly

- Merck

- Novartis

- Pfizer

- Takeda

- Tillotts Pharma

- UCB

The Global Inflammatory Bowel Disease Treatment Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 44.5 billion by 2034. This growth is primarily driven by a rising global prevalence of IBD, including Crohn's disease and ulcerative colitis, as well as expanding access to early diagnosis and treatment. Changing diets, sedentary lifestyles, and environmental factors are contributing to the increasing number of IBD cases, especially in developed nations. Enhanced awareness campaigns and more favorable reimbursement structures are improving diagnosis rates and patient adherence.

Innovation in treatment approaches-such as targeted biologics and small molecules-has significantly advanced therapeutic outcomes and reduced treatment-related complications. Government support in the form of public funding and faster regulatory reviews is also encouraging the development and uptake of next-generation therapies. With the patient population growing steadily, demand continues to rise for long-term, effective solutions that improve quality of life and reduce disease flare-ups. Collectively, these factors are shaping a robust and dynamic market environment for IBD therapies over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $44.5 Billion |

| CAGR | 6.5% |

In 2024, the Crohn's disease segment held a 56.5% share and is forecasted to grow at a CAGR of 6.3% during 2025-2034. This expansion is largely attributed to an uptick in newly diagnosed cases among younger individuals, particularly across North America and Europe. Crohn's disease tends to require more complex and long-term treatment approaches than ulcerative colitis, given that it can affect any part of the gastrointestinal tract and penetrate deeper layers of tissue. As a result, healthcare providers are increasingly utilizing high-value therapies such as immunosuppressants and biologics. The growing adoption of advanced treatment classes, including Janus kinase inhibitors and anti-integrin agents, has redefined how the disease is managed and significantly contributed to segment growth.

The injectable therapies segment generated the highest revenue in 2024, valued at USD 18.2 billion, and is expected to maintain a CAGR of 6.4% through 2034. This category is led by the widespread use of biologics, particularly monoclonal antibodies, which are generally delivered via injection. These therapies have become the cornerstone for treating moderate to severe IBD by offering precision targeting of inflammation pathways. Agents that modulate immune activity at the molecular level are proving highly effective in maintaining remission and minimizing disease recurrence, especially for patients unresponsive to traditional medications. Long-acting injectables also contribute to higher compliance rates and improved patient satisfaction.

U.S. Inflammatory Bowel Disease Treatment Market was valued at USD 8.8 billion in 2024. Growth in this market is driven by a rising incidence of both Crohn's disease and ulcerative colitis across diverse demographics. Improved diagnostic capabilities, enhanced access to specialists, and expanding use of targeted therapies are all accelerating market development. The availability of innovative drug delivery technologies, such as long-acting subcutaneous injectables and sustained-release formulations, has improved treatment adherence. These advancements are making it easier for patients to manage their conditions and maintain long-term remission, further boosting demand for advanced therapeutics.

Key players operating in the Global Inflammatory Bowel Disease Treatment Market include Pfizer, Biogen, Takeda, Dr Falk, Johnson & Johnson, CELLTRION, AbbVie, Ferring, Merck, UCB, Novartis, Tillotts Pharma, Lilly, and Amgen. These companies continue to influence market direction through strategic investments and innovative drug development. To strengthen their presence in the IBD treatment space, leading pharmaceutical firms are advancing a multi-pronged approach that includes research-driven innovation, regulatory engagement, and collaborative partnerships.

Companies are investing significantly in clinical trials to develop novel biologics and small molecules with improved efficacy and fewer side effects. Expanding product pipelines through licensing deals, mergers, and acquisitions has also become a common strategy. Many are working closely with health authorities to secure accelerated approvals and ensure broad reimbursement access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Drug class trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of IBD

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favorable reimbursement policies

- 3.2.1.4 Growing awareness and early diagnosis of IBD symptoms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of biologics and targeted therapies

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.6 Pipeline analysis

- 3.7 Investment scenarios outlook

- 3.8 Treatment switching patterns or sequencing trends

- 3.9 Epidemiological scenario

- 3.10 Future market trends/ Key marketed therapies

- 3.11 Brand analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Crohn's disease

- 5.3 Ulcerative colitis

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 First-line treatment

- 6.2.1 Aminosalicylates

- 6.2.2 Corticosteroids

- 6.3 Second-line treatment

- 6.3.1 TNF inhibitors

- 6.3.2 IL inhibitors

- 6.3.3 JAK inhibitors

- 6.3.4 Anti-integrin

- 6.4 Combination therapy

- 6.4.1 TNF inhibitors + thiopurines

- 6.4.2 Other combination therapies

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Oral

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick & mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Biogen

- 10.4 CELLTRION

- 10.5 Dr Falk

- 10.6 Ferring

- 10.7 Johnson & Johnson

- 10.8 Lilly

- 10.9 Merck

- 10.10 Novartis

- 10.11 Pfizer

- 10.12 Takeda

- 10.13 Tillotts Pharma

- 10.14 UCB