|

시장보고서

상품코드

1797714

식이섬유 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Food Fibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

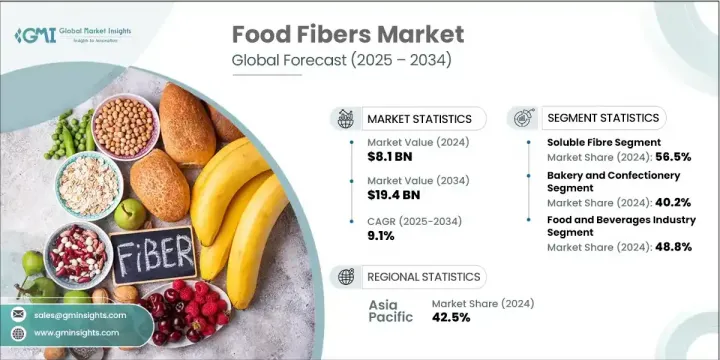

세계의 식이섬유 시장은 2024년에는 81억 달러로 평가되었으며 CAGR 9.1%로 성장하여 2034년까지 194억 달러에 이를 것으로 예측됩니다.

식이섬유는 난소화성 식물성 탄수화물이며, 특히 소화 건강, 혈당 조절, 식욕 조절 등 다양한 건강상의 이점을 제공합니다. 이 식이섬유는 과일, 콩류, 야채, 곡물에 자연적으로 포함되어 있으며 대체 유제품, 영양 강화 음료, 베이커리 제품 등 다양한 소모품에 포함되어 있습니다. 세계 소비자의 선호도가 기능적이고 건강한 식단으로 이동함에 따라 시장은 기세를 늘리고 있습니다.

이 동향은 식물 기반 생활의 추진, 장내 마이크로바이옴의 건강에 대한 의식의 높아짐, 식이섬유를 강화한 표시와 배합을 장려하는 지지적인 정책에 의해 더욱 증폭되고 있습니다. 마이크로캡슐화 및 고효율 압출 성형과 같은 식이섬유의 추출과 배합에 있어서의 새로운 혁신은 보다 고도로 매력적인 식품에 대한 문을 열고 있습니다. 제조업체는 천연 및 프리바이오틱스가 풍부한 클린 라벨 솔루션에 대한 수요 증가에 대응하기 위해 이러한 개발과 전략적으로 연계하고 있습니다. 진화하는 소비자의 라이프 스타일과 영양 의식에 뒷받침되는 기능성 섬유의 세계의 급속한 채용이이 업계의 강력한 성장에 대한 길을 열고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 81억 달러 |

| 예측 금액 | 194억 달러 |

| CAGR | 9.1% |

수용성 섬유는 2024년에 56.5%의 점유율을 차지했고, 46억 달러의 공헌이 되었습니다. 이눌린, 껌, 펙틴 등을 포함한 이러한 유형의 섬유는 유익한 미생물 먹이로 장 건강을 지원할 수 있기 때문에 식품 및 음료에 널리 사용됩니다. 그 용도는 식물성 우유와 발효 음료까지 및 식감과 영양 밀도 모두를 높이고 있습니다. 식품제조 공정에서도 수용성 식이섬유는 제품의 안정성과 입맛을 개선하고, 특히 감당유형이나 유제품을 사용하지 않는 것에서는 그 효과를 발휘합니다. 이들 섬유는 이중 역할을 하며, 식품 섹터의 다양한 제형에서 기능성 영양소 및 관능 증강제 둘 다의 역할을 합니다. 매일의 식단에 늘어나는 것은 소화와 신진대사 건강에 대한 소비자의 관심이 식품제조의 배합 전략을 어떻게 변화시키는지를 반영합니다.

베이커리 및 과자 부문은 40.2%의 점유율을 차지하며, 2024년에는 33억 달러에 달했습니다. 이 부문은 식이섬유의 주요 응용 분야인 것으로 변하지 않으며, 이것은 구운 과자, 곡물 빵, 시리얼 등의 아이템에서의 사용 증가에 기인합니다. 구운 과자에 포함된 식이섬유는 식감을 개선하고, 포만감을 높이고, 인공 첨가물을 피하는 클린 라벨 운동에 어울립니다. 과자류 제조업체는 맛이나 식감을 해치지 않고 당분이나 칼로리를 저감하기 위해서 기능성 섬유를 짜넣고 있습니다. 고섬유 스낵과 과립 가루 베이커리 제품에 대한 수요의 급증은 특히 건강 지향 제품에 대한 소비자 수요가 급증하고 있는 아시아태평양과 북미와 같은 지역을 중심으로 기술 혁신을 계속 추진하고 있습니다.

아시아태평양 시장은 2024년 42.5%의 점유율을 차지합니다. 이 지역의 리더십은 소화기계 건강에 대한 소비자 교육 증가, 중간층의 인구 증가, 기능성 식품 및 음료 카테고리의 급성장으로 이어집니다. 일본, 중국, 한국, 인도 등의 나라에서는 식이섬유가 풍부한 식물성 식품 중심의 식생활로의 전환이 진행되고 있습니다. 건강 지향 정책과 국가의 웰니스 이니셔티브의 지속적인 지원은 성장을 더욱 강화하고 있습니다. 특히 구운 과자와 영양보조 식품과 같은 카테고리에서 식물성 식품과 식이섬유를 강화한 제품의 인기가 높아짐에 따라 온라인 상거래와 디지털 소매 인프라는 아시아태평양의 다양한 인구 집단에서 제품 접근성을 개선하는 데 중요한 역할을 하고 있습니다.

세계 식이섬유 시장을 형성하는 주요 기업으로는 Archer Daniels Midland Company(ADM), Cargill, Incorporated, Roquette Freres SA, Tate & Lyle PLC, Ingredion Incorporated 등이 있습니다. 경쟁력을 유지하고 시장 점유율을 확대하기 위해 식이섬유 분야의 주요 기업들은 섬유 추출과 배합의 기술 혁신을 중시하고 있습니다. 기능적이고 통합하기 쉽고, 관능 특성을 높인 신규 블렌드를 개발하기 위해 연구 개발에 많은 투자를 실시했습니다. 기업은 또한 책임을 가지고 식물 원료를 조달하고 가공 효율성을 향상시킴으로써 지속가능성을 선호합니다. 푸드테크 기업과 영양에 특화된 신흥기업과의 협업을 통해 새로운 시장과 기술에 대한 액세스가 가능합니다. 또한 각 브랜드는 진화하는 소비자의 기대에 따라 클린 라벨 제품을 확대하기 위해 노력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTLE 분석

- 가격 동향

- 지역별

- 섬유 유형별

- 미래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(참고: 무역 통계는 주요 국가에서만 제공됨)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경 친화적인 노력

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 섬유 유형별, 2021-2034년

- 주요 동향

- 수용성 섬유

- 이눌린 및 올리고프룩토스 부문

- 펙틴 및 껌 부문

- 베타글루칸 및 특수섬유

- 불용성 섬유

- 셀룰로오스 및 개질 셀룰로오스

- 밀기울 및 곡물 섬유

- 과일 및 채소 섬유

- 기능성 섬유 및 프리바이오틱스 섬유

- 난소화성 전분 기술

- 갈락토올리고당(GOS) 및 프락토올리고당(FOS)

- 새로운 섬유

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 제과 및 과자류

- 빵 및 구운 과자

- 조식용 시리얼 및 스낵 식품

- 과자류 및 단맛 제품

- 음료

- 기능성 음료 및 스포츠 음료

- 유제품 및 식물 유래 대체품

- 주스 및 강화된 물

- 유제품 및 유제품 대체품

- 요구르트 및 발효 식품

- 치즈 및 가공 유제품

- 식물 유래 유제품 대체품

- 영양보조식품

- 분말 및 캡슐형

- 프리바이오틱스 및 장내 환경 보충제

- 체중 관리 및 대사 건강

제7장 시장 추계 및 예측 : 최종 이용 산업별, 2021-2034년

- 주요 동향

- 식품 및 음료 제조

- 대규모 식품 제조업체

- 지역 및 전문 식품 회사

- 기술 및 장비 공급업체

- 영양 보조식품 업계

- 보충제 제조업체 및 브랜드

- 계약 제조업자 및 개인 라벨

- 유통 및 소매 채널

- 기능성 식품 및 영양 보조 식품

- 기능성 식품 개발

- 의료 식품 및 임상 영양학

- 스포츠 및 퍼포먼스 영양

- 동물사료 및 반려동물 식품

- 프리미엄 반려동물 식품 용도

- 축산 및 양식

- 시장 개척 및 혁신

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제9장 기업 프로파일

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Freres SA

- Kerry Group PLC

- International Flavors & Fragrances Inc

- J Rettenmaier & Sohne GmbH Co KG

- Nexira Inc

The Global Food Fibers Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 19.4 billion by 2034. Food fibers, commonly known as dietary fibers, are indigestible plant-based carbohydrates that offer a variety of health benefits, particularly in digestive wellness, blood sugar regulation, and appetite control. These fibers are naturally present in fruits, legumes, vegetables, and grains, and are increasingly included in a wide range of consumables like dairy alternatives, fortified drinks, and bakery products. As global consumer preferences shift toward functional and health-forward eating, the market continues to gain momentum.

The trend is further amplified by the push for plant-based living, growing awareness of gut microbiome health, and supportive policies encouraging fiber-enhanced labeling and formulation. New innovations in fiber extraction and incorporation-such as microencapsulation and high-efficiency extrusion-are opening the door for more advanced and appealing food products. Manufacturers are strategically aligning with these developments to meet the growing demand for natural, prebiotic-rich, clean-label solutions. The rapid adoption of functional fibers globally, backed by evolving consumer lifestyles and nutritional awareness, is paving the way for robust growth in this industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 9.1% |

The soluble fibers held a 56.5% share in 2024, contributing USD 4.6 billion. These types of fibers, which include inulin, gums, and pectins, are widely used in foods and beverages because of their ability to support gut health by feeding beneficial microbes. Their use extends to plant-based milks and fermented beverages, where they enhance both texture and nutritional density. In the food manufacturing process, soluble fibers also improve product stability and mouthfeel, especially in reduced-sugar or dairy-free options. These fibers serve dual purposes, acting as both functional nutrients and sensory enhancers in various formulations across the food sector. Their rising inclusion in daily diets reflects how consumer interest in digestive and metabolic health is transforming formulation strategies within food production.

The bakery and confectionery segment held a 40.2% share, reaching USD 3.3 billion in 2024. This segment remains a dominant application area for food fibers, thanks to their growing use in items like baked snacks, whole grain breads, and cereals. Dietary fibers in baked goods improve texture, increase satiety, and align with the clean-label movement that avoids artificial additives. Confectionery manufacturers also integrate functional fibers to lower sugar and calorie content without compromising taste or texture. The surge in demand for high-fiber snack options and whole-grain bakery products continues to push innovation, especially across regions like Asia-Pacific and North America where consumer demand for wellness-oriented products is soaring.

Asia Pacific Food Fibers Market held a 42.5% share in 2024. This region's leadership is driven by increasing consumer education on digestive health, a swelling middle-class population, and rapid growth in functional food and beverage categories. Countries such as Japan, China, South Korea, and India are witnessing a transformation in dietary habits toward more fiber-rich, plant-centric foods. Ongoing support from health-conscious policies and national wellness initiatives is further driving growth. As plant-based and fiber-enhanced products gain popularity, especially in categories like baked goods and nutraceuticals, online commerce and digital retail infrastructure are playing a significant role in improving product access across diverse population groups in Asia Pacific.

Key companies shaping this Global Food Fibers Market include Archer Daniels Midland Company (ADM), Cargill, Incorporated, Roquette Freres SA, Tate & Lyle PLC, and Ingredion Incorporated. To stay competitive and expand their market share, leading companies in the food fibers sector are emphasizing innovation in fiber extraction and formulation. They are heavily investing in research to develop novel blends that are functional, easy to integrate, and have enhanced sensory properties. Businesses are also prioritizing sustainability by sourcing plant materials responsibly and improving processing efficiencies. Collaborations with food tech firms and nutrition-focused startups allow access to new markets and technologies. Moreover, brands are working to expand their clean-label offerings to align with evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fiber type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By fiber type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Fiber Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soluble fibres

- 5.2.1 Inulin and oligofructose segment

- 5.2.2 Pectin and gums segment

- 5.2.3 Beta-glucan and specialty fibres

- 5.3 Insoluble fibres

- 5.3.1 Cellulose and modified cellulose

- 5.3.2 Wheat bran and cereal fibres

- 5.3.3 Fruit and vegetable fibres

- 5.4 Functional and prebiotic fibres

- 5.4.1 Resistant starch technologies

- 5.4.2 Galacto-oligosaccharides (GOS) and fructo-oligosaccharides (FOS)

- 5.4.3 Novel and emerging fibres

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bakery and confectionery

- 6.2.1 Bread and baked goods

- 6.2.2 Breakfast cereals and snack foods

- 6.2.3 Confectionery and sweet goods

- 6.3 Beverages

- 6.3.1 Functional and sports beverages

- 6.3.2 Dairy and plant-based alternatives

- 6.3.3 Juice and enhanced water

- 6.4 Dairy and dairy alternatives

- 6.4.1 Yogurt and fermented products

- 6.4.2 Cheese and processed dairy

- 6.4.3 Plant-based dairy alternatives

- 6.5 Dietary supplements

- 6.5.1 Powder and capsule formats

- 6.5.2 Prebiotic and gut health supplements

- 6.5.3 Weight management and metabolic health

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverage manufacturing

- 7.2.1 Large-scale food manufacturers

- 7.2.2 Regional and specialty food companies

- 7.2.3 Technology and equipment suppliers

- 7.3 Dietary supplement industry

- 7.3.1 Supplement manufacturers and brands

- 7.3.2 Contract manufacturers and private label

- 7.3.3 Distribution and retail channels

- 7.4 Functional foods and nutraceuticals

- 7.4.1 Functional food development

- 7.4.2 Medical foods and clinical nutrition

- 7.4.3 Sports and performance nutrition

- 7.5 Animal feed and pet food

- 7.5.1 Premium pet food applications

- 7.5.2 Livestock and aquaculture

- 7.5.3 Market development and innovation

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill, Incorporated

- 9.2 Tate & Lyle PLC

- 9.3 Archer Daniels Midland Company

- 9.4 Ingredion Incorporated

- 9.5 Roquette Freres SA

- 9.6 Kerry Group PLC

- 9.7 International Flavors & Fragrances Inc

- 9.8 J Rettenmaier & Sohne GmbH + Co KG

- 9.9 Nexira Inc