|

시장보고서

상품코드

1797829

단백질 가수분해물 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

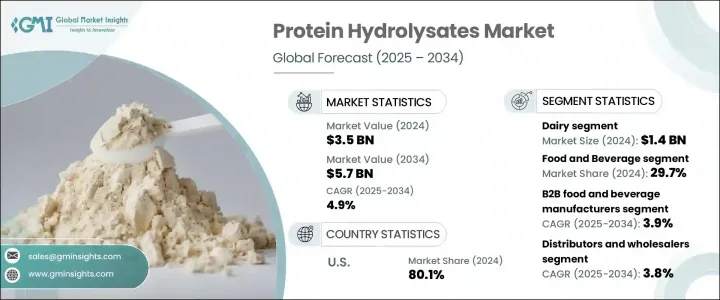

세계의 단백질 가수분해물 시장은 2024년 35억 달러로 평가되어 CAGR 4.9%로 성장해 2034년까지 57억 달러에 이를 것으로 추정되고 있습니다.

다양한 분야에서 기능적이고 소화하기 쉬운 영양성분에 대한 수요가 높아지고 있는 것이 이 시장의 확대에 박차를 가하고 있습니다. 단백질 가수분해물은 식물성, 유제품, 동물성, 해양성 단백질 등공급원으로부터 생산되며, 높은 생체이용률과 기능적 다양성에 의해 중점을 둡니다. 또, 유아용 조제 분유의 분야에서는 저알레르기성으로 소화하기 쉬운 분유 수요가 증가하고 있기 때문에 안정된 성장을 계속하고 있습니다. 이러한 단백질은 의료 영양, 개인 관리 제품, 의약품 등급 제형, 동물사료, 반려동물 영양 등의 분야에서도 널리 사용됩니다. 다양한 제조 기술 중에서도 효소 가수분해는 여전히 주류이며, 그 효율과 불필요한 제품별로 적은 고품질의 가수분해물을 얻을 수 있는 능력이 높게 평가되고 있습니다.

화학적 가수분해법이나 미생물적 가수분해법은 특정 기능성과 영양 특성을 가진 맞춤형 단백질 가수분해물을 생산하는데 있어서 그 역할을 계속하고 있지만, 부산물의 생성이나 덜 제어된 반응 환경에 의해 제한되는 경우가 많습니다. 열처리와 같은 물리적 방법은 널리 사용되지 않지만 단백질 분해를 줄이고 반응 효율을 향상시키는 새로운 기술로 검토되었습니다. 생명 공학, 정밀 발효 및 막 분리에 대한 최근의 획기적인 변화는 분자 수준에서 가수분해물의 조성을 미세 조정할 수 있게 되었습니다. 이러한 진보는 의료 영양, 식물성 스포츠 회복, 개인화 보충제, 심지어 화장품 제제와 같은 특수 분야에 최적화된 차세대 가수분해물의 개발을 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 35억 달러 |

| 예측 금액 | 57억 달러 |

| CAGR | 4.9% |

유제품 베이스 단백질 가수분해물 부문은 2024년 14억 달러를 창출해 40%의 점유율을 차지했습니다. 이러한 제품은 탁월한 흡수성과 기능성으로 주로 유아용 제제, 의료용 영양제 및 운동용 회복 제품에 사용됩니다. 우수한 영양 프로파일을 가진 유청 및 카제인 유도체는 이 부문의 성과의 중심이 되었습니다. 이 분야의 강점은 높은 영양 품질과 다양한 라이프 스테이지에서 단백질의 효능에 대한 인식 증가에 있습니다.

유아용 영양 분절은 2024년에 19.9%의 점유율을 차지했지만, 이는 기존의 유단백질에 과민증과 알레르기가 있는 유아를 위해 안전하고 소화성이 높은 단백질원에 대한 요구가 높아지고 있는 것이 배경에 있습니다. 알레르겐이 없고 장 친화적인 대체품에 대한 소비자의 관심이 증가함에 따라 아기 우유에서 가수분해 단백질의 사용이 계속 확대되고 있습니다. 이 분야는 규제 정책뿐만 아니라 정보통 부모의 건강 지향 유아용 솔루션에 대한 수요가 증가함에 따라 형성됩니다.

미국의 단백질 가수분해물 시장은 2024년에 80.1%의 점유율을 차지하며 10억 달러의 공헌이 됩니다. 이 나라는 건강 지향적이고 과학적으로 뒷받침되는 식품에 대한 소비자의 취향에 힘입어 단백질 가수분해물의 성숙한 혁신 주도 시장으로 자리잡고 있습니다. 소화기계의 건강, 근육의 회복, 면역 기능에 대한 동향 증가가 다양한 형태의 단백질 개발을 더욱 뒷받침하고 있습니다. 게다가 깨끗한 라벨에 대한 기대와 식물 유래의 대체 식품에 대한 관심 증가는 생산자에게 유제품 유래의 단백질을 넘어 혁신을 촉진하고 있습니다. 제조업체 각 회사는 진화하는 소비자의 가치에 따라 보다 지속가능하고 생물학적 이용가능한 단백질 원료를 도입하고 있습니다.

세계의 단백질 가수분해물 시장을 선도하는 주요 기업으로는 Cargill, Incorporated, Davisco Foods International, Archer Daniels Midland Company, Fonterra Co-operative, Arla Foods Ingredients 등이 있습니다. 선도적인 제조업체는 R & D 투자를 활용하여 면역 지원, 장 건강, 스포츠 회복 등 틈새 건강 기능에 맞는 가수분해물 제제를 설계합니다. 임상 연구자와 제제 전문가와의 전략적 제휴를 통해 각 브랜드는 생물학적 활성을 향상시키고 표적 용도에 맞게 펩타이드 프로파일을 조정할 수 있습니다. 대기업은 깨끗한 라벨과 식물 유래 트렌드 증가에 대응하기 위해 유제품을 사용하지 않고 알레르겐을 줄이는 옵션으로 제품 포트폴리오를 확대하고 있습니다. 또한 개발 기업은 선진국 시장과 신흥국 시장 모두에서 일관된 제품 품질과 비용 효율적인 확장성을 보장하기 위해 현지 조달 확대, 추적성 향상 및 가공 기술 혁신에 대한 투자를 통해 공급망의 강인성을 강화하고 있습니다.

목차

제1장 조사 방법

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 스포츠 및 임상 영양 제품 수요 증가

- 식물 유래 및 알레르겐이 없는 단백질에 대한 기호의 고조

- 효소 가수분해 기술의 진보

- 단백질의 건강효과에 대한 의식 고조

- 업계의 잠재적 위험 및 과제

- 높은 생산 비용과 복잡한 처리 방법

- 식품 원료에 대한 엄격한 규제 요건

- 시장 기회

- 기능성 식품 및 음료 분야에 진출

- 영양 보조 식품과 맞춤형 영양 성장

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTLE 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 원료별

- 코스트 내역 분석

- 특허 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경 친화적인 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계 및 예측 : 원료별, 2021-2034년

- 주요 동향

- 유제품

- 유청

- 카제인

- 우유

- 식물

- 콩

- 완두

- 쌀

- 밀

- 기타 식물

- 동물

- 고기

- 콜라겐

- 계란

- 해양

- 물고기

- 해산물

- 해양

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 음식

- 기능성 식품

- 음료

- 베이커리 및 과자류

- 유제품 및 대체품

- 고기 및 고기 대체품

- 스포츠 영양

- 분말 및 보충제

- 운동 전후 제품

- 회복과 지구력을 위한 제품

- 체중 관리 제품

- 유아영양

- 임상영양학 및 의료영양학

- 동물사료 및 반려동물 식품

- 화장품 및 퍼스널케어

- 의약품 및 영양보조식품

제7장 시장 추계 및 예측 : 제조 방법별, 2021-2034년

- 주요 동향

- 효소

- 화학약품

- 미생물

- 신규 기법

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- B2B 식품 및 음료 제조업체

- 영양 보조 식품 및 보충 회사

- 제약회사

- 동물사료 및 반려동물 식품 제조 업체

- 화장품 및 퍼스널케어 기업

- 조사 및 학술 기관

- 소비자 직접 판매 브랜드

제9장 시장 추계 및 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 직접 판매

- 판매자 및 도매업체

- 온라인 B2B 플랫폼

- 기타

제10장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 이탈리아

- 스페인

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 이집트

제11장 기업 프로파일

- Archer Daniels Midland Company(ADM)

- Arla Foods Ingredients

- Cargill, Incorporated

- Davisco Foods International

- Fonterra Co-operative Group Limited

- FrieslandCampina

- Glanbia plc

- Hilmar Ingredients

- Ingredia SA

- Kerry Group plc

The Global Protein Hydrolysates Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 5.7 billion by 2034. The growing demand for functional and easily digestible nutritional components across diverse sectors is fueling the expansion of this market. Protein hydrolysates are produced from sources such as plant, dairy, animal, and marine proteins, and are prized for their enhanced bioavailability and functional versatility. Their rapid absorption makes them especially valuable in sports nutrition, while the infant nutrition segment continues to grow steadily due to increasing demand for hypoallergenic and easily digestible formulas. These proteins are also widely used in areas like medical nutrition, personal care products, pharmaceutical-grade formulations, animal feeds, and pet nutrition. Among the various production techniques, enzymatic hydrolysis remains the dominant method, appreciated for its efficiency and ability to yield high-quality hydrolysates with fewer unwanted by-products.

Although chemical and microbial hydrolysis methods continue to play a role in producing customized protein hydrolysates with specific functional or nutritional attributes, they are often limited by by-product formation and less-controlled reaction environments. Physical methods such as thermal processing, while less widely adopted, are being revisited with new techniques that reduce protein degradation and improve reaction efficiency. Recent breakthroughs in biotechnology, precision fermentation, and membrane separation are now enabling manufacturers to fine-tune hydrolysate composition at a molecular level. These advances are driving the development of next-generation hydrolysates optimized for specialized sectors like medical nutrition, plant-based sports recovery, personalized supplements, and even cosmetic formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 4.9% |

The dairy-based protein hydrolysates segment generated USD 1.4 billion in 2024 and comprising 40% share. These products are primarily used in infant formulations, medical nutrition, and athletic recovery products due to their excellent absorption and functional characteristics. With their superior nutritional profile, whey and casein derivatives are central to the segment's performance. The segment's strength stems from high nutritional quality and increasing awareness around protein efficacy in various life stages.

The infant nutrition segment held 19.9% share in 2024, driven by the increasing need for protein sources that are both safe and digestible for infants with sensitivities or allergies to traditional milk proteins. The use of hydrolyzed proteins in baby formulas continues to grow due to heightened consumer focus on allergen-free and gut-friendly alternatives. This segment is shaped not only by regulatory policies but also by a stronger demand for health-conscious infant solutions from well-informed parents.

United States Protein Hydrolysates Market held 80.1% share in 2024, contributing USD 1 billion. The country has established itself as a mature and innovation-driven landscape for protein hydrolysates, supported by consumer preference for health-forward, science-backed food products. Growing trends in digestive health, muscle recovery, and immune function are further pushing development across different protein formats. Additionally, the rise in clean-label expectations and interest in plant-based alternatives is prompting producers to innovate beyond dairy-sourced proteins. Manufacturers are introducing more sustainable, bioavailable protein ingredients that align with evolving consumer values.

Key players leading the Global Protein Hydrolysates Market include Cargill, Incorporated, Davisco Foods International, Archer Daniels Midland Company, Fonterra Co-operative, and Arla Foods Ingredients. Major manufacturers are leveraging R&D investments to design hydrolysate formulations tailored to niche health functions such as immune support, gut health, and sports recovery. Strategic collaboration with clinical researchers and formulation specialists is allowing brands to enhance bioactivity and tailor peptide profiles for targeted applications. Leading players are expanding their product portfolios with dairy-free and allergen-reduced options to meet rising clean-label and plant-based trends. Additionally, companies are strengthening supply chain resilience by increasing local sourcing, improving traceability, and investing in processing innovation to ensure consistent product quality and cost-effective scalability in both developed and emerging markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Application

- 2.2.4 Production method

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sports and clinical nutrition products

- 3.2.1.2 Growing preference for plant-based and allergen-free proteins

- 3.2.1.3 Advancements in enzymatic hydrolysis technology

- 3.2.1.4 Increasing awareness of protein’s health benefits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and complex processing methods

- 3.2.2.2 Stringent regulatory requirements for food ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into functional foods and beverages segment

- 3.2.3.2 Growth in nutraceuticals and personalized nutrition

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Dairy

- 5.2.1 Whey

- 5.2.2 Casein

- 5.2.3 Milk

- 5.3 Plant

- 5.3.1 Soy

- 5.3.2 Pea

- 5.3.3 Rice

- 5.3.4 Wheat

- 5.3.5 Other plant sources

- 5.4 Animal

- 5.4.1 Meat

- 5.4.2 Collagen

- 5.4.3 Egg

- 5.5 Marine

- 5.5.1 Fish

- 5.5.2 Seafood

- 5.5.3 Marine

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.2.1 Functional foods

- 6.2.2 Beverages

- 6.2.3 Bakery and confectionery

- 6.2.4 Dairy products and alternatives

- 6.2.5 Meat and meat alternatives

- 6.3 Sports nutrition

- 6.3.1 Powders and supplements

- 6.3.2 Pre- and post-workout products

- 6.3.3 Recovery and endurance products

- 6.3.4 Weight management products

- 6.4 Infant nutrition

- 6.5 Clinical and medical nutrition

- 6.6 Animal feed and pet food

- 6.7 Cosmetics and personal care

- 6.8 Pharmaceuticals and nutraceuticals

Chapter 7 Market Estimates & Forecast, By Production Method, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Enzymatic

- 7.3 Chemical

- 7.4 Microbial

- 7.5 Novel and emerging methods

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 B2B food and beverage manufacturers

- 8.3 Nutraceutical and supplement companies

- 8.4 Pharmaceutical companies

- 8.5 Animal feed and pet food manufacturers

- 8.6 Cosmetics and personal care companies

- 8.7 Research and academic institutions

- 8.8 Direct-to-consumer brands

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Distributors and wholesalers

- 9.4 Online B2B platforms

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Italy

- 10.3.4 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Egypt

Chapter 11 Company Profiles

- 11.1 Archer Daniels Midland Company (ADM)

- 11.2 Arla Foods Ingredients

- 11.3 Cargill, Incorporated

- 11.4 Davisco Foods International

- 11.5 Fonterra Co-operative Group Limited

- 11.6 FrieslandCampina

- 11.7 Glanbia plc

- 11.8 Hilmar Ingredients

- 11.9 Ingredia SA

- 11.10 Kerry Group plc