|

시장보고서

상품코드

1801941

금속 절삭 공구 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Metal Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

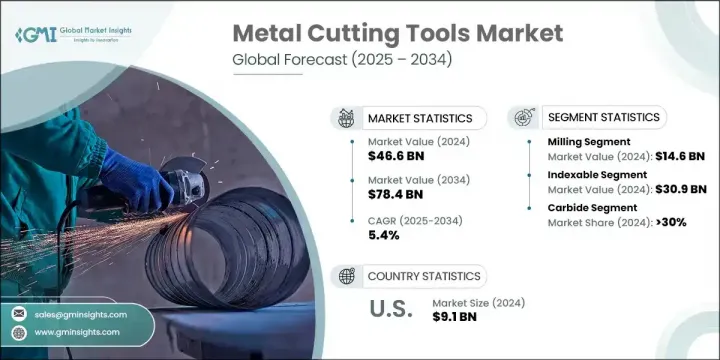

금속 절삭 공구 세계 시장 규모는 2024년에 466억 달러에 달했고, CAGR 5.4%로 성장하고 2034년에는 784억 달러에 이를 것으로 예측되고 있습니다.

최첨단 CNC와 다축 가공이 단순한 독립형 장비에서 스마트하고 상호 연결된 제조 시스템으로 금속 절삭 공구를 지속적으로 발전시켜 시장이 강한 기세를 보이고 있습니다. IoT의 통합과 적응 공구의 보급에 따라 현대의 기계공은 자동화의 숙련과 데이터 분석 및 고정밀 스킬의 융합을 요구할 수 있게 되었습니다. 이러한 지능형 제조 환경으로의 전환은 첨단 기술 훈련과 지속적인 기술 향상에 대한 수요를 끌어올리고 있습니다. 아시아태평양은 견고한 제조거점과 정부 주도 산업 확대에 힘입어 세계 시장을 선도하고 있습니다. 이 지역에서는 CNC와 지능형 가공 플랫폼의 도입이 급속히 진행되고 있으며, 각 산업에서 생산성 향상과 생산량 합리화가 진행되고 있습니다.

특히 일본, 인도, 중국 등의 국가에서는 자동차 및 전자기기 생산에 많은 투자가 이루어지고 있으며 정밀 공구 수요를 크게 밀어 올리고 있습니다. 산업의 근대화를 목표로 하는 정책 주도의 인센티브가 제조 공장 전체의 설비 업그레이드를 더욱 가속화하고 있습니다. 밀링 공구는 적응성, 높은 재료 제거율, CNC 시스템 및 다축 기계와의 호환성으로 금속 절삭 부문을 지배합니다. 이러한 공구는 거친 가공과 마무리 가공을 모두 요구하는 응용 분야에 널리 도입되었습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작금액 | 466억 달러 |

| 예측 금액 | 784억 달러 |

| CAGR | 5.4% |

밀링 공구는 2024년에 146억 달러의 매출을 올렸으며 2034년까지 연평균 복합 성장률(CAGR) 6.6%로 성장할 것으로 예측됩니다. 자동차 및 산업 분야에서 널리 사용되는 밀링 공구는 정밀도와 복잡한 형상 및 표면 마감 처리 능력을 통해 이러한 이점을 견인합니다. 유연성과 기능성의 조합으로 밀링 가공은 1차 가공과 2차 가공의 두 공정에서 필수적입니다.

인덱서블 공구는 2024년에 309억 달러의 매출을 올렸으며, 2025-2034년의 CAGR은 5.8%를 나타낼 전망입니다. 이러한 공구는 새로운 절삭면을 노출시키기 위해 회전할 수 있는 교체 가능한 칩을 사용하여 다운타임과 비용을 절감할 수 있는 능력에 의해 두드러집니다. 이 설계는 빈번한 재연마 및 설치가 필요 없기 때문에 인덱서블 공구는 대량 생산의 연속 고속 가공에 이상적입니다. 무거운 기계 제조 및 일반적인 엔지니어링과 같은 분야에서 내구성과 안정적인 성능이 도움이 됩니다.

미국의 금속 절삭 공구 시장은 87.5%의 점유율을 차지하며, 2024년에는 91억 달러의 매출을 올렸습니다. 이 나라의 견고한 제조 인프라와 CNC 기계의 보급이 계속 시장 확대를 추진하고 있습니다. 산업 자동화의 동향과 방위 및 자동차 등 분야의 왕성한 수요에 힘입어 미국은 정밀 공구의 주요 생산국이자 동시에 주요 소비국이기도 합니다. 규제면에서의 지원과 수출 경쟁력도 이 나라의 견고한 시장 기반에 공헌하고 있습니다.

금속 절삭 공구 시장에서 사업을 전개하는 기업은 그 존재감을 높이기 위해 정밀도, 내구성, 가공 속도를 향상시키는 차세대 공구를 개발하기 위한 연구 개발에 많은 투자를 하고 있습니다. 공구의 라이프사이클 관리 및 성능 분석을 강화하기 위해 AI와 디지털 모니터링의 통합에 중점을 두고 있습니다. 선도적인 제조업체는 생산 능력을 확대하고 신흥 시장에 대한 액세스를 얻기 위해 현지 기업과 합작 투자 회사를 설립했습니다. 스마트 절삭 공구, 인덱서블 절삭 공구, 에너지 효율이 우수한 절삭 공구 등 제품 포트폴리오를 다양화하는 것도 핵심 전략 중 하나입니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 기회

- 성장 가능성 분석

- 장래 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 제품별

- 규제 프레임워크

- 표준 및 컴플라이언스 요건

- 지역 규제 틀

- 인증기준

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 라틴아메리카

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추정 및 예측 : 툴별, 2021년-2034년

- 주요 동향

- 인덱서블

- 고체

제6장 시장 추정 및 예측 : 공정별, 2021년-2034년

- 주요 동향

- 밀링

- 드릴링

- 볼링

- 터닝

- 그라인딩

- 기타

제7장 시장 추정 및 예측 : 재료별, 2021년-2034년

- 주요 동향

- 탄화물

- 고속 스틸

- 스테인레스 스틸

- 세라믹

- 기타

제8장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 자동차

- 항공우주 및 방어

- 석유 및 가스

- 일반 기계가공

- 의료

- 전기 및 전자공학

- 기타

제9장 시장 추정 및 예측 : 유통 채널별, 2021년-2034년

- 주요 동향

- 직접

- 간접

제10장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

제11장 기업 프로파일

- Atlas Copco

- Bosch

- Ceratizit

- Emerson

- Guhring

- Iscar

- Kyocera

- Mapal

- 나치후지코시

- OSG

- Sandvik

- Seco Tools

- Stanley Black &Decker

- Sumitomo Electric Hardmetal

- TaeguTec

- Walter

The Global Metal Cutting Tools Market was valued at USD 46.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 78.4 billion by 2034. The market is witnessing strong momentum as cutting-edge CNC and multi-axis machining continue to evolve metal cutting tools from simple standalone devices into smart, interconnected manufacturing systems. As IoT integration and adaptive tooling become more prevalent, modern-day machinists are now required to merge automation proficiency with data analytics and high-precision skills. This shift toward intelligent manufacturing environments is pushing demand for advanced technical training and continuous upskilling. Asia-Pacific leads the global market, propelled by a robust manufacturing base and government-led industrial expansion. The region's quick uptake of CNC and intelligent machining platforms is enhancing productivity and streamlining output across industries.

Heavy investments in automotive and electronics production, especially in countries like Japan, India, and China, are significantly boosting demand for precision tooling. Policy-driven incentives aimed at industrial modernization are further accelerating equipment upgrades across manufacturing plants. Milling tools dominate the metal cutting segment, owing to their adaptability, high material removal rates, and compatibility with CNC systems and multi-axis machines. These tools are widely deployed in applications that require both rough cutting and fine finishing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.6 Billion |

| Forecast Value | $78.4 Billion |

| CAGR | 5.4% |

Milling tools generated USD 14.6 billion in 2024 and are projected to grow at a CAGR of 6.6% through 2034. Their widespread use in automotive and industrial sectors drives this dominance, thanks to their accuracy and ability to handle intricate shapes and surface finishes. The combination of flexibility and functionality makes milling essential for both primary and secondary machining processes.

The Indexable tools generated USD 30.9 billion in 2024 and are expected to register a CAGR of 5.8% during 2025-2034. These tools stand out due to their ability to reduce downtime and costs by using replaceable inserts that can be rotated to expose fresh cutting surfaces. This design eliminates the need for frequent regrinding and setup, making indexable tools ideal for continuous, high-speed machining in mass production scenarios. Sectors like heavy equipment manufacturing and general engineering benefit from their durability and consistent performance.

United States Metal Cutting Tools Market held an 87.5% share, generating USD 9.1 billion in 2024. The country's solid manufacturing infrastructure and widespread adoption of CNC machinery continue to fuel market expansion. Backed by industrial automation trends and strong demand from sectors such as defense and automotive, the US remains both a leading producer and a major consumer of precision tooling. Regulatory support and export competitiveness also contribute to the country's solid market foothold.

Key companies shaping the Global Metal Cutting Tools Market include Nachi-Fujikoshi, Emerson, Walter, Stanley Black & Decker, Ceratizit, Seco Tools, TaeguTec, Kyocera, Iscar, Sumitomo Electric Hardmetal, Bosch, Guhring, Sandvik, OSG, Atlas Copco, and Mapal. To strengthen their presence, companies operating in the metal cutting tools market are investing heavily in R&D to develop next-generation tools that improve precision, durability, and machining speed. Focused efforts are being made to integrate AI and digital monitoring to enhance tool lifecycle management and performance analytics. Leading manufacturers are expanding production capabilities and forming joint ventures with local players to gain access to emerging markets. Diversifying product portfolios to include smart, indexable, and energy-efficient cutting tools is another core strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool

- 2.2.3 Process

- 2.2.4 Material

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool, 2021-2034 ($Bn, Million Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 ($Bn, Million Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Million Units)

- 7.1 Key trends

- 7.2 Carbide

- 7.3 High speed steel

- 7.4 Stainless steel

- 7.5 Ceramics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & defense

- 8.4 Oil & gas

- 8.5 General machining

- 8.6 Medical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Atlas Copco

- 11.2 Bosch

- 11.3 Ceratizit

- 11.4 Emerson

- 11.5 Guhring

- 11.6 Iscar

- 11.7 Kyocera

- 11.8 Mapal

- 11.9 Nachi-Fujikoshi

- 11.10 OSG

- 11.11 Sandvik

- 11.12 Seco Tools

- 11.13 Stanley Black & Decker

- 11.14 Sumitomo Electric Hardmetal

- 11.15 TaeguTec

- 11.16 Walter