|

시장보고서

상품코드

1448840

AI와 RAN : 얼마나 빠른 속도로 움직이고 있는가?AI and RAN - How Fast Will They Run? |

||||||

이 보고서는 인공지능(AI)과 무선 액세스 네트워크(RAN)의 융합 지점을 탐구하고, 양자의 진화하는 관계를 조명하고 미래 궤도를 예측합니다.

SAMPLE VIEW

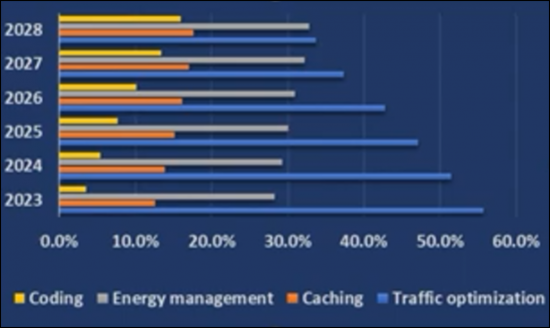

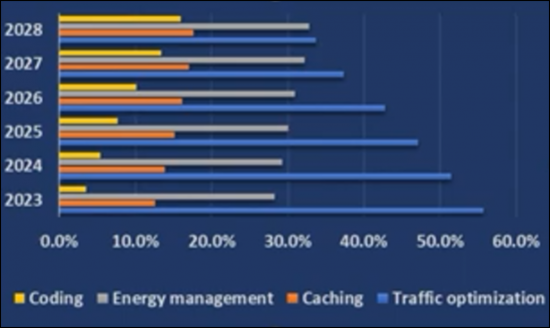

그림 1-1: RAN용 AI의 최종 용도: 수익 점유율 추이

출처: Insight Research

최근 몇 년동안 AI는 산업 전반의 혁신을 주도하는 매우 중요한 힘으로 부상하고 있습니다. 특히 통신 분야는 RAN 아키텍처에 AI를 통합하는 것이 통신 분야에 미치는 변혁적 영향을 목격하고 있습니다. 이 보고서는 이러한 시너지를 탐구하고, 이 두 가지의 융합에 대한 역학관계와 통신 산업에 미치는 영향에 대해 알아보고자 합니다.

분석 개요

- RAN용 AI 주소 지정 가능 시장(획득 가능한 시장 규모)은 2023년부터 2028년까지 매년 45%의 놀라운 성장세를 보일 전망입니다.

- 5G RAN의 AI 주소 지정 가능 시장은 이전 세대의 전화 통신보다 더 빠르게 성장할 것입니다.

- 아태지역은 RAN 캐시 용도를 위한 AI의 가장 큰 시장이 될 것입니다.

목차

제1장 주요 요약

제2장 AI/ML/DL : 주요 개념 설명

- 인공지능(AI)

- 머신러닝(ML)

- 지도 머신러닝

- 미지도 머신러닝

- 강화된 머신러닝

- K-Nearest Neighbor

- Deep Learning Neural Network (DLNN)

- 주목해야 할 ML/DL 알고리즘

제3장 RAN 가상화

- RAN과 진화

- E-UTRAN 상세

- 5G-NR, NSA, SA

- MEC

- The Rigid CPRI

- RAN에서 vRAN로의 진화

- VM 기반 vRAN와 컨테이너 기반 vRAN를 비교하는 방법은?

- NFV 아키텍처

- 컨테이너의 필요성

- 마이크로서비스

- 컨테이너의 형태

- 컨테이너 도입 방법

- 스테이트 풀 컨테이너와 스테이트리스 컨테이너

- 어드밴티지 컨테이너

- 컨테이너가 직면하는 과제

- RAN 가상화 : 얼라이언스 이야기

- O-RAN 아키텍처 개요

- O-RAN의 역사

- O-RAN 워크그룹

- 오픈 vRAN(O-vRAN)

- TIP(통신 인프라 프로젝트) OpenRAN

제4장 RAN AI의 최종 용도

- O-RAN과 AI

- 서론

- RIC, xApp, rApp

- WG2와 ML

- AI 이용 사례 : 트래픽 최적화

- 배경

- 방법론과 과제

- AI 기반 접근

- AI 이용 사례 : 캐싱

- AI 이용 사례 : 에너지 관리

- AI 이용 사례 : 코딩

제5장 RAN AI : 벤더 이니셔티브

- 서론

- 주요 분석 결과

- 기업 및 조직 개요

- Aira Channel Prediction xApp

- Aira Dynamic Radio Network Management rApp

- AirHop Auptim

- Aspire Anomaly Detection rApp

- Cisco Ultra Traffic Optimization

- Capgemini RIC

- Cohere MU-MIMO Scheduler

- DeepSig OmniSig

- Deepsig OmniPHY

- Ericsson Radio System

- Ericsson RIC

- Fujitsu Open RAN Compliant RUs

- HCL iDES rApp

- Huawei PowerStar

- Juniper RIC/Rakuten Symphony Symworld

- Mavenir mMIMO 64TRX

- Mavenir RIC

- Net AI xUPscaler Traffic Predictor xApp

- Nokia RAN Intelligent Controller

- Nokia AVA

- Nokia ReefShark Soc

- Nvidia AI-on-5G platform

- Opanga Networks

- P.I. Works Intelligent PCI Collision and Confusion Detection rApp

- Qualcomm RIC

- Qualcomm Cellwize CHIME

- Qualcomm Traffic Management Solutions

- Rimedo Policy-controlled Traffic Steering xApp

- Samsung Network Slice Manager

- ZTE PowerPilot

- VMware RIC

제6장 RAN AI : 통신 기업의 이니셔티브/h4>

- 서론

- 주요 분석 결과

- 기업 및 조직 개요

- AT&T Inc

- Axiata Group Berhad

- Bharti Airtel

- China Mobile

- China Telecom

- China Unicom

- CK Hutchison Holdings

- Deutsche Telekom

- Etisalat

- Globe Telecom Inc

- NTT DoCoMo

- MTN Group

- Ooredoo

- Orange

- PLDT Inc

- Rakuten Mobile

- Reliance Jio

- Saudi Telecom Company

- Singtel

- SK Telecom

- Softbank

- Telefonica

- Telenor

- Telkomsel

- T-Mobile US

- Verizon

- Viettel Group

- Vodafone

제7장 정량적 분석과 예측

- 분석 방법

- 예측용 분류법

- 세계 시장

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 트래픽 최적화

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 캐싱

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 에너지 관리

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 코딩

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

LSH 24.03.22

This report delves into the intersection of Artificial Intelligence (AI) and Radio Access Network (RAN), shedding light on their evolving relationship and forecasting their future trajectories.

SAMPLE VIEW

Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

Source: Insight Research

In recent years, AI has emerged as a pivotal force driving innovation across industries. The telecom sector, in particular, has witnessed a transformative impact with the integration of AI into RAN architecture. The report explores this synergy, uncovering the dynamics behind their convergence and the implications for the telecommunication landscape.

"At Insight Research, we recognize the seismic shifts occurring within the telecommunications industry, and our latest report elucidates the symbiotic relationship between AI and RAN," remarked Kaustubha Parkhi, Principal Analyst at Insight Research. "We're witnessing a paradigm shift in RAN architecture, with AI playing a pivotal role in driving efficiency, agility, and performance."

Key Highlights from the Report:

- The addressable market for AI in RAN will grow by an impressive 45% annually during 2023-2028

- The addressable market for AI in 5G RAN will grow faster than earlier telephony generations

- The APAC region will be the largest market for AI in RAN caching applications

With a meticulous breakdown of the market by application, region, and telephony generations, the report offers unparalleled quantitative insights, empowering stakeholders to make informed decisions in a rapidly evolving landscape.

Insight Research's "AI and RAN - How Fast Will They Run?" report is essential reading for telecom operators, technology providers, policymakers, and investors seeking to navigate the evolving landscape of AI-driven telecommunications infrastructure.

Table of Contents

1. Executive Summary

- 1.1. Key observations

- 1.2. Quantitative Forecast Taxonomy

- 1.3. Report Organization

2. AI/ML/DL - Key Concepts Explainer

- 2.1. Artificial Intelligence

- 2.2. Machine Learning (ML)

- 2.2.1. Supervised Machine Learning

- 2.2.2. Unsupervised Machine Learning

- 2.2.3. Reinforced Machine Learning

- 2.2.4. K-Nearest Neighbor

- 2.3. Deep Learning Neural Network (DLNN)

- 2.4. Noteworthy ML and DL Algorithms

- 2.4.1. Anomaly Detection

- 2.4.2. Artificial Neural Networks (ANN)

- 2.4.3. Bagged Trees

- 2.4.4. CART and SVM Algorithms

- 2.4.5. Clustering

- 2.4.6. Conditional Variational Autoencoder

- 2.4.7. Convolutional Neural Network

- 2.4.8. Correlation and Clustering

- 2.4.9. Evolutionary Algorithms and Distributed Learning

- 2.4.10. Feed Forward Neural Network

- 2.4.11. Graph Neural Networks

- 2.4.12. Hybrid Cognitive Engine (HCE)

- 2.4.13. Kalman Filter

- 2.4.14. Markov Decision Processes

- 2.4.15. Multilayer Perceptron

- 2.4.16. Naïve Bayes

- 2.4.17. Radial Basis Function

- 2.4.18. Random Forest

- 2.4.19. Recurrent Neural Network

- 2.4.20. Reinforced Neural Network

- 2.4.21. SOM Algorithm

- 2.4.22. Sparse Bayesian Learning

3. Virtualization of the RAN

- 3.1. The RAN and its Evolution

- 3.1.1. Closer Look at E-UTRAN

- 3.1.2. 5G- NR, NSA and SA

- 3.1.3. MEC

- 3.1.4. The Rigid CPRI

- 3.2. The Progression of the RAN to the vRAN

- 3.3. How VM-based and Container-based vRANs Compare?

- 3.3.1. NFV architecture

- 3.3.2. The Need for Containers

- 3.3.3. Microservices

- 3.3.4. Container Morphology

- 3.3.5. Container Deployment Methodologies

- 3.3.6. Stateful and Stateless Containers

- 3.3.7. Advantage Containers

- 3.3.8. Challenges Confronting Containers

- 3.4. RAN Virtualization - A Story of Alliances

- 3.4.1. O-RAN Architecture Overview

- 3.4.2. History of O-RAN

- 3.4.3. Workgroups of O-RAN

- 3.4.4. Open vRAN (O-vRAN)

- 3.4.5. Telecom Infra Project (TIP) OpenRAN

4. End-applications for AI in the RAN

- 4.1. O-RAN and AI

- 4.1.1. Introduction

- 4.1.2. RIC, xApps and rApps

- 4.1.3. WG2 and ML

- 4.2. AI Use-Case - Traffic Optimization

- 4.2.1. Background

- 4.2.2. Methodologies and Challenges

- 4.2.3. AI-based Approaches

- 4.3. AI Use-Case - Caching

- 4.3.1. Background

- 4.3.2. Methodologies and Challenges

- 4.3.3. AI-based Approaches

- 4.4. AI Use-Case - Energy Management

- 4.4.1. Background

- 4.4.2. Methodologies and Challenges

- 4.4.3. AI-based Approaches

- 4.5. AI Use-Case - Coding

- 4.5.2. AI-based Approaches

5. Vendor Initiatives for AI in the RAN

- 5.1. Introduction

- 5.2. Salient Observations

- 5.3. Company and Organization Summary

- 5.4. Aira Channel Prediction xApp

- 5.5. Aira Dynamic Radio Network Management rApp

- 5.6. AirHop Auptim

- 5.7. Aspire Anomaly Detection rApp

- 5.8. Cisco Ultra Traffic Optimization

- 5.9. Capgemini RIC

- 5.10. Cohere MU-MIMO Scheduler

- 5.11. DeepSig OmniSig

- 5.12. Deepsig OmniPHY

- 5.13. Ericsson Radio System

- 5.14. Ericsson RIC

- 5.15. Fujitsu Open RAN Compliant RUs

- 5.16. HCL iDES rApp

- 5.17. Huawei PowerStar

- 5.18. Juniper RIC/Rakuten Symphony Symworld

- 5.19. Mavenir mMIMO 64TRX

- 5.20. Mavenir RIC

- 5.21. Net AI xUPscaler Traffic Predictor xApp

- 5.22. Nokia RAN Intelligent Controller

- 5.23. Nokia AVA

- 5.24. Nokia ReefShark Soc

- 5.25. Nvidia AI-on-5G platform

- 5.26. Opanga Networks

- 5.27. P.I. Works Intelligent PCI Collision and Confusion Detection rApp

- 5.28. Qualcomm RIC

- 5.29. Qualcomm Cellwize CHIME

- 5.30. Qualcomm Traffic Management Solutions

- 5.31. Rimedo Policy-controlled Traffic Steering xApp

- 5.32. Samsung Network Slice Manager

- 5.33. ZTE PowerPilot

- 5.34. VMware RIC

6. Telco Initiatives for AI in the RAN

- 6.1. Introduction

- 6.2. Salient Observations

- 6.3. Company and Organization Summary

- 6.4. AT&T Inc

- 6.5. Axiata Group Berhad

- 6.6. Bharti Airtel

- 6.7. China Mobile

- 6.8. China Telecom

- 6.9. China Unicom

- 6.10. CK Hutchison Holdings

- 6.11. Deutsche Telekom

- 6.12. Etisalat

- 6.13. Globe Telecom Inc

- 6.14. NTT DoCoMo

- 6.15. MTN Group

- 6.16. Ooredoo

- 6.17. Orange

- 6.18. PLDT Inc

- 6.19. Rakuten Mobile

- 6.20. Reliance Jio

- 6.21. Saudi Telecom Company

- 6.22. Singtel

- 6.23. SK Telecom

- 6.24. Softbank

- 6.25. Telefonica

- 6.26. Telenor

- 6.27. Telkomsel

- 6.28. T-Mobile US

- 6.29. Verizon

- 6.30. Viettel Group

- 6.31. Vodafone

7. Quantitative Analysis and Forecasts

- 7.1. Research Methodology

- 7.2. Forecast Taxonomy

- 7.3. Global Market

- 7.3.1. Overall Market

- 7.3.2. Mobile Telephony Generations

- 7.3.3. Geographical Regions

- 7.4. Traffic Optimization

- 7.4.1. Overall Market

- 7.4.2. Mobile Telephony Generations

- 7.4.3. Geographical Regions

- 7.5. Caching

- 7.5.1. Overall Market

- 7.5.2. Mobile Telephony Generations

- 7.5.3. Geographical Regions

- 7.6. Energy Management

- 7.6.1. Overall Market

- 7.6.2. Mobile Telephony Generations

- 7.6.3. Geographical Regions

- 7.7. Coding

- 7.7.1. Overall Market

- 7.7.2. Mobile Telephony Generations

- 7.7.3. Geographical Regions

Figures & Tables

- Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

- Figure 3-1: VNF versus CNF Stacks

- Figure 3-2: O-RAN High-Level Architecture

- Figure 3-3: O-RAN High-Level Architecture

- Figure 3-4: Architecture of vRAN Base Station as Visualized by TIP.

- Figure 4-1: Reinforcement learning model training and actor locations per O-RAN WG2

- Figure 4-2: AI/ML Workflow in the O-RAN RIC as proposed O-RAN WG2

- Figure 4-3: AI/ML deployment scenarios

- Table 5-1: AI in RAN Product and Solution Vendor Summary

- Figure 5-1: The Aira channel detection xApp functional blocks

- Figure 5-2: Modules of the Aspire Anomaly Detection rApp

- Figure 5-3: OmniPHY Module Drop in Typical vRAN Stack Overview

- Figure 5-4: Ericsson IAP

- Figure 5-5: HCL iDES rApp Architecture

- Figure 5-6: Working of the Net Ai xUPscaler

- Figure 5-7: Nokia RIC programmability via AI/ML and Customized Applications

- Figure 5-8: Timesharing the GPU in Nvidia Aerial A100

- Figure 5-8: Rimedo TS xApp in the O-RAN architecture

- Figure 5-9: Rimedo TS xApp in the VMware RIC

- Figure 5-10: PowerPilot Solution Evolution

- Table 6-1: AI in RAN Telco Profile Snapshot

- Figure 7-1: AI in the RAN Market Forecast Taxonomy

- Table 7-1: Addressable Market in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-2: Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-2: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-3: Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-3: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-4: Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-5: Addressable Market in Traffic Optimization Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-4: Share of Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-6: Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-5: Share of Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-7: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-8: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-6: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-9: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-7: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-10: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-11: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-8: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-12: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-9: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-13: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-14: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-10: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-15: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-11: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

- 시장 전체

- 휴대폰 세대별

- 지역 구분별

This report delves into the intersection of Artificial Intelligence (AI) and Radio Access Network (RAN), shedding light on their evolving relationship and forecasting their future trajectories.

SAMPLE VIEW

Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

Source: Insight Research

In recent years, AI has emerged as a pivotal force driving innovation across industries. The telecom sector, in particular, has witnessed a transformative impact with the integration of AI into RAN architecture. The report explores this synergy, uncovering the dynamics behind their convergence and the implications for the telecommunication landscape.

"At Insight Research, we recognize the seismic shifts occurring within the telecommunications industry, and our latest report elucidates the symbiotic relationship between AI and RAN," remarked Kaustubha Parkhi, Principal Analyst at Insight Research. "We're witnessing a paradigm shift in RAN architecture, with AI playing a pivotal role in driving efficiency, agility, and performance."

Key Highlights from the Report:

- The addressable market for AI in RAN will grow by an impressive 45% annually during 2023-2028

- The addressable market for AI in 5G RAN will grow faster than earlier telephony generations

- The APAC region will be the largest market for AI in RAN caching applications

With a meticulous breakdown of the market by application, region, and telephony generations, the report offers unparalleled quantitative insights, empowering stakeholders to make informed decisions in a rapidly evolving landscape.

Insight Research's "AI and RAN - How Fast Will They Run?" report is essential reading for telecom operators, technology providers, policymakers, and investors seeking to navigate the evolving landscape of AI-driven telecommunications infrastructure.

Table of Contents

1. Executive Summary

- 1.1. Key observations

- 1.2. Quantitative Forecast Taxonomy

- 1.3. Report Organization

2. AI/ML/DL - Key Concepts Explainer

- 2.1. Artificial Intelligence

- 2.2. Machine Learning (ML)

- 2.2.1. Supervised Machine Learning

- 2.2.2. Unsupervised Machine Learning

- 2.2.3. Reinforced Machine Learning

- 2.2.4. K-Nearest Neighbor

- 2.3. Deep Learning Neural Network (DLNN)

- 2.4. Noteworthy ML and DL Algorithms

- 2.4.1. Anomaly Detection

- 2.4.2. Artificial Neural Networks (ANN)

- 2.4.3. Bagged Trees

- 2.4.4. CART and SVM Algorithms

- 2.4.5. Clustering

- 2.4.6. Conditional Variational Autoencoder

- 2.4.7. Convolutional Neural Network

- 2.4.8. Correlation and Clustering

- 2.4.9. Evolutionary Algorithms and Distributed Learning

- 2.4.10. Feed Forward Neural Network

- 2.4.11. Graph Neural Networks

- 2.4.12. Hybrid Cognitive Engine (HCE)

- 2.4.13. Kalman Filter

- 2.4.14. Markov Decision Processes

- 2.4.15. Multilayer Perceptron

- 2.4.16. Naïve Bayes

- 2.4.17. Radial Basis Function

- 2.4.18. Random Forest

- 2.4.19. Recurrent Neural Network

- 2.4.20. Reinforced Neural Network

- 2.4.21. SOM Algorithm

- 2.4.22. Sparse Bayesian Learning

3. Virtualization of the RAN

- 3.1. The RAN and its Evolution

- 3.1.1. Closer Look at E-UTRAN

- 3.1.2. 5G- NR, NSA and SA

- 3.1.3. MEC

- 3.1.4. The Rigid CPRI

- 3.2. The Progression of the RAN to the vRAN

- 3.3. How VM-based and Container-based vRANs Compare?

- 3.3.1. NFV architecture

- 3.3.2. The Need for Containers

- 3.3.3. Microservices

- 3.3.4. Container Morphology

- 3.3.5. Container Deployment Methodologies

- 3.3.6. Stateful and Stateless Containers

- 3.3.7. Advantage Containers

- 3.3.8. Challenges Confronting Containers

- 3.4. RAN Virtualization - A Story of Alliances

- 3.4.1. O-RAN Architecture Overview

- 3.4.2. History of O-RAN

- 3.4.3. Workgroups of O-RAN

- 3.4.4. Open vRAN (O-vRAN)

- 3.4.5. Telecom Infra Project (TIP) OpenRAN

4. End-applications for AI in the RAN

- 4.1. O-RAN and AI

- 4.1.1. Introduction

- 4.1.2. RIC, xApps and rApps

- 4.1.3. WG2 and ML

- 4.2. AI Use-Case - Traffic Optimization

- 4.2.1. Background

- 4.2.2. Methodologies and Challenges

- 4.2.3. AI-based Approaches

- 4.3. AI Use-Case - Caching

- 4.3.1. Background

- 4.3.2. Methodologies and Challenges

- 4.3.3. AI-based Approaches

- 4.4. AI Use-Case - Energy Management

- 4.4.1. Background

- 4.4.2. Methodologies and Challenges

- 4.4.3. AI-based Approaches

- 4.5. AI Use-Case - Coding

- 4.5.2. AI-based Approaches

5. Vendor Initiatives for AI in the RAN

- 5.1. Introduction

- 5.2. Salient Observations

- 5.3. Company and Organization Summary

- 5.4. Aira Channel Prediction xApp

- 5.5. Aira Dynamic Radio Network Management rApp

- 5.6. AirHop Auptim

- 5.7. Aspire Anomaly Detection rApp

- 5.8. Cisco Ultra Traffic Optimization

- 5.9. Capgemini RIC

- 5.10. Cohere MU-MIMO Scheduler

- 5.11. DeepSig OmniSig

- 5.12. Deepsig OmniPHY

- 5.13. Ericsson Radio System

- 5.14. Ericsson RIC

- 5.15. Fujitsu Open RAN Compliant RUs

- 5.16. HCL iDES rApp

- 5.17. Huawei PowerStar

- 5.18. Juniper RIC/Rakuten Symphony Symworld

- 5.19. Mavenir mMIMO 64TRX

- 5.20. Mavenir RIC

- 5.21. Net AI xUPscaler Traffic Predictor xApp

- 5.22. Nokia RAN Intelligent Controller

- 5.23. Nokia AVA

- 5.24. Nokia ReefShark Soc

- 5.25. Nvidia AI-on-5G platform

- 5.26. Opanga Networks

- 5.27. P.I. Works Intelligent PCI Collision and Confusion Detection rApp

- 5.28. Qualcomm RIC

- 5.29. Qualcomm Cellwize CHIME

- 5.30. Qualcomm Traffic Management Solutions

- 5.31. Rimedo Policy-controlled Traffic Steering xApp

- 5.32. Samsung Network Slice Manager

- 5.33. ZTE PowerPilot

- 5.34. VMware RIC

6. Telco Initiatives for AI in the RAN

- 6.1. Introduction

- 6.2. Salient Observations

- 6.3. Company and Organization Summary

- 6.4. AT&T Inc

- 6.5. Axiata Group Berhad

- 6.6. Bharti Airtel

- 6.7. China Mobile

- 6.8. China Telecom

- 6.9. China Unicom

- 6.10. CK Hutchison Holdings

- 6.11. Deutsche Telekom

- 6.12. Etisalat

- 6.13. Globe Telecom Inc

- 6.14. NTT DoCoMo

- 6.15. MTN Group

- 6.16. Ooredoo

- 6.17. Orange

- 6.18. PLDT Inc

- 6.19. Rakuten Mobile

- 6.20. Reliance Jio

- 6.21. Saudi Telecom Company

- 6.22. Singtel

- 6.23. SK Telecom

- 6.24. Softbank

- 6.25. Telefonica

- 6.26. Telenor

- 6.27. Telkomsel

- 6.28. T-Mobile US

- 6.29. Verizon

- 6.30. Viettel Group

- 6.31. Vodafone

7. Quantitative Analysis and Forecasts

- 7.1. Research Methodology

- 7.2. Forecast Taxonomy

- 7.3. Global Market

- 7.3.1. Overall Market

- 7.3.2. Mobile Telephony Generations

- 7.3.3. Geographical Regions

- 7.4. Traffic Optimization

- 7.4.1. Overall Market

- 7.4.2. Mobile Telephony Generations

- 7.4.3. Geographical Regions

- 7.5. Caching

- 7.5.1. Overall Market

- 7.5.2. Mobile Telephony Generations

- 7.5.3. Geographical Regions

- 7.6. Energy Management

- 7.6.1. Overall Market

- 7.6.2. Mobile Telephony Generations

- 7.6.3. Geographical Regions

- 7.7. Coding

- 7.7.1. Overall Market

- 7.7.2. Mobile Telephony Generations

- 7.7.3. Geographical Regions

Figures & Tables

- Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

- Figure 3-1: VNF versus CNF Stacks

- Figure 3-2: O-RAN High-Level Architecture

- Figure 3-3: O-RAN High-Level Architecture

- Figure 3-4: Architecture of vRAN Base Station as Visualized by TIP.

- Figure 4-1: Reinforcement learning model training and actor locations per O-RAN WG2

- Figure 4-2: AI/ML Workflow in the O-RAN RIC as proposed O-RAN WG2

- Figure 4-3: AI/ML deployment scenarios

- Table 5-1: AI in RAN Product and Solution Vendor Summary

- Figure 5-1: The Aira channel detection xApp functional blocks

- Figure 5-2: Modules of the Aspire Anomaly Detection rApp

- Figure 5-3: OmniPHY Module Drop in Typical vRAN Stack Overview

- Figure 5-4: Ericsson IAP

- Figure 5-5: HCL iDES rApp Architecture

- Figure 5-6: Working of the Net Ai xUPscaler

- Figure 5-7: Nokia RIC programmability via AI/ML and Customized Applications

- Figure 5-8: Timesharing the GPU in Nvidia Aerial A100

- Figure 5-8: Rimedo TS xApp in the O-RAN architecture

- Figure 5-9: Rimedo TS xApp in the VMware RIC

- Figure 5-10: PowerPilot Solution Evolution

- Table 6-1: AI in RAN Telco Profile Snapshot

- Figure 7-1: AI in the RAN Market Forecast Taxonomy

- Table 7-1: Addressable Market in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-2: Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-2: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-3: Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-3: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-4: Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-5: Addressable Market in Traffic Optimization Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-4: Share of Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-6: Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-5: Share of Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-7: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-8: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-6: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-9: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-7: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-10: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-11: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-8: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-12: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-9: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-13: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-14: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-10: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-15: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-11: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028