|

시장보고서

상품코드

1558623

IoT 로밍 시장(2024-2029년)Global IoT Roaming Market: 2024-2029 |

||||||

| 주요 통계 | |

|---|---|

| 통신사업자의 IoT 로밍 수익(2024년) : | 11억 달러 |

| 통신사업자의 IoT 로밍 수익(2029년) : | 23억 달러 |

| 5G IoT 로밍 연결 수(2029년) : | 39m |

| 예측 기간 : | 2024-2029년 |

통신사 IoT 로밍 수익은 2029년까지 20억 달러 돌파 전망

이 조사 자료집은 빠르게 성장하는 셀룰러 IoT 시장에서 IoT 로밍의 역할에 대한 분석과 실용적인 인사이트를 제공하여 이동통신사, IoT 기기 제조업체, IoT MVNO 등 이해관계자들이 IoT 로밍 연결에 대한 수요 증가에 대응할 수 있도록 돕습니다.

이 조사에는 5G 및 LPWA/LPWAN 로밍 연결에 대한 수요 증가, IoT 로밍에서 eSIM 기술의 역할 증대 등 IoT 로밍 시장의 주요 동향에 대한 상세한 평가도 포함되어 있습니다.

조사 대상 5G 확장 커넥티비티에는 다음과 같은 것들이 포함됩니다.

|

|

이 보고서는 또한 통신사업자와 IoT 연결 제공업체가 GSMA의 BCE(Billing and Charging Evolution)를 통해 IoT 로밍 연결의 수익화를 개선하고 로밍 스티어링 솔루션과 로밍 분석의 활용도를 향상시킬 수 있는 방법에 대한 전략적 제언을 담고 있습니다.

이 조사는 통신 사업자와 IoT 연결 제공업체가 IoT 로밍 서비스와 기업용 IoT 솔루션을 개선할 수 있는 방법을 제안하며, 원활한 연결을 제공하기 위한 위성 IoT 연결 통합에 대한 전략적 제안도 포함합니다. 또한 SGP.32 분석을 포함한 영구 로밍 등 로밍 제한에 대한 해결책으로 eSIM 기술 서비스 개발, 기업용 AI 통합 및 로밍 분석 개선, IoT SAFE를 포함한 IoT 보안 솔루션 개발에 대한 전략적 제언, 2G 및 3G 네트워크 단종에 따른 영향 관리에 대한 기업 지원에 대한 분석도 포함되어 있습니다.

주요 특징

- 시장 동향 : 위성 IoT 연결의 세계 연결 서비스 통합, 트래픽 조향에 영향을 미치는 기업용 툴 개발, eSIM 기술 및 기업용 현지화 서비스, IoT SAFE 및 IoT용 양자 암호화를 포함한 IoT 보안 솔루션 개발 등 IoT 로밍 시장의 주요 동향과 기회에 대한 인사이트를 제공합니다. 또한, IoT 로밍 서비스를 개선하기 위해 통신사 및 IoT 커넥티비티 벤더들이 투자해야 할 분야에 대한 분석과 권고사항도 포함되어 있습니다. 여기에는 5G 강화 커넥티드 로밍, 네트워크 간 슬라이스 로밍 조향, BCE로의 전환, IoT 로밍을 위한 네트워크 액세스 등 새로운 과금 모델 개발 등이 포함됩니다.

- 주요 요점 및 전략적 제언 : IoT 로밍 시장의 주요 발전 기회와 인사이트를 상세히 분석하고 통신 사업자와 IoT 연결 제공업체를 위한 전략적 제언을 제시합니다.

- 벤치마크 산업 예측 : 로밍 IoT 연결의 총 수, 로밍 IoT 연결로 인한 사업자의 총 수익, 로밍 IoT 연결로 생성되는 셀룰러 데이터의 총 수, 2G와 3G, 4G, 5G, LPWA와 같은 네트워크 기술별 분류에 대한 데이터가 제공됩니다.

- Juniper Research의 경쟁사 리더보드 : 12개 IoT 로밍 부가 가치 서비스 공급업체와 20개 세계 IoT 커넥티비티 제공업체의 역량, 용량, 각 분야별 공급업체의 시장 규모 및 서비스 제공에 대한 상세한 분석을 제공합니다.

샘플

시장 데이터 및 예측 보고서:

시장 동향 및 전략 보고서:

현재 시장 상황을 종합적으로 분석하여 전략적인 제안을 제공합니다.

목차

시장 동향 및 전략

제1장 중요 포인트와 전략적 추천사항

- 중요 포인트

- 주요 전략적 추천사항

제2장 시장 상황

- IoT 로밍 시장을 견인하는 주요 동향

- 5G와 LPWA의 등장에도 불구하고 4G가 IoT 로밍에서 계속해서 중요

- IoT 로밍에서 LPWA의 중요성 증대

- 5G IoT 로밍 성장

제3장 향후 기회와 시장 전략

- 주요 기회와 시장 전략

- 2G 및 3G 선셋 전략

- TAP와 BCE

- 로밍 분석

- 로밍 스티어링

- eSIM 및 iSIM

- IoT SAFE

제4장 국가별 준비 지수

- 국가별 준비 지수 : 소개

- 초점 시장

- 성장 시장

- 신흥 시장

경쟁 리더보드

제1장 IoT 로밍 VAS 서비스 : 경쟁 리더보드

제2장 IoT 로밍 VAS 벤더 : 프로파일

- 벤더 개요

- A1 International Business

- BICS

- Cellusys

- Comfone

- MACH

- Mobileum

- Syniverse

- Tata Communications

- Telna

- Tele2

- Telefonica Global Solutions

- TNS

- Juniper Research 리더보드 평가 방법

- 제한과 해석

제3장 세계의 IoT 연결 : 경쟁 리더보드

제4장 세계의 IoT 연결 : 경쟁 리더보드

- AT&T

- A1 Digital

- BICS

- Deutsche Telekom

- emnify

- Eseye

- iBASIS

- Kore Wireless

- Onomondo

- Orange Business Services

- Soracom

- Tata Communications

- Tele2 IoT

- Telefonica Tech

- Telenor Connexion

- Telit Cinterion

- Velos IoT

- Verizon

- Vodafone Business

- Wireless Logic

- Juniper Research 리더보드 평가 방법

- 제한과 해석

데이터 및 예측

제1장 소개 및 조사 방법

제2장 시장 개요와 향후 시장 전망

- 로밍중 IoT 연결 총수

- 로밍 IoT 연결에 의한 통신사업자 매출

- 로밍 IoT 연결에 의해 생성되는 데이터 합계

- 로밍 4G IoT 연결 총수

- 로밍 4G IoT 연결에 의한 통신사업자 매출

- 로밍 4G IoT 연결에 의해 생성되는 데이터 합계

- 로밍 5G IoT 연결 총수

- 로밍 5G IoT 연결에 의한 통신사업자 매출

- 로밍 5G IoT 연결에 의해 생성되는 데이터 합계

- 로밍 LPWA IoT 연결 총수

- 로밍 LPWA IoT 연결에 의한 통신사업자 매출

- 로밍 LPWA IoT 연결에 의해 생성되는 데이터 합계

| KEY STATISTICS | |

|---|---|

| Operator IoT roaming revenue in 2024: | $1.1bn |

| Operator IoT roaming revenue in 2029: | $2.3bn |

| 5G IoT roaming connections in 2029: | 39m |

| Forecast period: | 2024-2029 |

'Operator IoT Roaming Revenue to Break $2 Billion by 2029'

Overview

Our "IoT Roaming" research suite provides insights and actionable insights into the role of IoT roaming in the rapidly growing cellular IoT market; enabling stakeholders, such as mobile operators, IoT device manufacturers, and IoT MVNOs (Mobile Virtual Network Operators) to navigate the growing demand for IoT roaming connectivity.

Included is a detailed assessment of the key trends in the IoT roaming market, including the growing demand for 5G and LPWA (Low Power Wide Area)/LPWAN (Low Power Wide Area Network) roaming connectivity, as well as the growing role of eSIM technology in IoT roaming. Our 5G analysis assesses the role of 5G enhanced connectivity solutions, which provide improved quality of service; optimised for specific use cases.

The forms of 5G enhanced connectivity discussed include:

|

|

The report also provides strategic recommendations for how operators and IoT connectivity providers can improve their monetisation of IoT roaming connectivity via the GSMA's (Global System for Mobile Communications Association) BCE (Billing and Charging Evolution), and improve their use of roaming steering solutions, as well as roaming analytics.

The research delivers recommendations for how operators and IoT connectivity providers can improve their IoT roaming services and IoT solutions to enterprises, with strategic recommendations for the integration of satellite IoT connectivity to provide seamless connectivity. Plus development of eSIM technology services as a solution to roaming restrictions such as those on permanent roaming, including analysis of SGP.32, and the integration of AI and improvement of roaming analytics for enterprises. It includes further strategic recommendations for the development of IoT security solutions, including IoT SAFE, and analysis of how enterprises can be supported in managing the impact of 2G and 3G network sunsetting.

The market forecast suite includes several different options that can be purchased separately, including access to data mapping and a forecast document, a strategy and trends document detailing critical trends in the market, and strategic recommendations for developing and monetising IoT roaming services, such as the development of new charging models using BCE and the continued expansion of eSIM localisation services.

The report includes two Competitor Leaderboards. The first Competitor Leaderboard contains extensive analysis of the IoT roaming value-added services; assessing 12 market leaders providing a range of value-added services such as roaming analytics, roaming steering, and data and financial clearing. The second Competitor Leaderboard contains in-depth analysis of 20 leading vendors providing global IoT connectivity services to enterprises. It can also be purchased as a Full Research Suite, which contains all these elements and offers a substantial discount.

Collectively, they provide a critical tool for understanding the IoT roaming market, which will allow operators and IoT connectivity providers to shape their future strategies for service development and monetisation. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of a crucial connectivity market.

Key Features

- Market Dynamics: Insights into key trends and opportunities within the IoT roaming market, such as the integration of satellite IoT connectivity into global connectivity offerings, the development of tools for enterprises to influence traffic steering, eSIM technology and localisation services for enterprises, and the development of IoT security solutions, including IoT SAFE and quantum-resistant cryptography for IoT. It also includes analysis and recommendations for where operators and IoT connectivity vendors must look to invest to improve their IoT roaming services. This includes the development of 5G-enhanced connectivity roaming, inter-network slice roaming steering, the transition to BCE, and the development of new charging models, such as network access for IoT roaming.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the IoT roaming market, accompanied by strategic recommendations for operators and IoT connectivity providers.

- Benchmark Industry Forecasts: Data for the total number of roaming IoT connections, total operator revenue from roaming IoT connections, and total cellular data generated by roaming IoT connections. This data is provided for the market as a whole, as well as being split by the following network technologies: 2G and 3G, 4G, 5G, and LPWA.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment of 12 IoT roaming value-added services vendors, and 20 global IoT connectivity provider. This features market sizing of vendors in each sector and detailed analysis of their offerings.

SAMPLE VIEW

Market Data & Forecasting Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Key Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Key Trends Driving the IoT Roaming Market

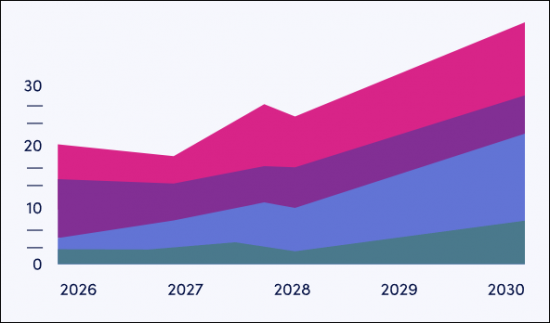

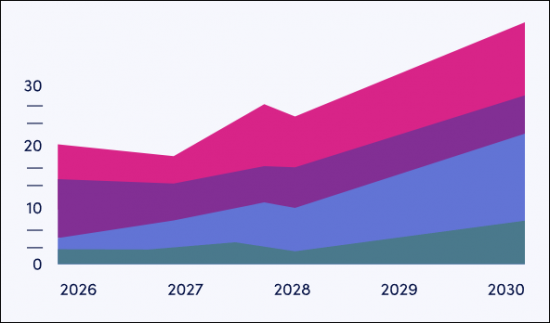

- Figure 2.1: Total Number of IoT Roaming Connections (m), Split By 8 Key Regions, 2024-2029

- 2.2.1. 4G to Remain Critical to IoT Roaming, Despite Emergence of 5G and LPWA

- Figure 2.2: Total Number of 4G IoT Roaming Connections (m), Split By 8 Key Regions, 2024-2029

- Table 2.3: 4G IoT Roaming Connections Compound Annual Growth Rate 2024-2029

- 2.2.2. LPWA to Become Increasingly Important in IoT Roaming

- Figure 2.4: Total Number of LPWA Roaming Connections, Split By 8 Key Regions, 2024-2029

- Table 2.5: NB-IoT and LTE-M Comparison

- Table 2.6: NB-IoT Evolution Comparison in 3GPP Standards

- Table 2.7: LTE Cat-M1 and LTE Cat-M2 Connectivity Comparison in 3GPP Standards

- Figure 2.8: Key LTE-M Use Cases

- 2.2.3. 5G IoT Roaming Growth

- Figure 2.9: Total Number of 5G IoT Roaming Connections, Split By 8 Key Regions, 2024-2029

- i. Enhanced Connectivity Roaming

3. Future Opportunities and Market Strategies

- 3.1. Key Opportunities and Market Strategies

- 3.1.1. 2G and 3G Sunsetting Strategies

- Figure 3.1: Total Number of 2G and 3G IoT Roaming Devices (m), Split By 8 Key Regions, 2024-2029

- Table 3.2: Upcoming 2G and 3G Network Sunsets (August 2024)

- 3.1.2. TAP and BCE

- Figure 3.3: BCE Reporting Exchange Flow

- 3.1.3. Roaming Analytics

- i. Provider Roaming Analytics

- ii. Enterprise Roaming Analytics

- Figure 3.4: Key Examples of Enterprise Roaming Analytics

- 3.1.4. Roaming Steering

- Table 3.5: OTA Roaming Steering Benefits and Costs

- Table 3.6: Signalling Roaming Steering Benefits and Costs

- 3.1.5. eSIM and iSIM

- ii. iSIM

- Table 3.7: SIM Form Factors and Dimensions

- ii. iSIM

- 3.1.6. IoT SAFE

- Figure 3.8: IoT SAFE Architecture

- Table 3.9: IoT SAFE Applet 1 and 2 Comparison

- Figure 3.10: IoT SAFE Service Operations

- Satellite IoT Roaming

- Figure 3.11: Total Satellite IoT Services Revenue ($m), Split by Market Vertical, 2024-2029

- Table 3.12: Select Recent Satellite IoT Announcements

- 3.1.1. 2G and 3G Sunsetting Strategies

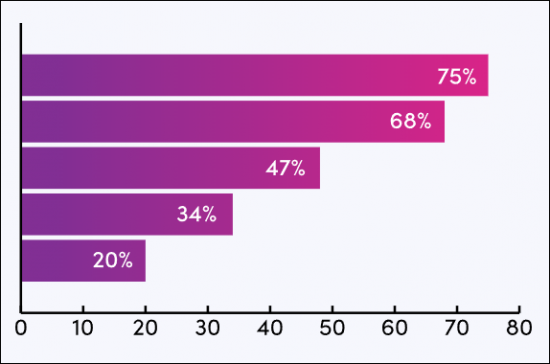

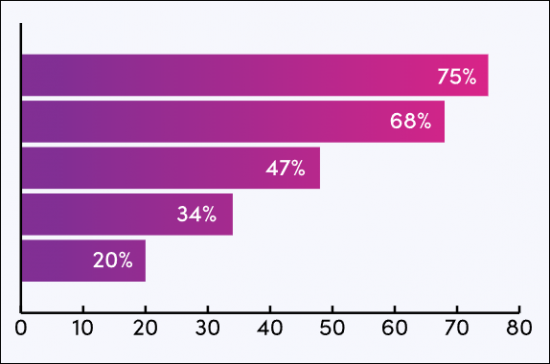

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: IoT Roaming Country Readiness Index Regional Definitions

- Table 4.2: Juniper Research Country Readiness Index Scoring Criteria

- Figure 4.3: Juniper Research Country Readiness Index

- Table 4.4: Report Country Readiness Index: Market Segments

- 4.1.1. Focus Market

- Figure 4.5: Total Number of LPWA Roaming Connections in Select Focus Markets (m), Split By 8 Key Regions, 2024-2029

- ii. The US

- Figure 4.6: Total Number of IoT Roaming Connections in the US (m), 2024-2029

- Figure 4.7: Total Operator Revenue from IoT Roaming in the US ($m), 2024-2029

- iii. China

- Figure 4.8: Total Number of IoT Roaming Connections in China (m), 2024-2029

- 4.2. Growth Markets

- Figure 4.9: Total Number of IoT Roaming Connections in Select Key Growth Markets (m), 2024-2029

- Figure 4.10: Total Number of IoT Roaming Connections in India (m), Regions, 2024-2029

- Table 4.11: TRAI IoT eSIM recommendations

- 4.3. Developing Markets

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.15: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.16: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.17: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.18: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.19: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. IoT Roaming VAS Services Competitor Leaderboard

- 1.1. Why Read this Report

- Table 1.1: Juniper Research Competitor Leaderboard Vendors and Product Portfolios: IoT Roaming

- Figure 1.2: Juniper Research Competitor Leaderboard: 12 Vendors

- Source: Juniper ResearchTable 1.3: Juniper Research Competitor Leaderboard: IoT Roaming Value-added Services Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: 12 Vendors

- Source: Juniper ResearchTable 1.3: Juniper Research Competitor Leaderboard: IoT Roaming Value-added Services Vendors & Positioning

2. IoT Roaming VAS Vendor Profiles

- 2.1. Vendor Profiles

- 2.1.1. A1 International Business

- i. Corporate Information

- Table 2.1: A1 Group Select Financial Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. BICS

- i. Corporate Information

- Table 2.2: BICS' Revenue, 2022-2023

- ii. Geographical Spread

- Figure 2.3. BICS' Global Presence Map

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Table 2.4: BICS Roaming Services

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.3. Cellusys

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: Cellusys' Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Comfone

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.6: Comfone's Key2roam Hub Coverage Map

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. MACH

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Mobileum

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.7: Mobileum Wholesale Business Advisor

- Figure 2.8: Mobileum IoT Steering of Roaming

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Syniverse

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Tata Communications

- i. Corporate Information

- Table 2.10: Tata Communications' Select Financial Information (Indian Rupee in crore), FY24

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.11: Tata Communications' Roaming Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.9. Telna

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Tele2

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Telefonica Global Solutions

- i. Corporate Information

- Table 2.12: Telefonica's Select Financial Information (Euro-m), 2020-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.13: TGS 5G Roaming Suite

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.12. TNS

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. A1 International Business

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

- Table 2.14: Juniper Research Competitor Leaderboard: IoT Roaming Value-added Services

3. Global IoT Connectivity Competitor Leaderboard

- 3.1. Introduction

- Figure 3.3.1: Juniper Research Competitor Leaderboard Vendors and Product Portfolios (Part One)

- Table 3.3.2: Juniper Research Competitor Leaderboard Vendors and Product Portfolios (Part Two)

- Figure 3.3.3: Juniper Research Competitor Leaderboard: Global IoT Connectivity

- Source: Juniper ResearchTable 3.4: Juniper Research Competitor Leaderboard: Vendors & Positioning

- Table 3.3.5: Juniper Research Competitor Leaderboard Heatmap: 20 Vendors (Part One)

- Figure 3.6: Juniper Research Competitor Leaderboard Heatmap: 20 Vendors (Part Two)

4. Global IoT Connectivity Competitor Leaderboard

- 4.1. Vendor Profiles

- 4.1.1. AT&T

- i. Corporate Information

- ii. Geographical Spread

- iii. Key clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.1: IoT Console

- Figure 4.2: AT&T Control Center Features

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.2. A1 Digital

- i. Corporate Information

- Table 4.3: A1 Group Select Financial Information, 2020-2023

- ii. Geographical Spread

- Figure 4.4: A1 Telekom Austria Group Operations Map

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.3. BICS

- i. Corporate Information

- Table 4.5: BICS Revenue ($), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.4. Deutsche Telekom

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.6: Deutsche Telekom IoT Connectivity Coverage

- Figure 4.7: Deutsche Telekom Platform Integrations

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.5. emnify

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.8: emnify 5G Coverage

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.6. Eseye

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.10: Eseye's AnyNet Federation and Direct Operator Interconnects (August 2024)

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.7. iBASIS

- i. Corporate Information

- ii. Geographical Spread

- Figure 4.11: iBASIS' Global Customer Connections

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.12: iBASIS' NB-IoT and LTE-M Coverage

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.8. Kore Wireless

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.13: Kore One Platform

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.9. Onomondo

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.10. Orange Business Services

- i. Corporate Information

- ii. Geographical Spread

- Figure 4.14: Orange Operations Map

- ii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.11. Soracom

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.15: Soracom Endorse Authentication Process

- Figure 4.16: Soracom Lagoon

- Figure 4.17: Soracom Unified Endpoint

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.12. Tata Communications

- i. Corporate Information

- Table 4.18: Tata Communications' Select Financial Information (Indian Rupee in crore), FY24

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.13. Tele2 IoT

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.19: Tele2 IoT Network Support 2024

- Figure 4.20: Tele2 2ACESS Data Transfer Management

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.14. Telefonica Tech

- i. Corporate Information

- Table 4.21: Telefonica's Select Financial Information (Euro-m), 2020-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.15. Telenor Connexion

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.22: Telenor Connexion's IoT Cloud Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.16. Telit Cinterion

- i. Corporate Information

- Table 4.23: Telit Cinterion's Select Financial Information ($m), 2020-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.24: Telit eSIM Provisioning Platform

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.17. Velos IoT

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.25: Velos NB-IoT and LTE-M Coverage

- Figure 4.26: Velos IoT eSIM Connectivity Hub Features

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.18. Verizon

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.19. Vodafone Business

- i. Corporate Information

- Table 4.27: Vodafone Business Select Financial Information (Million), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 4.28: Vodafone Business' LPWA Services Availability

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 4.1.20. Wireless Logic

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 4.1.1. AT&T

- 4.2. Juniper Research Leaderboard Assessment Methodology

- 4.3. Limitations & Interpretations

- Table 4.29: Juniper Research Competitor Leaderboard: Global IoT Connectivity

Data & Forecasting

1. Introduction and Methodology

- 1.1. Introduction

- 1.2. Forecast Methodology

- Figure 1.1: IoT Roaming Forecast Methodology

2. Market Summary and Future Market Outlook

- 2.1. Total Number of IoT Connections that Are Roaming

- Figure & Table 2.1: Total Number of IoT Connections that Are Roaming (m), Split By 8 Key Regions, 2024-2029

- Table 2.2: Total Number of IoT Roaming Connections Split by Network Type (m), 2024-2029

- 2.2. Total Operator Revenue from Roaming IoT Connectivity

- Figure & Table 2.3: Total Operator Revenue from Roaming IoT Connectivity

- 2.3. Total Data Generated by Roaming IoT Connections

- Figure & Table 2.4: Total Data Generated by Roaming IoT Connections

- 2.4. Total Number of Roaming 4G IoT Connections

- Figure & Table 2.5: Tota Number of Roaming 4G IoT Connections, Split By 8 Key Regions, 2024-2029

- 2.5. Total Operator Revenue from Roaming 4G IoT Connections

- Figure & Table 2.6: Total Operator Revenue from Roaming 4G IoT Connections ($m), Split By 8 Key Regions, 2024-2029

- 2.6. Total Data Generated by Roaming 4G IoT Connections

- Figure & Table 2.7: Total Data Generated by 4G IoT Connections (PB), Split By 8 Key Regions, 2024-2029

- 2.7. Total Number of Roaming 5G IoT Connections

- Figure & Table 2.8: Total Number of Roaming 5G IoT Connections (m), Split By 8 Key Regions, 2024-2029

- 2.8. Total Operator Revenue from Roaming 5G IoT Connections

- Figure 2.9: Total Operator Revenue from Roaming 5G IoT Connections ($m), Split By 8 Key Regions, 2024-2029

- 2.9. Total Data Generated by Roaming 5G IoT Connections

- Figure & Table 2.10: Total Data Generated by Roaming 5G IoT Connections (PB), Split By 8 Key Regions, 2024-2029

- 2.10. Total Number of Roaming LPWA IoT Connections

- Figure & Table 2.11: Total Number of Roaming LPWA IoT Connections (m), Split By 8 Key Regions, 2024-2029

- 2.11. Total Operator Revenue from Roaming LPWA IoT Connections

- Figure & Table 2.12: Total Operator Revenue from Roaming LPWA IoT Connections ($m), Split By 8 Key Regions, 2024-2029

- Table 2.13: Average Operator Revenue Per Month ($), Split By 8 Key Regions, 2024-2029

- 2.12. Total Data Generated by Roaming LPWA IoT Connections

- Figure & Table 2.14: Total Data Generated by Roaming LPWA IoT Connections (PB), Split By 8 Key Regions, 2024-2029