|

시장보고서

상품코드

1674507

모바일 ID 시장(2025-2029년)Global Mobile Identity Market: 2025-2029 |

||||||

세계의 모바일 ID 수익은 2029년에는 절반 이상을 API가 차지할 전망

| 주요 통계 | |

|---|---|

| 모바일 ID의 총 수익(2025년) : | 255억 달러 |

| 모바일 ID의 총 수익(2029년) : | 427억 달러 |

| 모바일 ID 수익 성장률(2025-2029년) : | 68% |

| 예측 기간 : | 2025-2029년 |

본 조사 패키지는 향후 5년간 크게 변화하는 모바일 ID 시장의 상세하고 통찰력 있는 분석을 제공합니다. 본 조사를 통해 모바일 ID 공급업체 및 모바일 운영자와 같은 이해관계자는 시장이 어떻게 발전하는지 더 잘 이해할 수 있습니다. SMS 비즈니스 메시징 감소 및 대체 모바일 ID 솔루션으로의 마이그레이션이 기존 서비스에 얼마나 민감한지 평가합니다.

이 제품군에는 모바일 ID 트래픽 및 미래 수익 가능성에 대한 데이터 및 예측을 포함하여 개별적으로 구매할 수 있는 여러 옵션이 포함되어 있습니다. 또한 시장의 주요 동향과 미래의 기회를 밝히는 통찰력이 있는 조사와 모바일 ID 분야의 주요 벤더 18개 회사에 대한 광범위한 분석도 포함되어 있습니다.

주요 특징

- 시장 역학 : 모바일 ID 시장의 변화로 인한 주요 동향과 시장 기회에 대한 인사이트를 제공합니다. 본 조사에서는 OTT 메시징 및 리치 커뮤니케이션 서비스(RCS)를 통한 일회용 비밀번호(OTP), 번호 확인 API 등 모바일 ID 공급업체 및 모바일 운영자의 주요 성장 기회를 다룹니다. 또한 모바일 운영자가 관리할 수 있는 비운영자 플랫폼으로 이동하는 인증 트래픽과 새로운 모바일 ID 솔루션의 보안으로 인한 과제를 평가하고 이러한 과제를 어떻게 해결해야 하는지 제안합니다. 또한 주요 61개국의 현재 시장의 발전 상황과 향후 성장에 관한 지역별 시장 성장률 분석도 게재하여 주요 주목 시장을 확인하고 있습니다.

- 주요 요점 및 전략적 제안 : 주요 발전 기회와 지식을 자세히 분석하고 공급업체와 모바일 운영자에 대한 주요 전략적 제안을 제공합니다.

- 벤치마크 업계 예측 : 5년간 예측 데이터베이스를 제공하여 각 분야의 사용자, 트래픽, 수익 및 예측을 보여줍니다. 이러한 분야에는 SMS OTP, 전화 번호 인증 API, RCS OTP, 음성 OTP, OTT OTP, 이동국 국제 가입자 번호(MSISDN), 생체 인증이 포함됩니다.

- Juniper Research의 경쟁 리더보드 : 주요 벤더 18개 기업의 능력을 평가하고 시장 실적, 수익, 미래 사업 전망 등의 기준으로 벤더를 채점합니다.

샘플

시장 동향 및 전략(PDF 보고서)

SAMPLE VIEW

시장 데이터 및 예측 보고서

설문조사 제품군에는 57개의 테이블과 25,900개 이상의 데이터 포인트로 구성된 종합적인 5년 예측 데이터 세트에 대한 액세스가 포함되어 있습니다. 설문조사 스위트에는 다음 측정항목이 포함됩니다.

|

|

이러한 지표는 다음 주요 시장별로 제공됩니다.

|

|

Juniper Research의 대화형 예측(Excel)에는 다음과 같은 기능이 있습니다.

- 통계 분석 : 데이터 기간 동안 모든 지역 및 국가에 대해 표시되는 특정 측정항목을 검색할 수 있습니다. 그래프는 쉽게 변경할 수 있으며 클립보드로 내보낼 수 있습니다.

- 국가별 데이터 도구 : 예측 기간 동안 모든 지역 및 국가 측정항목을 볼 수 있습니다. 검색창에 표시되는 측정항목을 필터링할 수 있습니다.

- 국가별 비교 도구 : 특정 국가를 선택하고 비교할 수 있습니다. 이 도구에는 그래프를 내보내는 기능이 포함되어 있습니다.

- What-if 분석 : 5가지 대화형 시나리오를 통해 사용자는 예측 전제조건과 비교할 수 있습니다.

목차

시장 동향·전략

제1장 중요 포인트·전략적 추천 사항

제2장 모바일 ID : 장래 시장 전망

- 모바일 ID : 서론

- OTP 기반 인증

- SMS OTP

- RCS 기반 인증

- 플래시 콜

- 비정형 보조 서비스 데이터(USSD) 기반 인증

- OTT 기반 인증

- SIM 기반 인증

- 프라이버시와 동의

- 디바이스 기반의 생체 인증

- 패스키

- 푸시 알림 인증

- 인증에 있어서의 AI와 블록체인

- 다요소 인증/2요소 인증

제3장 국가별 준비지수

- 국가별 준비 지수 : 서론

- 중점 시장

- 스마트폰의 보급

- 극동 및 중국

- 프랑스

- 인도

- 성장 시장

- 서유럽

- 홍콩

- 포화 시장

- 신흥국 시장

경쟁 리더보드

제1장 JuniperResearch의 경쟁 리더보드

제2장 벤더 프로파일

- 벤더 프로파일

- BICS

- Clickatell

- CM.com

- Comviva

- GMS Worldwide

- Infobip

- LINK Mobility

- Methics

- Mitto

- Monty Mobile

- Prelude

- Route Mobile

- Sinch

- Syniverse

- Tata Communications

- Telesign

- Twilio

- Vonage

- 조사 방법

- 제한과 해석

- 관련 조사

데이터 및 예측

제1장 시장 예측·중요 포인트

- 오퍼레이터 청구 모바일 ID의 총 수익

- 모바일 ID의 총 수익

제2장 SMS OTP

- 조사 방법

- MFA 또는 OTP에 사용되는 SMS 트래픽의 합계

- MFA 및 OTP SMS 트래픽의 플랫폼 총 수익

- 운영자 청구의 총 수익

제3장 전화번호 검증 API

- 조사 방법

- 전화번호 검증 API 호출의 총 수

- 전화번호 검증 API 호출을 통한 운영자 총 수익

제4장 RCS OTP

- 조사 방법

- 인증 메시지인 RCS 비즈니스 메시지의 총 수

- RCS 비즈니스 메시징 인증 트래픽의 총 수익

제5장 OTP 음성

- 조사 방법

- OTP 음성 API 통화를 통한 운영자 총 수익

제6장 OTT OTP

- 조사 방법

- OTP로 인한 OTT 비즈니스 메시지의 총 수

- OTT 비즈니스 메시징의 총 수익

제7장 모바일 ID을 위한 MSISDN

- 조사 방법

- MSISDN 로그인으로부터의 MNO 직접 총 수익

제8장 디바이스 기반 생체 인증

- 조사 방법

- 생체 인증 기능을 갖춘 스마트폰의 총 수

'APIs to Account for More Than Half of Global Mobile Identity Revenue by 2029'

| KEY STATISTICS | |

|---|---|

| Total mobile identity revenue in 2025: | $25.5bn |

| Total mobile identity revenue in 2029: | $42.7bn |

| 2025 to 2029 mobile identity revenue increase: | 68% |

| Forecast period: | 2025-2029 |

Overview

Our "Mobile Identity" research suite provides detailed and insightful analysis of a market set for significant change over the next five years. It enables stakeholders, from mobile identity vendors and mobile operators, to better understand how the mobile identity market will evolve; assessing the extent to which the decline in SMS business messaging and migration to alternative mobile identity solutions will disrupt established services.

The mobile identity market suite includes several different options that can be purchased separately, including data and forecasts for traffic and future revenue potential of mobile identity. Additionally, it includes an insightful study uncovering key trends and future opportunities within the market, as well as an extensive analysis of 18 leading vendors in the mobile identity space. The coverage can also be purchased as a full research suite, which contains all these elements and includes a substantial discount.

Collectively, they provide a critical tool for understanding this ever-changing market; allowing mobile identity vendors and operators to capitalise on trends and shape their future strategy. This research suite's unparalleled coverage makes it an incredibly useful resource for projecting the future of such an unpredictable market.

Key Features

- Market Dynamics: Insights into key trends and market opportunities resulting from changes within the mobile identity market. This study addresses key growth opportunities for mobile identity vendors and mobile operators, including one-time passwords (OTPs) via over the top (OTT) messaging and rich communications services (RCS), as well as number verification application programming interfaces (APIs). It assesses challenges posed to mobile operators by authentication traffic migrating to non-operator monetisable platforms and the security of emerging mobile identity solutions, providing recommendations for how these must be navigated. Moreover, it includes a regional market growth rate analysis on the current development and future growth of mobile identity across 61 key countries, identifying key focus markets.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the mobile identity market, accompanied by key strategic recommendations for mobile identity vendors and mobile operators.

- Benchmark Industry Forecasts: Five-year forecast databases are provided for the mobile identity market, providing user, traffic, and revenue splits for each sector. These sector splits include SMS OTPs, phone number verification APIs, RCS OTPs, voice OTPs, OTT OTPs, mobile station international subscriber directory number (MSISDN) and biometric authentication.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 18 mobile identity vendors via the Juniper Research Competitor Leaderboard; scoring these vendors on criteria such as market performance, revenue and future business prospects.

SAMPLE VIEW

Market Trends & Strategies PDF Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

SAMPLE VIEW

Market Data & Forecasts Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies

This trends analysis report examines the mobile identity market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly-changing market. This essential strategy report delivers a comprehensive analysis of the strategic opportunities for mobile identity providers, market challenges, and how stakeholders must navigate these. It also includes an evaluation of the key country-level opportunities for mobile roaming growth, with the Country Readiness Index.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 18 leading vendors in the mobile identity space. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers, based on capacity and capability assessments:

|

|

This competitive analysis document is centred around the Juniper Research Competitor Leaderboard, a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market; backed by a robust methodology.

The market-leading research suite for the mobile identity market includes access to a comprehensive five-year forecast dataset comprising 57 tables and over 25,900 datapoints. Metrics in the research suite include:

|

|

These metrics are provided for the following key market verticals:

|

|

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions via five interactive scenarios.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways and Strategic Recommendations

- 1.2. Key Takeaways

- 1.3. Strategic Recommendations

2. Mobile Identity: Future Market Outlook

- 2.1. Introduction To Mobile Identity

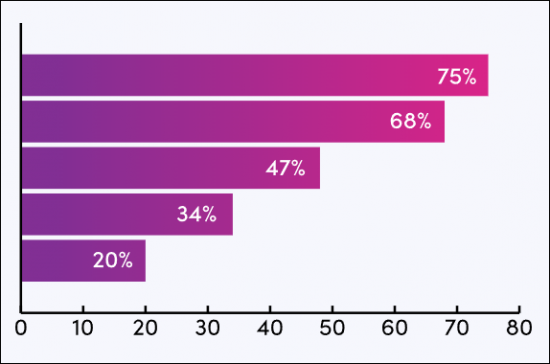

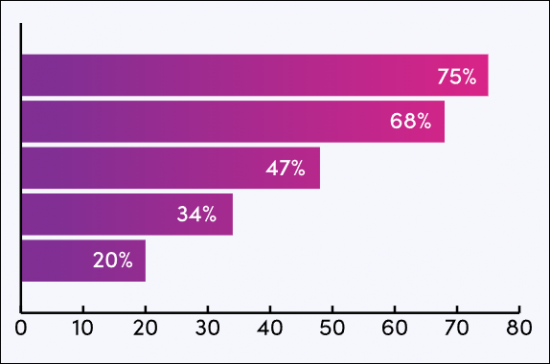

- Figure 2.1: Total Mobile Identity Revenue ($25.5 billion), Split by Channel, 2025

- Table 2.2: Fraudulent Challenges for Mobile Identity Vendors

- 2.2. OTP-based Authentication

- 2.2.1. SMS OTPs

- Figure 2.3: Total Cost of AIT and SMS Trashing to Enterprises ($m), Split by 8 Key Regions, 2024

- Figure 2.4: SMS OTPs

- Figure 2.5: Total Operator-billed Revenue from SMS OTPs ($m), Split by 8 Key Regions, 2025-2029

- 2.2.2. RCS-based Authentication

- Figure 2.6: RCS OTPs

- Figure 2.7: Total Revenue from RCS Business Messaging OTPs ($m), Split by 8 Key Regions, 2025-2029

- 2.2.3. Flash Calling

- 2.2.4. Unstructured Supplementary Service Data (USSD)-based Authentication

- 2.2.5. Over-the-top (OTT)-based Authentication

- Figure 2.8: Total Revenue from OTT OTPs ($m), Split by 8 Key Regions, 2025-2029

- 2.2.1. SMS OTPs

- 2.3. SIM-based Authentication

- Figure 2.9: Total Operator Revenue from Phone Number Verification APIs ($m), Split by 8 Key Regions, 2025-2029

- 2.3.1. Privacy and Consent

- 2.4. Device-based Biometric Authentication

- Figure 2.10: Proportion of Smartphones That are Capable of Biometric Authentication (%), Split by 8 Key Regions, 2025-2029

- 2.4.1. Passkeys

- 2.5. Push Notification Authentication

- 2.6. AI and Blockchain in Authentication

- 2.7. MFA/2FA

- Figure 2.11: MFA/2FA

3. Country Readiness Index

- 3.1. Introduction to Country Readiness Index

- Figure 3.1: Mobile Identity Country Readiness Index Regional Definitions

- Table 3.2: Juniper Research Country Readiness Index Scoring Criteria: Mobile Identity

- Figure 3.3: Juniper Research Country Readiness Index: Mobile Identity

- Table 3.4: Mobile Identity Country Readiness Index: Market Segments

- 3.2. Focus Markets

- Figure 3.5: Total Mobile Identity Revenue ($m), Split by Focus Markets, 2025

- 3.2.1. Smartphone Penetration

- Figure 3.6: Smartphone Penetration Rate (%), Split by Select Focus Markets, 2025-2029

- 3.2.2. Far East & China

- 3.2.3. France

- 3.2.4. India

- 3.3. Growth Markets

- Figure 3.7: Total Mobile Identity Revenue ($m), Split by Select Growth Markets, 2025-2029

- 3.3.1. West Europe

- 3.3.2. Hong Kong

- 3.4. Saturated Markets

- 3.5. Developing Markets

- Figure 3.8: Total Mobile Identity Revenue ($m), Split by Developing Markets, 2025

- Table 3.9: Juniper Research's Country Readiness Index Heatmap: North America

- Table 3.10: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 3.11: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 3.12: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 3.13: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 3.14: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 3.15: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 3.16: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Authentication Traffic to Migrate to Number Verification APIs

- Table 1.1: Juniper Research Competitor Leaderboard: Vendors & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: Mobile Identity

- Table 1.3: Juniper Research Competitor Leaderboard: Vendors

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Mobile Identity Vendors

- Authentication Traffic to Migrate to Number Verification APIs

2. Vendor Profiles

- 2.1. Mobile Identity Vendor Profiles

- 2.1.1. BICS

- i. Corporate Information

- Table 2.1: BICS' Select Financial Information (Euro-m), 2022 & 2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. Clickatell

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. CM.com

- i. Corporate Information

- Table 2.2: Acquisitions Made by CM.com, 2021-present

- Table 2.3: CM.com's Select Financial Information (Euro-m), 2022-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.4. Comviva

- i. Corporate Information

- Table 2.4: Comviva's Select Financial Information ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.5. GMS Worldwide

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Infobip

- i. Corporate Information

- Table 2.5: Infobip's Acquisitions - April 2021 to Present

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.6: Infobip's Signals Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.7. LINK Mobility

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Methics

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- Figure 2.7: Methics' Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Mitto

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Monty Mobile

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Prelude

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. Route Mobile

- i. Corporate Information

- Table 2.8: Route Mobile's Annual Financial Information (Indian Rupee Cr), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.9: Verified Call Service Process

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.13. Sinch

- i. Corporate Information

- Table 2.8: Sinch's Recent Acquisitions, 2020-2021

- Table 2.9: Sinch's Select Financial Information ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.14. Syniverse

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.10: Syniverse Identity and Authentication Engine

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Tata Communications

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. Telesign

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.17. Twilio

- i. Corporate Information

- Table 2.11: Twilio's Revenue ($m), 2021-2023

- Table 2.12: Twilio's Acquisitions, November 2019-present

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.18. Vonage

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. BICS

- 2.2. Juniper Research Leaderboard Methodology

- 2.3. Limitations & Interpretations

- Table 2.13: Juniper Research Competitor Leaderboard Scoring Criteria: Mobile Identity Vendors

- 2.4. Related Research

Data & Forecasting

1. Market Forecast & Key Takeaways

- 1.1. Introduction to Mobile Identity Forecasts

- Figure 1.1: Total Mobile Identity Revenue ($25bn), Split by Channel, 2025

- 1.1.1. Total Operator-billed Mobile Identity Revenue

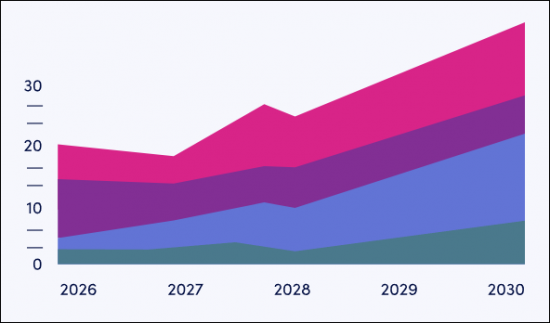

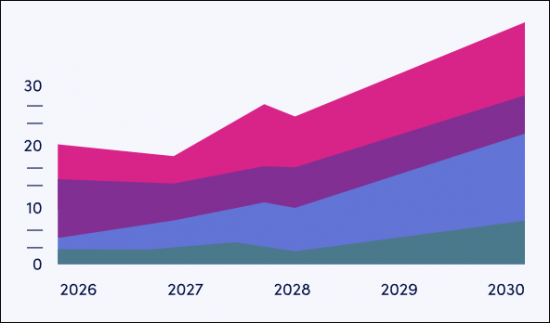

- Figure & Table 1.2: Total Operator-billed Mobile Identity Revenue ($m), Split by Key Regions, 2025-2029

- 1.1.2. Total Mobile Identity Revenue

- Figure & Table 1.3: Total Mobile Identity Revenue ($m), Split by 8 Key Regions, 2025-2029

- Table 1.4: Total Mobile Identity Revenue ($m), Split by Operator-billed and Non-Operator-billed revenue, 2025-2029

2. SMS OTPs

- 2.1. SMS OTPs

- 2.1.1. SMS OTP Methodology

- Figure 2.1: OTP SMS Forecast Methodology

- 2.1.2. Total SMS Traffic Used for MFA or OTP Use Cases

- Figure & Table 2.2: Total SMS Traffic Used for MFA or OTP Use Cases (m), Split by 8 Key Regions, 2025-2029

- 2.1.3. Total Platform Revenue from MFA and OTP SMS Traffic

- Figure & Table 2.3: Total Platform Revenue from MFA and OTP SMS Traffic ($m), Split by 8 Key Regions, 2025-2029

- 2.1.4. Total Operator-billed Revenue from SMS Which Use OTP & MFA Use Cases

- Figure & Table 2.4: Total Operator-billed Revenue from SMS which use OTP & MFA Use Cases ($m), Split by 8 Key Regions, 2025-2029

- 2.1.1. SMS OTP Methodology

3. Phone Number Verification APIs

- 3.1. Phone Number Verification APIs Introduction

- 3.1.1. Phone Number Verification APIs Methodology

- Figure 3.1: Phone Number Verification APIs Forecast Methodology

- 3.1.2. Total Number of Phone Number Verification API Calls

- Figure & Table 3.2: Total Number of Phone Number Verification API Calls (m), Split by 8 Key Regions, 2025-2029

- 3.1.3. Total Operator Revenue from Phone Number Verification API Calls

- Figure & Table 3.3: Total Operator Revenue from Phone Number Verification API Calls ($m), Split by 8 Key Regions, 2025-2029

- 3.1.1. Phone Number Verification APIs Methodology

4. RCS OTPs

- 4.1. RCS OTPs

- 4.1.1. RCS OTPs Methodology

- Figure 4.1: RCS OTPs Forecast Methodology

- 4.1.2. Total Number of RCS Business Messages Which are Authentication Messages

- Figure & Table 4.2: Total Number of RCS Business Messages Which are Authentication Messages (m), Split by 8 Key Regions, 2025-2029

- 4.1.3. Total Revenue from RCS Business Messaging Authentication Traffic

- Figure & Table 4.3: Total Revenue from RCS Business Messaging Authentication Traffic ($m), Split by 8 Key Regions, 2025-2029

- 4.1.1. RCS OTPs Methodology

5. OTP Voice

- 5.1. OTP Voice Introduction

- 5.1.1. OTP Voice Methodology

- Figure 5.1: OTP Voice Forecast Methodology

- 5.1.2. Total Operator Revenue from OTP Voice API Calls

- Figure & Table 5.2: Total Operator Revenue from OTP Voice API Calls ($m), Split by 8 Key Regions, 2025-2029

- 5.1.1. OTP Voice Methodology

6. OTT OTPs

- 6.1. OTT OTPs Introduction

- 6.1.1. OTT OTP Methodology

- Figure 6.1: OTT OTP Forecast Methodology

- 6.1.2. Total OTT Business Messages Attributable to OTPs

- Figure & Table 6.2: Total OTT Business Messages Attributable to OTPs

- 6.1.3. Total OTT Business Messaging Revenue

- Figure & Table 6.3: Total OTT Business Messaging Revenue ($m), Split by 8 Key Regions, 2025-2029

- Table 6.4: Potential Operator A2P Revenue Loss Due to OTT Business Messaging OTPs ($m), Split by 8 Key Regions, 2025-2029

- 6.1.1. OTT OTP Methodology

7. MSISDN For Mobile Identity

- 7.1. MSISDN Introduction

- 7.1.1. MSISDN Methodology

- Figure 7.1: MSISDN Forecast Methodology

- 7.1.2. Total MNO Direct Revenue from MSISDN Login

- Figure & Table 7.2: Total MNO Direct Revenue from MSISDN Login ($m), Split by 8 Key Regions, 2025-2029

- Table 7.3: Total Number of Mobile Devices Using MSISDN for Single Sign In (m), Split by 8 Key Regions, 2025-2029

- 7.1.1. MSISDN Methodology

8. Device-based Biometric Authentication

- 8.1. Device-based Biometric Authentication Introduction

- 8.1.1. Device-based Biometric Authentication Methodology

- Figure 8.1: Device-based Biometric Authentication Forecast Methodology

- 8.1.2. Total Number of Smartphones That are Capable of Biometric Authentication

- Figure & Table 8.2: Total Number of Smartphones That are Capable of Biometric Authentication (m), Split by 8 Key Regions, 2025-2029

- 8.1.1. Device-based Biometric Authentication Methodology