|

시장보고서

상품코드

1564672

리튬 이온 배터리용 실리콘 음극 : 특허 현황 분석(2024년)Silicon Anode for Li-ion Batteries - Patent Landscape Analysis 2024 |

||||||

리튬 이온 배터리의 실리콘계 음극의 가능성을 인정받으면서 이 기술을 시장에 출시하기 위해 많은 투자가 이루어지고 있습니다.

리튬 이온 배터리의 실리콘 기반 음극은 더 높은 에너지 밀도, 더 큰 중량 및 부피 용량, 적절한 열역학적 리튬화 잠재력, 더 높은 평균 전압 등 우수한 전기 화학적 성능을 제공합니다.

오늘날 리튬 이온 배터리에서 실리콘 음극의 사용이 현실화되고 있으며, 실리콘 음극의 스타트업에 수십억 달러가 유입되고(IDTechEx, 2021), 리튬 이온 배터리용 실리콘 음극 재료 시장 규모는 2034년까지 240억 달러에 달할 것으로 예상됩니다. (IDTechEx, 2024년). Advano, Sila Nanotechnology, Elkem, Group14, NanoGraf, OneD Materials, Nexeon 등 여러 재료 제조업체가 리튬 이온 배터리용 실리콘 활물질의 상업 생산을 발표했습니다. 마찬가지로 Amprius, Sionic Energy(구 NOHMS), Farasis Energy, Enovix, StoreDot, Samsung, Panasonic, PPES(Toyota와 Panasonic의 합작회사), Murata, Enevate/EnerTech 등 여러 배터리 제조업체가 실리콘 음극 리튬이온 배터리의 상용화를 발표했습니다. Tesla가 2019년 배터리 제조업체 Maxwell Technologies, 2021년 배터리 스타트업 SiLion을 인수했습니다. 같은 해 PPES와 Nexeon이 실리콘 음극 개발에 초점을 맞춘 제휴를 발표했고, StoreDot이 EVE Energy와 전략적 프레임워크 계약을 체결하고 전기자동차용 StoreDot XFC 리튬실리콘 셀의 상용화를 가속화하기 위해 Group14 Technologies와 파트너십을 체결했습니다. 또한 Daimler, Porsche, GM과 같은 자동차 OEM은 실리콘 음극의 잠재력을 인식하고 실리콘 음극 기업에 투자하거나 파트너십을 맺고 있습니다.

이 보고서는 리튬 이온 배터리용 실리콘 음극 산업에 대한 조사 및 분석을 통해 기술 및 지적재산권(IP)의 특허 상황과 주요 기업의 전략에 대한 정보를 제공합니다.

보고서에서 다룬 기업(일부)

LG Chem/LG Energy Solution, Panasonic/Sanyo, Samsung, Murata Manufacturing/Sony, Toyota, ATL(Amperex Technology), COSMX/COSLIGHT, Guoxuan High Tech Power Energy/Gotion, CATL(Contemporary Amperex Technology Ltd), Global Graphene, SVOLT/Fengchao Energy Technology, General Motors, NEC, SK Group, Enevate, Resonac(Showa Denko/Hitachi Chemical), Shanshan Energy Technology, Mitsubishi Chemical, BYD, EVE Energy, Bosch/SEEO, A123 Systems(Wanxiang group), Sunwoda, Nissan, Tafel New Energy Technology/Zenergy, BTR New Energy Material, Amprius/Berzelius, Nexeon, Mitsui Mining & Smelting Smelting, Envision/AESC, Tinci Materials Technology, TDK, Hitachi, JEVE(Tianjin EV Energy), Huawei, Hyundai/Kia, WeLion New Energy Technology, Wacker Chemie, BAK Battery, Hitachi Maxell, GS Yuasa, GS Yuasa, Mitsui Chemicals, Tianmu Energy Anode Material, CALB(China Aviation Lithium Battery), Yinlong Energy, Furukawa, Toshiba, Kaijin New Energy Technology, Smoothway Electronic Materials, Kunlunchem, Chery Automobile, Fujifilm, MU Ionic Solutions, Ube Corporation, Shin Etsu Chemical, Sumitomo Electric Industries, MGL New Materials, Sound Group, Zeon, FAW(China First Automobile Works)), BMW, Umicore, Sekisui Chemical, Capchem Group, Novolyte Technologies, 기타

목차

서론

- 보고서 배경과 목적

- 조사 범위

- Excel 데이터베이스

- 이 보고서를 더 잘 이해하기 위한 IP 기초지식

- 배터리 분야의 과제

- 실리콘 음극의 주요 장단점

- 실리콘 음극 리튬 이온 배터리의 주요 과제와 개선책

주요 요약

특허 상황 개요

주요 동향과 IP 기업

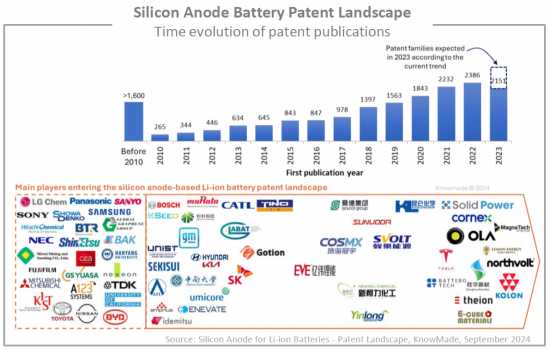

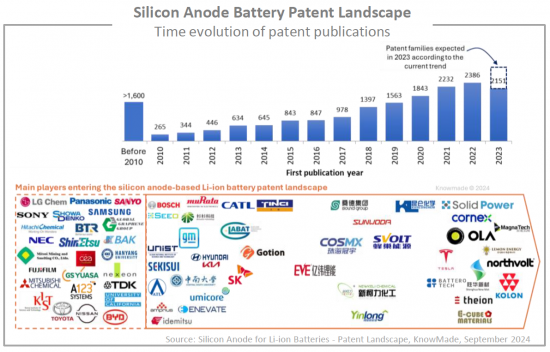

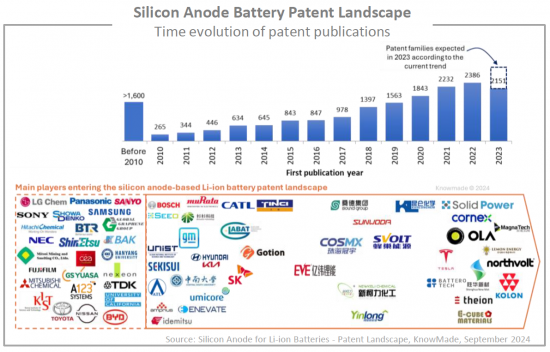

- 특허 공개와 주요 특허 출원인 시계열적 변화

- 특허 공개 추이 : 국가별

- 주요 특허 양수인 : 페턴트 패밀리수별

- 주요 특허 출원인 : 기업 분류별, 원산 국가별

- 특허 상황에 종사하는 주요 스타트업과 퓨어 기업

- 주요 IP 기업 타임라인

- 2021년 이후 IP 기업과 신규 참여 기업

- 주요 IP 기업 : 공급망 부문별(양극재, 음극, 배터리 셀)

- 특허의 현재 법적 현황(허가, 신청중, 실효)

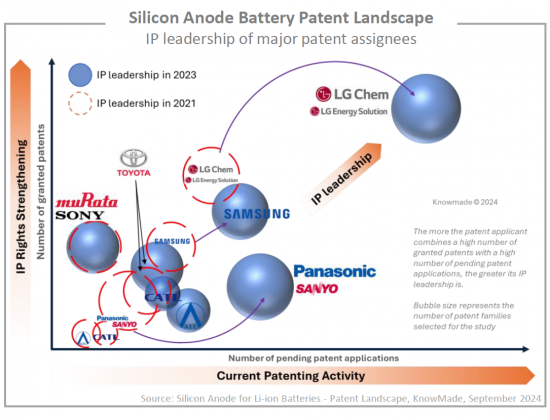

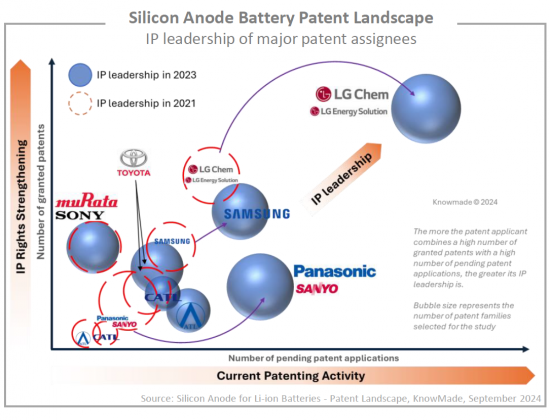

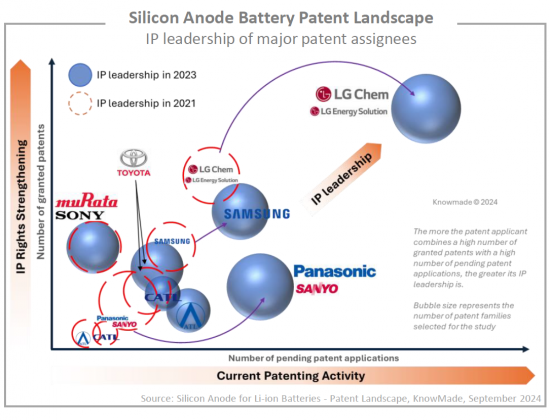

- 주요 양수인의 IP 리더십과 2021년부터 진화

- 주요 기업 특허의 지역적 범위

- 주요 출원인의 IP 전략(국내 전략 vs. 세계 전략)

- 주요 IP 기업과 신규 참여 기업

주요 기업의 최근 특허 활동

- Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, ATL, COSMX, Nexeon, Enevate, Ionobell, Enwires

스타트업과 퓨어 기업 인사이트

- 실리콘 음극 배터리 특허 상황에 관여하는 290개사 이상 스타트업과 퓨어 기업 매핑

- 중국 스타트업과 퓨어 기업

- 한국 스타트업과 퓨어 기업

- 일본 스타트업과 퓨어 기업

- 북미 스타트업과 퓨어 기업

- 유럽 스타트업과 퓨어 기업

- 기타(대만, 이스라엘, 인도, 싱가포르, 호주 등)

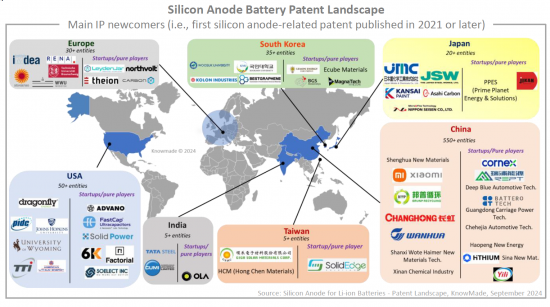

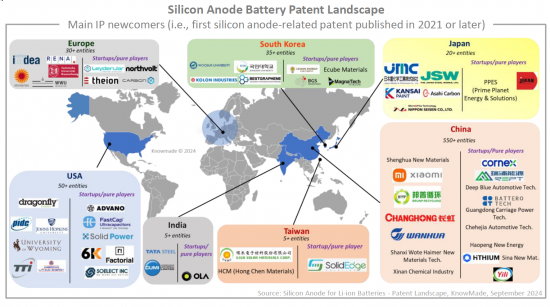

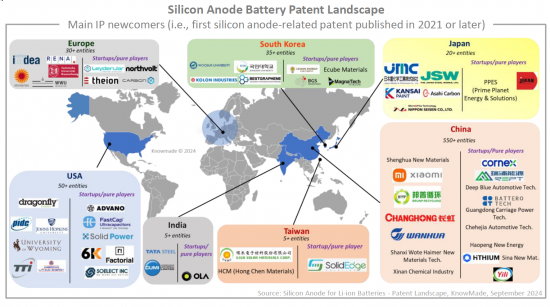

2021년 이후 IP 신규 참여 기업 인사이트

- 2021년 이후에 실리콘 음극 배터리에 관련된 최초 특허를 공개한 650개사 이상 IP 신규 참여 기업 매핑

- 중국의 IP 신규 참여 기업

- 한국의 IP 신규 참여 기업

- 일본의 IP 신규 참여 기업

- 미국의 IP 신규 참여 기업

- 유럽의 IP 신규 참여 기업

- 기타(대만, 캐나다, 인도 등)

부록

Knowmade 프레젠테이션

LSH 24.10.14

Who are the key players and newcomers in the global IP race for the promising silicon anode-based Li-ion batteries?

KEY FEATURES:

- PDF >100 slides

- Excel file >18,200 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments of the supply chain.

- Key players' IP position and the relative strength of their patent portfolio.

- Patents categorized by categorized by supply chain segments (materials, anode, battery cell, other battery components).

- Recent patenting activities of key players.

- Focus on startups, pure players, and IP newcomers.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

The recognized potential of the silicon-based anode for Li-ion batteries has led to significant investments in bringing this technology to market

Silicon-based anodes in Li-ion batteries offer superior electrochemical performance, including higher energy density, greater gravimetric and volumetric capacity, suitable thermodynamic lithiation potentials, and higher average voltage.

Today, the use of silicon-based anodes in Li-ion batteries is becoming a reality, with billions od dollars flowing into silicon anode start-ups (IDTechEx, 2021) and a market for silicon anode material for Li-ion batteries projected to reach $24 billion by 2034 (IDTechEx, 2024) . Several material manufacturers, such as Advano, Sila Nanotechnology, Elkem, Group14, NanoGraf, OneD Materials, and Nexeon, have announced the commercial production of silicon active materials for Li-ion batteries. Likewise, several battery manufacturers have announced the commercial availability of silicon anode Li-ion cells, including Amprius, Sionic Energy (formerly NOHMS), Farasis Energy, Enovix, StoreDot, Samsung, Panasonic, PPES (a joint venture between Toyota and Panasonic), Murata, and Enevate/EnerTech. In the automotive sector, there have been significant strategic acquisitions and partnerships. Tesla acquired battery manufacturer Maxwell Technologies in 2019 and battery start-up SiLion in 2021. That same year, PPES and Nexeon announced a partnership focused on silicon anode development, and StoreDot entered into a strategic framework agreement with EVE Energy, while partnering with Group14 Technologies to accelerate commercialization of StoreDot's XFC lithium-silicon cells for electric vehicles. Additionally, automotive OEMs such as Daimler, Porsche, and GM have recognized the potential of silicon anodes and have invested in and partnered with silicon anode companies.

In this highly competitive and dynamic environment, it is increasingly crucial to have a strong understanding of the patent landscape and the strategies of key players in technology and intellectual property (IP) . To meet this need, Knowmade is releasing a new Silicon Anode Batteries Patent Landscape report, which aims to clarify the current positions of IP players, analyze their IP strategies, and reveal where industry leaders, newcomers, and start-ups are focusing their R&D efforts.

A dynamic IP landscape

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the silicon anode Li-ion battery market. In this report, Knowmade's analysts provide a comprehensive overview of the competitive IP landscape and latest technological developments in this field. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and patented technologies. It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

Evolution of leading players' positions and entry of new patent applicants

LG Chem/LGES is leading the silicon anode battery patent landscape, with strong IP competition from Samsung, Murata, Panasonic/Sanyo, and Toyota. Additionally, we have identified over 290 start-ups and pure players involved in the patent landscape, and more than 650 new entrants who filed their first silicon anode-related patents in 2021 or later, most of whom are Chinese entities. In dedicated sections of the report, we focus on the IP portfolios held by key players, start-ups, and newcomers from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (anode material, anode, battery cell, other battery cell components).

Companies mentioned in the report (non-exhaustive)

LG Chem/LG Energy Solution, Panasonic/Sanyo, Samsung, Murata Manufacturing/Sony, Toyota, ATL (Amperex Technology), COSMX / COSLIGHT, Guoxuan High Tech Power Energy / Gotion, CATL (Contemporary Amperex Technology Ltd), Global Graphene, SVOLT / Fengchao Energy Technology, General Motors, NEC, SK Group, Enevate, Resonac (Showa Denko / Hitachi Chemical), Shanshan Energy Technology, Mitsubishi Chemical, BYD, EVE Energy, Bosch/SEEO, A123 Systems (Wanxiang group), Sunwoda, Nissan, Tafel New Energy Technology / Zenergy, BTR New Energy Material, Amprius / Berzelius, Nexeon, Mitsui Mining & Smelting, Envision / AESC, Tinci Materials Technology, TDK, Hitachi , JEVE (Tianjin EV Energy), Huawei, Hyundai/Kia, WeLion New Energy Technology, Wacker Chemie, BAK Battery, Hitachi Maxell, GS Yuasa, Mitsui Chemicals, Tianmu Energy Anode Material, CALB (China Aviation Lithium Battery), Yinlong Energy, Furukawa, Toshiba, Kaijin New Energy Technology, Smoothway Electronic Materials, Kunlunchem, Chery Automobile, Fujifilm, MU Ionic Solutions, Ube Corporation, Shin Etsu Chemical, Sumitomo Electric Industries, MGL New Materials, Sound Group, Zeon, FAW (China First Automobile Works), BMW, Umicore, Sekisui Chemical, Capchem Group, Novolyte Technologies, and more.

TABLE OF CONTENTS

INTRODUCTION

- Context & objectives of the report

- Scope of the report

- Excel database

- Basic knowledge of IP to better understand this report

- Challenges in battery field

- Main advantages and drawbacks of silicon anode

- Main challenges and improvement solutions for silicon anode lithium-ion battery

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

Main trends and IP players

- Time evolution of patent publications and main patent applicants

- Time evolution of patent publications by country

- Main patent assignees according to the number of their patent families

- Main patent assignees by companies' typology and originating countries

- Main start-ups and pure players involved in the patent landscape

- Timeline of main IP players

- Historical IP players and new entrants since 2021

- Main IP players by supply chain segments (anode material, anode, battery cell)

- Current legal status of patents (granted, pending, dead)

- IP leadership of main assignees and evolution from 2021

- Geographical coverage of main players' patents

- IP strategy of main patent applicants (domestic strategy vs. global strategy)

- Key IP players and newcomers

Recent patenting activity of key players

- Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, ATL, COSMX, Nexeon, Enevate, Ionobell, Enwires

Focus on start-ups and pure players

- Mapping of 290+ startups and pure players involved in the silicon anode battery patent landscape

- Chinese startups and pure players

- South Korean startups and pure players

- Japanese startups and pure players

- North American startups and pure players

- European startups and pure players

- Others (Taiwanese, Israeli, Indian, Singaporean, Australian, etc.)

Focus on IP newcomers since 2021

- Mapping of 650+ IP newcomers that published their first patent related silicon anode batteries in 2021 or later.

- Chinese IP newcomers

- South Korean IP newcomers

- Japanese IP newcomers

- American IP newcomers

- European IP newcomers

- Others (Taiwanese, Canadian, Indian, etc.)

ANNEX

- Methodology for patent search, selection and analysis

- Terminology

KNOWMADE PRESENTATION

Who are the key players and newcomers in the global IP race for the promising silicon anode-based Li-ion batteries?

KEY FEATURES:

- PDF >100 slides

- Excel file >18,200 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments of the supply chain.

- Key players' IP position and the relative strength of their patent portfolio.

- Patents categorized by categorized by supply chain segments (materials, anode, battery cell, other battery components).

- Recent patenting activities of key players.

- Focus on startups, pure players, and IP newcomers.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

The recognized potential of the silicon-based anode for Li-ion batteries has led to significant investments in bringing this technology to market

Silicon-based anodes in Li-ion batteries offer superior electrochemical performance, including higher energy density, greater gravimetric and volumetric capacity, suitable thermodynamic lithiation potentials, and higher average voltage.

Today, the use of silicon-based anodes in Li-ion batteries is becoming a reality, with billions od dollars flowing into silicon anode start-ups (IDTechEx, 2021) and a market for silicon anode material for Li-ion batteries projected to reach $24 billion by 2034 (IDTechEx, 2024) . Several material manufacturers, such as Advano, Sila Nanotechnology, Elkem, Group14, NanoGraf, OneD Materials, and Nexeon, have announced the commercial production of silicon active materials for Li-ion batteries. Likewise, several battery manufacturers have announced the commercial availability of silicon anode Li-ion cells, including Amprius, Sionic Energy (formerly NOHMS), Farasis Energy, Enovix, StoreDot, Samsung, Panasonic, PPES (a joint venture between Toyota and Panasonic), Murata, and Enevate/EnerTech. In the automotive sector, there have been significant strategic acquisitions and partnerships. Tesla acquired battery manufacturer Maxwell Technologies in 2019 and battery start-up SiLion in 2021. That same year, PPES and Nexeon announced a partnership focused on silicon anode development, and StoreDot entered into a strategic framework agreement with EVE Energy, while partnering with Group14 Technologies to accelerate commercialization of StoreDot's XFC lithium-silicon cells for electric vehicles. Additionally, automotive OEMs such as Daimler, Porsche, and GM have recognized the potential of silicon anodes and have invested in and partnered with silicon anode companies.

In this highly competitive and dynamic environment, it is increasingly crucial to have a strong understanding of the patent landscape and the strategies of key players in technology and intellectual property (IP) . To meet this need, Knowmade is releasing a new Silicon Anode Batteries Patent Landscape report, which aims to clarify the current positions of IP players, analyze their IP strategies, and reveal where industry leaders, newcomers, and start-ups are focusing their R&D efforts.

A dynamic IP landscape

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the silicon anode Li-ion battery market. In this report, Knowmade's analysts provide a comprehensive overview of the competitive IP landscape and latest technological developments in this field. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and patented technologies. It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

Evolution of leading players' positions and entry of new patent applicants

LG Chem/LGES is leading the silicon anode battery patent landscape, with strong IP competition from Samsung, Murata, Panasonic/Sanyo, and Toyota. Additionally, we have identified over 290 start-ups and pure players involved in the patent landscape, and more than 650 new entrants who filed their first silicon anode-related patents in 2021 or later, most of whom are Chinese entities. In dedicated sections of the report, we focus on the IP portfolios held by key players, start-ups, and newcomers from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (anode material, anode, battery cell, other battery cell components).

Companies mentioned in the report (non-exhaustive)

LG Chem/LG Energy Solution, Panasonic/Sanyo, Samsung, Murata Manufacturing/Sony, Toyota, ATL (Amperex Technology), COSMX / COSLIGHT, Guoxuan High Tech Power Energy / Gotion, CATL (Contemporary Amperex Technology Ltd), Global Graphene, SVOLT / Fengchao Energy Technology, General Motors, NEC, SK Group, Enevate, Resonac (Showa Denko / Hitachi Chemical), Shanshan Energy Technology, Mitsubishi Chemical, BYD, EVE Energy, Bosch/SEEO, A123 Systems (Wanxiang group), Sunwoda, Nissan, Tafel New Energy Technology / Zenergy, BTR New Energy Material, Amprius / Berzelius, Nexeon, Mitsui Mining & Smelting, Envision / AESC, Tinci Materials Technology, TDK, Hitachi , JEVE (Tianjin EV Energy), Huawei, Hyundai/Kia, WeLion New Energy Technology, Wacker Chemie, BAK Battery, Hitachi Maxell, GS Yuasa, Mitsui Chemicals, Tianmu Energy Anode Material, CALB (China Aviation Lithium Battery), Yinlong Energy, Furukawa, Toshiba, Kaijin New Energy Technology, Smoothway Electronic Materials, Kunlunchem, Chery Automobile, Fujifilm, MU Ionic Solutions, Ube Corporation, Shin Etsu Chemical, Sumitomo Electric Industries, MGL New Materials, Sound Group, Zeon, FAW (China First Automobile Works), BMW, Umicore, Sekisui Chemical, Capchem Group, Novolyte Technologies, and more.

TABLE OF CONTENTS

INTRODUCTION

- Context & objectives of the report

- Scope of the report

- Excel database

- Basic knowledge of IP to better understand this report

- Challenges in battery field

- Main advantages and drawbacks of silicon anode

- Main challenges and improvement solutions for silicon anode lithium-ion battery

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

Main trends and IP players

- Time evolution of patent publications and main patent applicants

- Time evolution of patent publications by country

- Main patent assignees according to the number of their patent families

- Main patent assignees by companies' typology and originating countries

- Main start-ups and pure players involved in the patent landscape

- Timeline of main IP players

- Historical IP players and new entrants since 2021

- Main IP players by supply chain segments (anode material, anode, battery cell)

- Current legal status of patents (granted, pending, dead)

- IP leadership of main assignees and evolution from 2021

- Geographical coverage of main players' patents

- IP strategy of main patent applicants (domestic strategy vs. global strategy)

- Key IP players and newcomers

Recent patenting activity of key players

- Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, ATL, COSMX, Nexeon, Enevate, Ionobell, Enwires

Focus on start-ups and pure players

- Mapping of 290+ startups and pure players involved in the silicon anode battery patent landscape

- Chinese startups and pure players

- South Korean startups and pure players

- Japanese startups and pure players

- North American startups and pure players

- European startups and pure players

- Others (Taiwanese, Israeli, Indian, Singaporean, Australian, etc.)

Focus on IP newcomers since 2021

- Mapping of 650+ IP newcomers that published their first patent related silicon anode batteries in 2021 or later.

- Chinese IP newcomers

- South Korean IP newcomers

- Japanese IP newcomers

- American IP newcomers

- European IP newcomers

- Others (Taiwanese, Canadian, Indian, etc.)

ANNEX

- Methodology for patent search, selection and analysis

- Terminology