|

시장보고서

상품코드

1611486

탄화규소(SiC)의 특허 정세 분석(2024년)Silicon Carbide (SiC) Patent Landscape Analysis 2024 |

||||||

SiC 산업에서 최신 IP의 진화와 동향을 해명.

SiC 공급망 전체의 특허 활동을 조사.

SiC 기술 : 복잡하고 빠르게 진화하는 상황

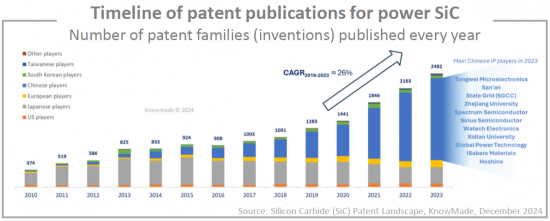

2022년 탄화규소(SiC) 특허 상황에서 KnowMade는 SiC 디바이스의 지적재산(IP) 활동이 활발해지고 있음을 밝혔습니다. 역사적인 IP 기업의 대부분은 이 시기에 SiC 발명의 보호 범위의 확대를 목표로 하고 있습니다. 전기자동차(EV)가 파워 SiC 시장의 상승을 촉진했기 때문에 SiC 기업은 유럽과 중국 등 이 산업에 전략적 지역에서 더 많은 특허를 출원하게 되었습니다. 이와 병행하여 EV 붐에 더 많은 신규 진출기업이 SiC 기술 개발을 가속화 했기 때문에 젊은 SiC 시장의 조기 리더들은 향후 몇 년간의 격렬한 경쟁에 대비하여 IP 활동을 유지하거나 가속시키고 있습니다. 이러한 상황에서 주요 SiC 기업은 시장 점유율을 보호하고 SiC 산업 진출에 필요한 대규모 투자를 보장하기 위해 특허를 활용할 수 있습니다. 시장 경쟁의 격화는 이미 IP 상황에 현저하게 나타났습니다.

미국과 중국 사이의 지정학적 긴장은 특허 출원 증가를 일으키고 있으며, 세계 각지, 특히 중국에서 현지 반도체 에코시스템의 형성을 가속화하고 있습니다. 2023년 중국 기업이 SiC 공급망 전체의 특허 공개의 70% 이상을 차지하고, 신규 참가 기업의 수도 눈부시고, 그 중에는 SiC 웨이퍼 산업에 관련된 기업도 많습니다. 이처럼 많은 기업들이 SiC 웨이퍼 개발에 종사하는 중, 중국은 이미 공급 부족 상황을 막는 데 성공했지만, 치열한 가격 경쟁으로 많은 공급업체에게 경제적으로 불안정한 시대가 도래했습니다. 이러한 새로운 상황은 SiC 웨이퍼 공급업체 간 특허 소송에 유리하게 작용할 수 있습니다.

본 보고서에서는 세계의 탄화규소(SiC) 산업에 대해 조사 분석하고, 1만 9,000건을 넘는 특허의 Excel 데이터베이스에 더해, 세계의 특허 동향의 해설이나 주요 기업의 IP 프로파일 등의 정보를 제공합니다.

목차

서문

- 보고서 배경

- 보고서의 목적

- 조사 전략과 조사 범위

- 리딩 가이드 : 보고서에서 적절한 정보 찾기

- 특허 검색, 선택, 분석 기법

- 특허 분석 용어

Excel 데이터베이스

- 이 조사를 위해 선택된 모든 특허와 통계 분석에서 권리자 당 전체 데이터를 포함하는 Excel 파일.

주요 요약

- 하이라이트

- SiC 기판, SiC 파워 디바이스, SiC 패키징 모듈, SiC 회로의 각 공급망 부문에 대해

- 주요 IP 기업의 타임라인

- 활동 중인 IP 기업, 활동을 정지한 IP 기업, 신규 참가 IP 기업

- 주요 특허출원자 : 하위 부문별

- 주요 IP 기업 : 국가별

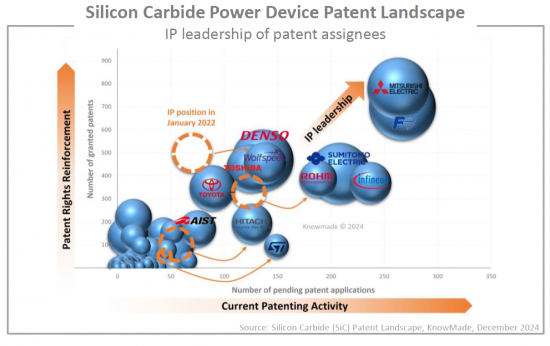

- 특허권자의 IP 리더십

특허 상황 분석

특허 정세 개요

- 주요 동향

- 주요 특허권자

- 공급망 전체에 걸친 주요 IP 기업의 포지셔닝

- IP 신규 진출기업

- 최근의 IP 제휴 및 특허거래

- 중국의 IP 기업에 주목

- SiC 특허 상황에서 주요 중국 기업

- 중국의 IP 신규 진출기업

- 최근 중국의 IP 제휴 및 특허거래

- 세계 IP 활동을 전개하는 중국 기업

SiC 기판의 특허 상황

- (벌크, 에피 웨이퍼, 육성 장치, 마무리 및 슬라이싱에 관한 특허 포함)

- 특허 공개의 시계열 변화 : 하위 부문별

- 주된 특허권자의 랭킹

- 주된 특허권자 : 하위 부문별

- 존속특허의 지리적 범위

- 주요 특허권자와 특허출원자 : 국가별

- 특허권자의 IP 리더십

- 벌크 SiC와 베어 SiC 웨이퍼에 주목

- SiC 에피택셜 웨이퍼에 주목

SiC 파워 디바이스의 특허 상황

- (다이오드, MOSFET, 기타 디바이스 및 기술적 측면과 관련된 특허 포함)

- 특허 공개의 시계열 변화 : 하위 부문별

- 주된 특허권자의 랭킹

- 주된 특허권자 : 하위 부문별

- 존속특허의 지리적 범위

- 주요 특허권자와 특허출원자 : 국가별

- 특허권자의 IP 리더십

- SiC 다이오드에 주목

- SiC MOSFET(플레이너, 트렌치 MOSFET)에 주목

SiC 파워 모듈의 특허 상황

- (패키징, 모듈, 캡슐화, 다이 부착, 기생, 열 문제 등과 관련된 특허 포함)

- 주된 특허권자의 랭킹

- 존속특허의 지리적 범위

- 주요 특허권자와 특허출원자 : 국가별

- 특허권자의 IP 리더십

SiC 회로의 특허 상황

- 주된 특허권자의 랭킹

- 존속특허의 지리적 범위

- 주요 특허권자와 특허출원자 : 국가별

- 특허권자의 IP 리더십

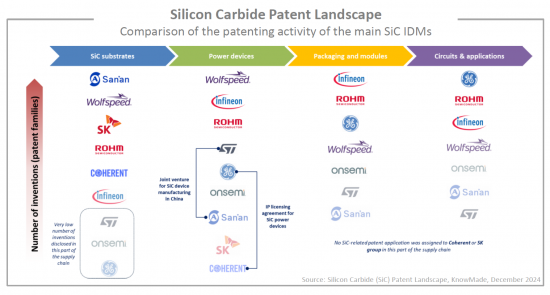

주요 SiC IDM IP 프로파일

- 주요 SiC IDM의 비교

- 특허 공개의 시계열 변화

- SiC 공급망 전반에 걸친 특허 활동의 수준과 IP 포트폴리오의 권리 행사 가능성

- SiC 공급망 전체에 걸친 특허권자의 IP 리더십

- SiC MOSFET 특허권자의 IP 리더십

- 유효한 특허 포트폴리오의 지리적 범위

- 세계의 IP 리더십

- IP 프로파일

- 각 기업에 대해 : SiC 특허 포트폴리오 개요(특허 활동, 특허 법적 상태, 지리적 범위, 기술 범위), 최신 IP 개발.

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- 각 기업에 대해 : SiC 특허 포트폴리오 개요(특허 활동, 특허 법적 상태, 지리적 범위, 기술 범위), 최신 IP 개발.

KnowMade 프레젠테이션

AJY 24.12.30Figure out the latest IP evolutions and trends in the SiC industry.

Explore the patenting activities across the SiC supply chain.

Key features:

- PDF>170 slides

- Excel database containing all patents analyzed in the report (>19,000 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active/inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Providing a detailed picture of the Chinese SiC ecosystem focusing on the patenting activity of Chinese entities.

- Patents categorized in 5 main supply chain segments and 10 main sub-segments: bulk SiC & bare SiC wafers, epitaxial SiC substrates (incl. growth apparatus, finishing), SiC devices (diodes, planar MOSFETs, trench MOSFETs), SiC modules (thermal issues, parasitics, die-attach, encapsulation), circuits.

- IP profile of main players: Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

SiC technology: A complex and fast-evolving landscape

In the Silicon Carbide (SiC) patent landscape 2022, KnowMade found out that the intellectual property (IP) activities were ramping up for SiC devices. Many historical IP players aimed to increase the perimeter of protection for their SiC inventions at this time. Electric vehicles (EV) had been driving the emergence of the power SiC market, prompting SiC companies to file more patents in strategic regions for this industry, such as Europe and China. In parallel, early leaders in the young SiC market have maintained or even accelerated their IP activities to prepare for a stronger competition in the next few years, since the EV boom led many new players to speed up the development of SiC technology. In this context, patents may be leveraged by leading SiC companies to protect their market share and thereby secure the large investments that have been required to enter the SiC industry. The growing competition in the market is already conspicuous in the IP landscape.

Geopolitical tensions between US and China have also triggered an increase in patent filings, accelerating the formation of local semiconductor ecosystems across the world, especially in China. In 2023, Chinese players were responsible for more than 70% of patent publications across the whole SiC supply chain, with an impressive number of newcomers, of which many companies involved in the SiC wafer industry. With such a high number of companies involved in SiC wafer developments, China has already succeeded in stopping the shortage situation but opened a period of economic instability for many suppliers due to a fierce price competition. This new context may favor patent litigations between SiC wafer suppliers.

Patent landscape overview

The first section of the Silicon Carbide (SiC) Patent Landscape report 2024 describes the global patent competition across the SiC supply chain by identifying the main IP players and newcomers and positioning their patent portfolios in each part of the SiC supply chain. The SiC patent portfolios are also analyzed geographically to highlight important markets in the IP strategy of SiC companies.

For SiC power devices, the patent analysis has been split into diodes, MOSFET and other SiC devices. What's more, for SiC MOSFET, the IP competitive analysis is available for planar MOSFET and trench MOSFET separately. It highlights the fact that most companies in the SiC patent landscape have integrated trench MOSFET in their technological roadmap, leading to an acceleration in patent filings in this area. As a result, trench MOSFET has become an increasingly competitive IP space in recent years.

Furthermore, a special focus is made on China which stands out by the explosion of the number of patent assignees in recent years, and an IP activity that is strongly dominated by domestic patent filings. Few players stand out by filing patent applications outside China. Interestingly, due to the very high patenting activity in China, patent analysis has become very relevant to describe such a dense ecosystem and make it less opaque to global competitors.

Eventually, the patent analysis highlights the IP activities of main market players, which are facing strong competition from many players in this landscape. They are either future market competitors, future integrators of SiC devices such as automotive Tiers-1 and OEM, or even potential suppliers (SiC equipment, materials). Indeed, patents may also be instrumental in negotiations and partnerships across the future SiC supply chain.

IP profiles of key players

The second section of the Silicon Carbide (SiC) Patent Landscape report 2024 focuses on the IP activities of main SiC device market players and/or companies investing significantly into building a vertically-integrated infrastructure for SiC. Such companies have adopted an IDM business model and look to integrate within the company every step of SiC manufacturing, from material growth, to device manufacturing and packaging. Interestingly, the comparison of their IP activities highlights quite differentiated IP strategies. While certain companies heavily rely on patents to assert their position in the market, other companies have not significantly developed their patent portfolio across the SiC supply chain. Regarding the geographic distribution of patent filings, there are also some discrepancies between players, showing the relative importance of the different markets for each company (US, Japan, Europe, China, South Korea and Taiwan).

This patent analysis provides a complete overview of the SiC patent portfolios held by Wolfspeed, Infineon, onsemi, Rohm, SK, STMicroelectronics, Coherent (and its licensor General Electric) and San'an. By focusing on the recent patenting activities of such players, it is possible to detect small signals, such as involvement in new technological areas (e.g., superjunction structures, trench MOSFET), or a strong IP activity in new regions. As such, it may provide some indications regarding the strategic plans of the company. Eventually, this review of the latest patent publications details the recent evolutions of SiC technology at every level of the supply chain.

Useful Excel patent database

This report includes an extensive Excel database with the 19,000+ patent families (inventions) analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and segments (bulk SiC, epitaxial SiC substrates, SiC diodes, planar SiC MOSFETs, trench SiC MOSFETs, SiC modules, circuits, etc.). Additionally, the Excel file comprises the complete data by assignee from the statistical analyses, including the number of patent families, timeline of patenting activity, number of granted patents and pending patent applications, and geographical coverage of patent portfolio.

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Sumitomo Electric, Denso, Fuji Electric, Toyota Group, Hitachi, Infineon, Toshiba, Rohm, Resonac, Panasonic , Wolfspeed, SICC, CETC, Nissan, State Grid (SGCC), General Electric, San'an, LG Corporation, CRRC, ABB, Hyundai, Siemens, Global Power Technology, Shindengen Electric Manufacturing, STMicroelectronics, CEC, FerroTec Holdings, Synlight Crystal, Onsemi, Bosch, Disco, Kansai Electric Power (KEPCO), TankeBlue, SK group, Tongwei Microelectronics, Midea, BASiC Semiconductor, TYSiC - Tianyu Semiconductor Technology, PN Junction Semiconductor, iSabers Materials, Spectrum Semiconductor, Shin-Etsu, KY Semiconductor, Sanken Electric, Gree Electric Appliances, Century Goldray (CENGOL), Sharp, Kyocera, Watech Electronics, Sirius Semiconductor, Huawei, Proterial (Hitachi Metals), Senic, Toyo Tanso, Shanghai Hestia Power, Coherent, YASC - Anhui Yangtze Advanced Semiconductor, GlobalWafers, BYD, Northrop Grumman, Microchip Technology, EpiWorld, Volkswagen Group, Sumitomo Metal Mining, JRC - Japan Radio, Semikron Danfoss, Chongqing Wattscience Electronic Technology, Hoshine, Power Integrations, Meidensha Electric Manufacturing, StarPower Semiconductor, United Nova Technology (UNT), Soitec, Delta Electronics, ZF, Guangzhou Summit Crystal Semiconductor (GZSC), Jiangsu Jixin Advanced Materials, Xiner, Huaxinwei Semiconductor Technology (Beijing) , Semisouth Lab, Beijing Microcore Technology, Hypersics Semiconductor, SiCentury, Macrocore Semiconductor, Daikin Industries, Nissin Electric, Raytheon Technologies, NCE Power, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Objectives of the report

- Research strategy and scope of the report

- Reading guide: find the right information in the report

- Methodology for patent search, selection and analysis

- Terminology for patent analysis

EXCEL DATABASE

- Excel file that includes all patent selected for this study, along with the complete data by assignee from the statistical analyses.

EXECUTIVE SUMMARY

- Highlights

- For each supply chain segment SiC substrates, SiC power devices, SiC packaging & modules, and SiC circuits:

- Timeline of main IP players

- IP players still active, IP players no longer active, IP newcomers

- Leading patent assignees by sub-segments

- Leading IP players by country

- IP leadership of patent assignees

PATENT LANDSCAPE ANALYSIS

Patent Landscape Overview

- Main trends

- Main patent owners

- Position of main IP players across the supply chain

- IP newcomers

- Recent IP collaborations & patent transactions

- Focus on Chinese IP players

- Main Chinese companies in the SiC patent landscape

- Chinese IP newcomers

- Recent Chinese IP collaborations & patent transactions

- Chinese entities with global IP activities

SiC Substrate Patent Landscape

- (Includes patents related to bulk, epiwafers, growth apparatus, and finishing & slicing)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on Bulk SiC and bare SiC wafers

- Focus on SiC epitaxial wafers

SiC Power Devices Patent Landscape

- (Includes patents related to diodes, MOSFETs, other devices and technological aspects)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on SiC diodes

- Focus on SiC MOSFETs (planar and trench MOSFETs)

SiC Power Modules Patent Landscape

- (Includes patents related to packaging, modules, encapsulation, die-attach, parasitics, thermal issues, etc.)

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

SiC Circuits Patent Landscape

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

IP PROFILES OF MAIN SiC IDM

- Comparison between main SiC IDM

- Time evolution of patent publications

- Level of patenting activity and IP portfolio enforceability across the SiC supply chain

- IP leadership of patent assignees across the SiC supply chain

- IP leadership of patent assignees for SiC MOSFET

- Geographical coverage of alive patent portfolio

- IP leadership across the world

- IP profiles

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.