|

시장보고서

상품코드

1893724

철도 관리 시스템 시장 : 제공별, 철도 유형별, 지역별 - 예측(-2030년)Railway Management System Market By Offering (Solution, Service), Railway Type - Global Forecast to 2030 |

||||||

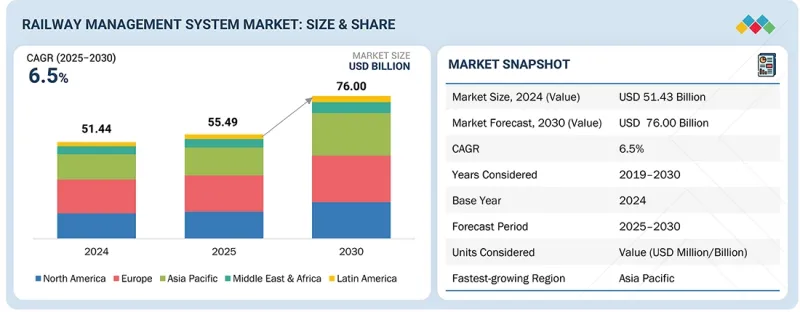

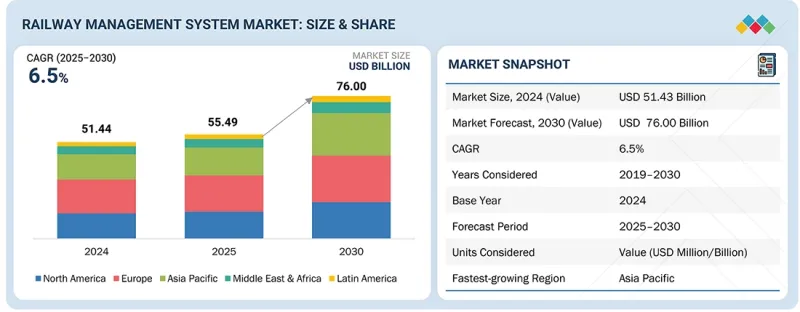

철도 관리 시스템 시장 규모는 2025년 554억 9,000만 달러에서 2030년까지 760억 달러로 성장할 것으로 예상되며, 예측 기간 동안 CAGR은 6.5%로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 가치(100만/10억 달러) |

| 부문 | 제공별, 철도 유형별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 남미, 중동 및 아프리카 |

승객의 기대치가 변화함에 따라 철도 사업자는 원활하고 편안한 여행 경험을 제공해야 합니다. 통합 발권 시스템, 실시간 승객 정보, Wi-Fi 연결, 엔터테인먼트 서비스는 현대 철도 관리 시스템의 표준 기능이 되고 있습니다.

철도 관리 시스템 시장의 서비스 부문은 철도 운영의 복잡성과 엔드 투 엔드 전문 지식에 대한 수요 증가로 인해 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다. 컨설팅 서비스는 디지털 전환과 규제 준수를 위한 운영사의 노력을 지원하여 선제적 수요를 창출합니다. 시스템 통합 및 도입은 기존의 신호 시스템, 차량 원격 측정, 새로운 클라우드 기반 교통 관리 플랫폼을 연계하기 위해 전문 통합업체가 필요합니다. 지원 및 유지보수 서비스는 철도 사업자가 가동 시간, 안전, 사이버 보안, 예지보전을 우선시하는 가운데 지속적인 수익원이 되어 장기 서비스 계약을 촉진할 수 있습니다. 또한, 전기화, 고속 노선, 도시 모빌리티 프로젝트에 대한 민관 투자의 증가는 외부 서비스에 의존하는 대규모 도입 프로그램을 촉진하고 있습니다. 종합적인 서비스 번들과 성능 기반 SLA를 제공하는 벤더는 가치 획득에 있어 우위를 점하고, 단독 하드웨어나 소프트웨어보다 더 빠르게 서비스 성장을 가속화할 수 있습니다.

지원 및 유지보수 부문이 가장 큰 시장 점유율을 차지할 것으로 추정되는 배경에는 철도 관리 시스템이 안전하고 효율적이며 중단 없는 운영을 보장하기 위해 지속적인 모니터링, 업그레이드 및 기술적 개입이 필요하다는 점이 있습니다. 철도 네트워크가 첨단 신호 시스템, 실시간 모니터링, 예지보전, 통합 교통 관리 플랫폼을 도입함에 따라 이러한 시스템의 복잡성이 증가함에 따라 전문 지원 서비스에 대한 장기적인 의존도가 높아지고 있습니다. 사업자는 성능 유지 및 규정 준수를 위해 소프트웨어 업데이트, 시스템 상태 모니터링, 원격 진단, 예비 부품 관리, 수정 유지보수를 벤더에 의존하고 있습니다. 노후화된 인프라는 자산 수명 연장과 고가의 다운타임을 피하기 위해 지속적인 유지보수의 필요성을 더욱 증폭시키고 있습니다. 각 벤더들은 다년 유지보수 계약, 원격 운영 지원, IoT 및 AI와 통합된 상태 모니터링형 유지보수 솔루션을 제공함으로써 이 분야를 강화하고 있습니다. 여객 및 화물 서비스 모두에서 운영 안정성과 가동 시간은 미션 크리티컬한 요소이기 때문에 지속적인 지원 및 유지보수는 필수적인 경상 비용으로, 예측 기간 동안 이 분야가 시장 점유율을 지배할 것으로 예상됩니다.

아시아태평양은 집중적인 공공 투자, 급속한 도시화, 대규모 용량 확장 프로젝트가 신호 시스템, 교통 관리 및 디지털 운영 플랫폼에 대한 강력한 수요를 견인하여 가장 높은 CAGR을 달성할 태세를 갖추고 있습니다. 인도의 국가 마스터플랜과 회랑 계획은 신호 시스템 업데이트와 멀티모달 연결성에 대한 투자를 가속화하고 있습니다. 키위레일에 알스톰의 ICONIS를 도입하는 등 대규모 배치와 관제센터 현대화는 운행 계획과 네트워크 가시성을 향상시키는 교통 관리 시스템에 대한 지역 내 높은 수요를 보여줍니다. 호주에서는 여러 노선의 지하철 확장 및 신공항 연결선 건설로 인해 통합 제어 및 자동화 플랫폼에 대한 수요가 증가하고 있습니다. 싱가포르에서는 MRT의 신뢰성 향상 및 업데이트 프로그램이 계속되고 있으며, 고밀도 도시 네트워크에서 도시 교통의 현대화 요구가 부각되고 있습니다. 중국의 지속적인 철도 현대화와 네트워크 확장은 디지털 신호 시스템, 예지보전, 라이프사이클 서비스 분야의 잠재적 시장을 더욱 확대시키고 있습니다. 정책 지원, 자금 조달 환경, 대규모 신규 및 기존 프로젝트가 결합되어 아시아태평양은 철도 관리 시스템 분야에서 가장 빠르게 성장하는 지역이 되었습니다.

철도 관리 시스템 시장의 주요 기업은 Alstom SA(프랑스), Huawei Technologies Co., Ltd.(중국), Siemens AG(독일), Hitachi, Ltd.(일본), Wabtec Corporation(미국), Cisco Systems, Inc.(미국), ABB(스위스), Indra Sistemas, S.A.(스페인), IBM(미국), Honeywell International Inc.(미국), CAF, Construcciones y Auxiliar de Ferrocarriles, S.A.(스페인), WSP(Canada), Kyosan Electric Mfg. Co.,(일본), Advantech Co., Ltd.(대만), Thales(프랑스), Amadeus IT Group SA(스페인), AtkinsRealis(영국), DXC Technology Company(미국), Fujitsu Limited(일본), Railroad Software(미국), Railcube(네덜란드), Praedico(네덜란드), NWAY Technologies Private Limited(인도), Eurotech S.p.A.(이탈리아), Frequentis(오스트리아), Railinc Corporation(미국), Arcadis Gen Holdings Limited(영국), Telegraph(미국), Tracis(영국), Rail-Flow(독일)입니다. 이들 기업은 철도 관리 시스템 시장에서 사업을 확장하기 위해 파트너십, 계약, 협업, 신제품 출시, 제품 개선, 인수 등 다양한 성장 전략을 채택하고 있습니다.

조사 범위

본 보고서의 주요 장점

이 보고서는 시장 리더와 신규 진입자에게 전체 철도 관리 시스템 시장 및 하위 부문의 수익 규모에 대한 가장 정확한 추정치를 제공합니다. 이를 통해 이해관계자들은 경쟁 상황을 이해하고, 자사의 포지셔닝을 강화하거나 적절한 시장 진입 전략을 수립하는 데 도움이 되는 인사이트를 얻을 수 있습니다. 또한, 시장 동향을 파악하고 주요 시장 촉진요인, 억제요인, 과제, 기회에 대한 정보를 제공합니다.

이 보고서는 다음 사항에 대한 인사이트를 제공합니다:

주요 촉진요인(정부의 적극적인 정책 및 민관 협력, 세계 도시화와 여객 수요 증가, 예지보전과 실시간 자산 관리), 억제요인(높은 초기 하드웨어 및 통합 비용, 분절된 레거시 인프라), 기회(교통 인프라에 지능형 솔루션 통합, 실시간 데이터 분석 및 비즈니스 인텔리전스 서비스), 도전 과제(데이터 보안 및 프라이버시 문제, 엄격한 안전 및 규제 문제) 분석 데이터 분석 및 비즈니스 인텔리전스 서비스), 과제(데이터 보안 및 프라이버시 문제, 엄격한 안전 및 규제 기준) 분석.

- 제품 개발/혁신 : 철도 관리 시스템 시장의 향후 기술 동향, 연구개발, 신제품 및 서비스 출시에 대한 상세한 분석.

- 시장 개발 : 수익성 높은 시장에 대한 종합적인 정보 - 이 보고서는 다양한 지역의 철도 관리 시스템 시장을 분석합니다.

- 시장 다각화 : 철도 관리 시스템 시장의 신제품 및 서비스, 미개척 지역, 최근 동향, 투자에 대한 종합적인 정보를 제공합니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 주요 인사이트

제4장 시장 개요

- 시장 역학

- 상호 접속된 시장과 분야 횡단적인 기회

- Tier 1/2/3 기업의 전략적 활동

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 철도 관리 시스템 시장

제6장 기술, 특허, 디지털, AI의 도입별 전략적 파괴

- 주요 신기술

- 보완적 기술

- 기술 로드맵

- 특허 분석

- AI/생성형 AI가 철도 관리 시스템 시장에 미치는 영향

- 성공 사례와 실세계에 대한 응용

제7장 규제 상황

- 지역 규제와 컴플라이언스

- 업계 표준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매자 이해관계자와 구입 평가 기준

- 다양한 최종 이용 산업으로부터의 미충족 수요

제9장 철도 관리 시스템 시장(제공별)

- 솔루션

- 서비스

제10장 철도 관리 시스템 시장(철도 유형별)

- 여객

- 화물

제11장 철도 관리 시스템 시장(지역별)

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 호주와 뉴질랜드

- 기타

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

- 기타

- 라틴아메리카

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오와 동향

제13장 기업 개요

- 주요 진출 기업

- ALSTOM SA

- HUAWEI TECHNOLOGIES CO., LTD.

- SIEMENS

- HITACHI, LTD.

- WABTEC CORPORATION

- CISCO SYSTEMS, INC.

- ABB

- INDRA SISTEMAS, S.A.

- IBM CORPORATION

- HONEYWELL INTERNATIONAL INC.

- 기타 기업

- CAF

- WSP

- KYOSAN ELECTRIC MFG. CO., LTD.

- ADVANTECH CO., LTD.

- THALES

- AMADEUS IT GROUP SA

- ATKINSREALIS

- DXC TECHNOLOGY COMPANY

- FUJITSU

- 스타트업/중소기업

- RAILROAD SOFTWARE

- RAILCUBE

- PRAEDICO

- NWAY TECHNOLOGIES

- EUROTECH S.P.A.

- FREQUENTIS

- RAILINC CORPORATION

- ARCADIS GEN HOLDINGS LIMITED

- TELEGRAPH

- TRACSIS PLC

- RAIL-FLOW

제14장 조사 방법

제15장 부록

KSM 26.01.06MarketsandMarkets forecasts that the railway management system market size is projected to grow from USD 55.49 billion in 2025 to USD 76.00 billion by 2030, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Offering, By Railway Type |

| Regions covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

As passenger expectations evolve, railway operators are under pressure to provide a seamless and enjoyable travel experience. Integrated ticketing systems, real-time passenger information, Wi-Fi connectivity, and entertainment services are becoming standard features of modern railway management systems.

"Among offerings, railway management services are projected to grow at the highest CAGR during the forecast period."

The services segment in the railway management system market is projected to register the highest CAGR during the forecast period due to the expanding complexity of railway operations and the growing demand for end-to-end expertise. Consulting services guide operators through digital transformation and regulatory compliance, creating upfront demand. System integration and deployment tie together legacy signaling, rolling stock telemetry, and new cloud-based traffic management platforms, requiring specialist integrators. Support and maintenance provide recurring revenue as rail operators prioritize uptime, safety, cybersecurity and predictive maintenance, driving long-term service contracts. Additionally, rising public and private investment in electrification, high-speed corridors, and urban mobility projects fuels large deployment programs that rely on external services. Vendors offering comprehensive service bundles and performance-based SLAs are better positioned to capture value, accelerating services growth faster than standalone hardware or software.

"Support & maintenance services are poised to hold the largest share of the railway management services during the forecast period."

The support & maintenance segment is estimated to account for the largest market share because railway management systems require continuous overseeing, upgrades, and technical intervention to ensure safe, efficient, and uninterrupted operations. As rail networks adopt advanced signaling, real-time monitoring, predictive maintenance, and integrated traffic management platforms, the complexity of these systems increases, creating long-term reliance on specialized support services. Operators depend on vendors for software updates, system health monitoring, remote diagnostics, spare parts management, and corrective maintenance to maintain performance and regulatory compliance. Aging infrastructure further amplifies the need for sustained maintenance to extend asset life and avoid costly downtime. Vendors are strengthening this segment by offering multi-year maintenance contracts, remote operations support, and condition-based maintenance solutions integrated with IoT and AI. Since operational reliability and uptime are mission-critical for both passenger and freight services, ongoing support and maintenance become essential recurring expenditures, positioning this segment to dominate market share across the forecast period.

"Asia Pacific is projected to grow with the highest CAGR during the forecast period."

Asia Pacific is poised for the highest CAGR as concentrated public investment, rapid urbanization, and major capacity projects drive strong demand for signaling, traffic management, and digital operations platforms. India's national master plan and corridor programs are accelerating signaling upgrades and multimodal connectivity investments. Large deployments and control-center modernization, such as Alstom's ICONIS rollout for KiwiRail, demonstrate regional appetite for traffic management systems that improve scheduling and network visibility. Australia's multi-line metro expansion and new airport links are lifting demand for integrated control and automation platforms. Singapore's continued MRT reliability and upgrade programs underscore urban transit modernization needs across dense city networks. China's sustained rail modernization and network expansion further widen the addressable market for digital signaling, predictive maintenance, and lifecycle services. Collectively, policy support, funding availability, and high-volume greenfield and brownfield projects make Asia Pacific the fastest-growing region for railway management systems.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Managers - 40%, C-level Executives - 35%, and Director Level - 25%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The major players in the railway management system market are Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), Honeywell International Inc. (US), CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRealis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), Railcube (Netherlands), Praedico (Netherlands), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), Arcadis Gen Holdings Limited (UK), Telegraph (US), Tracis (UK), and Rail-Flow (Germany). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations, new product launches, product enhancements, and acquisitions, to expand their footprint in the railway management system market.

Research Coverage

The report segments the global railway management system market based on offering has been classified into solutions (rail operations management, rail traffic management [signaling solutions, real-time train planning and route scheduling/optimizing, centralized traffic control, positive train control, rail communications-based train control {CBTC}, other traffic management solutions], asset management, intelligent in-train solutions, other solutions [passenger information systems, network management, security, surveillance, and access control]) and services (consulting services, system integration and deployment services, support and maintenance services), by railway type (passenger, freight). By region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key benefits of the report

The report would help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall railway management system market and the subsegments. This report would help stakeholders understand the competitive landscape and gain insights to better position their businesses and plan suitable go-to-market strategies. The report would help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (favorable government initiatives and public-private partnerships, rising global urbanization and passenger demand, predictive maintenance and real-time asset management), restraints (high upfront hardware and integration costs, fragmented legacy infrastructure), opportunities (integration of intelligent solutions in transportation infrastructure, real-time data analytics and business intelligence services), and challenges (data security and privacy issues, stringent safety and regulatory standards).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the railway management system market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the railway management system market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the railway management system market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), Honeywell International Inc. (US), CAF (Construcciones y Auxiliar de Ferrocarriles, S.A.) (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRealis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), Railcube (Netherlands), Praedico (Netherlands), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), Arcadis Gen Holdings Limited (UK), Telegraph (US), Tracis (UK), and Rail-Flow (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RAILWAY MANAGEMENT SYSTEM MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY MANAGEMENT SYSTEM MARKET

- 3.2 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING AND REGION

- 3.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 3.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 3.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Favorable government initiatives and public-private partnerships

- 4.2.1.2 Rising global urbanization and passenger demand

- 4.2.1.3 Predictive maintenance and real-time asset management

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront hardware and integration costs

- 4.2.2.2 Fragmented legacy infrastructure

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of intelligent solutions in transportation infrastructure

- 4.2.3.2 Real-time data analytics and business intelligence services

- 4.2.3.3 Renewable energy integration and decarbonization

- 4.2.4 CHALLENGES

- 4.2.4.1 Data security and privacy issues

- 4.2.4.2 Stringent safety and regulatory standards

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL RAILWAY MANAGEMENT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 OEMS (ORIGINAL EQUIPMENT MANUFACTURERS)

- 5.3.2 CONNECTIVITY SERVICE PROVIDERS

- 5.3.3 SOLUTION AND SERVICE PROVIDERS

- 5.3.4 SYSTEM INTEGRATORS

- 5.3.5 RAILWAY OPERATING BODIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2026

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY SYSTEM, 2024

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO FOR HS CODE: 853010

- 5.6.2 IMPORT SCENARIO FOR HS CODE: 853010

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NORTHERN TRAINS AND FUJITSU DEPLOYED INTEGRATED MOBILE TICKETING PLATFORM TO ENHANCE REVENUE PROTECTION

- 5.10.2 HITACHI RAIL AND RFI DELIVERED ADVANCED SIGNALING INTEGRATION FOR ITALY'S HIGH-SPEED RAIL NETWORK MODERNIZATION

- 5.10.3 PRASA AND HUAWEI IMPLEMENTED SMART PERIMETER SECURITY TO REDUCE THEFT AND IMPROVE RAILWAY SAFETY OPERATIONS

- 5.10.4 QUEENSLAND RAIL AND DXC DIGITALIZED MAINTENANCE OPERATIONS WITH MOBILE SAP WORK MANAGEMENT SOLUTION

- 5.10.5 THALES ENABLED UNIFIED DIGITAL IDENTITY PLATFORM FOR LEADING GLOBAL RAIL OPERATOR TO TRANSFORM PASSENGER EXPERIENCE

- 5.11 IMPACT OF 2025 US TARIFF - RAILWAY MANAGEMENT SYSTEM MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.3.1 Strategic Shifts and Emerging Trends

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 China

- 5.11.4.3 Europe

- 5.11.4.4 Asia Pacific (excluding China)

- 5.11.5 IMPACT ON END-USER INDUSTRY

- 5.11.5.1 Freight and intermodal logistics

- 5.11.5.2 Passenger transit and commuter rail

- 5.11.5.3 Urban metro systems and light rail

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 FUTURE RAILWAY MOBILE COMMUNICATION SYSTEM (FRMCS)

- 6.1.2 DIGITAL TWIN TECHNOLOGY

- 6.1.3 EUROPEAN TRAIN CONTROL SYSTEM (ETCS) LEVEL 3

- 6.1.4 DIGITAL AUTOMATIC COUPLING (DAC)

- 6.1.5 HYDROGEN FUEL CELL AND BATTERY-ELECTRIC PROPULSION SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 GEOSPATIAL INFORMATION SYSTEMS (GIS) AND LIDAR TECHNOLOGY

- 6.2.2 CLOUD COMPUTING AND OPERATIONAL TECHNOLOGY (OT) CLOUD INFRASTRUCTURE

- 6.2.3 EDGE COMPUTING AND REAL-TIME DATA PROCESSING

- 6.2.4 COMPUTER VISION AND MACHINE VISION INSPECTION SYSTEMS

- 6.3 TECHNOLOGY ROADMAP

- 6.3.1 SHORT-TERM (2025-2026) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2028) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2029-2030+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 JURISDICTION ANALYSIS

- 6.4.6 TOP APPLICANTS

- 6.5 IMPACT OF AI/GEN AI ON RAILWAY MANAGEMENT SYSTEM MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 CASE STUDIES OF AI IMPLEMENTATION IN RAILWAY MANAGEMENT SYSTEM MARKET

- 6.5.3 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.5.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN RAILWAY MANAGEMENT SYSTEM MARKET

- 6.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6.1 ALSTOM: DRIVING PREDICTIVE MAINTENANCE TRANSFORMATION IN RAILWAY SYSTEMS WITH HEALTHHUB

- 6.6.2 SIEMENS MOBILITY: ADVANCING RAIL INFRASTRUCTURE MODERNIZATION THROUGH AI-POWERED DIGITAL TWINS

- 6.6.3 HITACHI RAIL: TRANSFORMING RAILWAY OPERATIONS WITH AI-ENABLED HMAX DIGITAL ASSET MANAGEMENT

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 MARKET DRIVERS

- 9.2 SOLUTIONS

- 9.2.1 RAIL OPERATIONS MANAGEMENT

- 9.2.1.1 Need for smooth, uninterrupted routine operations to drive market

- 9.2.2 RAIL TRAFFIC MANAGEMENT

- 9.2.2.1 Signaling solutions

- 9.2.2.1.1 Increasing focus on disaster management and loss minimization to drive market

- 9.2.2.2 Real-time train planning and route scheduling/optimizing

- 9.2.2.2.1 Rising need for improved workflow management and timetable planning to drive market

- 9.2.2.3 Centralized traffic control

- 9.2.2.3.1 Growing emphasis on collecting crucial real-time information about traffic density to drive market

- 9.2.2.4 Positive train control

- 9.2.2.4.1 Surge in use of GPS-based safety technology to drive market

- 9.2.2.5 Rail communications-based train control

- 9.2.2.5.1 Increasing demand for mass transit transport to drive market

- 9.2.2.6 Other traffic management solutions

- 9.2.2.1 Signaling solutions

- 9.2.3 ASSET MANAGEMENT

- 9.2.3.1 Enterprise asset management

- 9.2.3.1.1 Rising inclination toward centralized asset inventory management to drive the market

- 9.2.3.2 Field service management

- 9.2.3.2.1 Increasing need for optimized workforce allocation to drive market

- 9.2.3.3 Asset performance management

- 9.2.3.3.1 Growing focus on monitoring equipment health to drive market

- 9.2.3.4 Other asset management solutions

- 9.2.3.1 Enterprise asset management

- 9.2.4 INTELLIGENT IN-TRAIN SOLUTIONS

- 9.2.4.1 Increasing demand for enhanced passenger experience to drive market

- 9.2.5 OTHER SOLUTIONS

- 9.2.1 RAIL OPERATIONS MANAGEMENT

- 9.3 SERVICES

- 9.3.1 CONSULTING

- 9.3.1.1 Growing shift toward smart railway infrastructure to drive market

- 9.3.2 SYSTEM INTEGRATION AND DEPLOYMENT

- 9.3.2.1 Rising demand for cost-effective systems with minimal deployment-related disruptions to drive market

- 9.3.3 SUPPORT & MAINTENANCE

- 9.3.3.1 Need for troubleshooting assistance and repairing components to drive market

- 9.3.1 CONSULTING

10 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE

- 10.1 INTRODUCTION

- 10.1.1 MARKET DRIVERS

- 10.2 PASSENGER

- 10.3 FREIGHT

11 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Favorable government initiatives to drive market

- 11.2.2 CANADA

- 11.2.2.1 Growing capital investments to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Increasing emphasis on improving infrastructure to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Rising number of electrified tracks and rail modernization efforts to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Surge in liberalization efforts to drive market

- 11.3.4 ITALY

- 11.3.4.1 Increasing emphasis on carbon neutrality efforts to drive market

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Booming Belt and Road Initiative to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Rising focus on diversified revenue streams to drive market

- 11.4.3 INDIA

- 11.4.3.1 Increasing development of high-speed rail network to drive market

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Growing focus on Cross River Rail and Inland Rail projects to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 KSA

- 11.5.1.1 Growing focus on Cross River Rail and Inland Rail projects to drive market

- 11.5.2 UAE

- 11.5.2.1 Increasing number of logistics and fleet transport companies to drive market

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Growing adoption of IoT and cloud technologies to drive market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 KSA

- 11.6 LATIN AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Surge in information technology infrastructure development and upgrades to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Accelerating railway modernization and private concessions to transform Argentina's rail network

- 11.6.3 REST OF LATIN AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint: Key players, 2024

- 12.6.5.2 Offering footprint: Key players, 2024

- 12.6.5.3 Solution footprint: Key players, 2024

- 12.6.5.4 Railway type footprint: Key players, 2024

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 ALSTOM SA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and enhancements

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 HUAWEI TECHNOLOGIES CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product Launches and Enhancements

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SIEMENS

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product Launches and Enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HITACHI, LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product Launches and Enhancements

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 WABTEC CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product Launches and Enhancements

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CISCO SYSTEMS, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product Launches and Enhancements

- 13.1.7 ABB

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 INDRA SISTEMAS, S.A.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product Launches

- 13.1.8.3.2 Deals

- 13.1.9 IBM CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 HONEYWELL INTERNATIONAL INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 ALSTOM SA

- 13.2 OTHER PLAYERS

- 13.2.1 CAF

- 13.2.2 WSP

- 13.2.3 KYOSAN ELECTRIC MFG. CO., LTD.

- 13.2.4 ADVANTECH CO., LTD.

- 13.2.5 THALES

- 13.2.6 AMADEUS IT GROUP SA

- 13.2.7 ATKINSREALIS

- 13.2.8 DXC TECHNOLOGY COMPANY

- 13.2.9 FUJITSU

- 13.3 SMES/STARTUPS

- 13.3.1 RAILROAD SOFTWARE

- 13.3.2 RAILCUBE

- 13.3.3 PRAEDICO

- 13.3.4 NWAY TECHNOLOGIES

- 13.3.5 EUROTECH S.P.A.

- 13.3.6 FREQUENTIS

- 13.3.7 RAILINC CORPORATION

- 13.3.8 ARCADIS GEN HOLDINGS LIMITED

- 13.3.9 TELEGRAPH

- 13.3.10 TRACSIS PLC

- 13.3.11 RAIL-FLOW

14 RESEARCH METHODOLOGY

- 14.1 RESEARCH DATA

- 14.1.1 SECONDARY DATA

- 14.1.1.1 Key data from secondary sources

- 14.1.2 PRIMARY DATA

- 14.1.2.1 Breakup of primary interviews

- 14.1.2.2 Key primary interview participants

- 14.1.2.3 Key data from primary sources

- 14.1.2.4 Key industry insights

- 14.1.1 SECONDARY DATA

- 14.2 DATA TRIANGULATION

- 14.3 MARKET SIZE ESTIMATION METHODOLOGY

- 14.3.1 TOP-DOWN APPROACH

- 14.3.1.1 Demand-side analysis

- 14.3.2 BOTTOM-UP APPROACH

- 14.3.1 TOP-DOWN APPROACH

- 14.4 RESEARCH ASSUMPTIONS

- 14.5 RISK ASSESSMENT

- 14.6 RESEARCH LIMITATIONS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS