|

시장보고서

상품코드

1774594

의약품 포장 장비 시장 : 제품별, 제형별, 자동화별, 최종사용자별, 지역별 - 예측(-2030년)Pharmaceutical Packaging Equipment Market by Product (Primary: Aseptic Filling and Sealing Equipment), Formulation (Liquid Packaging Equipment: Aseptic Liquid), Automation (Manual), End User (Pharma Manufacturing Companies) - Global Forecast to 2030 |

||||||

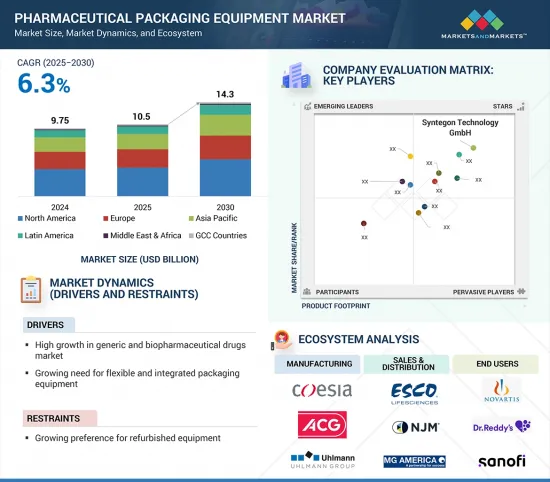

의약품 포장 장비 시장 규모는 예측 기간 동안 6.3%의 CAGR로 확대되어 2025년 106억 달러에서 2030년에는 143억 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2024-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 제형별, 자동화별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

의약품 포장 장비 시장은 안전성, 변조 방지, 규제 준수 의약품 포장에 대한 수요 증가, 의약품 생산 증가, 연속성 및 추적성에 대한 요구 증가에 의해 주도되고 있습니다. 자동화, 로봇 공학 및 AI 통합의 기술 발전은 효율성과 정확성을 향상시킵니다. 그러나 높은 자본 비용, 복잡한 검증 절차, 엄격한 규제 기준은 특히 소규모 제조업체에게 큰 도전이 되고 있습니다. 이러한 제약에도 불구하고, 신흥국의 제약 인프라 확대와 지속가능하고 친환경적인 포장의 확산은 기기 제조업체에게 큰 성장 기회를 제공하고 있습니다.

1차 포장 장비 분야에서는 무균 의약품, 생물학적 제제, 백신의 생산이 증가함에 따라 무균 충전 및 밀봉 장비가 가장 큰 시장 점유율을 차지하고 있습니다. 이 장비는 제품의 안전성, 엄격한 규제 기준 준수, 유통기한 연장을 보장합니다. 주사제 제제 및 팬데믹(세계적 대유행)에 따른 백신 제조에 대한 수요 증가는 무균 기술의 채택을 더욱 가속화하고 있습니다.

액체 포장 장비의 경우, 무균 주사제, 생물학적 제제 및 백신에 대한 수요가 증가함에 따라 무균 액체가 의약품 포장 장비 시장에서 가장 큰 점유율을 차지하고 있습니다. 이러한 제품들은 효능과 안전성을 유지하기 위해 무공해 포장이 필요합니다. 전 세계적으로 엄격한 규제와 만성질환의 증가로 인해 제약 제조업체는 무균 액체 포장 솔루션에 투자하여 고품질의 규정을 준수하는 약물전달을 실현하고 있습니다.

아시아태평양은 중국, 인도, 한국 등의 국가에서 의약품 제조의 급속한 확대로 인해 의약품 포장 장비 시장에서 가장 높은 성장률을 보일 것으로 예상됩니다. 헬스케어 투자 증가, 의약품 현지 생산에 대한 정부 지원 정책, 제네릭 의약품 및 생물학적 제제에 대한 수요 증가가 장비 채택을 촉진하고 있습니다. 또한, 자동화, 규제 준수, 비용 효율적인 생산에 대한 관심이 높아지면서 이 지역 전체에서 첨단 포장 솔루션에 대한 수요가 증가하고 있습니다.

세계의 의약품 포장 장비 시장에 대해 조사했으며, 제품별, 제형별, 자동화별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 업계 동향

- 미충족 수요와 최종사용자의 기대

- 기술 분석

- 가격 분석

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 규제 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 특허 분석

- 무역 분석

- 인접 시장 분석

- 사례 연구 분석

- 투자와 자금 조달 시나리오

- AI/생성형 AI가 의약품 포장 장비 시장에 미치는 영향

- 2025년 미국 관세가 의약품 포장 장비 시장에 미치는 영향

제6장 의약품 포장 장비 시장(제품별)

- 소개

- 1차 포장 장비

- 2차 포장 장비

- 라벨링 및 시리얼화 장비

제7장 의약품 포장 장비 시장(제형별)

- 소개

- 액체

- 고형

- 반고형

- 기타

제8장 의약품 포장 장비 시장(자동화별)

- 소개

- 자동 의약품 포장 장비

- 반자동 의약품 포장 장비

- 수동 의약품 포장 장비

제9장 의약품 포장 장비 시장(최종사용자별)

- 소개

- 제약 제조 기업

- 의약품 위탁생산 회사

제10장 의약품 포장 장비 시장(지역별)

- 소개

- 유럽

- 유럽의 거시경제 전망

- 독일

- 이탈리아

- 영국

- 프랑스

- 스페인

- 기타

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 의약품 연구개발에 대한 정부 자금 증가가 시장 성장을 촉진

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 의료 인프라 개선과 국내 의약품 제조에 대한 주력으로 시장 성장을 촉진

- GCC 국가의 거시경제 전망

제11장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 주요 기업 연구개발비, 2022년과 2023년의 비교

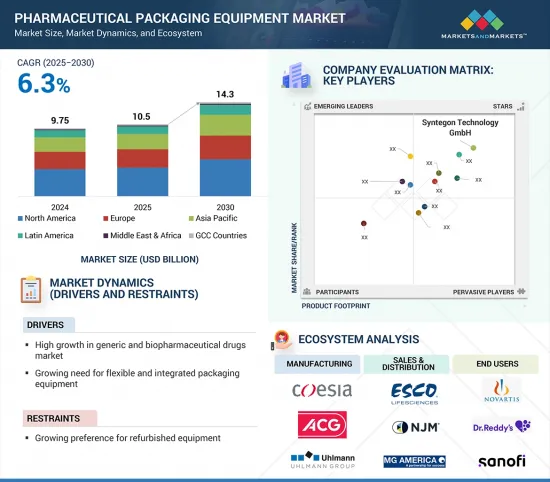

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 진출 기업

- SYNTEGON TECHNOLOGY GMBH

- KORBER AG

- INDUSTRIA MACCHINE AUTOMATICHE(IMA) S.P.A.

- COESIA S.P.A.

- BAUSCH+STROBEL

- MARCHESINI GROUP S.P.A.

- ROMACO GROUP

- UHLMANN

- MAQUINARIA INDUSTRIAL DARA, SL

- MULTIVAC GROUP

- OPTIMA

- ACG

- ACCUTEK PACKAGING COMPANY, INC.

- VANGUARD PHARMACEUTICAL MACHINERY

- BUSCH MACHINERY

- 기타 기업

- NVENIA

- TRUSTAR PHARMA PACK EQUIPMENT CO., LTD.

- INLINE FILLING SYSTEMS

- MG2 S.R.L.

- DUKE TECHNOLOGIES

- NJM PACKAGING INC.

- HARRO HOFLIGER VERPACKUNGSMASCHINEN GMBH

- APPLICATIONS SOFTWARE TECHNOLOGY(AST), LLC

- TRUKING TECHNOLOGY LIMITED

- ACIC PHARMACEUTICALS INC.

제13장 부록

ksm 25.07.29The pharmaceutical packaging equipment market is projected to reach USD 14.3 billion by 2030 from USD 10.6 billion in 2025, at a CAGR of 6.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Formulation, Automation, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

The pharmaceutical packaging equipment market is driven by increasing demand for safe, tamper-evident, and regulatory-compliant drug packaging, rising pharmaceutical production, and the growing need for serialization and traceability. Technological advancements in automation, robotics, and AI integration enhance efficiency and accuracy. However, high capital costs, complex validation procedures, and strict regulatory standards pose challenges, especially for small manufacturers. Despite these constraints, expanding pharmaceutical infrastructure in emerging economies and the push for sustainable, eco-friendly packaging offer substantial growth opportunities for equipment manufacturers.

In the realm of primary packaging equipment, aseptic filling and sealing equipment hold the largest market share due to the rising production of sterile drugs, biologics, and vaccines that require contamination-free environments. This equipment ensures product safety, compliance with stringent regulatory standards, and extended shelf life. The increasing demand for injectable formulations and pandemic-driven vaccine production further accelerates the adoption of aseptic technologies.

In terms of liquid packaging equipment, aseptic liquids hold the largest share in the pharmaceutical packaging equipment market due to the growing demand for sterile injectable drugs, biologics, and vaccines. These products require contamination-free packaging to maintain efficacy and safety. Stringent global regulations and the increasing prevalence of chronic diseases drive pharmaceutical manufacturers to invest in aseptic liquid packaging solutions, ensuring high-quality and compliant drug delivery.

The Asia Pacific is anticipated to experience the highest growth rate in the pharmaceutical packaging equipment market due to the rapid expansion of pharmaceutical manufacturing in countries such as China, India, and South Korea. Rising healthcare investments, supportive government policies for local drug production, and increasing demand for generics and biologics are driving equipment adoption. Furthermore, a growing emphasis on automation, regulatory compliance, and cost-effective production enhances the demand for advanced packaging solutions throughout the region.

A breakdown of the primary participants (supply-side) for the pharmaceutical packaging equipment market referred to in this report is provided below:

- By Company Type: Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation: C-level: 42%, Director Level: 29%, and Others: 29%

- By Region: North America: 29%, Europe: 24%, Asia Pacific: 29%, Latin America: 10%, Middle East & Africa: 5%, GCC Countries: 3%

Prominent players in the pharmaceutical packaging equipment market are Syntegon Technology GmbH (Germany), Industria Macchine Automatiche (IMA) S.p.A (Italy), Korber AG (Germany), Coesia S.p. A. (Italy), Marchesini Group S.p.A (Italy), Bausch+Strobel (Germany). Uhlmann (Germany), Maquinaria Industries Dara, SL (US), MULTIVAC Group (Germany), Vanguard Pharmaceutical Machinery, Inc. (US), OPTIMA (Germany), ACG (India), Harro Hofliger Verpackungsmaschinen GmbH (Germany), Truking Technology Limited (China), Trustar Pharma Pack Equipment, Co. Ltd. (China), MG2 s.r.l. (Italy).

Research Coverage

The report evaluates the pharmaceutical packaging equipment market. It estimates the market size and future growth potential of this market based on various segments, including product, formulation, automation, end-user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leaders/new entrants with data on the nearest approximations of the revenue numbers for the overall pharmaceutical packaging equipment market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gaining further insights to place their businesses better and make appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (high growth in generic & biopharmaceutical markets, rising need for flexible and integrated packaging equipment, increase in offshore pharmaceutical manufacturing, increase in number of contract manufacturers for cost-effective pharmaceuticals, high regulatory standards on packaging and stringent norms against counterfeit drugs, innovation in pharmaceutical packaging and delivery systems, increase in OTC drug sales and measures to reduce OTC counterfeiting), restraints (growing preference for refurbished equipment in low-cost manufacturing locations), opportunities (high growth opportunities in emerging economies, rising demand for automated pharmaceutical packaging solutions, higher adoption of self-medication and home care products, increasing pharmaceutical R&D investments) and challenges (uncertainties in regulations and standards of pharmaceutical packaging process, growth in personalized and precision medicine supply chains)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global pharmaceutical packaging equipment market

- Market Development: Comprehensive information on the lucrative emerging markets by type of product, application, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global pharmaceutical packaging equipment market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global pharmaceutical packaging equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primaries (supply- and demand-side participants)

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE MARKET SIZE ESTIMATION (REVENUE SHARE ANALYSIS)

- 2.2.2 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.3 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY PRODUCT AND COUNTRY (2024)

- 4.3 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, REGIONAL MIX, 2023-2030

- 4.5 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High growth in generic & biopharmaceutical drugs markets

- 5.2.1.2 Rising need for flexible and integrated packaging equipment

- 5.2.1.3 Increase in offshore pharmaceutical manufacturing

- 5.2.1.4 Increasing number of contract manufacturers for cost-effective pharmaceuticals

- 5.2.1.5 High regulatory standards on packaging and stringent norms against counterfeit drugs

- 5.2.1.6 Innovation in pharmaceutical packaging and delivery systems

- 5.2.1.7 Increase in OTC drug sales and measures to reduce OTC counterfeiting

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing preference for refurbished equipment in low-cost manufacturing locations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth opportunities in emerging economies

- 5.2.3.2 Rising demand for automated pharmaceutical packaging solutions

- 5.2.3.3 Higher adoption of self-medication and home care products

- 5.2.3.4 Increasing pharmaceutical R&D investments

- 5.2.4 CHALLENGES

- 5.2.4.1 Growth in personalized and precision medicine supply chains

- 5.2.4.2 Uncertainties in regulations and standards of pharmaceutical packaging process

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 CHANGE OF PACE AND DISRUPTIVENESS IN THREE ERAS OF PHARMACEUTICAL PACKAGING

- 5.4 UNMET NEEDS & END-USER EXPECTATIONS

- 5.4.1 DEVELOPMENT OF PRODUCTION LINES FOR SMALL BATCH SIZES AND RESEARCH PURPOSES

- 5.4.2 AUTOMATION AND INTEGRATION OF PACKAGING EQUIPMENT TO CUT COSTS

- 5.4.3 RISING FOCUS ON LABELING AND SERIALIZATION FOR ANTI-COUNTERFEITING OF DRUGS

- 5.4.4 GROWING DEMAND FOR ASEPTIC FILLING AND SEALING EQUIPMENT

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Serialization and track-and-trace systems

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Industrial robotics and pick-and-place arms

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Sustainable packaging materials and technology

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF PRIMARY PHARMACEUTICAL PACKAGING EQUIPMENT, BY TYPE, 2022-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING EQUIPMENT, BY KEY PLAYER, 2022-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING EQUIPMENT, BY REGION, 2022-2024

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- 5.9.1 ROLE IN ECOSYSTEM

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 THREAT OF SUBSTITUTES

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 KEY BUYING CRITERIA

- 5.12 REGULATORY ANALYSIS

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY LANDSCAPE

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.1.2 Canada

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 Japan

- 5.12.2.3.2 China

- 5.12.2.3.3 India

- 5.12.2.4 Brazil

- 5.12.2.1 North America

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.15 PATENT ANALYSIS

- 5.15.1 LIST OF KEY PATENTS

- 5.16 TRADE ANALYSIS

- 5.16.1 IMPORT DATA FOR HS CODE 842230, 2020-2024

- 5.16.2 EXPORT DATA FOR HS CODE 842230, 2020-2024

- 5.17 ADJACENT MARKET ANALYSIS

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 ALPHAPACK SYSTEMS BY COMBI PACKAGING SYSTEMS TO STREAMLINE PACKAGING AND MEET INCREASED DEMAND

- 5.18.2 RMA ASSEMBLY MACHINES BY SYNTEGON TECHNOLOGY TO REDUCE SETUP COSTS AND ENABLE FASTER ENTRY FOR NEW THERAPIES

- 5.18.3 C80/90 SERIES BY IMA TO ENHANCE DIAGNOSTIC ACCURACY IN RADIOLOGY

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 IMPACT OF AI/GEN AI ON PHARMACEUTICAL PACKAGING EQUIPMENT MARKET

- 5.20.1 MARKET POTENTIAL OF AI IN PHARMACEUTICAL PACKAGING EQUIPMENT MARKET

- 5.20.2 AI USE CASES

- 5.20.3 KEY COMPANIES IMPLEMENTING AI

- 5.20.4 FUTURE OF GENERATIVE AI IN PHARMACEUTICAL PACKAGING EQUIPMENT MARKET

- 5.21 IMPACT OF 2025 US TARIFF ON PHARMACEUTICAL PACKAGING EQUIPMENT MARKET

- 5.21.1 KEY TARIFF RATES

- 5.21.2 PRICE IMPACT ANALYSIS

- 5.21.3 IMPACT ON END-USE INDUSTRIES

6 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 PRIMARY PACKAGING EQUIPMENT

- 6.2.1 ASEPTIC FILLING AND SEALING EQUIPMENT

- 6.2.1.1 Technological advancements and automation to drive segment growth

- 6.2.2 BOTTLE FILLING AND CAPPING EQUIPMENT

- 6.2.2.1 Higher adoption of plastic bottles in pharmaceutical packaging to support segment growth

- 6.2.3 BLISTER PACKAGING EQUIPMENT

- 6.2.3.1 Higher output and better adaptability of blister packs to fuel demand

- 6.2.4 SOFT-TUBE FILLING AND SEALING EQUIPMENT

- 6.2.4.1 Increasing demand for soft-tube-based drug formulations and OTC pain relief ointments to aid market growth

- 6.2.5 SACHET PACKAGING EQUIPMENT

- 6.2.5.1 Greater applications of sachets and pouches in unit dose packaging to drive segment

- 6.2.6 STRIP PACKAGING EQUIPMENT

- 6.2.6.1 User-friendly strip packaging to propel segment growth

- 6.2.7 COUNTING EQUIPMENT

- 6.2.7.1 Initiatives to develop remote tablet counting machines for better accuracy and efficiency in medical dispensing to drive market

- 6.2.8 OTHER PRIMARY PACKAGING EQUIPMENT

- 6.2.1 ASEPTIC FILLING AND SEALING EQUIPMENT

- 6.3 SECONDARY PACKAGING EQUIPMENT

- 6.3.1 CARTONING EQUIPMENT

- 6.3.1.1 Rising use of automation and integration to foster greater flexibility of cartoning equipment

- 6.3.2 CASE PACKING EQUIPMENT

- 6.3.2.1 Increasing demand for flexible packaging to support market growth

- 6.3.3 WRAPPING EQUIPMENT

- 6.3.3.1 Technological advancements and customizations in wrapping equipment to increase productivity

- 6.3.4 TRAY PACKING EQUIPMENT

- 6.3.4.1 Technological advances to support automatic troubleshooting and program resetting without human intervention

- 6.3.5 PALLETIZING & DEPALLETIZING EQUIPMENT

- 6.3.5.1 Automation in palletizing & depalletizing equipment to drive market

- 6.3.1 CARTONING EQUIPMENT

- 6.4 LABELING & SERIALIZATION EQUIPMENT

- 6.4.1 BOTTLE & AMPOULE LABELING & SERIALIZATION EQUIPMENT

- 6.4.1.1 Increasing awareness about anti-counterfeit technologies to drive market

- 6.4.2 CARTON LABELING & SERIALIZATION EQUIPMENT

- 6.4.2.1 Carton labelling & serialization equipment to eliminate need for physical inspection and provide unique identification

- 6.4.3 DATA MATRIX LABELING & SERIALIZATION EQUIPMENT

- 6.4.3.1 Better speed and ease of use to propel segment growth

- 6.4.1 BOTTLE & AMPOULE LABELING & SERIALIZATION EQUIPMENT

7 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY FORMULATION

- 7.1 INTRODUCTION

- 7.2 LIQUID PACKAGING EQUIPMENT

- 7.2.1 ASEPTIC LIQUID PACKAGING EQUIPMENT

- 7.2.1.1 Automation of packaging lines and increased use of robotics to propel segment growth

- 7.2.2 SYRUP PACKAGING EQUIPMENT

- 7.2.2.1 Rising use of automated bottle filling and capping machines to aid market growth

- 7.2.3 EYE DROP PACKAGING EQUIPMENT

- 7.2.3.1 Technological advancements to increase demand for automated form-fill-seal equipment for eye drop packaging

- 7.2.4 EAR DROP PACKAGING EQUIPMENT

- 7.2.4.1 Increasing use of robotic vial filling to support market growth

- 7.2.5 AEROSOL PACKAGING EQUIPMENT

- 7.2.5.1 Integration of filling and sealing processes to gain importance in aerosol packaging

- 7.2.6 OTHER LIQUID PACKAGING EQUIPMENT

- 7.2.1 ASEPTIC LIQUID PACKAGING EQUIPMENT

- 7.3 SOLID PACKAGING EQUIPMENT

- 7.3.1 TABLET PACKAGING EQUIPMENT

- 7.3.1.1 Need for handling smaller batches with higher accuracy and precision to aid segment growth

- 7.3.2 CAPSULE PACKAGING EQUIPMENT

- 7.3.2.1 Capsule counting machines with filling and inspection systems to minimize errors and reduce processing time

- 7.3.3 POWDER PACKAGING EQUIPMENT

- 7.3.3.1 High demand for robotic powder packaging equipment to augment segment growth

- 7.3.4 GRANULE PACKAGING EQUIPMENT

- 7.3.4.1 Need for better dosing accuracy to augment market growth

- 7.3.5 OTHER SOLID PACKAGING EQUIPMENT

- 7.3.1 TABLET PACKAGING EQUIPMENT

- 7.4 SEMI-SOLID PACKAGING EQUIPMENT

- 7.4.1 OINTMENT PACKAGING EQUIPMENT

- 7.4.1.1 High-speed operations to drive demand for automated ointment packaging equipment

- 7.4.2 CREAM PACKAGING EQUIPMENT

- 7.4.2.1 Increasing demand for filling, capping, and sealing machines for cream packaging to aid market growth

- 7.4.3 SUPPOSITORY PACKAGING EQUIPMENT

- 7.4.3.1 Reducing drug pipelines and rising costs to limit segment growth

- 7.4.4 OTHER SEMI-SOLID PACKAGING EQUIPMENT

- 7.4.1 OINTMENT PACKAGING EQUIPMENT

- 7.5 OTHER PRODUCT PACKAGING EQUIPMENT

8 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY AUTOMATION

- 8.1 INTRODUCTION

- 8.2 AUTOMATIC PHARMACEUTICAL PACKAGING EQUIPMENT

- 8.2.1 REQUIREMENT FOR FASTER AND MORE COMPLEX PACKAGING SOLUTIONS TO FUEL MARKET GROWTH

- 8.3 SEMI-AUTOMATIC PHARMACEUTICAL PACKAGING EQUIPMENT

- 8.3.1 AFFORDABILITY AND FLEXIBILITY OF SEMI-AUTOMATIC MACHINES TO DRIVE MARKET

- 8.4 MANUAL PHARMACEUTICAL PACKAGING EQUIPMENT

- 8.4.1 AFFORDABILITY AND SIMPLICITY OF MANUAL MACHINES IN LOW-VOLUME PRODUCTION TO SPUR ADOPTION

9 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL MANUFACTURING COMPANIES

- 9.2.1 HIGH DEMAND FOR PERSONALIZED MEDICINES AND TECHNOLOGICAL ADVANCEMENTS TO PROPEL MARKET GROWTH

- 9.3 PHARMACEUTICAL CONTRACT MANUFACTURING COMPANIES

- 9.3.1 ABILITY TO REDUCE COSTS AND IMPROVE EFFICIENCY TO FUEL MARKET GROWTH

10 PHARMACEUTICAL PACKAGING EQUIPMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 EUROPE

- 10.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.2.2 GERMANY

- 10.2.2.1 Presence of pharmaceutical manufacturing companies and favorable regulatory policies to aid market growth

- 10.2.3 ITALY

- 10.2.3.1 Growing consumption of OTC and generic drugs to drive market

- 10.2.4 UK

- 10.2.4.1 Increasing geriatric population and rising demand for prescription and OTC drugs to drive market

- 10.2.5 FRANCE

- 10.2.5.1 Presence of leading pharmaceutical companies to propel market growth

- 10.2.6 SPAIN

- 10.2.6.1 Rising geriatric population and increasing healthcare expenditure to augment market growth

- 10.2.7 REST OF EUROPE

- 10.3 NORTH AMERICA

- 10.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.3.2 US

- 10.3.2.1 US to dominate North American pharmaceutical packaging equipment market during forecast period

- 10.3.3 CANADA

- 10.3.3.1 Increasing demand for generic drugs to drive market

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Favorable government healthcare reforms and developed contract manufacturing market to drive growth

- 10.4.3 JAPAN

- 10.4.3.1 Advanced pharmaceutical market and high geriatric population to favor market growth

- 10.4.4 INDIA

- 10.4.4.1 Low manufacturing costs and presence of skilled workforce to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Rising government healthcare spending and increasing focus on clinical trials to drive market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Increasing healthcare expenditure and stringent regulatory standards to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Low labor and manufacturing costs to propel market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increased prevalence of chronic diseases and high demand for pharmaceutical products to spur market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RISE IN GOVERNMENT FUNDING FOR PHARMACEUTICAL R&D TO AUGMENT MARKET GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.7 GCC COUNTRIES

- 10.7.1 IMPROVED HEALTH INFRASTRUCTURE AND FOCUS ON DOMESTIC DRUG MANUFACTURING TO AID MARKET GROWTH

- 10.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN PHARMACEUTICAL PACKAGING EQUIPMENT MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 R&D EXPENDITURE OF KEY PLAYERS, 2022 VS. 2023

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Product footprint (primary packaging equipment)

- 11.6.5.4 Product footprint (secondary packaging equipment)

- 11.6.5.5 Product footprint (labeling & serialization equipment)

- 11.6.5.6 Formulation footprint

- 11.6.5.7 Automation footprint

- 11.6.5.8 End-user footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of startups/SMEs

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY VALUATION & FINANCIAL METRICES

- 11.9.1 COMPANY VALUATION

- 11.9.2 FINANCIAL METRICS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SYNTEGON TECHNOLOGY GMBH

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 KORBER AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 INDUSTRIA MACCHINE AUTOMATICHE (IMA) S.P.A.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 COESIA S.P.A.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses & competitive threats

- 12.1.5 BAUSCH+STROBEL

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses & competitive threats

- 12.1.6 MARCHESINI GROUP S.P.A.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 ROMACO GROUP

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 UHLMANN

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 MAQUINARIA INDUSTRIAL DARA, SL

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 MULTIVAC GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Expansions

- 12.1.11 OPTIMA

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.12 ACG

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Expansions

- 12.1.13 ACCUTEK PACKAGING COMPANY, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 VANGUARD PHARMACEUTICAL MACHINERY

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 BUSCH MACHINERY

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 SYNTEGON TECHNOLOGY GMBH

- 12.2 OTHER PLAYERS

- 12.2.1 NVENIA

- 12.2.2 TRUSTAR PHARMA PACK EQUIPMENT CO., LTD.

- 12.2.3 INLINE FILLING SYSTEMS

- 12.2.4 MG2 S.R.L.

- 12.2.5 DUKE TECHNOLOGIES

- 12.2.6 NJM PACKAGING INC.

- 12.2.7 HARRO HOFLIGER VERPACKUNGSMASCHINEN GMBH

- 12.2.8 APPLICATIONS SOFTWARE TECHNOLOGY (AST), LLC

- 12.2.9 TRUKING TECHNOLOGY LIMITED

- 12.2.10 ACIC PHARMACEUTICALS INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS