|

시장보고서

상품코드

1777130

EV 커넥터 시장 : 용도별, 시스템별, 전압별, 접속별, 추진력별, 컴포넌트별, 지역별 예측(-2032년)EV Connector Market by System (Sealed, Unsealed), Application (ADAS & Safety, Battery Management, Body Control & Interiors), Propulsion (BEV, PHEV, FCEV), Voltage, Connection, Component, and Region - Global Forecast to 2032 |

||||||

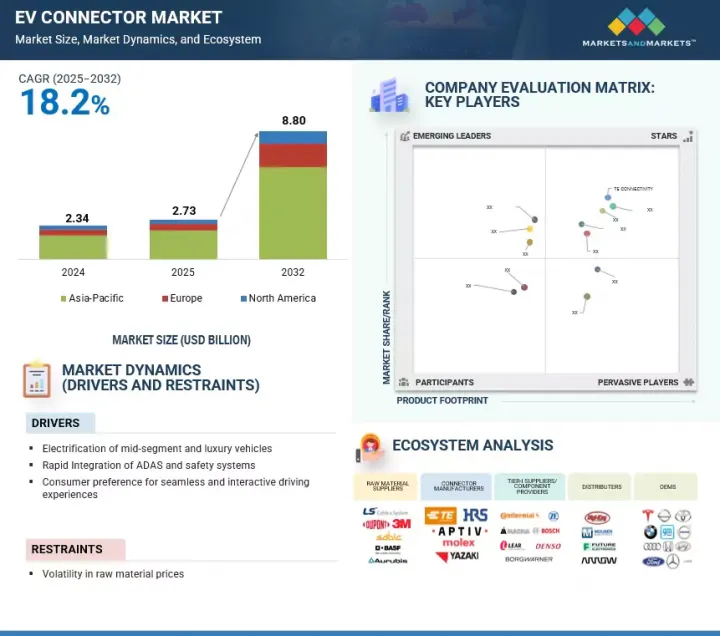

EV 커넥터 시장 규모는 2025년 27억 3,000만 달러에서 2032년에는 88억 달러에 이르고, CAGR은 18.2%를 나타낼 전망입니다.

전기 및 소프트웨어 정의 차량이 발전함에 따라 첨단 EV 커넥터의 채택이 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 유닛 | 금액(100만 달러), 1,000대 |

| 부문 | 용도별, 시스템별, 전압별, 접속별, 추진력별, 컴포넌트별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

최근의 전기차는 전력, 신호 및 데이터 라인을 소형 인터페이스에 결합한 고전압, 다중 신호 커넥터를 사용하여 효율성을 높이고 무게를 줄였습니다. 구역별 전기 아키텍처로 전환됨에 따라 차량에는 제한된 공간에서 복잡한 신호 전송을 관리하기 위해 소형화되고 고밀도 커넥터가 필요합니다. 자동차용 이더넷 및 동축 유형과 같은 고속 데이터 커넥터는 ADAS 및 무선 업데이트를 위한 실시간 데이터 흐름을 지원하기 위해 필수적입니다. 이러한 커넥터는 전자기 간섭을 방지하면서 안정적인 성능을 유지하도록 설계되었습니다. 인버터와 같은 고전력 시스템에서는 좁은 공간에서 열을 제어하기 위해 액체 냉각 커넥터가 등장하고 있습니다. 온도, 전류 및 마모 상태를 모니터링하기 위해 센서가 내장된 스마트 커넥터도 도입되고 있습니다.

고전압 커넥터는 EV에 필수적인 부품으로, 여러 고에너지 시스템에 걸쳐 효율적이고 안정적인 전력 전달을 가능하게 합니다. 이 커넥터는 추진, 열 관리 및 전자 하위 시스템에서 중심적인 역할을 하며, 복잡한 아키텍처의 원활한 통합을 보장합니다. 이 커넥터의 적용 범위는 핵심 드라이브트레인 기능에서 ADAS, BMS 및 조명과 같은 첨단 시스템으로 확대되고 있습니다. BMS에서 고전압 커넥터는 배터리 모듈, 전압 및 온도 센서, 제어 유닛을 연결하여 400V 이상에서 작동하는 고전압 배터리 팩의 안전한 모니터링, 균형 조정, 제어를 보장합니다. 이들은 고전류 부하와 온도 변화 하에서도 신호 정확도와 전력 안정성을 유지해야 합니다. 엔진 관리 시스템에서 이러한 커넥터는 배터리에서 모터로 전력을 전달하며, 속도, 토크, 재생 제동 등 모터 기능의 정밀한 제어를 가능하게 합니다. 이들은 IP6K9K 방수/방진 등급, 고진동 저항성, 열 내구성 등 자동차 등급 표준을 충족하도록 설계되었습니다. EV 시스템이 더 높은 전압과 더 컴팩트한 설계로 발전함에 따라 고전압 커넥터는 전도성, 열 성능 및 통합성이 개선되어 효율적이고 안정적인 EV 운영에 필수적인 부품이 되고 있습니다. 소형 커넥터, EMI 차폐 및 경량 소재와 같은 고전압 커넥터 기술의 지속적인 발전은 안전성, 신뢰성 및 효율성 개선에 더욱 집중되고 있습니다.

FCEV는 고전압 및 고전류 파워트레인 시스템과 연료 전지 스택, 배터리 및 전기 구동계의 통합으로 인해 첨단 커넥터에 대한 수요가 가속화되고 있습니다. 극한 온도, 진동 및 수소 노출이 특징인 열악한 작동 환경에서는 밀폐되고 내화학성이 뛰어난 커넥터 솔루션이 필요합니다. 또한, 온보드 안전, 감지 및 열 관리 시스템의 복잡성으로 인해 소형, 고밀도 및 EMI 차폐 신호 커넥터에 대한 요구가 촉진되고 있습니다. 이러한 커넥터는 수소 사용 및 안전 요구 사항으로 인해 높은 수준의 밀폐, 신뢰성 및 내화학성을 충족해야 합니다. 일반적으로 FCEV에서는 연료 전지 스택, 고전압 배터리, 구동 모터, 인버터, DC-DC 컨버터, 냉각수 히터 등 열 관리 시스템에 커넥터가 사용됩니다. 이러한 고전압 커넥터는 고온 및 화학적으로 활성적인 환경에서 안정적인 작동을 지원해야 합니다. FCEV는 일반적으로 고전압 전기 시스템을 사용합니다. 저전압 커넥터는 연료 전지 제어 장치, 수소 탱크 시스템, 누출 감지 센서, 캐빈 시스템 등에 사용됩니다. EV 커넥터는 우수한 절연 및 안전 기능을 갖추어 연료 전지에서 전기 모터, 보조 시스템, 배터리로 전력을 안전하게 분배하고 전송합니다.

유럽은 Rosenberger Group(독일), TE Connectivity(아일랜드), Leoni(독일) 등 주요 Tier-1 공급업체를 보유하고 있습니다. 국내 커넥터 제조업체 외에도 세계의의 EV 커넥터 생산업체들이 유럽에서 활동하고 있습니다. 일본 항공 전자 산업 주식회사(일본), Amphenol Corporation(미국), Hirose Electric Co., Ltd.(일본)는 해당 지역에 제조 시설과 판매 사무소를 보유하고 있습니다. 이들의 강력한 존재감은 예측 기간 동안 유럽 EV 커넥터 시장 확장에 기여할 것으로 예상됩니다. 또한 유럽의 여러 국가들은 전기차 보급을 위해 상당한 인센티브를 제공하고 있습니다. 이 지역은 제로 또는 저공해 차량에 중점을 두고 있어 전기자동차에 대한 수요도 급증하고 있습니다. 예를 들어, 영국은 2030년까지 가솔린 및 디젤 차량을 단계적으로 폐지하고 EV 채택을 장려할 계획을 발표했습니다.

본 보고서에서는 세계의 EV 커넥터 시장에 대해 조사했으며, 용도별, 시스템별, 전압별, 접속별, 추진력별, 컴포넌트별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 가격 분석

- 무역 분석

- 생태계 분석

- 공급망 분석

- 기술 분석

- 특허 분석

- 규제 상황

- 사례 연구 분석

- 주된 회의 및 이벤트(2025-2026년)

- 투자 및 자금조달 시나리오

- AI의 영향

- 주요 이해관계자와 구매 기준

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 중국의 EV커넥터 에코시스템에 있어서의 중국 수출업체와 외국 참가 기업의 전략적 포지셔닝

- 자율주행차에서의 EV 커넥터의 진화

제6장 EV 커넥터 시장(용도별)

- 소개

- ADAS와 안전 시스템

- 바디 컨트롤 & 인테리어

- 인포테인먼트 시스템

- 엔진 매니지먼트 & 파워트레인

- 배터리 관리 시스템

- 차량 조명

- 기타 용도

- 주요 인사이트

제7장 EV 커넥터 시장(시스템별)

- 소개

- 밀폐형

- 비밀폐형

- 주요 인사이트

제8장 EV 커넥터 시장(전압별)

- 소개

- 저전압

- 중전압

- 고전압

- 주요 인사이트

제9장 EV 커넥터 시장(접속별)

- 소개

- 와이어 대 와이어

- 와이어 대 기판

- 보드 대 보드

- 기타

- 주요 인사이트

제10장 EV 커넥터 시장(추진력별)

- 소개

- BEV

- PHEV

- FCEV

- HEV

- 주요 인사이트

제11장 EV 커넥터 시장(컴포넌트별)

- 소개

- 단자

- 하우징

- 락

- 기타

제12장 EV 커넥터 시장(지역별)

- 소개

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 유럽

- 거시경제 전망

- 네덜란드

- 독일

- 프랑스

- 노르웨이

- 오스트리아

- 영국

- 스페인

- 스웨덴

- 스위스

- 덴마크

- 북미

- 거시경제 전망

- 미국

- 캐나다

제13장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점(2021-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- TE CONNECTIVITY

- APTIV

- YAZAKI CORPORATION

- MOLEX

- HIROSE ELECTRIC CO., LTD.

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

- AMPHENOL CORPORATION

- ROSENBERGER GROUP

- KYOCERA CORPORATION

- FURUKAWA ELECTRIC CO., LTD.

- LUXSHARE PRECISION INDUSTRY CO., LTD.

- 기타 기업

- JST MFG. CO., LTD.

- LITTELFUSE, INC.

- SHENGLAN TECHNOLOGY CO., LTD.

- KINSUN INDUSTRIES INC.

- TXGA LLC

- THB GROUP

- LUMBERG HOLDINGS, INC.

- LEONI AG

- SAMTEC

- FUJIKURA LTD.

- ITT INC.

- WURTH ELEKTRONIK EISOS GMBH & CO. KG

- HUBER SUHNER

제15장 시장에서의 제안

제16장 부록

HBR 25.08.01The EV connector market is projected to reach USD 8.80 billion by 2032, from USD 2.73 billion in 2025, with a CAGR of 18.2%. As electric and software-defined vehicles evolve, the adoption of advanced EV connectors is rising.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Segments | System, Propulsion, Connection, Application, Voltage, Component, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

Modern EVs employ high-voltage, multi-signal connectors that combine power, signal, and data lines in a compact interface, improving efficiency and reducing weight. With the shift toward zonal electrical architectures, vehicles require miniaturized and high-density connectors to manage complex signal transmission within limited space. High-speed data connectors such as automotive Ethernet and coaxial types are becoming essential to support real-time data flow for ADAS and over-the-air updates. These connectors are designed to maintain reliable performance while resisting electromagnetic interference. In high-power systems like inverters, liquid-cooled connectors are emerging to control heat in tight spaces. Smart connectors with built-in sensors are also being introduced to monitor temperature, current, and wear conditions.

"High voltage is expected to be the fastest-growing segment by voltage during the forecast period."

High-voltage connectors are essential for EVs, enabling efficient and reliable power transfer across multiple high-energy systems. They play a central role in propulsion, thermal management, and electronic subsystems, ensuring seamless integration of complex architectures. Their application extends beyond core drivetrain functions to advanced systems such as ADAS, BMS, and lighting. In BMS, high-voltage connectors link battery modules, voltage and temperature sensors, and control units, ensuring safe monitoring, balancing, and control of high-voltage battery packs, which typically operate at 400V or above. They must maintain signal accuracy and power stability under high current loads and temperature changes. In engine management systems, these connectors transfer power from the battery to the motor while allowing precise control of motor functions such as speed, torque, and regenerative braking. They are designed to meet automotive-grade standards like IP6K9K sealing, high vibration resistance, and thermal durability. As EV systems move toward higher voltages and more compact designs, high-voltage connectors are improving in conductivity, thermal performance, and integration, making them vital for efficient and reliable EV operations. Ongoing advancements in high-voltage connector technologies, such as miniaturized connectors, EMI shielding, and lightweight materials, are further focused on improving safety, reliability, and efficiency.

"FCEV is expected to be the fastest-growing segment by propulsion during the forecast period."

FCEVs are accelerating demand for advanced connectors due to their high voltage and high current powertrain systems and the integration of fuel cell stacks, batteries, and electric drivetrains. The harsh operating environment, marked by temperature extremes, vibration, and hydrogen exposure, necessitates sealed and chemically resistant connector solutions. Additionally, the complexity of onboard safety, sensing, and thermal management systems drives the need for compact, high-density, and EMI-shielded signal connectors. These connectors must meet high standards for sealing, reliability, and chemical resistance due to hydrogen use and safety requirements. Typically, in FCEVs, connectors are used in fuel cell stacks, high-voltage batteries, traction motors, inverters, DC-DC converters, and thermal systems like coolant heaters. These high-voltage connectors must support stable operation in high-temperature and chemically active environments. FCEVs generally operate with high-voltage electrical systems. Low-voltage connectors are used in fuel cell control units, hydrogen tank systems, leak detection sensors, and cabin systems. EV connectors with exceptional insulation and safety features safely distribute and transmit power from the fuel cell to the electric motor, auxiliary systems, and battery.

"Europe is expected to be the second fastest market during the forecast period."

Europe hosts leading Tier-I suppliers in the EV connector market, including Rosenberger Group (Germany), TE Connectivity (Ireland), and Leoni (Germany), among others. In addition to domestic connector manufacturers, EV connector producers from around the world also operate in Europe. Japan Aviation Electronics Industry, Ltd. (Japan), Amphenol Corporation (US), and Hirose Electric Co., Ltd. (Japan) have manufacturing facilities and sales offices in the region. Their significant presence is expected to contribute to the expansion of the European EV connector market during the forecast period. Furthermore, several countries in Europe are promoting EVs through significant incentives. The demand for electric vehicles has also surged due to the region's focus on zero- or low-emission vehicles. For example, the UK has announced plans to phase out petrol and diesel vehicles by 2030 and to encourage EV adoption.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 30%, Tier I - 55%, and Others - 15%,

- By Designation: CXOs - 15%, Managers - 15%, and Executives - 70%

- By Region: North America - 30%, Europe - 20%, and Asia Pacific - 50%

The EV connector market is dominated by established players such as TE Connectivity (Ireland), Aptiv (Ireland), Yazaki Corporation (Japan), Molex (US), and Hirose Electric Co., Ltd. (Japan). These companies actively manufacture and develop new and advanced connectors. They have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage:

The market study covers the EV connector market by system (sealed and unsealed), connection (wire-to-wire, wire-to-board, board-to-board, and other connection types), propulsion (BEV, PHEV, FCEV, and HEV), application (ADAS & safety systems, body control & interiors, infotainment systems, engine management & powertrain, battery management systems, vehicle lighting, and other applications), voltage (low voltage, medium voltage, high voltage), component (terminal, housing, lock, and other components), and region (north America, Europe, and Asia Pacific). It also covers the competitive landscape and company profiles of the major players in the EV connector market.

Key Benefits of Purchasing this Report

The study offers a detailed competitive analysis of the key players in the market, including their company profiles, important insights into product and business offerings, recent developments, and main market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall EV connector market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, helping stakeholders keep track of market dynamics.

The report provides insights on the following points:

- Analysis of key drivers (OEMs' emphasis on electrification of mid-segment and luxury vehicles, Rapid integration of ADAS and safety systems, Consumer preference for seamless and interactive driving experience), restraints (Volatility in Raw Material Prices), opportunities (Scaling of autonomous driving technologies, Shift toward advanced electrical/electronic (E/E) architecture), and challenges (Material degradation due to mechanical wear and thermal stresses, Transition from conventional connector systems to modular platform designs) influencing the growth of the EV connector market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the EV connector market

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV connector market across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the EV connector market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like TE Connectivity (Ireland), Aptiv (Ireland), Yazaki Corporation (Japan), Molex (US), and Hirose Electric Co., Ltd. (Japan) in the EV connector market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Primary interviewees from demand and supply sides

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Major objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV CONNECTOR MARKET

- 4.2 EV CONNECTOR MARKET, BY REGION

- 4.3 EV CONNECTOR MARKET, BY APPLICATION

- 4.4 EV CONNECTOR MARKET, BY CONNECTION

- 4.5 EV CONNECTOR MARKET, BY PROPULSION

- 4.6 EV CONNECTOR MARKET, BY VOLTAGE

- 4.7 EV CONNECTOR MARKET, BY SYSTEM

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 OEMs' emphasis on electrification of mid-segment and luxury vehicles

- 5.2.1.2 Rapid integration of ADAS and safety systems

- 5.2.1.3 Consumer preference for seamless and interactive driving experience

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Scaling of autonomous driving technologies

- 5.2.3.2 Shift toward advanced electrical/electronic (E/E) architecture

- 5.2.4 CHALLENGES

- 5.2.4.1 Material degradation due to mechanical wear and thermal stresses

- 5.2.4.2 Transition from conventional connector systems to modular platform designs

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.3.2 AVERAGE SELLING PRICE OF EV CONNECTORS OFFERED BY KEY PLAYERS

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 853670)

- 5.4.2 EXPORT SCENARIO (HS CODE 853670)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 EV CONNECTOR MANUFACTURERS

- 5.5.3 EV CONNECTOR DISTRIBUTORS

- 5.5.4 TIER I/COMPONENT PROVIDERS

- 5.5.5 AUTOMOTIVE OEMS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 High-frequency and high-speed connectors

- 5.7.1.2 Miniaturized connectors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Power delivery and management

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Thermal management systems

- 5.7.3.2 Advanced materials

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.9.2.1 QC/T1067-2017

- 5.9.2.2 USCAR-2

- 5.9.2.3 GMW3191-2012

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 AUTOMOTIVE MINIATURIZATION SOLUTIONS BY MOLEX

- 5.10.2 CONNECTED, AUTONOMOUS, AND ELECTRIC WIRE HARNESSES BY SUMITOMO ELECTRIC GROUP

- 5.10.3 SPEEDFLOAT MA01 SERIES BY JAE

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 IMPACT OF AI

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 STRATEGIC POSITIONING OF CHINESE EXPORTERS AND FOREIGN ENTRANTS IN CHINA'S EV CONNECTOR ECOSYSTEM

- 5.16.1 CHINESE CONNECTOR EXPORTERS

- 5.16.2 FOREIGN CONNECTOR FIRMS IN CHINA

- 5.17 EVOLUTION OF EV CONNECTORS IN AUTONOMOUS VEHICLES

- 5.17.1 SIGNIFICANCE OF EV CONNECTORS IN AUTONOMOUS VEHICLE ARCHITECTURE

- 5.17.2 REQUIREMENTS OF EV CONNECTORS IN AUTONOMOUS VEHICLES

- 5.17.3 STRATEGIC ALIGNMENT BY EV CONNECTOR MANUFACTURERS

6 EV CONNECTOR MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 ADAS & SAFETY SYSTEMS

- 6.2.1 RAPID INTEGRATION OF AUTONOMOUS AND SEMI-AUTONOMOUS FUNCTIONS

- 6.3 BODY CONTROL & INTERIORS

- 6.3.1 RISE OF ADVANCED AND AUTONOMOUS ELECTRIC VEHICLES

- 6.4 INFOTAINMENT SYSTEMS

- 6.4.1 SURGE IN DEMAND FOR CONSOLIDATED IN-VEHICLE ENTERTAINMENT SYSTEMS

- 6.5 ENGINE MANAGEMENT & POWERTRAIN

- 6.5.1 INCREASED COMPLEXITY OF PLUG-IN HYBRID ELECTRIC VEHICLES

- 6.6 BATTERY MANAGEMENT SYSTEMS

- 6.6.1 TREND OF GREEN ENERGY IN AUTOMOTIVE INDUSTRY

- 6.7 VEHICLE LIGHTING

- 6.7.1 LARGE-SCALE ADOPTION OF DYNAMIC AND CUSTOMIZABLE LIGHTING IN ELECTRIC VEHICLES

- 6.8 OTHER APPLICATIONS

- 6.9 PRIMARY INSIGHTS

7 EV CONNECTOR MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 SEALED

- 7.2.1 ONGOING LAUNCHES OF APPLICATION-FOCUSED PRODUCTS

- 7.3 UNSEALED

- 7.3.1 EXTENSIVE USE IN IN-CABIN APPLICATIONS

- 7.4 PRIMARY INSIGHTS

8 EV CONNECTOR MARKET, BY VOLTAGE

- 8.1 INTRODUCTION

- 8.2 LOW VOLTAGE

- 8.2.1 INCREASED PREFERENCE DUE TO COMPACT SIZE AND COST SAVINGS

- 8.3 MEDIUM VOLTAGE

- 8.3.1 SHIFT TOWARD ELECTRIC AND HYBRID VEHICLES

- 8.4 HIGH VOLTAGE

- 8.4.1 LARGE-SCALE INTEGRATION OF ADVANCED ONBOARD ELECTRONICS

- 8.5 PRIMARY INSIGHTS

9 EV CONNECTOR MARKET, BY CONNECTION

- 9.1 INTRODUCTION

- 9.2 WIRE-TO-WIRE

- 9.2.1 INTEGRATION WITH POWER ELECTRONICS AND LIGHTING SYSTEMS

- 9.3 WIRE-TO-BOARD

- 9.3.1 DEPLOYMENT IN ELECTRONIC CONTROL UNITS AND INFOTAINMENT SYSTEMS

- 9.4 BOARD-TO-BOARD

- 9.4.1 FACILITATES MODULAR DESIGN, MINIMAL SIGNAL LOSS, AND HIGH-SPEED DATA TRANSMISSION

- 9.5 OTHER CONNECTION TYPES

- 9.6 PRIMARY INSIGHTS

10 EV CONNECTOR MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 BEV

- 10.2.1 IMPLEMENTATION OF STRICT EMISSION REGULATIONS

- 10.3 PHEV

- 10.3.1 HEIGHTENED DEMAND FOR HIGH-VOLTAGE APPLICATIONS

- 10.4 FCEV

- 10.4.1 COMPLEXITY OF ONBOARD SAFETY, SENSING, AND THERMAL MANAGEMENT SYSTEMS

- 10.5 HEV

- 10.6 PRIMARY INSIGHTS

11 EV CONNECTOR MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 TERMINAL

- 11.3 HOUSING

- 11.4 LOCK

- 11.5 OTHER COMPONENTS

12 EV CONNECTOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Rise in domestic EV production and sales to drive market

- 12.2.3 INDIA

- 12.2.3.1 Localization of EV connectors to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Strong OEM base and advanced electrification strategies to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Growing incorporation of smart cockpit features in local EV models to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 NETHERLANDS

- 12.3.2.1 Continuous innovations in connector technologies to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Leadership in premium EV manufacturing and large-scale electronics integration to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Collaborations between OEMs and EV connector manufacturers to drive market

- 12.3.5 NORWAY

- 12.3.5.1 Integration of smart-diagnostic-ready connectors in EVs to drive market

- 12.3.6 AUSTRIA

- 12.3.6.1 Focus on development and prototyping of advanced EV connectors to drive market

- 12.3.7 UK

- 12.3.7.1 Significant presence of local EV connector manufacturers to drive market

- 12.3.8 SPAIN

- 12.3.8.1 Strong EV production capacity to drive market

- 12.3.9 SWEDEN

- 12.3.9.1 National objective of fossil-free transportation to drive market

- 12.3.10 SWITZERLAND

- 12.3.10.1 Elevated demand for miniaturized and climate-resistant connectors to drive market

- 12.3.11 DENMARK

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Integration of ADAS, V2X, and platform-specific high-voltage architectures to drive market

- 12.4.3 CANADA

- 12.4.3.1 Regulatory push for full electrification to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 TE CONNECTIVITY

- 13.3.2 APTIV

- 13.3.3 YAZAKI CORPORATION

- 13.3.4 MOLEX

- 13.3.5 HIROSE ELECTRIC CO., LTD.

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 System footprint

- 13.7.5.4 Connection footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 TE CONNECTIVITY

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 APTIV

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 YAZAKI CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 MOLEX

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/developments

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 HIROSE ELECTRIC CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/developments

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.6.3.3 Others

- 14.1.7 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches/developments

- 14.1.7.3.2 Expansions

- 14.1.7.3.3 Others

- 14.1.8 AMPHENOL CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 ROSENBERGER GROUP

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.10 KYOCERA CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches/developments

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Others

- 14.1.11 FURUKAWA ELECTRIC CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.12 LUXSHARE PRECISION INDUSTRY CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.12.3.3 Others

- 14.1.1 TE CONNECTIVITY

- 14.2 OTHER PLAYERS

- 14.2.1 JST MFG. CO., LTD.

- 14.2.2 LITTELFUSE, INC.

- 14.2.3 SHENGLAN TECHNOLOGY CO., LTD.

- 14.2.4 KINSUN INDUSTRIES INC.

- 14.2.5 TXGA LLC

- 14.2.6 THB GROUP

- 14.2.7 LUMBERG HOLDINGS, INC.

- 14.2.8 LEONI AG

- 14.2.9 SAMTEC

- 14.2.10 FUJIKURA LTD.

- 14.2.11 ITT INC.

- 14.2.12 WURTH ELEKTRONIK EISOS GMBH & CO. KG

- 14.2.13 HUBER+SUHNER

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR EV CONNECTORS

- 15.2 EMPHASIS ON STRENGTHENING EV CONNECTOR PORTFOLIO FOR ADAS AND SAFETY SYSTEMS

- 15.3 HIGH IP-RATED SEALED SOLUTIONS, SMART DIAGNOSTICS, AND MODULAR DESIGNS TO BE KEY FOCUS AREAS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS